Powered Air-Purifying Respirator Market Size

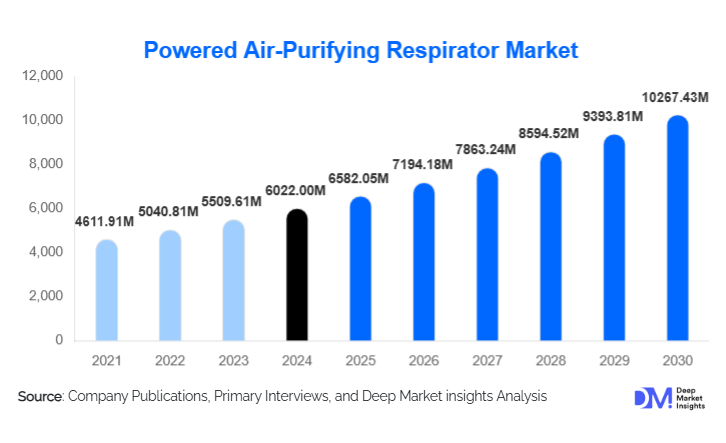

According to Deep Market Insights, the global powered air-purifying respirator market size was valued at USD 6,022.00 million in 2024 and is projected to grow from USD 6,582.05 million in 2025 to reach USD 10,267.43 million by 2030, expanding at a CAGR of 9.30% during the forecast period (2025–2030). Increasing workplace safety regulations, rising demand across healthcare and industrial sectors, and rapid adoption of advanced respiratory protection technologies are key contributors to the market’s sustained expansion.

Key Market Insights

- Full-face PAPR systems dominate the global market, accounting for over 50% of total 2024 revenues, driven by comprehensive protection requirements across healthcare, chemical handling, and hazardous industries.

- Standard PAPR technologies remain the largest technology segment, while smart/connected systems featuring IoT sensors and real-time monitoring represent the fastest-growing segment.

- Healthcare is the largest end-use industry, comprising 30–35% of global demand due to infection control protocols, biohazard exposure risk, and emergency preparedness.

- North America leads the global PAPR market, while Asia-Pacific is the fastest-growing region driven by industrial expansion and regulatory modernization.

- Technological innovation, including digital airflow monitoring, improved filter media, and lightweight battery systems, is reshaping competitive strategies.

- Government safety regulations and occupational health mandates are generating mandatory demand across construction, mining, pharmaceuticals, and manufacturing.

What are the latest trends in the powered air-purifying respirator market?

Smart, Sensor-Integrated Respiratory Systems

Technology is rapidly transforming PAPR applications. Manufacturers are developing connected devices equipped with real-time airflow monitoring, battery diagnostics, air quality sensors, biometric feedback, and integrated communication systems. These next-generation PAPRs support predictive maintenance and enhance worker safety through automated alerts when exposure levels exceed safe limits. Adoption is accelerating in cleanrooms, pharmaceuticals, chemical industries, and emergency response teams that require constant visibility into environmental hazards.

Shift Toward Ergonomic, Lightweight, and Sustainable Designs

As end users demand prolonged comfort and lower operating costs, the market is witnessing a shift toward lightweight materials, reusable components, modular filter systems, and high-efficiency rechargeable batteries. Sustainability trends are driving interest in PAPRs that reduce disposable component waste. Manufacturers are introducing long-life HEPA filters, low-energy blowers, and recyclable housings, aligning with corporate ESG priorities and regulatory pressures to minimize environmental impact.

What are the key drivers in the PAPR market?

Growing Emphasis on Occupational Health & Safety Compliance

Government bodies such as OSHA, NIOSH, and EU workplace safety regulators are enforcing stricter respiratory protection standards. Sectors like pharmaceuticals, construction, mining, and chemical manufacturing face mandatory compliance requirements, accelerating procurement of PAPRs to protect workers from airborne toxins, particulates, and biological hazards.

Rising Healthcare Demand for Advanced Respiratory Protection

The global healthcare and biotechnology sectors have become major demand centers for PAPRs, driven by infection prevention protocols, sterile processing, lab research safety, and emergency response readiness. Hospitals increasingly favor PAPRs because they offer higher protection levels and reusability compared to disposable N95 respirators, reducing long-term costs and medical waste.

Rapid Advancement in Battery, Filter, and Airflow Technologies

Improvements in blower efficiency, filter media, and compact battery systems have enhanced the usability of PAPRs across long shifts. Wider adoption follows improved comfort, reduced weight, noise reduction, and extended runtimes, important considerations for industrial and frontline users.

