Premium Denim Jeans Market Size

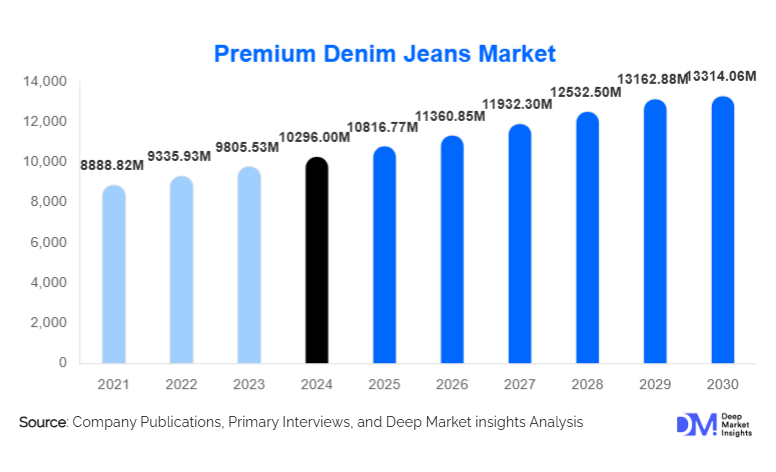

According to Deep Market Insights, the global premium denim jeans market size was valued at USD 10,296.00 Million in 2024 and is projected to grow from USD 10,816.77 Million in 2025 to reach USD 13,314.06 Million by 2030, expanding at a CAGR of 5.03% during the forecast period (2025–2030). Market expansion is fueled by rising demand for high-quality apparel, sustainability-led fashion preferences, increasing disposable incomes, and strong online retail penetration that has democratized access to premium denim globally.

Key Market Insights

- Premium denim demand is shifting toward sustainable and eco-conscious products, including organic cotton, recycled fibers, and low-water dyeing processes.

- Selvedge and raw denim remain the fastest-growing premium segments, driven by craftsmanship-focused consumers.

- Women’s premium denim accounts for the largest growing demographic, supported by evolving fashion trends and rising disposable income among working women.

- APAC is the fastest-growing regional market, led by China, India, Japan, and South Korea.

- Online retail dominates premium denim distribution, accounting for nearly one-third of all global sales.

- Technological innovations, stretch denim, waterless dyeing, and premium finishes are reshaping consumer expectations and brand differentiation.

What are the latest trends in the Premium Denim Jeans Market?

Sustainability and Eco-Denim Innovation Accelerate

Brands are aggressively shifting toward sustainable, eco-friendly premium denim. Innovations such as recycled cotton blends, hemp denim, plant-based dyes, and waterless finishing technologies are becoming mainstream. Premium consumers increasingly prioritise environmental responsibility, driving demand for transparent supply chains, carbon-neutral manufacturing, and ethically sourced raw materials. Leading brands are integrating sustainability certifications, traceable materials, and eco-labelling to strengthen consumer trust. As environmental regulations tighten globally, sustainability-led premium denim is expected to account for a significantly higher share of the market by 2030.

Rise of Selvedge, Raw Denim & Craftsmanship-Led Fashion

Selvedge and raw denim have surged in popularity, especially among fashion-conscious buyers seeking durability, authenticity, and heritage craftsmanship. The “slow fashion” movement has contributed to this rise, encouraging consumers to invest in long-lasting wardrobe pieces rather than fast fashion. Premium brands are responding with limited-edition drops, artisan-crafted jeans, and vintage washes using advanced finishing techniques. These styles are particularly influential in markets like the U.S., Japan, and Europe, strengthening the identity and exclusivity associated with premium denim ownership.

What are the key drivers in the Premium Denim Jeans Market?

Rising Global Affluence and Premiumization of Fashion

The expanding global middle class, particularly across APAC and Latin America, is fueling premium apparel spending. Consumers are increasingly opting for high-quality denim that offers superior fit, durability, and brand prestige. Premium denim is becoming a wardrobe essential rather than a niche fashion category, especially among urban professionals and millennials who value quality over quantity. This macro trend of “premiumization” across apparel retail is expected to continue driving long-term demand for premium denim jeans.

E-commerce Expansion and D2C Brand Growth

Online retail has revolutionised premium denim distribution. With improved size selection tools, virtual try-ons, free returns, and personalisation, consumers increasingly prefer online channels for buying premium denim. Digital-native premium denim brands, many using D2C models, have emerged as formidable competitors to legacy brands. Their ability to combine premium materials, innovative design, and competitive pricing through streamlined supply chains has reshaped the competitive landscape. E-commerce now accounts for nearly 30% of global premium denim sales.

Shift Toward Smart-Casual & Lifestyle Fashion

Post-pandemic fashion norms have accelerated demand for casual yet stylish attire. Premium denim fits seamlessly into this evolving lifestyle. Straight-fit, relaxed-fit, stretch denim, and selvedge jeans have gained traction as consumers seek comfort and versatility. With many workplaces adopting hybrid or casual dress codes, premium denim is increasingly accepted as smart-casual attire, boosting repeat purchase rates.

What are the restraints for the global market?

High Price Points Restrict Mass Adoption

Premium denim jeans often cost 2–4 times more than mass-market alternatives. This limits adoption among price-sensitive populations, particularly in lower-income regions. While aspirational buying persists, high pricing remains the primary barrier preventing widespread penetration of premium denim brands in emerging markets.

