Pottery Ceramics Market Size

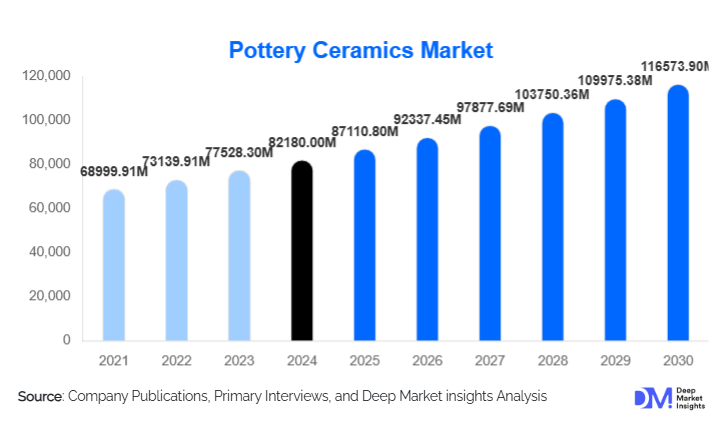

According to Deep Market Insights, the global pottery ceramics market size was valued at USD 82180 million in 2024 and is projected to grow from USD 87110.8 million in 2025 to reach USD 116573.9 million by 2030, expanding at a CAGR of 6% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for premium tableware and decorative ceramics, expanding applications in hospitality and interior design, and the growing appeal of sustainable, handcrafted products among global consumers.

Key Market Insights

- Tableware and kitchenware remain the dominant product category, accounting for a significant share of global pottery ceramics revenues, supported by strong demand from households and the hospitality sector.

- Asia Pacific leads global production and export of pottery ceramics, while North America and Europe account for a significant share of premium and designer ceramic consumption.

- Porcelain and bone china materials command the highest value share, representing a large portion of ceramic tableware revenues thanks to their strength, finish, and premium positioning.

- Online and direct to consumer channels are expanding rapidly, allowing artisanal studios and niche brands to access international buyers with relatively low entry barriers.

- Technological adoption in kilns, glazes, and digital printing is improving consistency, productivity, and design flexibility, particularly for larger integrated manufacturers.

- Global players are increasing capital expenditure on automation, production modernization, and new facilities, underscoring confidence in medium term demand for pottery and related traditional ceramics.

What are the latest trends in the pottery ceramics market?

Artisanal, Sustainable, and Heritage Ceramics Moving Mainstream

One of the most visible trends in the pottery ceramics market is the mainstreaming of artisanal and sustainable ceramics. Consumers in North America and Europe, as well as affluent segments in Asia and the Middle East, are increasingly seeking objects that combine utility with craftsmanship and cultural identity. Smaller studios and heritage brands are benefitting from this shift, positioning hand thrown, hand painted, and limited edition pieces as premium lifestyle products rather than purely functional ware. Government and regional initiatives that support craft clusters and traditional pottery communities are amplifying this effect, with several markets promoting local ceramics as exportable cultural assets. At the same time, eco friendly narratives around natural clay bodies, lead free glazes, and durable, plastic free tableware are reinforcing ceramics as a responsible alternative to disposable or synthetic materials.

Technology Infusion and 3D Printed Ceramics

Another key trend is the adoption of technologies that improve both design and manufacturing efficiency. Large manufacturers are investing in energy efficient kilns, pressure casting lines, advanced glazing systems, and digital printing for photo realistic or highly customized surfaces. Some producers are experimenting with additive manufacturing, using 3D printing to prototype intricate forms, lattice structures, or technical ceramic components that would be difficult to achieve using traditional methods. These tools allow for faster design iteration, personalized series for hospitality and gifting, and tight quality control at scale. On the commercial side, advanced production technologies are helping large groups reduce energy consumption per unit, increase output, and maintain consistent quality across global plants, which is essential as demand from hotel, restaurant, and catering buyers continues to grow.

What are the key drivers in the pottery ceramics market?

