Printed and Digital Newspaper Market Size

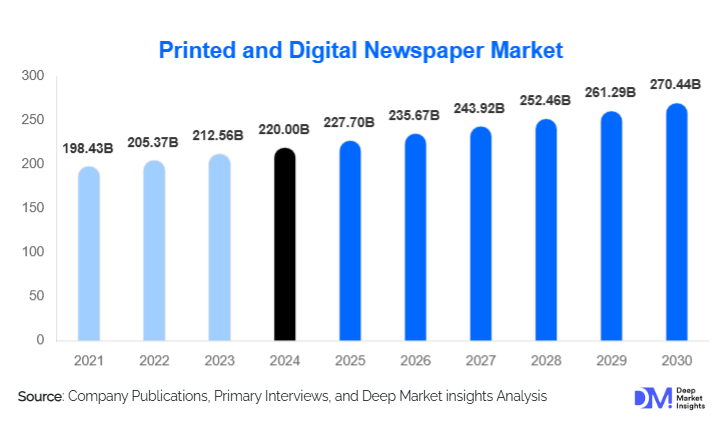

According to Deep Market Insights, the global printed and digital newspaper market size was valued at USD 220.00 billion in 2024 and is projected to grow from USD 227.70 billion in 2025 to reach USD 270.44 billion by 2030, expanding at a CAGR of 3.5% during the forecast period (2025–2030). The market’s evolution is shaped by declining print circulation, rapid digital readership adoption, and a strategic shift toward subscription-based monetization and premium journalism. While mature markets continue to experience contraction in print revenues, emerging economies and digital-first business models are stabilizing overall market value.

Key Market Insights

- Digital newspapers are the fastest-growing format, driven by subscription adoption, mobile news consumption, and premium content strategies.

- Subscription-based revenue models dominate, accounting for nearly half of total market revenues as publishers reduce reliance on volatile advertising income.

- Asia-Pacific is the largest regional market, supported by strong vernacular print demand and expanding digital penetration.

- Regional and vernacular-language newspapers outperform English publications in circulation volume, especially in emerging economies.

- Institutional readership is expanding steadily, driven by demand from corporates, government bodies, and educational institutions.

- Technology adoption, such as AI, data analytics, and newsroom automation, is transforming content creation, personalization, and cost efficiency.

What are the latest trends in the printed and digital newspaper market?

Acceleration of Digital Subscription Models

Publishers globally are prioritizing digital subscription growth as a core revenue pillar. Metered paywalls, tiered pricing, and bundled print-digital offerings are being widely adopted to enhance reader monetization. Premium investigative journalism, opinion pieces, and exclusive business insights are increasingly positioned behind paywalls, resulting in higher average revenue per user. Digital-only newspapers and legacy publishers alike are reporting steady growth in paid subscribers, particularly in North America, Europe, and Japan.

Rise of Vernacular and Localized News Platforms

Regional and vernacular-language newspapers are gaining renewed importance, especially across Asia-Pacific, Africa, and Latin America. Localized reporting, political relevance, and community-focused content continue to drive loyalty and stable readership. Many publishers are digitizing regional content through low-data mobile platforms, enabling monetization even in price-sensitive markets. This trend is strengthening the resilience of local newspapers despite global print declines.

What are the key drivers in the printed and digital newspaper market?

Growing Demand for Credible and Trusted Journalism

In an environment of misinformation and unverified digital content, consumers increasingly value established newspapers as trusted sources. This has positively impacted subscription uptake and institutional demand, particularly for business, financial, and political newspapers. Trust-based branding is emerging as a competitive advantage, enabling premium pricing and long-term subscriber retention.

Expansion of Institutional and Enterprise Subscriptions

Corporations, financial institutions, law firms, and government agencies continue to rely on newspapers for policy monitoring, economic insights, and regulatory updates. Institutional subscriptions provide predictable, high-margin revenue streams and are expanding at a faster rate than individual print subscriptions. Digital enterprise licensing models are further supporting this growth.

What are the restraints for the global market?

Structural Decline in Print Advertising Revenues

Traditional print advertising, particularly classified ads, has migrated to digital platforms and marketplaces. This has significantly reduced revenue for print-focused publishers and regional newspapers. Rising printing and distribution costs further compress margins, accelerating print circulation decline in developed markets.

Competition from Free Digital Content and Social Platforms

News aggregators and social media platforms continue to capture audience attention without directly contributing to content creation costs. This intensifies competition, increases churn risk, and places downward pressure on pricing, particularly for general news content.

What are the key opportunities in the newspaper industry?

Digital Transformation and AI Integration

Artificial intelligence and automation present significant opportunities for cost optimization and content innovation. AI-driven recommendation engines, automated reporting for financial and sports news, and personalized newsletters are enhancing engagement while reducing newsroom costs. Publishers investing in technology are better positioned to sustain profitability.

Growth in Emerging and Underserved Markets

Rising literacy rates, urbanization, and political engagement in emerging economies create sustained demand for both print and digital newspapers. Governments and educational institutions increasingly partner with newspapers for public information dissemination, creating new revenue streams beyond traditional readership.

Product Type Insights

Printed newspapers continue to hold a majority share, accounting for approximately 62% of the global market in 2024, driven by strong demand in Asia-Pacific and Africa. However, digital newspapers represent the most dynamic segment, contributing nearly 38% of total revenue and expanding rapidly through web-based platforms, mobile apps, and e-paper editions. Digital formats benefit from scalability, lower distribution costs, and global reach, making them the primary focus of future investment.

Revenue Model Insights

Subscription-based newspapers dominate the market with an estimated 46% share of 2024 revenues, reflecting the success of paywalls and premium content strategies. Advertisement-supported models account for around 34%, while hybrid revenue models contribute the remaining share. The trend clearly favors recurring subscription income over cyclical advertising revenues.

End-Use Insights

Individual consumers account for nearly 70% of total demand, supported by retail subscriptions and single-copy sales. Institutional consumers represent the fastest-growing end-use segment, expanding at an estimated 4–5% CAGR, driven by enterprise subscriptions, academic usage, and government demand for verified information.

| By Product Format | By Revenue Model | By Content Focus | By Language | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 26% of the global newspaper market, led by the United States. The region is characterized by high digital subscription penetration, premium pricing models, and strong institutional demand. Print circulation continues to decline, but digital revenues provide a partial offset.

Europe

Europe holds around 22% market share, with strong demand in the U.K., Germany, and France. Public broadcasting competition is high, but established newspapers maintain loyal readership through premium journalism and digital innovation.

Asia-Pacific

Asia-Pacific is the largest regional market, contributing nearly 34% of global revenues. India, China, and Japan dominate demand, with India representing the fastest-growing country market due to strong vernacular print readership and rising digital adoption.

Latin America

Latin America accounts for approximately 8% of the market, led by Brazil and Mexico. Economic volatility impacts advertising revenues, but digital readership is steadily increasing.

Middle East & Africa

This region represents a growing opportunity, supported by rising literacy, urbanization, and political engagement. Nigeria, South Africa, and the UAE are key demand centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Printed and Digital Newspaper Industry

- News Corp

- The New York Times Company

- Gannett Co., Inc.

- Nikkei Inc.

- Axel Springer SE

- Daily Mail and General Trust

- Schibsted ASA

- The Guardian Media Group

- The Washington Post Company

- Tribune Publishing

- Asahi Shimbun Company

- Times Group (India)

- Yomiuri Shimbun Holdings

- Fairfax Media

- South China Morning Post Group