Pruning Shears Market Size

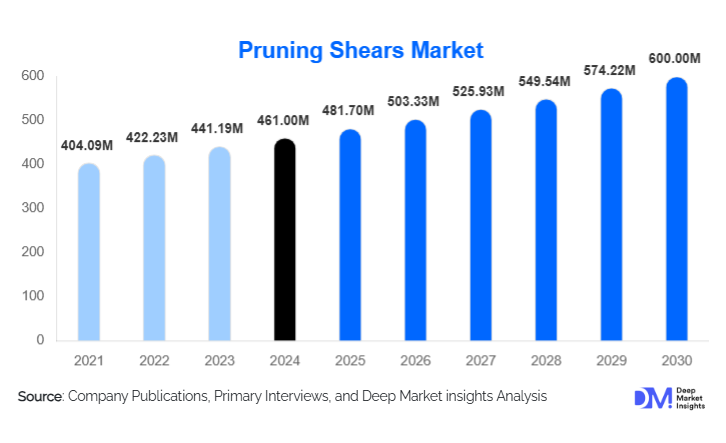

According to Deep Market Insights, the global pruning shears market size was valued at USD 461.00 million in 2024 and is projected to grow from USD 481.70 million in 2025 to reach USD 600.00 million by 2030, expanding at a CAGR of 4.49% during the forecast period (2025–2030). The pruning shears market growth is primarily driven by rising demand from residential gardening, commercial landscaping, and horticulture farms, increasing adoption of electric and ergonomic pruning tools, and expanding awareness of sustainable and efficient agricultural practices globally.

Key Market Insights

- Electric and battery-powered pruning shears are increasingly adopted, improving productivity and reducing labor fatigue for commercial landscapers and orchard managers.

- Residential gardening continues to drive stable demand, especially in North America and Europe, fueled by post-pandemic lifestyle changes and urban gardening trends.

- Asia-Pacific is emerging as a key growth region, led by China and India, due to expanding horticulture exports and domestic demand for durable and mid-range pruning shears.

- Technological innovation, including lightweight alloys, ergonomic designs, and anti-fatigue handles, is shaping premium and professional tool adoption.

- Sustainability-focused materials and modular designs are becoming a differentiator, enabling manufacturers to target eco-conscious consumers and institutional buyers.

- Distribution channels are evolving, with e-commerce gaining traction alongside traditional retail for both premium and mid-range pruning shears.

What are the latest trends in the pruning shears market?

Adoption of Electric and Ratchet Pruning Shears

With rising labor costs and demand for efficiency, commercial landscapers, orchard owners, and municipal maintenance contractors are increasingly adopting ratchet and electric pruning shears. These tools allow faster, cleaner cuts, particularly for dense branches, and reduce repetitive strain injuries among workers. Manufacturers are introducing cordless lithium-ion battery models, enabling extended operation times without sacrificing portability. This trend is boosting premium product sales and encouraging further innovation in power-assisted hand tools.

Premiumization and Ergonomic Design

Product differentiation through ergonomic handles, anti-fatigue grips, lightweight aluminum alloys, and titanium-coated blades is reshaping the market. Consumers are willing to pay premium prices for durability, precision, and comfort. Ergonomic pruning shears reduce strain during prolonged use, appealing to both residential and commercial buyers. Premiumization is particularly visible in developed markets like the U.S., Germany, and Japan, where performance and design aesthetics influence purchasing decisions.

What are the key drivers in the pruning shears market?

Rising Demand from Residential Gardening and Urban Landscaping

The global shift toward home gardening and urban green spaces has created consistent demand for pruning tools. Residential gardeners increasingly replace manual shears with more advanced models, driving mid-range and premium tool adoption. Urban landscaping projects, public parks, and community gardens are also expanding, contributing to steady consumption. North America and Europe remain major hubs due to high disposable income and strong lifestyle interest in gardening.