Rising Urban Incomes and Lifestyle Oriented Home Décor

Global urbanization and rising disposable incomes are central growth drivers. Middle and upper income households are investing more in tableware, serveware, and decorative pieces that reflect personal style and social status. Social media has amplified the visual importance of dining, gifting, and interior aesthetics, encouraging consumers to trade up from basic utility ware to branded or artisanal ceramics. This is especially evident in segments such as dinnerware sets, statement vases, and coordinated kitchen collections, where repeat purchases and seasonal refreshes are increasingly common.

Growth in Hospitality, Foodservice, and Real Estate

The hospitality sector is a structural demand engine for pottery ceramics. Hotels, restaurants, cafés, and catering operators require durable, visually appealing tableware and serving pieces that reinforce brand and guest experience. As global foodservice and travel recover and expand, especially in Asia Pacific and the Middle East, procurement of ceramic tableware and decorative items is growing at a steady pace. At the same time, commercial and residential real estate investment is boosting demand for ceramic sanitary ware, tiles, and decorative objects for lobbies, rooms, and common spaces. This mix of new builds and renovations supports both mass produced and bespoke ceramic solutions.

Shift Toward Sustainable, Durable, and Non Toxic Materials

Consumers and institutional buyers are paying more attention to the environmental and health impacts of materials used in homes and hospitality environments. Pottery ceramics benefit from being durable, reusable, and, when properly formulated, low in toxic substances such as lead or cadmium. Regulatory tightening on food contact materials and rising scrutiny of plastics and coated metals are indirectly benefiting ceramics, particularly in tableware and drinkware. Brands are responding with clear declarations about glaze safety, recyclable packaging, and lifecycle durability, which strengthens the positioning of ceramics as a long term, responsible choice.

What are the restraints for the global market?

High Energy and Raw Material Costs

Pottery ceramic production is energy intensive, relying on high firing temperatures and, in many cases, multiple firing cycles for bisque and glaze. Energy price volatility, particularly in Europe and parts of Asia, has increased cost pressure on manufacturers and narrowed margins for lower priced products. Meanwhile, high quality clay, kaolin, feldspar, and specialty glaze ingredients can face supply disruptions or price spikes. Producers are mitigating this through kiln efficiency upgrades, fuel switching, and tighter raw material sourcing, but cost sensitivity remains a challenge in budget oriented segments.

Product Fragility and Competition from Alternative Materials

Despite improvements in body strength and glaze performance, ceramic items remain relatively fragile compared with stainless steel, certain polymers, and some composite materials. Breakage during handling, shipping, and end use raises replacement rates and logistics costs, especially for cross border e commerce shipments. In price sensitive markets, ceramic products also compete with glass, plastic, melamine, and enamelware that may offer lower upfront cost or higher perceived toughness. This substitution risk is most pronounced in institutional and mass retail channels where unit cost and durability are tightly scrutinized.

What are the key opportunities in the pottery ceramics industry?

Premiumization and Design Led Positioning

There is meaningful headroom for premium and design driven pottery ceramics in both mature and emerging markets. Brands and studios that invest in distinctive aesthetics, collaborations with designers or artists, and limited edition collections can capture higher margins and foster repeat purchase among design conscious consumers. Hospitality buyers, especially in luxury and boutique segments, are increasingly willing to pay for custom shapes, colorways, and branding that differentiate guest experiences. This supports a shift from purely cost driven sourcing to value and design led procurement for ceramics.

Expansion of E Commerce and Direct to Consumer Models

Online channels present a strong opportunity for both global brands and small studios. Marketplaces and branded websites allow sellers to reach international customers without heavy investment in physical retail. High quality visuals, storytelling around heritage and making processes, and flexible customization options are particularly well suited to digital channels. Subscription boxes for ceramics, made to order dinnerware, and small batch drops are emerging as attractive models for capturing demand among younger, digitally native buyers. As shipping and packaging solutions improve, more categories of pottery ceramics become viable for cross border e commerce.

