Projectors Market Size

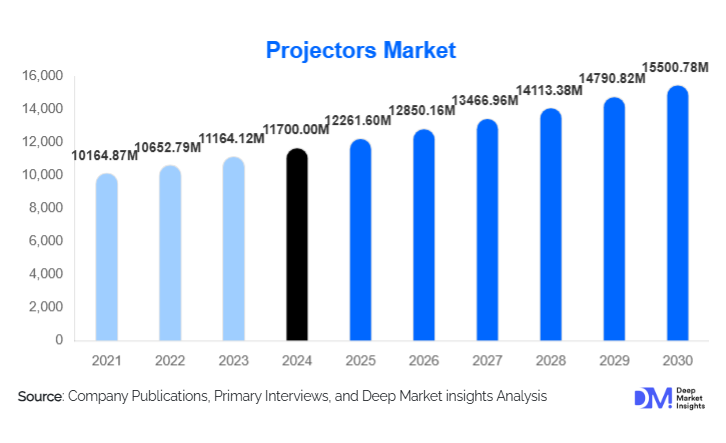

According to Deep Market Insights, the global projectors market size was valued at USD 11,700.00 million in 2024 and is projected to grow from USD 12,261.60 million in 2025 to reach USD 15,500.78 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). The projectors market growth is primarily driven by rising investments in smart education infrastructure, increasing adoption of laser-based projection technologies, and growing demand for immersive visualization across corporate, entertainment, and industrial applications.

Key Market Insights

- Laser projectors are rapidly replacing lamp-based systems due to longer lifespan, lower maintenance costs, and superior image consistency.

- Education remains the largest end-use segment, supported by government-led digital classroom initiatives across emerging economies.

- Asia-Pacific dominates global demand, led by China and India, owing to large-scale institutional deployments and manufacturing scale.

- Ultra-short-throw and fixed-installation projectors are gaining traction in space-constrained corporate and urban residential environments.

- 4K and high-brightness projectors are witnessing strong uptake in cinemas, events, simulation, and professional visualization.

- Software integration and AI-based image optimization are emerging as key differentiation factors among leading manufacturers.

What are the latest trends in the projectors market?

Shift Toward Laser and Solid-State Projection

The most prominent trend in the global projectors market is the accelerated transition from lamp-based systems to laser and LED-based projection. Laser projectors offer operating lifespans exceeding 20,000 hours, significantly reducing the total cost of ownership for enterprises, educational institutions, and entertainment venues. This shift is particularly evident in corporate offices, museums, airports, and cinemas, where uninterrupted operation and image stability are critical. Manufacturers are increasingly focusing on compact laser engines, improved thermal management, and recyclable components, aligning with sustainability goals and energy-efficiency regulations.

Growing Adoption of Immersive and Interactive Projection

Interactive and immersive projection solutions are gaining traction across education, simulation, and experiential entertainment. Edge blending, projection mapping, and multi-projector setups are increasingly used in exhibitions, live events, and industrial training environments. In education and corporate collaboration spaces, interactive projectors combined with touch overlays and cloud-based software are enhancing engagement and productivity. The integration of AI-driven calibration, automatic keystone correction, and content management platforms is further improving ease of use and driving adoption among non-technical users.

What are the key drivers in the projectors market?

Expansion of Smart Education and Digital Classrooms

Government investments in digital education infrastructure are a major growth driver for the projectors market. Public schools, universities, and training centers continue to favor projectors as cost-effective large-format display solutions, particularly in emerging economies. National programs aimed at improving digital literacy and hybrid learning models are sustaining large-volume procurement, especially for mid-brightness and Full HD projectors.

Rising Demand for Large-Format Visual Experiences

Across corporate, entertainment, and residential sectors, demand for large-format visual experiences is increasing. Projectors provide scalable screen sizes beyond 100 inches at a lower cost compared to large LED displays, making them attractive for conference rooms, home theaters, and event venues. Growth in live events, esports, and location-based entertainment is further reinforcing demand for high-brightness and 4K-enabled systems.

