Printing Inks Market Size

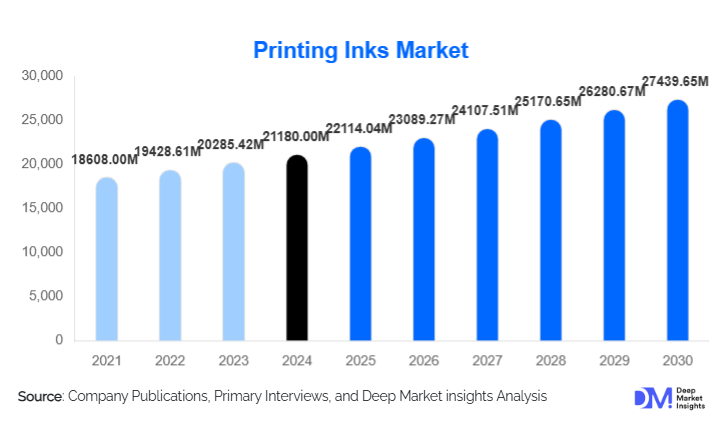

According to Deep Market Insights, the global printing inks market size was valued at USD 21,180.00 million in 2024 and is projected to grow from USD 22,114.04 million in 2025 to reach USD 27,439.65 million by 2030, expanding at a CAGR of 4.41% during the forecast period (2025–2030). Growth in the printing inks industry is primarily fueled by the rapid expansion of flexible packaging, accelerated adoption of digital printing technologies, and the rising emphasis on sustainable, low-VOC ink formulations driven by regulatory and consumer pressures.

Key Market Insights

- Water-based and UV-curable inks are gaining strong traction due to global sustainability regulations and the shift away from solvent-heavy formulations.

- Packaging printing remains the dominant application segment, driven by the global boom in e-commerce, FMCG, and pharmaceutical packaging.

- Asia-Pacific leads global demand, supported by large-scale manufacturing hubs in China, India, and Southeast Asia.

- Digital printing inks represent the fastest-growing segment, driven by customization, short-run printing, and advances in inkjet technologies.

- Europe is at the forefront of sustainable ink innovation, especially due to REACH and food-contact compliance requirements.

- Industrial applications such as printed electronics, automotive interiors, and textiles are reshaping the specialty inks market.

What are the latest trends in the printing inks market?

Surge in Sustainable and Regulatory-Compliant Inks

The demand for eco-friendly inks is accelerating as governments and global brands commit to stricter environmental compliance. Water-based, bio-derived, and low-VOC formulations are replacing solvent-heavy inks in packaging and commercial printing. Manufacturers are investing heavily in new resin systems, such as acrylic and polyurethane dispersions, that support compostable packaging substrates. Furthermore, food-safe inks designed for direct and indirect contact packaging are becoming critical due to heightened consumer safety awareness. This shift is positioning sustainability-driven ink producers at the center of market innovation.

Acceleration of Digital and On-Demand Printing

The rapid transformation of printing workflows toward customization and short-run production is boosting demand for high-performance digital inks. Technologies such as inkjet and electrophotographic printing are increasingly used in packaging, textiles, décor, and industrial applications. UV-curable digital inks, with fast curing and minimal waste, are enabling printers to streamline operations. Digital textile printing, powered by pigment and dye-sublimation inks, is growing at double-digit rates as brands demand quick design cycles and reduced water usage. The trend aligns with global digitization across print service providers and manufacturers.

What are the key drivers in the printing inks market?

Growing Demand for Flexible Packaging

Flexible packaging continues to replace rigid formats due to its cost efficiency, sustainability advantages, and branding flexibility. This trend significantly boosts demand for flexographic, gravure, and UV-curable inks. The rise in packaged food, personal care products, and e-commerce shipping has made flexible packaging the leading ink-consuming application, contributing nearly half of global ink revenues.

Innovation in Specialty and Functional Inks

Industries such as electronics, automotive, medical devices, and 3D manufacturing increasingly rely on functional inks, conductive, dielectric, heat-resistant, or antimicrobial. These high-performance inks deliver superior margins and enable new applications such as printed sensors, smart packaging, and wearable electronics. As industrial automation expands, demand for these advanced inks is accelerating globally.

Shift Toward Digital Printing Technologies

Digital printing eliminates plate-making, reduces waste, and enables rapid turnaround, all essential for modern production environments. Inkjet and electrophotographic inks are witnessing strong adoption in textile printing, label production, commercial printing, and industrial décor. This shift is further supported by advancements in printhead technology and improved adhesion properties of UV-curable digital inks.

What are the restraints for the global market?

Raw Material Price Volatility

Printing ink manufacturing depends heavily on petrochemical-derived solvents, pigments, and resins. Global fluctuations in crude oil prices, geopolitical disruptions, and supply chain constraints significantly impact operating costs. Smaller manufacturers struggle to maintain profitability during volatile periods, limiting market competitiveness.

Regulatory Pressures and Compliance Costs

Stringent environmental and food-contact regulations across Europe, North America, and Asia require continuous reformulation, rigorous testing, and compliance documentation. Restrictions on heavy metals, VOC emissions, and aromatic solvents impose additional production costs. These regulatory challenges slow down innovation cycles for manufacturers unable to invest in sustainable R&D.

What are the key opportunities in the printing inks industry?

Sustainable Ink Technologies and Circular Packaging

As global packaging brands commit to carbon reduction and recyclability, demand for compostable, water-based, and bio-resin inks is surging. Companies that develop food-compliant, de-inkable, and low-VOC inks can capture premium segments of the market. The shift toward circular packaging frameworks, especially in Europe, creates multi-billion-dollar opportunities for eco-ink manufacturers.

