Professional Skincare Market Size

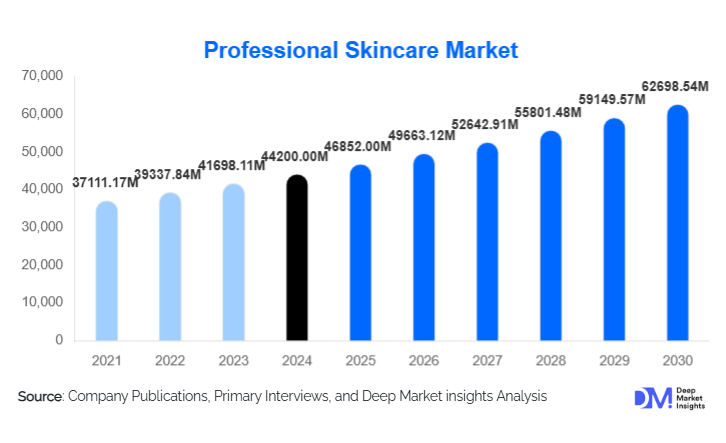

According to Deep Market Insights, the global professional skincare market size was valued at USD 44,200.00 million in 2024 and is projected to grow from USD 46,852.00 million in 2025 to reach USD 62,698.54 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The professional skincare market growth is driven by rising demand for clinically proven skincare solutions, increasing adoption of non-invasive aesthetic procedures, and growing awareness around preventive and corrective skin health treatments. Unlike mass-market cosmetics, professional skincare products are characterized by higher concentrations of active ingredients, dermatologist endorsement, and regulated usage across medical and aesthetic settings.

Key Market Insights

- Professional facial care products dominate the market, accounting for nearly half of global demand due to frequent use in anti-aging, acne, and pigmentation treatments.

- Dermatology and medical aesthetic clinics lead end-use adoption, driven by bundled treatment protocols and higher per-patient spending.

- North America holds the largest market share, supported by high procedure volumes, premium pricing, and advanced clinical infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by medical tourism, expanding middle-class populations, and increasing awareness of clinical skincare.

- Cosmeceuticals and bioactive formulations are gaining strong traction, as clinicians prioritize efficacy-backed, science-driven products.

- Technology-enabled personalization, including AI-based skin diagnostics and customized treatment regimens, is reshaping professional skincare delivery models.

What are the latest trends in the professional skincare market?

Shift Toward Preventive and Maintenance Skincare

The professional skincare market is witnessing a structural shift from corrective treatments toward preventive and long-term skin health management. Consumers across age groups are increasingly adopting professional-grade skincare products as part of ongoing maintenance regimens, rather than only post-procedure solutions. Clinics are promoting early intervention for aging, pigmentation, and barrier repair, which has significantly increased repeat usage and long-term customer engagement. This trend is particularly strong among millennials and Gen Z consumers, who seek proactive skincare solutions supported by clinical validation.

Integration of Technology and Data-Driven Skincare

Advanced skin diagnostic technologies are increasingly integrated into professional skincare practices. AI-powered imaging tools, skin scanners, and data-driven treatment algorithms allow dermatologists to offer personalized skincare solutions with measurable outcomes. Professional brands are aligning product portfolios with these technologies, enabling clinics to design customized treatment protocols. This trend enhances treatment efficacy, improves patient satisfaction, and strengthens brand loyalty among clinicians and consumers alike.

What are the key drivers in the professional skincare market?

Rising Demand for Non-Invasive Aesthetic Procedures

The rapid global growth of non-invasive and minimally invasive aesthetic procedures is a major driver for the professional skincare market. Products used for pre-treatment preparation, post-procedure recovery, and long-term results maintenance are essential components of aesthetic protocols. As procedure volumes increase, clinics rely heavily on professional skincare to enhance outcomes, reduce recovery time, and improve patient satisfaction, driving consistent demand.

Growing Skin Health Awareness and Aging Population

Rising awareness of skin health, combined with an aging global population, is accelerating demand for anti-aging and corrective skincare solutions. Consumers are increasingly seeking dermatologist-recommended products for concerns such as wrinkles, hyperpigmentation, acne, and sensitivity. This driver is particularly strong in developed markets, where consumers are willing to invest in premium, clinically validated skincare solutions.

What are the restraints for the global market?

