Premium Fragrances Market Size

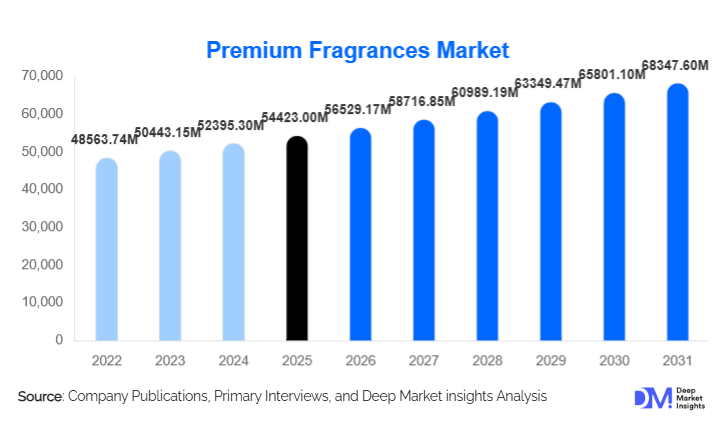

According to Deep Market Insights, the global premium fragrances market size was valued at USD 54,423.00 million in 2024 and is projected to grow from USD 56,529.17 million in 2025 to reach USD 68,347.60 million by 2030, expanding at a CAGR of 3.87% during the forecast period (2025–2030). The premium fragrances market growth is primarily driven by the rising premiumization of personal care products, increasing disposable incomes, and strong consumer preference for luxury, niche, and long-lasting fragrances with strong brand identity.

Key Market Insights

- Premium fragrances are transitioning from occasional luxury purchases to daily lifestyle essentials, especially among millennials and Gen Z consumers.

- Niche and ultra-luxury fragrances are gaining strong traction, supported by demand for exclusivity, artisanal craftsmanship, and rare ingredients.

- Europe dominates the global market, supported by fragrance heritage, strong brand presence, and high per-capita consumption.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class wealth, expanding luxury retail, and gifting culture.

- E-commerce and DTC channels are reshaping distribution, enabling personalization, higher margins, and global reach.

- Unisex and gender-neutral fragrances are expanding the addressable consumer base and redefining traditional segmentation.

What are the latest trends in the premium fragrances market?

Rise of Niche, Artisanal, and Ultra-Luxury Fragrances

The premium fragrances market is experiencing accelerated growth in niche, artisanal, and ultra-luxury offerings, driven by consumers’ growing desire for exclusivity, authenticity, and emotional storytelling. These fragrances are typically characterized by limited production runs, the use of rare and high-cost natural raw materials, and complex, unconventional olfactory compositions. Consumers are increasingly moving away from mass-market scents toward signature fragrances that reflect individuality, lifestyle, and personal identity.

Independent perfume houses and luxury brands are expanding their portfolios with extrait de parfum, bespoke blends, and made-to-order creations, enabling significantly higher average selling prices and gross margins compared to traditional premium fragrances. This trend is particularly pronounced in Europe, where fragrance craftsmanship has deep cultural roots, in North America, where personalization and exclusivity are highly valued, and in the Middle East, where demand for high-concentration, long-lasting oud and amber-based fragrances remains structurally strong.

Digital-First Brand Engagement and Personalization

Technology is playing a transformative role in how consumers discover, evaluate, and purchase premium fragrances. AI-powered scent profiling tools, virtual fragrance consultations, and subscription-based sampling models are reducing purchase hesitation in an otherwise sensory-driven category. Brands are increasingly leveraging data analytics to understand scent preferences and deliver hyper-personalized recommendations across digital channels.

Social media, influencer marketing, and immersive digital storytelling have become central to customer acquisition strategies, particularly among millennials and Gen Z consumers. Direct-to-consumer (DTC) platforms allow brands to control pricing, collect consumer insights, and build long-term loyalty while improving margins. Virtual brand experiences, online exclusives, and limited-edition digital launches are further reinforcing this digital-first shift.

What are the key drivers in the premium fragrances market?

Premiumization of Personal Care and Grooming

Global consumers are increasingly trading up from mass-market fragrances to premium alternatives, driven by heightened awareness of ingredient quality, scent longevity, and brand prestige. Fragrances are no longer viewed as occasional luxury purchases but as integral components of daily grooming and self-expression. This shift supports higher average selling prices, increased frequency of use, and stronger brand loyalty, particularly in developed markets.

Influence of Celebrity, Fashion, and Luxury Branding

Celebrity endorsements, fashion house extensions, and luxury brand collaborations continue to exert a strong influence on consumer purchasing behavior. Limited-edition releases, seasonal collections, and designer collaborations create urgency and scarcity, reinforcing premium positioning. This driver is especially impactful in North America and Asia-Pacific, where celebrity culture and aspirational consumption significantly shape luxury buying decisions.

What are the restraints for the global market?