Restraints: High Cost and Availability of Lower-Cost Alternatives

The initial cost of PAPRs is significantly higher than that of disposable respirators, limiting adoption in small enterprises and developing regions. Additionally, in environments where regulatory requirements are less stringent, companies often substitute PAPRs with cheaper passive respirator options, restraining market expansion.

What are the key opportunities in the powered air-purifying respirator industry?

Technological Leap Into IoT-Enabled Safety Ecosystems

The strongest opportunity lies in smart PAPRs that integrate air-quality analytics, Bluetooth connectivity, and cloud-based monitoring. These solutions enable predictive safety, enhance regulatory reporting, and support employer risk management systems. As industries digitize safety operations, connected PAPRs will become central to occupational health intelligence platforms.

Expansion Across Emerging Markets and Industrializing Economies

Countries in the Asia-Pacific, Latin America, and the Middle East are investing heavily in manufacturing, pharmaceuticals, and infrastructure. As these industries become more regulated, demand for advanced respiratory protection will accelerate. Market entrants that establish early distribution networks and localized manufacturing will gain a strategic advantage.

Healthcare Preparedness and Biosecurity Investments

Governments are building strategic stockpiles of PAPRs for emergency response, infectious disease outbreaks, and hospital preparedness. This long-term policy shift creates stable multi-year procurement opportunities for manufacturers and suppliers.

Product Type Insights

Full-face mask PAPRs dominate the global market, representing approximately 50–52% of the total 2024 market value. Their ability to provide complete eye, respiratory, and facial protection makes them essential in chemical handling, biohazard labs, and frontline medical environments. Half-mask and hood-based systems serve niche requirements but lack the wide regulatory acceptance associated with full-face configurations.

Application Insights

Welding and metalworking applications hold the largest share due to widespread exposure to toxic fumes, particulates, and high-temperature contaminants. These environments require continuous airflow and sealed protection, making PAPRs the preferred standard over passive respirators. Biohazard and chemical handling applications are the fastest growing, driven by pharmaceutical manufacturing and healthcare diagnostics.

Distribution Channel Insights

Direct OEM sales account for nearly half of all PAPR purchases, driven by enterprise-wide procurement, custom configurations, and service contracts. Industrial distributors remain important for aftermarket sales, while e-commerce platforms are gaining traction among small and medium buyers seeking cost-effective solutions and quick lead times.

End-Use Analysis

The healthcare sector is the largest end-use segment, contributing 30–35% of 2024 market revenues. Rising incidences of airborne pathogens, surgical sterilization needs, and laboratory expansion have fueled significant PAPR adoption. Manufacturing, chemicals, and oil & gas sectors also generate strong demand due to strict exposure control standards. New applications are emerging in biotechnology, semiconductor cleanrooms, and emergency response services.

Export-driven demand is growing as European and North American manufacturers ship advanced PAPRs to Asia-Pacific, Latin America, and the Middle East, where industrialization and safety compliance pressures are accelerating. End-use industries such as pharmaceuticals and mining, each valued in the hundreds of billions globally, are projected to increase respiratory equipment investments at 6–9% annually.

| By Product Type | By Technology | By End-Use Industry | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the PAPR market, accounting for roughly 35–38% of global demand in 2024. Strong OSHA regulations, widespread industrial use, and advanced healthcare infrastructure sustain high adoption. The U.S. leads the region, driven by pharmaceutical manufacturing and emergency response investments.

Europe

Europe represents approximately 28–30% of global PAPR demand, led by Germany, the U.K., France, and the Nordics. Strict worker protection legislation, strong environmental compliance, and robust chemical and manufacturing sectors underpin market strength. The region is also an early adopter of smart, connected PAPRs.

Asia-Pacific

APAC is the fastest-growing regional market, expanding at 8–10% annually. China and India lead demand due to rapid industrialization, growing healthcare investments, and improved regulatory enforcement. Japan, South Korea, and Australia exhibit stable, high-value demand driven by advanced industrial and healthcare ecosystems.

Latin America

Latin America’s growth is driven by Brazil, Mexico, and Chile, where mining, oil & gas, and construction activities require advanced respirators. Adoption remains below developed regions but is accelerating due to increasing government pressure on occupational safety compliance.

Middle East & Africa

The region is experiencing rising adoption driven by oil & gas, construction, and healthcare investments. Saudi Arabia and the UAE are the largest markets, while South Africa leads demand in the African continent. Growing industrial diversification programs are further boosting market penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Powered Air-Purifying Respirator Market

- 3M

- MSA Safety

- Dräger

- Honeywell

- CMP Safety

- Bullard

- Moldex-Metric

- Optrel

- RSG Safety

- Scott Safety

- Avon Protection

- GVS Group

- Sundström Safety

- Elmridge