Digital Expansion in Packaging and Textiles

Digital printing is transforming packaging workflows by enabling small-batch production, regional customization, and rapid prototyping. In textiles, digital pigment inks are reducing water usage by up to 80%, aligning with sustainable fashion goals. As global textile printing shifts from screen to digital, ink manufacturers are positioned to capture significant new revenue streams.

High-Growth Potential in Emerging Markets

Countries such as India, Indonesia, Vietnam, and Brazil are witnessing rapid industrialization, expansion of the FMCG sectors, and modernization of printing infrastructure. These markets offer high-volume demand for flexographic, gravure, and UV inks. With governments promoting domestic manufacturing through initiatives like “Make in India,” global ink manufacturers can expand through joint ventures and localized production.

Product Type Insights

Flexographic inks dominate the global product landscape, accounting for approximately 32% of the 2024 market share. Their popularity stems from exceptional versatility across flexible packaging, labels, corrugated boxes, and e-commerce-ready packaging materials. Water-based flexo inks are seeing rapid adoption due to sustainability mandates, while UV-flexo systems offer superior curing speeds and durability for high-performance applications. Meanwhile, gravure inks remain preferred for long-run packaging jobs in Asia, digital inks are rapidly scaling for short-run printing, and screen inks support niche industrial applications such as ceramics and printed electronics.

Application Insights

Packaging printing is the largest application category, contributing nearly 48% of global ink consumption in 2024. The rise of FMCG products, pharmaceuticals, and on-demand packaging for e-commerce shipments fuels continuous growth. Commercial printing—including brochures, magazines, and promotional materials—remains important but is gradually transitioning toward digital formats. Textile printing, propelled by digital inkjet adoption, is growing at its fastest pace, while industrial applications such as automotive interiors, electronics, and décor are expanding due to the increased use of functional and specialty inks.

Distribution Channel Insights

Direct sales channels dominate the printing inks market, as major converters and packaging manufacturers procure inks under long-term contracts with global suppliers. Distributor-led channels continue to serve small and mid-size print shops across developing markets. Online procurement platforms are growing, driven by demand for transparency, price comparison, and rapid replenishment. OEM partnerships with printer manufacturers represent a strategic channel in the digital inks segment, ensuring compatibility and boosting recurring ink consumption.

End-User Type Insights

Food & beverage packaging is the largest end-user category, accounting for approximately 29% of the 2024 market. Stringent safety requirements and increasing packaged food consumption are accelerating demand for compliant inks. Pharmaceuticals represent another high-growth segment, driven by traceability regulations and anti-counterfeit labeling needs. Consumer goods, textiles, and industrial manufacturing continue to diversify ink demand with requirements ranging from aesthetic branding to functional performance. Emerging industries such as printed electronics and IoT device manufacturing are generating niche opportunities for conductive, dielectric, and high-temperature inks.

| By Ink Type | By Formulation Technology | By Application | By Resin Type | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 22% of the global printing inks market in 2024. The U.S. leads demand with strong packaging, commercial printing, and digital printing industries. Growth is driven by sustainable ink adoption, modernization of flexo printing lines, and rising pharmaceutical packaging needs. Canada contributes a steady demand focused on eco-friendly and UV-curable inks.

Europe

Europe holds around 26% of the global market share and serves as the global hub for sustainable ink innovation. Germany, Italy, the U.K., and France dominate regional demand, propelled by strict environmental regulations (REACH, food-contact safety) and a mature packaging industry. European converters are transitioning heavily toward water-based and UV-curable systems to meet circular packaging goals.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, with a 38% share in 2024 and a forecast CAGR of over 6.5%. China remains the world’s largest consumer and exporter of printed packaging materials. India is the fastest-growing national market, supported by expanding FMCG sectors, government manufacturing incentives, and the modernization of printing infrastructure. Japan and South Korea continue to drive specialty ink demand for electronics, automotive, and high-tech industrial applications.

Latin America

Latin America represents approximately 8% of global ink consumption, with Brazil and Mexico leading regional demand. Growth is driven by the expansion of food packaging, personal care, and pharmaceutical industries. Mexico’s integration with North American supply chains boosts flexo and gravure ink consumption for export-oriented packaging.

Middle East & Africa

The region holds around 6% market share, with the UAE and Saudi Arabia serving as key hubs for packaging and label printing. Africa’s growing middle-class population and rising packaged goods consumption are expanding printing ink demand, especially in South Africa, Kenya, and Nigeria. Infrastructure investments and regulatory modernization support long-term growth potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Printing Inks Market

- DIC Corporation

- Flint Group

- Sun Chemical Corporation

- Siegwerk Druckfarben

- Toyo Ink SC Holdings

- Hubergroup

- Sakata Inx Corporation

- Fujifilm Imaging Colorants

- Agfa-Gevaert Group

- Nazdar Ink Technologies

- Hexion (Specialty Chemicals Division)

- Wikoff Color Corporation

- Zeller+Gmelin

- ALTANA AG (ACTEGA & BYK)

- Kao Corporation (Specialty Inks Division)

Recent Developments

- In March 2025, DIC Corporation expanded its production of water-based and bio-resin inks in India under the “Make in India” manufacturing initiative.

- In January 2025, Siegwerk announced a new portfolio of de-inkable inks designed to support circular packaging and improve recycling efficiency across Europe.

- In February 2025, Flint Group launched a next-generation UV-flexo ink series optimized for high-speed label and packaging presses.