Portable Scanner Market Size

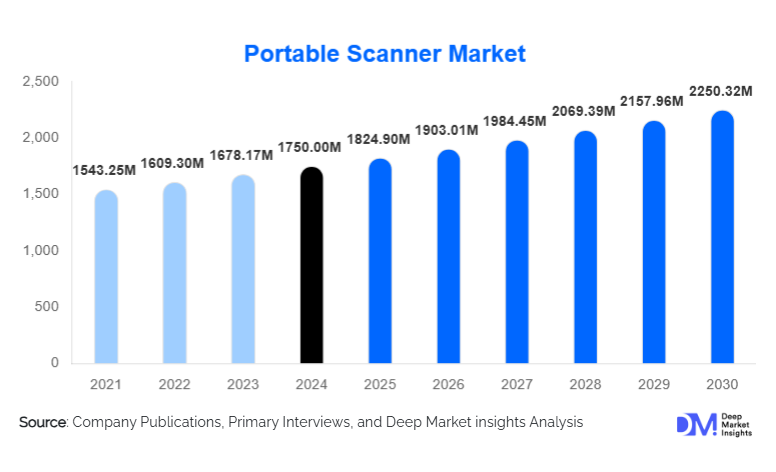

According to Deep Market Insights, the global portable scanner market size was valued at USD 1,750.00 million in 2024 and is projected to grow from USD 1,824.90 million in 2025 to reach USD 2,250.32 million by 2030, expanding at a CAGR of 4.28% during the forecast period (2025–2030). Growth is driven by accelerating digital transformation, rising demand for mobile and cloud-connected scanning solutions, and expanding applications across logistics, retail, healthcare, education, and SMEs. Increasing adoption of wireless, AI-enabled, and smartphone-integrated scanning technologies is reshaping customer expectations and broadening the market’s global footprint.

Key Market Insights

- Digitization initiatives across enterprises and governments are accelerating demand for mobile, lightweight, and cloud-enabled portable scanners.

- Wireless and cloud-integrated scanners dominate new product launches, as users increasingly demand seamless mobility and remote data access.

- Transportation & logistics represent the largest end-use segment, driven by booming e-commerce, warehousing automation, and last-mile delivery growth.

- North America holds the largest market share, supported by strong technology adoption and high enterprise digitalization rates.

- Asia-Pacific is the fastest-growing region, propelled by SME digitalization, rapid expansion of e-commerce, and supportive government initiatives.

- AI-based OCR, auto-classification, and cloud workflows are emerging as key technological differentiators in the competitive landscape.

What are the latest trends in the portable scanner market?

AI-Enhanced Scanning & Cloud Workflow Automation

Portable scanner manufacturers are increasingly integrating AI and machine learning capabilities into their devices. These functions include advanced OCR, automatic document classification, intelligent cropping, text prediction, and metadata tagging. Cloud-based workflows now enable users to scan documents and instantly sync them to enterprise storage, CRM/ERP platforms, or shared workspaces. This trend is reshaping portable scanners into intelligent data-capture solutions rather than simple imaging devices. Enterprises in logistics, healthcare, and legal services are adopting these tools to accelerate document processing, minimize manual input errors, and enhance workflow efficiency. Cloud-native scanners with subscription-based software add-ons are also expanding recurring revenue models for manufacturers.

Mobility-First Designs Integrated With Smartphones & Tablets

As hybrid work expands globally, portable scanners are becoming thinner, lighter, and more mobile-centric. Bluetooth and Wi-Fi connectivity, app integration, and smartphone-powered scanning workflows are increasingly standard. Users can now scan documents directly into mobile apps, collaborate in real time, and utilize phone-based analytics or editing tools. This trend particularly appeals to SMEs, field professionals, educators, and remote workers. In addition, collapsible and battery-powered scanners are emerging across entry-level and mid-tier product lines, enabling true portability for on-the-go document capture. Ruggedized mobile scanners designed for logistics and warehousing environments are also gaining traction as e-commerce volumes surge.

What are the key drivers in the portable scanner market?

Growing Enterprise Digitization and Paperless Transformation

Organizations worldwide are shifting from paper-heavy operations to digital workflows. Industries such as healthcare, banking, government, and professional services increasingly require mobile digitization tools to improve recordkeeping, compliance, and operational efficiency. Portable scanners support this transition by offering rapid, high-quality digitization without the need for bulky office equipment. SMEs, in particular, are adopting these solutions to streamline administrative processes and reduce physical storage costs.

Expansion of E-Commerce, Logistics & Real-Time Data Capture

The rapid growth of global e-commerce and supply chain activities is significantly boosting demand for portable barcode and data-capture scanners. Warehouses and shipping hubs rely on handheld scanners for inventory tracking, proof-of-delivery, and real-time shipment validation. As companies optimize last-mile delivery operations and invest in logistics automation, portable scanners have become indispensable tools for operational accuracy and speed.

What are the restraints for the global portable scanner market?

Competition From Smartphone-Based Scanning Applications

Smartphone cameras equipped with scanning apps present an easily accessible alternative to dedicated portable scanners, especially for casual and non-enterprise users. Many individuals and micro-businesses rely on free or low-cost mobile apps for basic scanning needs, reducing demand for entry-level hardware. This substitution challenge pressures manufacturers to innovate and differentiate through advanced imaging, enterprise security, and software ecosystems.