Commercial Horticulture and Orchard Expansion

Commercial farms, orchards, and vineyards are adopting professional-grade pruning tools to enhance efficiency. Ratchet and electric pruning shears are preferred for precise and clean cuts, ensuring higher yield quality and reducing labor dependency. Regions such as the U.S., China, Italy, Spain, and Chile have witnessed notable increases in commercial pruning tool purchases, supporting premium and semi-professional product segments.

What are the restraints for the global market?

Price Sensitivity in Developing Markets

While premium pruning shears are growing in demand, many buyers in developing regions prioritize affordability. High-cost electric or ratchet models remain inaccessible to small-scale farmers and low-income consumers, limiting market penetration. Manufacturers need to balance cost with durability to capture this segment.

Raw Material Price Volatility

Fluctuating prices of steel, aluminum, and battery components impact manufacturing costs and profit margins. Smaller players struggle to absorb price increases, creating competitive pressures. This volatility can slow market expansion, particularly for premium and mid-range segments.

What are the key opportunities in the pruning shears market?

Emerging Demand in Asia-Pacific and Latin America

Growing horticulture exports and domestic agricultural investments in countries like China, India, Brazil, and Kenya are creating new demand centers. Localized production and distribution present opportunities for both global and regional players to expand market reach and improve supply chain efficiency.

Eco-Friendly and Sustainable Product Development

Tools with recyclable materials, longer product life cycles, and reduced environmental impact are increasingly favored by institutional buyers and eco-conscious consumers. Modular designs with replaceable blades and lightweight, recyclable handles are emerging as key differentiators. Sustainability-focused product lines help manufacturers secure long-term contracts and align with regulatory trends.

Integration of Technological Features

Smart features, such as cut counters, battery life indicators, and precision cutting tools for controlled agriculture, present growth opportunities. These innovations cater to professional users and precision farming applications, adding value beyond traditional manual shears.

Product Type Insights

Bypass pruning shears dominate the global market, accounting for 38% of 2024 sales, primarily due to their versatility and ability to make clean cuts on live plant material without damaging the plant structure. This makes them highly preferred among residential gardeners, commercial landscapers, and horticulture professionals. The key driver for this segment is the increasing adoption in professional orchards and urban landscaping projects, where precision cutting and plant health are critical.

Ratchet and electric pruning shears are the fastest-growing segments, driven by labor efficiency, ergonomic benefits, and reduced fatigue for professional users. These tools are particularly gaining traction in commercial farming, orchards, and large-scale horticulture operations where repetitive pruning tasks are labor-intensive. Technological innovations, including lithium-ion battery integration, lightweight alloy construction, and precision blades, further enhance adoption. Anvil shears remain relevant for cutting hard or dead wood, supported by commercial users and hobbyists managing dense shrubs and older plants. Specialty floral and straight-blade shears cater to niche horticultural and floriculture markets, including bonsai care, floral arrangement businesses, and controlled-environment agriculture, ensuring precise and delicate cuts without crushing soft stems.

Application Insights

Residential gardening remains the largest application, contributing 41% of market value, with high adoption in North America, Europe, and Japan. Growth is driven by the increasing popularity of home gardening, rooftop gardens, and urban green initiatives, which encourage regular pruning and maintenance activities.

Commercial landscaping and horticulture farms are driving the fastest growth (6.5% CAGR), fueled by urban infrastructure development, expansion of green public spaces, and rising professional standards in landscape aesthetics. Orchards, vineyards, and municipal maintenance also represent expanding applications, particularly in regions investing in export-oriented horticulture. Emerging applications include precision horticulture and controlled-environment agriculture, where electric and ergonomic pruning tools improve operational efficiency, reduce labor costs, and ensure consistent plant yields.

