Portable Fabric Canopies Market Size

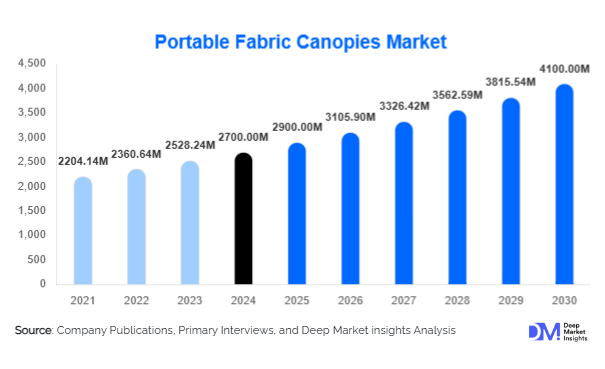

According to Deep Market Insights, the global portable fabric canopies market size was valued at USD 2,700 million in 2024 and is projected to grow from USD 2,900 million in 2025 to reach USD 4,100 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025-2030). Market growth is driven by the rising demand for lightweight, cost-effective, and versatile shelter solutions across residential, commercial, hospitality, and industrial sectors. Increasing consumer preference for outdoor leisure activities, rapid urbanization, and advances in durable, weather-resistant fabrics are further propelling adoption globally.

Key Market Insights

- Technological advances in canopy fabrics such as UV-resistant polyester, flame-retardant vinyl, and water-repellent composites are improving durability and expanding usage.

- E-commerce distribution dominates growth, with consumers preferring online purchases for variety, convenience, and competitive pricing.

- Hospitality and event industries lead demand globally, as outdoor weddings, exhibitions, and festivals increasingly use large-scale canopy structures.

- North America accounts for the largest market share in 2024, driven by high disposable income and an established outdoor leisure culture.

- Asia-Pacific is the fastest-growing region, supported by urbanization, rising middle-class income, and government spending on public spaces.

- Sustainability and eco-friendly materials are becoming key differentiators, with manufacturers focusing on recyclable fabrics and modular designs.

What are the latest trends in the portable fabric canopies market?

Eco-Friendly and Sustainable Canopies

There is a growing shift toward eco-friendly canopy solutions that use recyclable or biodegradable fabrics. Manufacturers are experimenting with organic cotton blends, low-VOC coatings, and solar-integrated fabrics. These innovations align with global sustainability goals and appeal strongly to environmentally conscious consumers, particularly in Europe and North America. Additionally, government regulations encouraging sustainable construction materials are accelerating the adoption of green canopy solutions.

Smart Canopy Solutions

Technological integration is reshaping the canopy market. Smart canopies equipped with IoT sensors, solar panels, and automated retractable systems are gaining popularity in commercial and institutional applications. These features provide weather adaptation, energy generation, and remote control options, making them highly attractive for both hospitality and industrial users. Such advancements position portable fabric canopies as not just shelters, but multifunctional infrastructure assets.

What are the key drivers in the portable fabric canopies market?

Rising Popularity of Outdoor Living

The global lifestyle trend of outdoor dining, backyard recreation, and garden entertainment is fueling demand for portable canopies. Homeowners are investing in modular shade solutions to extend living spaces, while restaurants and cafés use canopies to create al fresco dining areas, directly boosting residential and commercial demand.

Expansion of the Hospitality and Event Industry

Weddings, festivals, sports events, and exhibitions increasingly require large-scale, temporary shade and shelter solutions. Portable fabric canopies are the preferred choice due to their flexibility, cost-effectiveness, and ease of installation. With global event tourism expanding, canopy manufacturers are witnessing significant growth opportunities in the hospitality sector.

Government and Institutional Spending

Municipalities and educational institutions are investing in portable canopy structures for public parks, playgrounds, outdoor classrooms, and community events. This trend, particularly prominent in APAC and the Middle East, is a major growth driver supported by urban planning and infrastructure modernization programs.

What are the restraints for the global market?

Durability and Maintenance Concerns

Although modern canopy fabrics are more durable, long-term wear and tear from extreme weather, UV exposure, and frequent assembly/disassembly remains a concern. High maintenance costs and shorter product life cycles deter some commercial buyers.

