Portable Cups Market Size

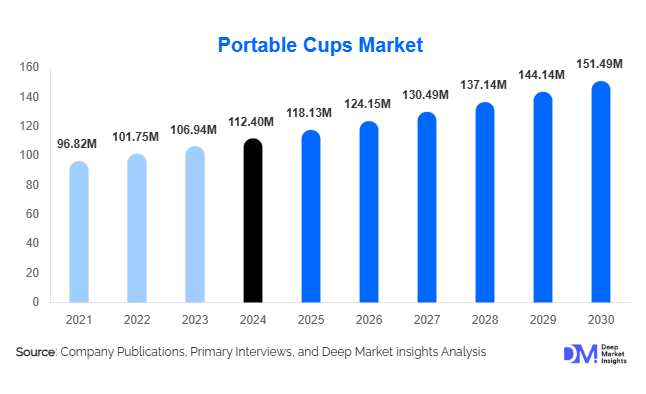

According to Deep Market Insights, the global portable cups market size was valued at USD 112.40 million in 2024 and is projected to grow from USD 118.13 million in 2025 to reach USD 151.49 million by 2030, expanding at a CAGR of 5.1% during the forecast period (2025–2030). The portable cups market growth is primarily driven by rising environmental awareness, increasing adoption of reusable drinkware, growth in outdoor and fitness lifestyles, and the global push to reduce single-use plastic consumption across travel, foodservice, and daily commuter applications.

Key Market Insights

- Collapsible and foldable portable cups dominate demand, driven by convenience, compactness, and suitability for travel and outdoor use.

- Silicone-based portable cups lead material adoption, owing to flexibility, food safety, heat resistance, and durability.

- North America remains the largest value market, supported by sustainability-conscious consumers and premium product adoption.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class income, and expanding e-commerce penetration.

- Online and direct-to-consumer channels account for the largest share, benefiting from digital marketing and influencer-led product discovery.

- Product innovation and sustainable certifications are becoming critical competitive differentiators among global brands.

What are the latest trends in the portable cups market?

Sustainability-Driven Product Innovation

Sustainability has become the defining trend in the portable cups market. Manufacturers are increasingly adopting BPA-free plastics, food-grade silicone, stainless steel, and bio-composite materials to meet regulatory requirements and consumer expectations. Lightweight collapsible designs, reusable lids, and long-life insulation are being prioritized to replace disposable cups in everyday use. Many brands are also emphasizing recyclability, minimal packaging, and carbon-neutral manufacturing processes. This trend is particularly strong in Europe and North America, where regulatory pressure and consumer awareness around plastic waste reduction are highest.

Premiumization and Lifestyle Branding

The market is witnessing strong premiumization, with consumers willing to pay higher prices for insulated, stylish, and multifunctional portable cups. Brands are positioning portable cups as lifestyle accessories rather than utility products, leveraging design aesthetics, personalization options, and brand storytelling. Integration with fitness, outdoor adventure, and urban commuting lifestyles has increased repeat purchases and brand loyalty. Social media-driven marketing and influencer partnerships are accelerating visibility, particularly among younger demographics.

What are the key drivers in the portable cups market?

Rising Environmental Awareness and Regulations

Global efforts to curb single-use plastic consumption are a major growth driver for the portable cups market. Governments across Europe, North America, and parts of Asia-Pacific are implementing bans, levies, and sustainability mandates that encourage reusable alternatives. Portable cups are increasingly being adopted by commuters, travelers, and foodservice operators as practical replacements for disposable cups, creating sustained demand across both consumer and institutional segments.

Growth in Outdoor, Travel, and Fitness Activities

The expanding global participation in outdoor recreation, fitness routines, and travel is significantly boosting demand for portable cups. Activities such as hiking, camping, gym workouts, and cycling require lightweight and durable hydration solutions. Portable cups are now considered essential accessories within these lifestyles, particularly in developed economies and tourism-driven regions.

E-Commerce and Direct-to-Consumer Expansion

The rapid growth of e-commerce platforms has transformed how portable cups are marketed and sold. Online channels allow brands to educate consumers on sustainability benefits, offer customization, and access global markets with lower distribution costs. Direct-to-consumer models are improving margins and accelerating brand penetration in emerging economies.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Despite long-term cost benefits, portable cups involve higher upfront costs compared to disposable alternatives. This price sensitivity limits adoption in developing regions, particularly where sustainability awareness is still evolving. Manufacturers must balance affordability with quality to unlock mass-market potential.

Raw Material Price Volatility

Fluctuations in the prices of food-grade silicone, stainless steel, and specialty plastics pose challenges to profit margins. Smaller manufacturers are particularly vulnerable, as they lack long-term supplier contracts and economies of scale, making cost management a key operational challenge.

What are the key opportunities in the portable cups industry?

Institutional and Corporate Adoption

Corporate sustainability initiatives and ESG commitments are creating opportunities for bulk procurement of portable cups for offices, airlines, railways, and events. Branded and customized portable cups are increasingly used for employee engagement, promotional campaigns, and zero-waste initiatives, offering stable, high-volume demand.

Emerging Market Penetration

Asia-Pacific, Latin America, and the Middle East present strong growth opportunities due to rising urban populations, increasing travel, and expanding fitness culture. Localized manufacturing, affordable product lines, and digital-first marketing strategies can significantly accelerate adoption in these regions.

Product Type Insights

Collapsible and foldable portable cups account for the largest share of the market, representing approximately 38% of global revenue in 2024. Their compact design and ease of portability make them highly suitable for travel, commuting, and outdoor activities. Insulated portable cups are gaining traction in the premium segment, driven by demand for temperature retention and durability. Rigid and stackable cups continue to find demand in institutional and promotional use cases.

Material Insights

Silicone-based portable cups dominate the market with an estimated 34% share in 2024, supported by flexibility, safety, and compatibility with collapsible designs. Stainless steel follows closely, driven by premium insulated products. Plastic-based cups remain relevant in cost-sensitive segments, while bamboo fiber and bio-composites are emerging as niche sustainable alternatives.

End-Use Insights

Outdoor and adventure applications represent the largest end-use segment, accounting for nearly 29% of market demand. Fitness and sports applications are the fastest-growing, expanding at over 12% CAGR, driven by global wellness trends. Daily commuting and office use are gaining importance as hybrid work models encourage reusable drinkware adoption.

Distribution Channel Insights

Online marketplaces and direct-to-consumer platforms dominate distribution, accounting for approximately 46% of global sales. Specialty outdoor retailers and sporting goods stores continue to play a key role in premium product sales. Supermarkets and hypermarkets support volume-driven demand, particularly in urban markets.

| By Product Type | By Material Type | By Capacity | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global portable cups market in 2024, led by the United States. High environmental awareness, strong outdoor culture, and premium product adoption drive regional demand. Corporate sustainability initiatives further support growth.

Europe

Europe represents nearly 27% of the market, supported by strict regulations on single-use plastics and high consumer preference for sustainable products. Germany, the U.K., and France are key contributors, with strong demand for silicone and insulated cups.

Asia-Pacific

Asia-Pacific accounts for about 29% of global demand and is the fastest-growing region, expanding at over 11% CAGR. China, Japan, South Korea, and India drive growth through urbanization, manufacturing scalability, and rising disposable income.

Latin America

Latin America holds approximately 7% market share, with Brazil and Mexico leading adoption. Growth is supported by rising fitness culture and increasing awareness of reusable products.

Middle East & Africa

The Middle East & Africa region contributes around 5% of global demand. The UAE and South Africa are key markets, driven by premium lifestyle products, travel, and outdoor activities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|