Portable Solar Power Cooler Market Size

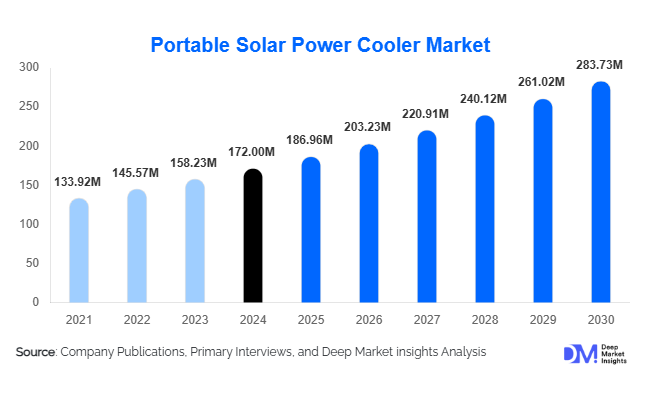

According to Deep Market Insights, the global portable solar power cooler market size was valued at USD 172.00 million in 2024 and is projected to grow from USD 186.96 million in 2025 to reach USD 283.73 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). Market growth is primarily driven by rising demand for off-grid cooling solutions, increasing adoption of renewable energy-powered appliances, and expanding use across outdoor recreation, healthcare cold chains, disaster relief, and defense applications.

Key Market Insights

- Hybrid solar-plus-battery coolers dominate demand, enabling uninterrupted cooling in low-irradiance and nighttime conditions.

- Outdoor recreation remains the largest application, supported by growth in camping, RV travel, marine activities, and overlanding.

- Healthcare and pharmaceutical cold storage is the fastest-growing segment, driven by vaccine distribution and rural healthcare expansion.

- North America leads global demand, while Asia-Pacific is the fastest-growing regional market.

- Technological advancements in lithium-ion batteries, energy-efficient compressors, and smart temperature monitoring are improving performance and lowering lifetime costs.

- Government-backed renewable energy and disaster preparedness programs are accelerating institutional procurement globally.

What are the latest trends in the portable solar power cooler market?

Integration of Advanced Battery Storage Systems

Manufacturers are increasingly integrating high-density lithium-ion and LiFePO4 battery systems into portable solar power coolers to ensure consistent cooling performance regardless of sunlight availability. These battery advancements extend operating hours, improve charging efficiency, and reduce reliance on auxiliary power sources. Battery-enabled coolers are becoming standard for healthcare, defense, and humanitarian applications where uninterrupted temperature control is critical. The shift toward modular and replaceable battery packs is also improving product lifespan and reducing the total cost of ownership.

Smart and Connected Solar Coolers

Smart features such as digital temperature displays, Bluetooth and Wi-Fi connectivity, mobile app integration, and real-time energy consumption monitoring are gaining traction. These technologies allow users to remotely track temperature stability, battery health, and power input, making solar coolers more attractive for medical cold-chain logistics and premium consumers. IoT-enabled diagnostics and predictive maintenance capabilities are increasingly being adopted by institutional buyers to minimize downtime and reduce spoilage risks.

What are the key drivers in the portable solar power cooler market?

Rising Demand for Off-Grid and Renewable Cooling Solutions

Global efforts to reduce dependence on fossil fuels and improve energy access in remote regions are major drivers of market growth. Portable solar power coolers offer a clean, decentralized alternative to diesel-powered refrigeration, particularly in regions with unreliable grid infrastructure. Government incentives for renewable energy adoption and sustainability-focused procurement policies are further accelerating demand.

Expansion of Outdoor Recreation and Mobile Lifestyles

Growth in camping, adventure tourism, recreational boating, and van-life culture—especially in North America and Europe—is significantly boosting consumer adoption. Solar-powered coolers are increasingly preferred for their portability, low operating costs, and ability to function independently of grid electricity, making them ideal for extended outdoor use.

Healthcare Cold Chain and Vaccine Distribution Growth

The expansion of vaccination programs, biologics distribution, and mobile healthcare services is driving strong demand for portable solar-powered cold storage. These solutions are critical for maintaining temperature-sensitive medicines in rural and off-grid settings, particularly across Asia-Pacific, Africa, and Latin America.