Competition from Permanent Structures

In some markets, permanent or semi-permanent alternatives such as pergolas and lightweight tensile structures compete with portable canopies. This limits growth, particularly in high-income segments where long-term durability is prioritized over mobility.

What are the key opportunities in the portable fabric canopies industry?

Integration with Smart City Infrastructure

As cities evolve into smart hubs, canopies with integrated solar panels, IoT connectivity, and air-quality monitoring sensors can play a vital role in sustainable urban infrastructure. Governments are increasingly open to modular, eco-friendly solutions for shading public areas, providing a lucrative opportunity for manufacturers.

Expansion into Emerging Economies

Countries in the Asia-Pacific, Africa, and Latin America are experiencing rising urbanization and outdoor leisure culture. Affordable canopy solutions for residential and commercial use in these regions are expected to drive significant market penetration, supported by expanding e-commerce platforms.

Innovations in Fabric Technology

Manufacturers investing in advanced textiles, such as self-cleaning fabrics, fire-retardant blends, and UV-resistant composites, can capture market share by offering superior performance. Such innovations also help meet stringent regulatory standards in developed markets, widening export potential.

Product Type Insights

Pop-up canopies dominate the global market, accounting for nearly 42% of total market share in 2024. Their ease of installation, lightweight structure, and affordability make them highly popular for residential, recreational, and small-scale commercial uses. This segment continues to expand rapidly through e-commerce platforms, which make smaller canopy products easily accessible to households worldwide.

Fabric Material Insights

Polyester canopies hold the leading position in 2024, representing around 38% of global revenue share. Polyester is preferred for its affordability, durability, and adaptability with waterproof and UV-resistant coatings. While polyethylene and vinyl-coated polyester are growing segments, polyester remains the most widely adopted fabric material across residential and commercial users.

Size & Capacity Insights

Medium-sized canopies (10’ x 20’) are the most widely used, holding 36% of the market share in 2024. They provide an optimal balance between portability and coverage, making them highly suitable for events, automotive shelters, and commercial applications. The segment is projected to maintain its dominance through 2030.

End-Use Insights

Commercial end-use applications lead the global market, capturing nearly 34% of total demand in 2024. Outdoor dining, street markets, exhibitions, and retail stalls drive adoption, particularly in North America and Europe. Meanwhile, hospitality and event industries are experiencing the fastest growth, driven by post-pandemic recovery in weddings and global events.

Distribution Channel Insights

Online retail dominates distribution, accounting for approximately 48% of global sales in 2024. The accessibility of diverse canopy options, coupled with competitive pricing and consumer preference for digital shopping, makes this the fastest-growing sales channel worldwide.

| By Product Type | By Fabric Material | By Size & Capacity | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for the largest market share of 34% in 2024. The U.S. leads demand due to strong consumer interest in outdoor living, high participation in recreational activities, and extensive use of canopies in hospitality and events.

Europe

Europe represents 27% of the global market, with Germany, the U.K., and France driving demand. Growth is supported by consumer emphasis on sustainable fabrics and outdoor leisure culture in urban environments.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected at a CAGR of 8.9%. China and India dominate demand due to rising disposable incomes, expanding middle-class populations, and growing adoption of canopy solutions for both residential and commercial uses.

Latin America

Latin America, led by Brazil and Mexico, is showing steady growth as urbanization and e-commerce penetration fuel demand for affordable canopy solutions.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is witnessing rising adoption of premium canopy solutions for hospitality and outdoor leisure. Africa, led by South Africa and Nigeria, is experiencing growing demand through institutional and community-level investments in public infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Fabric Canopies Market

- Caravan Canopy

- Quik Shade

- ABCCANOPY

- Eurmax

- Core Equipment

- Ozark Trail

- Impact Canopy

- King Canopy

- Outsunny

- ShelterLogic

- Quest Canopy

- EZ Up Canopy

- Shade Tech

- Goutime

- Vingli

Recent Developments

- In June 2025, ABCCANOPY introduced a new line of eco-friendly polyester canopies made from recycled PET bottles, targeting European and North American markets.

- In April 2025, ShelterLogic announced strategic expansion into India through a partnership with local distributors to cater to rising residential and event canopy demand.

- In January 2025, Caravan Canopy launched a smart retractable canopy equipped with solar charging panels and weather sensors for commercial applications.