Volatility in Raw Material Prices

Premium fragrances depend heavily on natural ingredients such as essential oils, resins, woods, and botanical extracts. Climate change, geopolitical tensions, and supply chain disruptions have increased volatility in raw material availability and pricing. These fluctuations directly affect production costs, pricing strategies, and profit margins, particularly for niche and artisanal brands that rely on rare natural inputs.

Stringent Regulatory and Compliance Requirements

Regulatory frameworks governing fragrance ingredients, safety standards, and sustainability disclosures are becoming increasingly stringent, particularly in Europe. Compliance with evolving regulations raises R&D costs, extends product development timelines, and creates barriers to entry for smaller brands. Continuous reformulation requirements further add to operational complexity.

What are the key opportunities in the premium fragrances industry?

Expansion in Emerging Luxury Markets

Emerging markets across Asia-Pacific, the Middle East, and Latin America represent significant growth opportunities for premium fragrance brands. Rising disposable incomes, rapid urbanization, and increasing exposure to global luxury trends are fueling aspirational consumption. Localization of fragrance profiles, such as oud-heavy compositions in the Middle East and lighter floral or fresh notes in Asia, enhances cultural relevance and accelerates market penetration.

Growth of Sustainable and Ethical Fragrances

Consumers are increasingly prioritizing sustainability, transparency, and ethical sourcing in premium fragrance purchases. Brands adopting responsibly sourced ingredients, refillable and recyclable packaging, and clean-label formulations are gaining a competitive advantage. Investments in green chemistry, carbon-neutral manufacturing, and sustainability certifications are expected to drive long-term brand differentiation and consumer trust.

Product Type Insights

Eau de Parfum (EDP) dominates the premium fragrances market, accounting for approximately 38% of global revenue in 2024. Its leadership is driven by an optimal balance of scent intensity, longevity, and price accessibility, making it suitable for daily use while retaining a luxury perception. Parfum and extrait de parfum represent the fastest-growing sub-segment, supported by rising demand for ultra-luxury, long-lasting fragrances and niche brand expansion. Eau de Toilette remains relevant in warmer climates and among younger consumers seeking lighter formulations, while colognes and eau fraîche serve seasonal and entry-premium demand.

Fragrance Family Insights

Floral fragrances hold the largest market share at 32%, driven by strong demand among women consumers and their widespread use in gifting occasions. The segment benefits from cultural familiarity, broad demographic appeal, and continuous innovation in floral blends. Woody and oriental/amber fragrances are gaining momentum, particularly in men’s and unisex categories, driven by preferences for deeper, richer, and longer-lasting profiles. Gourmand and fresh fragrances are seeing increased adoption among millennials and Gen Z consumers, reflecting evolving preferences toward comfort-driven and contemporary scent profiles.

Distribution Channel Insights

Specialty beauty retail remains the leading distribution channel, accounting for approximately 36% of premium fragrance sales. Its dominance is supported by experiential in-store testing, trained consultants, and curated brand portfolios that encourage premium purchases. Brand-owned boutiques and DTC channels are expanding rapidly, driven by higher margins, exclusive launches, and personalized consumer engagement. Travel retail continues to play a critical role in luxury fragrance discovery, while e-commerce marketplaces are growing through convenience, broader access, and competitive pricing.

End-Use Insights

Personal daily wear represents the largest end-use segment, accounting for nearly 48% of total demand, reflecting the normalization of premium fragrances in everyday grooming routines. Gifting and seasonal purchases account for approximately 30% of market demand, driven by festive seasons, holidays, and luxury gift-giving traditions. Corporate and professional gifting is emerging as a high-potential segment, particularly in the Asia-Pacific and Middle East regions, where premium fragrances are widely used as status-driven business gifts.

| By Product Type | By Fragrance Family | By Gender Targeting | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global premium fragrances market, accounting for a 34% share in 2024, driven by key markets such as France, Italy, Germany, and the U.K. The region’s dominance is supported by deep-rooted fragrance heritage, the presence of leading luxury houses, high per-capita consumption, and strong export activity. Consumer preference for artisanal craftsmanship, niche brands, and sustainable formulations further strengthens regional demand.

North America

North America accounts for approximately 29% of global demand, led by the United States. Growth is driven by strong DTC adoption, high influence of celebrity and fashion branding, and premium lifestyle spending. The region also benefits from the rapid adoption of digital personalization tools and subscription-based fragrance models.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at nearly 9.5% CAGR. China, Japan, South Korea, and India are driving growth through rising disposable incomes, expanding luxury retail infrastructure, and a strong gifting culture. Increased exposure to Western luxury brands and social media-driven consumption trends are further accelerating adoption.

Latin America

Latin America holds around 6% of the global market, led by Brazil and Mexico. Growth is supported by rising urbanization, expanding middle-class populations, and increasing appetite for affordable premium fragrances among younger consumers.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of global revenue, driven primarily by the UAE and Saudi Arabia. High demand for oud-based, oriental, and high-concentration fragrances, combined with strong luxury spending and gifting traditions, underpins regional growth. The region’s cultural preference for long-lasting, intense fragrances continues to support premium and ultra-luxury segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|