Growth in Technical and Functional Ceramics Within the Pottery Space

Beyond decorative and tableware categories, there is opportunity in functional ceramic products that draw on traditional pottery know how but serve industrial or laboratory needs. Examples include laboratory crucibles, ceramic bakeware designed for high performance ovens, and specialty insulators used in smaller batch applications. As demand for heat and chemical resistant materials continues to grow in consumer and light industrial contexts, manufacturers that can combine design, performance, and cost effectiveness in these niches can unlock additional revenue streams.

Product Type Insights

Tableware and kitchenware dominate the pottery ceramics product mix, accounting for a substantial share of total market revenues in 2024. This category includes plates, bowls, mugs, cups, saucers, serving platters, and tea or coffee sets used in both households and commercial foodservice. The segment benefits from high replacement rates, strong gifting demand, and its central role in the dining experience for restaurants and hotels. Decorative ceramics, including vases, sculptures, and art tiles, form the next largest segment, supported by home décor and interior design trends. Sanitary and architectural ceramic products, where they overlap with traditional pottery, contribute additional volume but are often classified under broader sanitary ware or tile markets rather than pure pottery ceramics.

Application Insights

Residential use is the largest application area for pottery ceramics, driven by everyday dining, entertaining, and home decoration. Demand is reinforced by lifestyle media, cooking shows, and social media content that highlight table styling and interior aesthetics. Hospitality and foodservice applications represent the fastest growing demand segment, as hotels, restaurants, cafés, and catering operations upgrade to coordinated, brand aligned tableware and presentation pieces. Growth in global tourism, rising frequency of dining out, and the professionalization of food delivery packaging all support this trend. In addition, institutions such as schools, corporate canteens, and healthcare facilities procure durable ceramics for repeated, hygienic use, while niche technical and lab applications contribute incremental value in specialist product lines.

Distribution Channel Insights

Offline retail channels, including department stores, specialty kitchen and home décor shops, and branded outlets, continue to account for a large share of pottery ceramics sales, particularly in mid and premium price points where tactile inspection and in store merchandising are important. However, online channels are growing faster than brick and mortar, aided by richer product photography, customer reviews, and the ease of comparing styles and prices. E commerce platforms and direct brand websites increasingly support mass customization, personalization, and made to order flows for tableware and decorative items. For larger contract orders, business to business channels and direct relationships with hospitality and real estate clients remain critical, with many leading brands operating dedicated HoReCa divisions to serve this segment.

End Use Industry Insights

By end use industry, the residential and hospitality sectors together account for the majority of pottery ceramics demand. Residential buyers drive volume through everyday tableware and décor, while hospitality, including hotels, resorts, cruise lines, and restaurants, anchors the premium and high durability end of the market. The hospitality segment is expected to grow faster than residential in the medium term, closely tracking investments in travel, tourism, and foodservice infrastructure. Commercial real estate and interior design firms are significant downstream influencers, specifying ceramics for lobbies, office spaces, and mixed use developments. Industrial and laboratory buyers, though smaller in revenue terms, are important for specialized functional ceramics that carry higher average selling prices and more stable long term contracts.

Material Insights

Material choice is an important differentiator for performance, look, and price positioning. Earthenware serves the lower to mid price segment, valued for its warm aesthetics but limited mechanical strength. Stoneware offers improved durability and is widely used in both household and café tableware. Porcelain and bone china anchor the premium segment, prized for their whiteness, translucency, and high strength relative to wall thickness. Across the broader ceramic tableware space, porcelain accounts for a large portion of value share, reflecting its popularity in both consumer and hospitality applications. High purity technical ceramics remain a niche within the pottery ceramics definition but represent opportunities for margin rich specialty products where thermal and chemical resistance are critical.

| Product Type Insights | Application Insights | Distribution Channel Insights | End Use Industry Insights | Material Insights |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is a key demand center for pottery ceramics, with the United States acting as one of the largest importers of ceramic tableware and decorative pottery globally. The region is characterized by strong demand for branded and designer ceramics, a mature hospitality industry, and a well developed e commerce ecosystem. Consumers in the United States and Canada show a high willingness to pay for premium and artisanal products, with independent studios and domestic brands increasingly successful alongside imported European and Asian collections. Contract sales to restaurants, hotels, and corporate clients also make this an attractive region for mid to high end suppliers.

