Preserved Fresh Flower Market Size

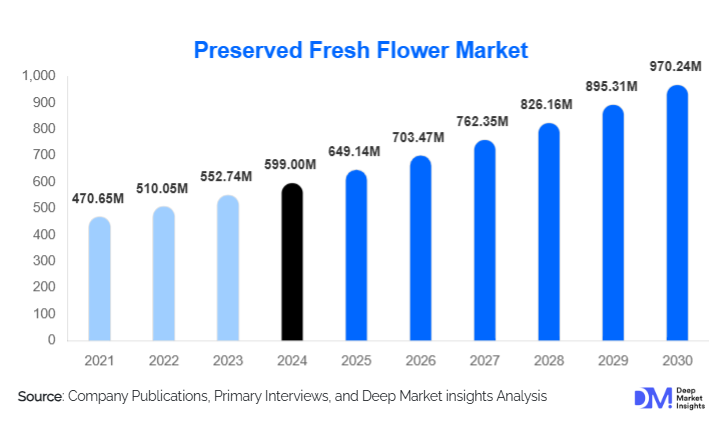

According to Deep Market Insights, the global preserved fresh flower market size was valued at USD 599.00 million in 2024 and is projected to grow from USD 649.14 million in 2025 to reach USD 970.24 million by 2030, expanding at a CAGR of 8.37% during the forecast period (2025–2030). The preserved fresh flower market growth is primarily driven by increasing consumer preference for long-lasting, low-maintenance floral décor, rising adoption of luxury gifting practices, and expansion of online retail platforms offering customizable floral arrangements across global markets.

Key Market Insights

- Rising demand for sustainable and eco-friendly gifting solutions is driving growth, with consumers preferring flowers that maintain aesthetic appeal for months without water or maintenance.

- Preserved roses lead the product segment, dominating global market share due to their popularity in luxury gifting, weddings, and premium home décor applications.

- Online retail channels are expanding rapidly, allowing consumers to access a wide range of preserved flower options with customization and subscription models, boosting recurring demand.

- Asia-Pacific is emerging as the fastest-growing region, driven by urbanization, rising middle-class income, and increasing wedding and gifting culture in China, India, and Southeast Asia.

- Europe remains the largest market in 2024, with Germany, France, and the U.K. showing strong demand due to high disposable income and luxury lifestyle adoption.

- Technological innovations in flower preservation, including glycerin infusion and hybrid treatments, are enabling longer shelf-life and color retention, reshaping consumer preferences and premium product offerings.

What are the latest trends in the preserved fresh flower market?

Luxury and Sustainable Flower Décor

Consumers increasingly prefer preserved flowers for luxury décor applications at homes, hotels, and offices due to their maintenance-free nature and aesthetic longevity. The shift toward sustainability has boosted the appeal of naturally preserved flowers over synthetic alternatives. High-end interior designers and event planners are integrating preserved flowers into wedding décor, corporate gifting, and luxury events, reflecting a trend toward the premiumization of floral products. Subscription-based floral décor services and customizable arrangements are also gaining popularity, allowing repeat consumption and creating recurring revenue opportunities.

Online and E-Commerce Dominance

The rise of online retail platforms has revolutionized the preserved fresh flower market. E-commerce allows brands to reach urban and semi-urban consumers directly, offering personalized gifting options, same-day delivery, and subscription services. Digital platforms have also enabled data-driven insights into consumer preferences, helping manufacturers optimize product offerings. Mobile apps, social media, and influencer marketing have significantly shaped purchasing patterns, especially among younger demographics seeking customized and Instagram-worthy floral arrangements.

What are the key drivers in the preserved fresh flower market?

Growing Affinity for Low-Maintenance and Long-Lasting Décor

Consumers increasingly prefer flowers that retain natural beauty without frequent maintenance. Preserved flowers offer months-long shelf life with minimal care, making them ideal for personal décor, hospitality, and corporate settings. This trend aligns with urban lifestyles, where time-constrained consumers seek aesthetically pleasing yet hassle-free home and office décor solutions. Rising awareness of eco-friendly gifting practices further strengthens the adoption of preserved flowers over fresh flowers.

