Premium Hair Care Market Size

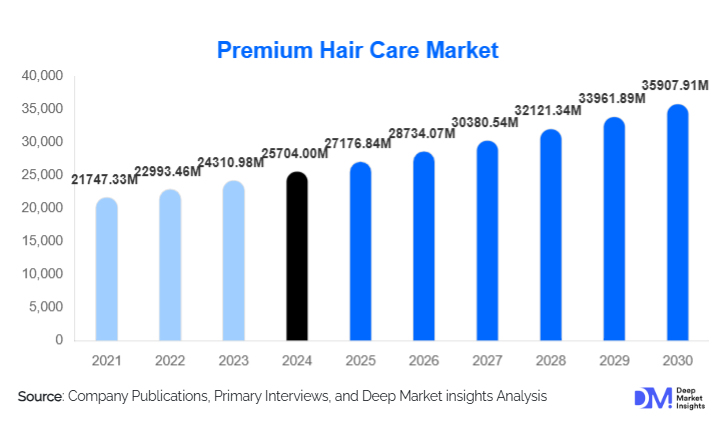

According to Deep Market Insights, the global premium hair care market size was valued at USD 25,704.00 million in 2024 and is projected to grow from USD 27,176.84 million in 2025 to reach USD 35,907.91 million by 2030, expanding at a CAGR of 5.73% during the forecast period (2025–2030). The premium hair care market growth is driven by rising consumer preference for high-performance formulations, increasing focus on scalp health, growing demand for clean and natural ingredients, and the rapid premiumization of personal care across both developed and emerging economies.

Key Market Insights

- Premium hair care is increasingly positioned as an extension of skincare, with consumers prioritizing scalp health, anti-aging benefits, and science-backed formulations.

- Natural, clean-label, and botanical-based formulations dominate product innovation, driven by heightened ingredient awareness and regulatory scrutiny.

- North America leads global consumption, supported by high disposable income, brand penetration, and strong DTC adoption.

- Asia-Pacific is the fastest-growing region, fueled by premiumization in China and India and the global influence of Korean and Japanese hair care brands.

- E-commerce and direct-to-consumer channels are reshaping distribution, offering personalized solutions, subscriptions, and data-driven engagement.

- Salon and professional endorsements remain critical, significantly influencing consumer trust and repeat purchases.

What are the latest trends in the premium hair care market?

Shift Toward Scalp-Centric and Skinification Products

One of the most prominent trends in the premium hair care market is the shift toward scalp-centric solutions. Consumers increasingly recognize the scalp as an extension of facial skin, driving demand for exfoliating scrubs, scalp serums, tonics, and microbiome-balancing products. Brands are introducing formulations enriched with peptides, ceramides, niacinamide, and hyaluronic acid, mirroring skincare actives. This trend is particularly strong in North America, Europe, and East Asia, where dermatological credibility and clinical claims influence purchasing behavior.

Technology-Enabled Personalization and DTC Growth

Technology is playing a transformative role in premium hair care. AI-based hair diagnostics, online consultations, and personalized product regimens are gaining traction, particularly through DTC platforms. Brands are leveraging consumer data to offer customized solutions for hair fall, damage repair, and texture management. Subscription-based models and smart packaging that tracks usage are also emerging, improving customer retention and lifetime value while reinforcing premium brand positioning.

What are the key drivers in the premium hair care market?

Rising Disposable Income and Premiumization of Beauty

Increasing disposable income, especially among urban consumers, is a key driver of premium hair care adoption. Consumers are trading up from mass-market products to premium alternatives that promise superior efficacy, sensory experience, and brand prestige. This premiumization trend is particularly evident in Asia-Pacific and Latin America, where aspirational consumption and exposure to global beauty trends are accelerating demand.

Growing Demand for Clean, Sustainable, and Ethical Products

Consumers are increasingly scrutinizing ingredient lists, sourcing practices, and environmental impact. Premium hair care brands benefit from this shift as they are better positioned to invest in sustainable packaging, cruelty-free testing, and ethically sourced ingredients. Regulatory alignment and clean beauty certifications further strengthen consumer trust and drive long-term growth.

What are the restraints for the global market?

High Product Pricing and Limited Accessibility

Premium hair care products command significantly higher price points due to advanced formulations, R&D costs, and brand positioning. This restricts adoption in price-sensitive markets and limits penetration beyond urban and high-income consumer segments. Economic uncertainty can also temporarily shift consumer spending toward affordable alternatives.

Volatility in Raw Material Supply and Costs

Many premium products rely on natural oils, organic extracts, and specialty actives, which are vulnerable to agricultural variability and supply chain disruptions. Fluctuating input costs can pressure margins and complicate pricing strategies for manufacturers.

What are the key opportunities in the premium hair care industry?

Emerging Market Expansion and Localization

Emerging economies such as India, Indonesia, Vietnam, Brazil, and Mexico present strong growth opportunities. Brands that localize formulations based on climate, hair texture, and cultural preferences can rapidly scale adoption. Affordable-premium tiers tailored to these markets offer significant volume potential.

Integration of Biotechnology and Advanced Actives

The application of biotechnology in hair care, such as fermented ingredients, bio-peptides, and plant stem cell extracts, offers differentiation and pricing power. Premium brands investing in proprietary actives and patented formulations are well-positioned to capture long-term value.