High Cost of Professional Skincare Products

Professional skincare products are significantly more expensive than mass-market alternatives due to higher R&D investment, regulatory compliance, and professional exclusivity. This limits adoption in price-sensitive markets and restricts penetration beyond urban centers. High treatment costs can also reduce accessibility for middle-income consumers, particularly in emerging economies.

Regulatory and Compliance Challenges

Strict regulatory requirements across regions create barriers for new product launches and global expansion. Differences in ingredient approvals, labeling norms, and clinical testing requirements increase compliance costs and extend time-to-market. Smaller brands face challenges scaling internationally due to regulatory complexity.

What are the key opportunities in the professional skincare industry?

Expansion in Emerging Markets and Medical Tourism

Emerging economies in the Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Countries such as China, India, South Korea, Brazil, and the UAE are becoming hubs for dermatology and aesthetic tourism. Professional skincare brands can capitalize on this trend by developing region-specific formulations, partnering with private clinics, and leveraging medical tourism infrastructure.

Personalized and Sustainable Professional Skincare

There is a growing opportunity in personalized skincare solutions tailored to individual skin profiles, lifestyles, and genetic factors. In parallel, demand for sustainable, clean-label professional skincare is rising as regulators and consumers prioritize safety and environmental responsibility. Brands that combine personalization with sustainability are well-positioned to gain a competitive advantage.

Product Type Insights

Professional facial care products represent the largest product segment, accounting for approximately 48% of the global market in 2024. These products are widely used for anti-aging, acne management, and pigmentation correction, driving frequent clinic visits and repeat purchases. Professional body care products follow, supported by demand for firming, anti-cellulite, and treatments in spas and wellness centers. Sun care and problem-skin treatments represent smaller but steadily growing segments, particularly in regions with high UV exposure and rising dermatological awareness.

Ingredient Category Insights

Cosmeceuticals and bio-active compounds lead ingredient adoption, holding nearly 34% market share in 2024. Dermatologists increasingly prefer formulations backed by clinical efficacy, including peptides, retinoids, and growth-factor-based actives. Natural and botanical ingredients are gaining share, particularly in Europe and Asia-Pacific, as demand grows for gentler formulations compatible with sensitive skin.

End-Use Insights

Dermatology and medical aesthetic clinics dominate the professional skincare market, collectively accounting for about 52% of global demand. These settings benefit from integrated treatment protocols and high-value patient engagement. Spas and salons represent a stable secondary segment, particularly in luxury hospitality and wellness tourism. Professional home-use products prescribed by clinicians are growing rapidly, enabling brands to extend usage beyond in-clinic applications.

Distribution Channel Insights

Direct B2B distribution from manufacturers to clinics remains the dominant channel, accounting for nearly 61% of market share. This model supports training, exclusivity, and margin optimization. Authorized professional distributors play a key role in emerging markets, while licensed e-commerce platforms are expanding for professional home-use products, improving accessibility without compromising clinical oversight.

| By Product Type | By Ingredient Category | By Treatment Type | By End-Use Channel | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 34% of the global professional skincare market in 2024. The United States leads regional demand due to high adoption of aesthetic procedures, strong dermatologist networks, and premium pricing structures. Canada also contributes to steady growth supported by rising awareness of clinical skincare.

Europe

Europe held around 27% market share, driven by Germany, France, Italy, and the U.K. The region benefits from strong dermatological expertise, aging demographics, and high acceptance of cosmeceuticals and medical-grade skincare.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at an estimated 10.2% CAGR. China, South Korea, Japan, and India are key markets, supported by medical tourism, expanding clinic networks, and strong cultural emphasis on skincare. South Korea, in particular, is a global innovation hub for professional skincare formulations.

Latin America

Latin America accounts for about 7% of global demand, led by Brazil and Mexico. Growth is supported by a high interest in aesthetic treatments and expanding private clinic infrastructure.

Middle East & Africa

The Middle East & Africa region represents roughly 5% market share, with the UAE and Saudi Arabia driving demand through luxury wellness investments and medical tourism initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Professional Skincare Market

- L’Oréal Group

- Estée Lauder Companies

- Galderma

- Johnson & Johnson

- Beiersdorf AG

- Shiseido Company

- AbbVie (Allergan)

- Unilever

- Amorepacific Group

- Pierre Fabre Group

- LVMH

- Natura &Co

- Kao Corporation

- Procter & Gamble

- Coty Inc.