What are the restraints for the global market?

High Initial Acquisition Cost

Portable solar power coolers are significantly more expensive upfront compared to conventional electric or ice-based coolers. While long-term operating savings are substantial, the higher initial investment can deter price-sensitive consumers and small organizations, particularly in developing markets.

Performance Variability in Low Solar Conditions

Cooling efficiency can be affected in regions with limited sunlight or extreme weather conditions. Although battery integration mitigates this challenge, systems without adequate storage capacity may experience reduced performance, limiting adoption in certain geographies.

What are the key opportunities in the portable solar power cooler industry?

Healthcare and Humanitarian Procurement Programs

Large-scale public health initiatives and disaster preparedness programs present significant growth opportunities. Governments and international organizations are increasingly prioritizing solar-powered refrigeration for vaccines, blood storage, and emergency food preservation. Long-term supply contracts and donor-funded projects offer stable revenue streams for manufacturers meeting medical-grade standards.

Integration with Smart Energy Ecosystems

Opportunities exist to integrate portable solar coolers into broader smart energy ecosystems, including solar generators, portable power stations, and microgrid solutions. Cross-compatibility with other solar-powered devices can enhance value propositions and open new distribution channels.

Product Type Insights

Compressor-based portable solar power coolers dominate the market, accounting for approximately 42% of total revenue in 2024, due to their superior cooling efficiency and ability to maintain consistent temperatures across a wide range of conditions. Thermoelectric coolers remain popular for lightweight and small-capacity applications, particularly among recreational users. Absorption-based solar coolers represent a niche segment, primarily used in specialized off-grid and research applications.

Application Insights

Outdoor recreation is the leading application segment, contributing around 31% of global market revenue in 2024. Healthcare and pharmaceutical storage follow closely, driven by vaccine cold-chain requirements. Food and beverage storage for commercial and personal use represents a growing segment, particularly among mobile vendors and fisheries. Defense and humanitarian aid applications, while smaller in volume, command higher average selling prices due to ruggedization and certification requirements.

Distribution Channel Insights

E-commerce platforms and direct-to-consumer channels are gaining prominence, particularly for recreational and consumer-grade products. Direct sales to governments, NGOs, and institutional buyers dominate healthcare, defense, and disaster relief procurement. Specialty outdoor and equipment retailers continue to play a key role in premium and professional-grade product distribution.

End-Use Insights

Healthcare and pharmaceuticals represent the fastest-growing end-use segment, expanding at over 15% CAGR. Outdoor recreation remains the largest volume consumer, while agriculture and fisheries are emerging as high-growth end uses in developing regions. Military and defense applications provide stable, contract-based demand with strong margins.

| By Product Type | By Power Configuration | By Portability Format | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 34% of the global portable solar power cooler market in 2024, led by the United States. High participation in outdoor recreation, strong defense spending, and early adoption of renewable technologies support market dominance. Canada also contributes a steady demand through recreational and emergency preparedness applications.

Asia-Pacific

Asia-Pacific held nearly 29% market share in 2024 and is the fastest-growing region, expanding at nearly 14.8% CAGR. China and India lead regional demand, driven by healthcare infrastructure expansion, rural electrification, and disaster management programs. Southeast Asia and Australia are emerging markets for recreational and marine applications.

Europe

Europe shows strong adoption across Germany, France, the U.K., and Nordic countries, supported by sustainability-driven consumer behavior and robust outdoor recreation culture. Demand is particularly strong for energy-efficient and eco-certified products.

Latin America

Latin America is experiencing steady growth, led by Brazil and Mexico. Agriculture, fisheries, and disaster preparedness are key demand drivers, supported by increasing government focus on renewable energy solutions.

Middle East & Africa

The region is witnessing rising demand for off-grid healthcare and humanitarian applications, particularly across Sub-Saharan Africa. The Middle East shows growing adoption driven by defense, oil & gas field operations, and emergency preparedness initiatives.

Company Market Share

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Solar Power Cooler Market

- Dometic Group

- Indel B

- ARB Corporation

- Engel Australia

- EcoFlow

- Goal Zero

- BougeRV

- Iceco

- Setpower

- Whynter

- Alpicool

- SnoMaster

- Mobicool

- Truma Group

- Unique Appliances