Distribution Channel Insights

Offline retail dominates, representing 63% of sales, supported by hardware stores, garden centers, and specialty shops. Its growth is driven by the widespread availability of products, immediate accessibility, and hands-on product assessment for professional and residential buyers. E-commerce platforms are rapidly growing, particularly for premium and mid-range tools, offering direct-to-consumer sales, subscription-based services, and personalized product recommendations. The convenience of online ordering, home delivery, and access to product reviews is accelerating adoption in regions with high digital penetration, such as North America, Europe, and Asia-Pacific urban centers.

B2B direct sales to institutions, commercial farms, and municipal authorities remain a critical channel for professional-grade pruning shears, driven by bulk procurement, long-term supplier contracts, and the increasing demand for ergonomic and battery-powered tools in commercial operations.

End-User Insights

Residential gardening is the largest end-use segment, while commercial landscaping, orchards, and vineyards are the fastest-growing. Key growth drivers include rising urbanization, expanding green public spaces, and increasing adoption of advanced horticultural practices. Institutional buyers, including municipalities and public gardens, are investing heavily in premium ergonomic and battery-powered tools to improve labor efficiency and plant care standards.

Emerging applications in horticulture exports, controlled-environment agriculture, and large-scale plantation farming provide long-term growth opportunities. In these sectors, precision pruning and reduced labor intensity are critical, encouraging adoption of mid-range and premium electric pruning shears. Technological innovation and product differentiation remain key drivers for professional adoption in these high-value end-use segments.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 29% of the global market, led by the U.S., with Canada contributing significantly. High disposable income, urban gardening trends, and the presence of professional landscaping services drive demand. Key growth drivers include the increasing adoption of premium and ergonomic pruning tools, the expansion of green urban infrastructure, and strong consumer interest in sustainable and efficient gardening solutions. The rise of e-commerce platforms has also improved accessibility for specialized products, particularly battery-powered pruning shears.

Europe

Europe holds 27% of the global market, with Germany, France, Italy, and the U.K. leading demand. Growth is driven by urban gardening, vineyards, and orchard maintenance, supported by sustainability awareness and eco-friendly product adoption. Younger demographics and increased interest in home gardening are boosting mid-range and premium pruning shears. Technological adoption, including ergonomic designs and electric pruning shears, is rapidly increasing, particularly in Germany and the U.K., where efficiency and labor-saving tools are highly valued.

Asia-Pacific

Asia-Pacific is the fastest-growing region (6.8% CAGR), led by China, India, and Japan. China dominates manufacturing, supplying both domestic and export demand, while India’s growing horticulture, floriculture, and export-oriented farming drive domestic market growth. Japan focuses on professional-grade tools for urban and commercial applications. Key growth drivers include expanding commercial agriculture, rising urbanization, increased disposable income, and the adoption of technology-driven pruning tools such as battery-powered and ratchet shears for labor efficiency.

Latin America

Brazil and Chile drive growth, primarily in orchards, vineyards, and commercial farming, representing 9% of the global market. Rising exports of fruits and flowers, government incentives for commercial agriculture, and growing awareness of labor-saving tools are key growth drivers. Affluent consumers and professional landscapers increasingly import high-quality pruning shears, supporting mid-range and premium segment adoption. Infrastructure improvements and modernization of commercial horticulture operations further accelerate demand.

Middle East & Africa

Africa hosts key production hubs and shows strong demand in Kenya, South Africa, and Nigeria. Urban green projects, expansion of commercial agriculture, and export-oriented horticulture are key drivers. The Middle East, led by the UAE and Saudi Arabia, exhibits rising adoption among professional landscapers, municipalities, and premium users, supported by high disposable income and investment in urban greenery. Infrastructure development, government-backed horticulture programs, and increasing use of electric and ergonomic pruning tools are strengthening market growth in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pruning Shears Market

- Fiskars Group

- Felco SA

- Stanley Black & Decker

- Husqvarna Group

- Corona Tools

- Gardena (Husqvarna)

- ARS Corporation

- Okatsune

- Wolf-Garten

- Bahco

- Makita

- Bosch

- Spear & Jackson

- Samurai Tools

- Truper