What are the restraints for the global market?

Competition from Large-Format Flat Panel Displays

Declining prices of large LCD and LED flat panels pose a challenge to projector adoption, particularly in corporate and premium education environments. Flat panels offer higher brightness in ambient light conditions and simpler installation, prompting some buyers to substitute projection systems in smaller rooms.

Pricing Pressure in Entry-Level Segments

Intense competition from low-cost manufacturers has led to commoditization in portable and home entertainment projectors. Margin pressure in these segments compels established brands to continuously innovate or shift focus toward professional and high-value applications.

What are the key opportunities in the projectors industry?

Growth in Experiential Entertainment and Simulation

Rising investments in immersive entertainment, simulation, and digital twin environments present strong opportunities for projector manufacturers. Applications in defense training, healthcare visualization, automotive design, and theme parks require high-resolution, high-brightness projection systems, enabling vendors to command premium pricing and long-term service contracts.

Emerging Demand in Developing Regions

Untapped demand in Africa, Southeast Asia, and parts of Latin America offers growth opportunities, particularly for education and government applications. Localization of manufacturing and partnerships with system integrators can help players penetrate these price-sensitive but high-volume markets.

Technology Type Insights

DLP projectors lead the global market, accounting for approximately 46% of total revenue in 2024, driven by superior contrast and reliability in cinema and large-venue applications. LCD projectors maintain a strong presence in education due to color accuracy and affordability, while LCoS technology is primarily used in high-end home cinema and professional visualization, where image precision is critical.

Light Source Insights

Laser projectors represent the largest and fastest-growing light source segment, contributing nearly 41% of global revenue in 2024. Lamp-based projectors are steadily declining but still maintain relevance in cost-sensitive applications. LED and hybrid systems are gaining adoption in portable and compact form factors.

End-Use Insights

Education accounts for approximately 29% of global projector demand, followed by corporate and business applications. Home entertainment is experiencing renewed growth driven by gaming and streaming content, while cinema and media applications continue to drive demand for ultra-high-brightness systems. Emerging use cases in healthcare, retail, and industrial simulation are expanding the market’s application base.

| By Projection Technology | By Light Source Type | By Resolution | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global projectors market with around 38% share in 2024. China accounts for nearly 17% of global demand due to large-scale education deployments, cinema expansion, and domestic manufacturing strength. India is the fastest-growing market in the region, supported by government education initiatives and rising corporate adoption.

North America

North America holds approximately 26% of the global market, led by the United States. Demand is driven by corporate collaboration spaces, home cinema adoption, and the strong presence of the entertainment and simulation industries.

Europe

Europe represents about 22% of global demand, with Germany, the UK, and France as key markets. Adoption is supported by corporate digitalization, cultural venues, and high-end residential applications.

Latin America

Latin America accounts for a smaller but steadily growing share, led by Brazil and Mexico. Education and government procurement remain the primary demand drivers in the region.

Middle East & Africa

The Middle East & Africa region is emerging as a high-growth market, supported by investments in smart cities, mega events, and education infrastructure, particularly in the UAE and Saudi Arabia.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Projectors Market

- Epson

- Sony

- Panasonic

- BenQ (Qisda)

- Canon

- Barco

- Christie Digital

- Sharp NEC Display Solutions

- Optoma (Coretronic)

- ViewSonic

- LG Electronics

- Samsung Electronics

- Acer

- Xiaomi

- Dell Technologies

Recent Developments

- In 2025, multiple leading manufacturers expanded their laser projector portfolios, targeting education and corporate collaboration spaces with energy-efficient models.

- In 2024, major cinema projector suppliers introduced next-generation 4K laser systems designed for premium large-format theaters.

- In 2024, several global players increased investments in localized manufacturing across Asia to reduce costs and improve supply chain resilience.