Expansion of Luxury Gifting and Events Industry

The wedding, gifting, and hospitality sectors are major growth drivers for preserved flowers. Luxury gifting culture in North America, Europe, and the Middle East is pushing demand for premium preserved roses, orchids, and other flowers. Hotels, restaurants, and corporate offices increasingly invest in floral décor to enhance ambiance and customer experience. Customized arrangements and high-value packaging have contributed to higher profit margins and steady market growth.

What are the restraints for the global market?

High Manufacturing and Preservation Costs

Preserved flowers require specialized preservation techniques, chemicals, and quality control processes, increasing production costs. This can limit adoption in price-sensitive markets and pose challenges for small-scale manufacturers to compete with established premium brands. The need for controlled storage and transportation further adds to operational costs.

Limited Awareness in Emerging Markets

In several regions, including parts of Africa and Latin America, awareness and acceptance of preserved flowers are limited. Cultural preference for fresh flowers and limited availability of retail channels restrict market penetration. Educating consumers about the long-lasting benefits and eco-friendly aspects of preserved flowers remains a challenge for market growth in these areas.

What are the key opportunities in the preserved fresh flower market?

Expansion in Emerging Markets

Rising urbanization, disposable income, and wedding culture in Asia-Pacific, the Middle East, and Latin America offer significant growth potential. Companies can target tier-2 and tier-3 cities through online platforms and regional manufacturing partnerships to tap into these high-growth markets. Increased awareness campaigns and collaborations with local florists can help overcome cultural barriers and expand adoption.

Integration of Advanced Preservation Technologies

Investment in cryopreservation, glycerin infusion, and hybrid preservation techniques allows manufacturers to produce flowers with enhanced color retention, fragrance, and shelf life. Technological innovations create opportunities for premium product lines, targeting high-end gifting, hospitality, and luxury décor segments. Adoption of eco-friendly chemical treatments further aligns products with sustainable consumer preferences.

Digital and Subscription-Based Business Models

Online retail and subscription-based services provide recurring revenue opportunities. Monthly or seasonal flower delivery services are gaining popularity among urban consumers and corporate clients. Personalized arrangements, AI-driven recommendations, and digital marketing campaigns offer new ways to engage customers, enhance brand loyalty, and expand market share.

Product Type Insights

Preserved roses dominate the global preserved fresh flower market, accounting for approximately 38% of total market share in 2024, making them the leading product type worldwide. Their dominance is driven primarily by their strong symbolic association with love, luxury, and celebration, which makes them the preferred choice for premium gifting, weddings, anniversaries, and high-end interior décor. Roses also offer superior adaptability to preservation techniques, enabling better color retention, petal structure stability, and longer shelf life compared to other flower varieties.

Additionally, preserved roses benefit from a wide color spectrum, including customized and non-natural hues such as metallic, pastel, and ombré shades, which enhances their appeal across luxury and design-oriented applications. Premium packaging innovations, such as acrylic boxes, glass domes, and branded gift cases, further reinforce the market leadership of preserved roses by increasing perceived value and average selling prices. Other preserved flower types, including carnations, orchids, tulips, and mixed floral arrangements, are gaining gradual traction, particularly in hospitality décor and artistic installations. However, these products currently serve niche or complementary roles, while preserved roses remain the most commercially scalable and globally demanded product category.

Application Insights

Personal and home décor represent the largest application segment in the preserved fresh flower market, accounting for approximately 40% of global demand in 2024. This segment’s leadership is driven by rising urbanization, increasing preference for low-maintenance interior décor, and the growing influence of aesthetic-driven home styling trends promoted through social media and interior design platforms. Preserved flowers are increasingly used in living spaces, dining areas, work-from-home setups, and luxury apartments due to their long-lasting visual appeal and minimal upkeep requirements.

The wedding and events segment is emerging as one of the fastest-growing applications, supported by the premiumization of wedding décor and the need for durable floral arrangements that maintain freshness throughout multi-day celebrations. Preserved flowers significantly reduce replacement and maintenance costs for event planners while offering consistent visual quality. Hospitality applications, including hotels, restaurants, spas, and corporate offices, also contribute steadily to market growth, as preserved flowers provide a cost-effective solution for maintaining an elegant ambiance in high-footfall environments. Corporate gifting, retail arrangements, and luxury brand activations further expand application diversity, reinforcing the market’s resilience across both consumer and commercial end-use segments.