Product Type Insights

Premium shampoos dominate the global premium hair care market, accounting for approximately 32% of the 2024 market size. This leadership is primarily driven by high daily usage frequency, innovation in sulfate-free formulations, scalp-focused variants, and the growing consumer preference for hair damage repair solutions. Conditioners and hair masks follow closely, benefiting from rising consumer emphasis on hydration, nourishment, and restorative treatments for chemically treated or heat-styled hair. Hair oils and serums are experiencing rapid adoption, particularly in the Asia-Pacific region, where traditional oiling practices intersect with modern, high-performance, premium formulations. Scalp care products, including serums, tonics, and exfoliating scrubs, represent the fastest-growing niche segment, reflecting increasing consumer awareness about hair fall, thinning, and scalp health, as well as the rising demand for preventative and anti-aging solutions.

Hair Concern Insights

Among various hair concerns, hair damage repair leads the market, holding an estimated 29% share. This growth is propelled by widespread use of heat styling tools, frequent chemical treatments such as coloring and perming, and increased exposure to pollution and environmental stressors. Hair fall and thinning treatments are expanding steadily, driven by lifestyle-induced stress, aging populations, and rising consumer focus on scalp nutrition and active hair growth solutions. Scalp health and anti-aging hair care are emerging as high-growth areas, particularly among premium consumers seeking scientifically-backed, preventative solutions for hair loss, graying, and overall hair vitality.

Distribution Channel Insights

E-commerce and direct-to-consumer (DTC) channels account for nearly 34% of global premium hair care sales. These channels are expanding due to convenience, wider product access, personalized engagement, subscription models, and online consultations. Salon and professional channels remain highly influential, particularly for product trials, professional endorsements, and building brand credibility. Specialty beauty retailers and luxury department stores continue to play a critical role in positioning premium products, providing consumer education, and supporting brand discovery. The combination of online and offline channels allows brands to optimize reach while offering tailored experiences to different consumer segments.

Consumer Group Insights

Women dominate the market, accounting for approximately 61% of total demand, driven by broader treatment routines, higher product usage, and greater willingness to invest in premium formulations. The men’s premium hair care segment is expanding rapidly, fueled by growing grooming awareness, lifestyle changes, and specialized products targeting hair loss, thinning, and styling needs. Unisex and gender-neutral formulations are gaining traction, reflecting shifting consumer preferences toward inclusivity, shared household routines, and multifunctional products. The convergence of skincare principles into hair care has also encouraged broader adoption across all demographics.

| By Product Type | By Hair Concern | By Consumer Group | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 31% of the global premium hair care market, led primarily by the United States. The region’s growth is driven by high disposable income, strong brand penetration, rapid adoption of direct-to-consumer and e-commerce platforms, and a growing focus on clean beauty, dermatologist-recommended, and science-backed formulations. Consumers increasingly prioritize scalp health, anti-aging hair solutions, and sulfate-free or natural formulations. Urbanization, lifestyle-driven hair concerns, and strong salon networks further reinforce regional demand, making North America a highly lucrative and innovation-driven market.

Europe

Europe holds approximately 27% market share, with Germany, France, the U.K., and Italy driving demand. The market is supported by a strong heritage in luxury and premium cosmetics, high consumer awareness of sustainability, and stringent regulatory standards promoting safe, high-quality products. Growth is fueled by rising preferences for eco-friendly formulations, plant-based ingredients, and anti-aging or damage-repair hair care solutions. Increasing salon penetration, professional endorsements, and high urban population density in key European countries further stimulate the consumption of premium products.

Asia-Pacific

Asia-Pacific represents nearly 29% of the global market and is the fastest-growing region, expanding at over 10% CAGR. China, Japan, South Korea, and India dominate demand, driven by rapid premiumization, increasing social media influence, rising disposable incomes, and the strong cultural tradition of hair oiling, combined with modern premium formulations. Urban lifestyle changes, growing salon and professional networks, and high adoption of DTC platforms contribute to strong growth. Innovation leadership from South Korea and Japan, particularly in scalp care and anti-aging hair solutions, further propels the region’s premium hair care consumption.

Latin America

Latin America accounts for around 8% of the market, with Brazil and Mexico leading growth. Market expansion is fueled by rising middle-class income, increasing beauty consciousness, and expanding professional salon networks in urban centers. The adoption of premium shampoos, conditioners, and hair repair products is growing steadily due to rising awareness of chemical hair damage, heat styling, and hair fall concerns. E-commerce and social media-driven marketing are enhancing product visibility, while the influence of European and North American brands continues to shape local preferences.

Middle East & Africa

The Middle East & Africa region holds approximately 5% market share, led by the UAE and Saudi Arabia. Growth is driven by high-income populations, strong preference for luxury grooming products, and exposure to imported premium hair care brands. Urbanization, professional salon culture, and rising awareness of hair damage prevention, scalp care, and hair health contribute to regional demand. The region is also witnessing increasing e-commerce adoption, influencer-led marketing, and high penetration of international premium brands, further boosting consumption in key markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Premium Hair Care Market

- L’Oréal

- Procter & Gamble

- Unilever

- Estée Lauder Companies

- Shiseido

- Henkel

- Kao Corporation

- Amorepacific

- Coty

- Olaplex

- Oribe

- Aveda

- Moroccanoil

- Briogeo

- Kérastase