Price Sensitivity Among SMEs and Individual Users

High-quality portable scanners with wireless connectivity and AI-driven features can be expensive for cost-sensitive buyers, especially in emerging markets. SMEs often delay investment or opt for low-cost alternatives, slowing penetration rates. Additionally, fluctuating component costs and supply chain disruptions may increase device prices, making it harder for manufacturers to compete in entry-level segments.

What are the key opportunities in the portable scanner industry?

Cloud-Integrated and Subscription-Based Smart Scanning Ecosystems

The rise of cloud-based workflows presents a major opportunity for scanner manufacturers to evolve from hardware sellers to integrated solutions providers. Subscription-based OCR, automated indexing, secure cloud storage, and workflow analytics can create long-term recurring revenue streams. Devices that seamlessly integrate with platforms such as Google Workspace, Microsoft 365, and enterprise DMS tools will gain strong competitive advantages.

Growing Demand in E-Commerce, Retail & Logistics Automation

The global expansion of online marketplaces and warehousing infrastructure creates strong demand for rugged, reliable, and mobile barcode scanners. New entrants can target logistics hubs in Asia-Pacific, the Middle East, and Latin America, where e-commerce penetration is rising rapidly. Features such as real-time connectivity, cloud dashboards, and ergonomic designs offer strong differentiation. Integrating these devices with IoT-based warehouse management systems represents an emerging growth frontier.

Product Type Insights

Handheld and non-rugged barcode scanners dominate the market, accounting for nearly 45% of 2024 revenue. These devices are widely used in logistics, retail, and warehousing environments due to their affordability, durability, and plug-and-play functionality. Automatic document scanners and sheet-fed portable models are gaining popularity among SMEs and professionals who require mobile document digitisation. Wireless and battery-powered designs continue to expand across all categories, driven by demand for mobility and remote workflows.

Application Insights

Logistics and warehousing represent the largest share of portable scanner applications, driven by real-time data capture needs and high-volume inventory transactions. Retail follows closely, with scanners used for POS operations, stock audits, and shelf management. In office and SME environments, portable document scanners support administrative digitisation, contract management, and on-the-go document processing. Healthcare adoption is rising for patient record management, pharmaceutical tracking, and secure data capture, while education uses scanners for archival digitisation and exam processing.

Distribution Channel Insights

Online platforms dominate portable scanner sales, with e-commerce enabling price comparison, product reviews, and rapid delivery. Enterprise buyers typically rely on direct sales or IT solution providers, especially for integrated scanning systems deployed within logistics or healthcare operations. Retail electronics stores capture a modest share of consumer and SME purchases. Subscription-based software add-ons and D2C sales models are reshaping revenue structures for leading hardware manufacturers.

User Type Insights

Enterprise users, including logistics providers, retailers, and large service organisations, represent the highest-value segment, prioritising performance, durability, and workflow integration. SMEs constitute a fast-growing group, driven by digital transformation and the need for affordable, mobile scanning tools. Individual professionals and remote workers increasingly use compact wireless scanners for travel, fieldwork, and home-office applications, contributing to rising demand in the personal productivity category.

| By Product Type | By Technology | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, capturing nearly 35–40% of global revenue in 2024. The U.S. leads adoption due to high digital maturity across enterprises, strong logistics infrastructure, and rapid uptake of AI-powered scanning solutions. Demand is especially strong in healthcare, legal, retail, and e-commerce sectors, where document accuracy and compliance are critical. Cloud-integrated scanning systems and wireless portable devices are widely adopted across SMEs and remote workers.

Europe

Europe remains a mature but steadily growing market, driven by enterprise digitalization, GDPR-driven documentation standards, and retail modernization. Germany, the U.K., and France lead demand for portable scanners in logistics and industrial sectors. Strong emphasis on compliance and secure document workflows supports the adoption of advanced devices with encrypted connectivity and AI-based OCR.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by the proliferation of SMEs, expansion of e-commerce delivery networks, and government-backed digital transformation programs. China and India exhibit high demand for both barcode scanners in logistics and cost-effective document scanners for SMEs. Japan and South Korea contribute a significant demand for premium and technologically advanced scanning systems. Rising smartphone integration further accelerates adoption across APAC markets.

Latin America

Latin America is witnessing gradual growth, led by Brazil and Mexico, where retail expansion and warehouse modernization create new opportunities for portable barcode scanners. Budget-friendly portable scanners are in high demand among SMEs, while enterprise digitization initiatives are fostering the adoption of more advanced devices in banking, healthcare, and logistics.

Middle East & Africa

MEA markets are expanding steadily as logistics hubs in the UAE, Saudi Arabia, and South Africa invest in digital supply chain tools. Africa’s growing SME ecosystem and digitization of public services are prompting interest in portable document scanners. Regional adoption is expected to accelerate as governments invest in trade infrastructure and digital identity initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Portable Scanner Market

- Canon Inc.

- Fujitsu Ltd.

- Epson

- HP Inc.

- Brother Industries

- Plustek Inc.

- Visioneer

- IRIS S.A.

- Honeywell International

- Zebra Technologies

- Toshiba TEC Corporation

- Opticon Sensors Europe

- SATO Holdings Corporation

- Doxie (Apparent Corp.)

- Seiko Instruments

Recent Developments

- In March 2025, Canon introduced a new range of cloud-integrated portable scanners featuring on-device AI OCR and encrypted Wi-Fi connectivity for enterprise users.

- In January 2025, Epson launched an ultra-compact battery-powered scanner designed for field professionals and mobile office environments.

- In September 2024, Honeywell upgraded its handheld barcode scanner lineup with enhanced durability and improved scanning speeds for high-volume logistics operations.