Distribution Channel Insights

Online retail channels are the fastest-growing distribution segment in the preserved fresh flower market, holding approximately 30% of global market share in 2024. The leadership of this channel is driven by increasing consumer preference for convenience, personalization, and direct-to-consumer purchasing models. E-commerce platforms and brand-owned websites allow customers to customize flower types, colors, packaging, and delivery schedules, significantly enhancing the buying experience.

Subscription-based models for seasonal décor and gifting are gaining popularity, particularly among urban households and corporate clients, contributing to recurring revenue streams for manufacturers. Digital marketing, influencer collaborations, and social commerce platforms play a crucial role in driving brand visibility and consumer engagement. Offline retail channels, including florists, specialty stores, and premium lifestyle outlets, remain relevant in regions with strong cultural preferences for physical inspection and immediate purchase. However, these channels are increasingly integrated with digital platforms through hybrid models such as online ordering with local fulfillment and same-day delivery. This omnichannel approach is emerging as a key growth strategy for manufacturers seeking to balance reach, customer experience, and logistics efficiency.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global preserved fresh flower market in 2024, led by the United States and Canada. Regional growth is driven by high disposable income, strong demand for luxury gifting solutions, and widespread adoption of e-commerce platforms. The region’s mature corporate gifting ecosystem and well-developed hospitality sector significantly contribute to sustained demand for premium preserved roses and orchids. Additionally, rising awareness of sustainable and low-maintenance décor solutions, combined with a strong culture of seasonal and occasion-based gifting, supports long-term market expansion. The presence of established premium brands and advanced logistics infrastructure further strengthens North America’s market position.

Europe

Europe represents the largest regional market, accounting for approximately 32% of global market share in 2024, with Germany, France, and the United Kingdom leading demand. Growth in the region is driven by strong consumer preference for eco-friendly, sustainable, and premium lifestyle products. European consumers demonstrate a high willingness to pay for long-lasting floral décor that aligns with sustainability values and aesthetic sophistication. The region’s well-established wedding industry, luxury home décor culture, and emphasis on innovative preservation techniques support continued demand. Strict environmental regulations also encourage the adoption of preserved flowers as an alternative to frequently replaced fresh flowers, reinforcing Europe’s leadership in the global market.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, projected to expand at a CAGR of approximately 10% through 2030. China, India, Japan, and Southeast Asian countries are key contributors, driven by rapid urbanization, rising disposable income, and the growing influence of Western-style luxury gifting and wedding trends. The expansion of e-commerce platforms and mobile-first purchasing behavior enables manufacturers to reach tier-2 and tier-3 cities efficiently. Increasing social media influence, premiumization of weddings, and rising demand for luxury home décor among younger consumers are key drivers accelerating adoption across the region.

Latin America

Latin America, led by Brazil and Argentina, is an emerging market for preserved fresh flowers. Growth in the region is driven by increasing urban weddings, rising awareness of premium décor solutions, and the gradual expansion of organized retail and online channels. While adoption remains moderate compared to developed regions, premium gifting and hospitality applications are gaining traction. Economic recovery in select countries and increasing exposure to global lifestyle trends are expected to support steady long-term growth, particularly in metropolitan areas.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is witnessing strong growth driven by luxury gifting culture, high per-capita income, and expansion of premium hospitality and event industries. Demand is largely concentrated in high-end preserved floral arrangements used for weddings, corporate gifting, and luxury interiors. Africa plays a dual role as both a growing consumer market and a major floriculture production hub. Countries such as Kenya and South Africa support global supply through export-oriented floriculture industries, benefiting from favorable climate conditions and established flower cultivation expertise. Increasing investment in value-added preservation processes within the region is expected to enhance both domestic consumption and export-driven growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Preserved Fresh Flower Market

- Forever Roses

- Venus ET Fleur

- RoseForever

- Florasis

- Eternal Roses

- LUXURY Bloom

- Amour Flowers

- Frozen Petals

- Arte de Fleur

- Diamond Roses

- Everlasting Flowers

- The Million Roses

- FloraQueen

- Rosetella

- BloomsyBox