Volatility in Raw Material Prices and Supply Chain Risks

Premium denim production relies heavily on cotton, water-intensive manufacturing, and specialised finishing techniques. Fluctuations in cotton prices, geopolitical trade tensions, and rising costs of sustainable materials exert pressure on brand margins. Additionally, supply chain disruptions, from manufacturing delays to shipping bottlenecks, can lead to inventory shortages, hinder product launches, and increase operational costs.

What are the key opportunities in the Premium Denim Jeans Market?

Sustainability-led Differentiation & New Green Premium Lineups

Growing environmental awareness offers a major opportunity for brands to position themselves as sustainability leaders. Eco-denim, recycled fibres, plant-based dyes, and closed-loop manufacturing can command premium prices and attract eco-conscious buyers. Brands that build transparent, traceable supply chains stand to gain the most.

Emerging Market Demand, APAC, LATAM & MEA

Rising disposable incomes in Asia-Pacific, Latin America, and the Middle East & Africa create significant long-term potential for premium denim. Localised fit options, region-specific styles, culturally relevant marketing, and flexible pricing strategies can help brands penetrate these fast-growing markets. Countries such as China, India, Brazil, Mexico, the UAE, and Saudi Arabia represent key growth frontiers.

Premium Lifestyle Collaborations & Limited-Edition Drops

Collaborations with designers, artists, celebrities, and streetwear brands are shaping consumer excitement around premium denim. Limited-edition drops create exclusivity and drive demand among younger demographics. Brands can also partner with luxury fashion houses to elevate craftsmanship and extend their presence in the high-end apparel ecosystem.

Product Type Insights

Selvedge and raw denim dominate premium denim growth, accounting for nearly 25–30% of the 2024 market. Consumers increasingly associate selvedge denim with durability, authenticity, and artisanal craftsmanship. Slim-fit and straight-fit styles continue to hold steady demand, while relaxed and baggy fits are re-emerging for younger demographics. Stretch denim, which combines comfort with premium aesthetics, remains a strong sub-segment, particularly popular among women and consumers seeking all-day wearability.

Application Insights

Premium denim is primarily used for casual lifestyle wear, representing the largest application segment globally. Smart-casual and work-casual applications are rapidly expanding as office dress codes evolve. Fashion-focused applications, including designer collaborations, vintage washes, and limited-edition jeans, cater to trend-driven consumers. The rise of sustainable fashion has further expanded the “eco-denim” application segment, which appeals to buyers prioritising environmental transparency.

Distribution Channel Insights

Online retail leads the premium denim market, accounting for approximately 30% of global 2024 sales. Digital platforms allow consumers to compare fits, explore style options, and benefit from fast shipping and hassle-free returns. Specialist premium denim boutiques, brand-owned stores, and department stores continue to serve as key offline channels. The rise of direct-to-consumer brands has reshaped pricing strategies, enabling competitive price premiums supported by storytelling and brand identity. Social media, influencer branding, and live e-commerce continue to accelerate digital adoption.

End-User Insights

Women represent the fastest-growing end-user segment, capturing around 35–40% of the 2024 market. Fashion-forward styles, varied fits, and premium stretch materials drive this demand. Men remain a major segment owing to higher adoption of selvedge, slim-fit, and straight-fit premium jeans. Youth and teens are emerging as influential buyers, driven by social media trends, urban lifestyle fashion, and aspirational purchasing behaviours.

| By Product Type | By Fabric / Material Type | By End-User | By Distribution Channel | By Price/Positioning Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for 30–35% of the global market in 2024, driven by strong brand heritage, mature retail ecosystems, and high disposable incomes. The U.S. remains the largest premium denim market globally, with strong demand for selvedge, limited-edition drops, and designer collaborations.

Europe

Europe holds 20–25% of the market, supported by fashion-conscious consumers in Germany, the U.K., France, Italy, and Scandinavia. Demand for sustainable and ethically produced denim is highest in this region.

Asia-Pacific

APAC captured 25–30% of the market and is the fastest-growing region. China and India are leading growth through rising middle-class affluence, while Japan and South Korea exhibit strong demand for selvedge and raw denim based on legacy craftsmanship trends.

Latin America

LATAM represents 5–8% of global demand, led by Brazil, Mexico, and Argentina. While growth is steady, economic volatility remains a challenge for premium brand penetration.

Middle East & Africa

MEA accounts for 5–7% of the market, with GCC nations, South Africa, and Kenya driving demand. Growth is supported by luxury fashion adoption and increasing Western fashion influence.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Premium Denim Jeans Market

- Levi Strauss & Co.

- VF Corporation

- Gap Inc.

- Kering S.A.

- H&M Hennes & Mauritz AB

- PVH Corp.

- Pepe Jeans S.L.

- Bestseller A/S

- G-Star RAW

- AEO Management Co. (American Eagle)

- AG Adriano Goldschmied Inc.

- Marks & Spencer Group plc

- Armani S.p.A.

- Uniqlo Co. Ltd.

- U.S. Polo Assn.

Recent Developments

- In March 2025, Levi’s announced a global expansion of its circular denim program featuring recycled fibre integration and waterless manufacturing.

- In January 2025, G-Star RAW launched a new selvedge denim series produced with zero-water dyeing technology.

- In June 2025, PVH Corp. introduced advanced stretch-denim technology focused on durability and comfort for premium Calvin Klein and Tommy Hilfiger denim lines.