Europe

Europe combines a long tradition of ceramic craftsmanship with strong modern demand for both functional and decorative pottery. Countries such as Germany, Italy, Spain, Portugal, and the United Kingdom host several globally recognized tableware and decorative ceramics brands. European buyers are particularly sensitive to sustainability, origin, and design authenticity, favoring lead free, durable ceramics and often supporting regional or heritage manufacturers. The region also acts as an important export base, supplying premium products to North America, the Middle East, and parts of Asia. Regulatory standards on food contact materials and worker safety are among the strictest globally, pushing local producers toward high quality and compliance led differentiation.

Asia Pacific

Asia Pacific is the largest production hub for pottery ceramics and one of the fastest growing consumption regions. China, India, Vietnam, Thailand, and Indonesia play leading roles in manufacturing, supported by abundant raw materials, competitive labor, and large domestic markets. China remains a major exporter of mass market and mid range ceramics, while Japan, South Korea, and parts of China and Taiwan specialize in high quality, design led products. Rising middle class incomes in China, India, and Southeast Asia are boosting domestic sales of branded and premium tableware. In addition, several multinational and regional brands operate joint ventures and plants in the region to serve both local and export markets efficiently.

Latin America

Latin America represents a growing but still developing market for pottery ceramics. Brazil, Mexico, and Argentina lead regional demand, supported by expanding middle classes, increasing urbanization, and a growing hospitality and tourism sector. Local manufacturers often focus on mid priced goods tailored to domestic tastes, while imports from Europe and Asia address premium niches. There is also a strong tradition of folk and artisanal ceramics that serves both local buyers and export customers looking for culturally distinctive pieces. Currency volatility and economic cycles remain important variables for demand and investment decisions in the region.

Middle East and Africa

The Middle East and parts of Africa offer attractive growth potential, particularly in segments tied to construction, hospitality, and luxury retail. Gulf Cooperation Council countries, including the United Arab Emirates and Saudi Arabia, are investing heavily in hotels, restaurants, and retail projects, driving procurement of premium tableware and interior ceramics. Regional champions in tiles, sanitary ware, and tableware are leveraging these projects to scale production and introduce higher value design lines. In Africa, local production is complemented by imports that target the upper middle and affluent segments, especially in South Africa, Kenya, and Nigeria, where modern retail and hospitality are expanding.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The pottery ceramics market is moderately fragmented. The top five key players together account for roughly 30% of global revenues, reflecting the coexistence of large integrated manufacturers and a long tail of regional brands and artisanal producers. Leading companies focus on broad product portfolios, multi regional manufacturing footprints, and strong distribution into both retail and hospitality channels, while smaller players compete on design, craftsmanship, and niche positioning.

Key Players in the Pottery Ceramics Market

- Villeroy & Boch AG

- RAK Ceramics PJSC

- Noritake Co., Ltd.

- Churchill China plc

- Portmeirion Group PLC

- Rosenthal GmbH

- Lenox Corporation

- Royal Doulton

- Wedgwood

- Denby Pottery Company

- Fiesta Tableware Company

- Clay Craft India Pvt. Ltd.

- Heath Ceramics

- East Fork Pottery

- Guangxi Sanhuan Enterprise Group

Recent Developments

- In March 2025, Villeroy & Boch reported strong revenue growth and confirmed investments focused on modernizing production sites and strengthening brand presence, including new flagship retail formats.

- In May 2025, RAK Ceramics announced upgrades to next generation technologies to improve design flexibility and production efficiency, reinforcing its position as a leading ceramics manufacturer across tiles, sanitary ware, and tableware.

- In September 2025, RAK Ceramics disclosed additional capital investments aimed at capacity expansions and technology upgrades to enhance profitability and capture rising regional demand.