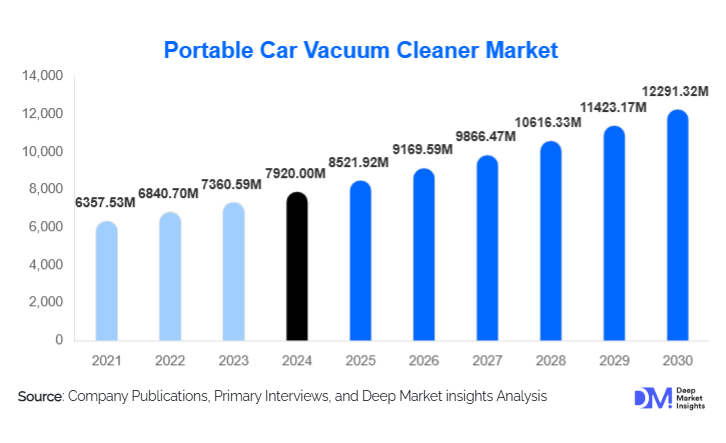

Portable Car Vacuum Cleaner Market Size

According to Deep Market Insights, the global portable car vacuum cleaner market size was valued at USD 7,920 million in 2024 and is projected to grow from USD 8,521.92 million in 2025 to reach USD 12,291.32 million by 2030, expanding at a CAGR of 7.6% during the forecast period (2025–2030). The market growth is primarily driven by rising vehicle ownership, increasing consumer awareness regarding vehicle hygiene, the shift toward cordless battery-operated models, and growing adoption by commercial fleet operators and ride-hailing services.

Key Market Insights

- Cordless battery-operated vacuum cleaners dominate the market due to ease of use, portability, and improved battery performance.

- Wet & dry vacuum cleaners lead suction technology adoption, offering versatility for cleaning liquid spills, dust, and debris in both personal and commercial vehicles.

- Handheld compact vacuums account for the largest product share because of their lightweight design, storage convenience, and adaptability to different vehicle types.

- Online retail channels drive market penetration, enabling consumers to compare features, access reviews, and purchase products directly from brand websites and e-commerce platforms.

- North America and Asia-Pacific represent major regional markets, with the U.S. and China as the leading countries for demand and technological adoption.

- Fleet and commercial users are emerging as high-growth end-use segments, creating recurring revenue streams for manufacturers through bulk procurement.

What are the latest trends in the portable car vacuum cleaner market?

Technological Advancements Driving Product Differentiation

Manufacturers are increasingly integrating BLDC motors, lithium-ion batteries, and HEPA filtration systems into portable car vacuum cleaners. These technologies enhance suction efficiency, runtime, and dust containment while reducing noise and heat generation. Smart features such as battery health indicators, modular attachments for pet hair or crevice cleaning, and fast-charging capabilities are becoming standard in premium models. Technological innovation not only boosts performance but also supports higher price points and stronger brand loyalty.

Shift Toward Cordless and Compact Form Factors

Consumer preference is moving toward cordless handheld vacuums due to convenience, portability, and compatibility with both personal and commercial vehicle maintenance. Compact vacuums can easily fit into car trunks or storage compartments, making them ideal for individual vehicle owners and fleets requiring frequent cleaning. The trend is especially strong in urban areas where small car interiors demand lightweight and flexible cleaning solutions.

What are the key drivers in the portable car vacuum cleaner market?

Rising Vehicle Ownership and Hygiene Awareness

The global increase in passenger vehicle ownership, combined with heightened awareness of vehicle cleanliness and allergen control, is driving demand for portable car vacuum cleaners. Consumers are more conscious of dust, pet hair, and food debris in vehicles, leading to increased adoption of compact and powerful cleaning solutions.

Technological Integration and Product Innovation

Advances in battery technology, BLDC motors, and HEPA filters have significantly improved the efficiency, suction power, and durability of portable vacuums. Cordless models, especially those powered by lithium-ion batteries, are increasingly replacing corded versions, expanding market appeal across price segments and geographies.

Growth of E-commerce and Direct-to-Consumer Channels

Online retail platforms allow consumers to compare products, read reviews, and access global brands without physical store limitations. E-commerce growth has been particularly influential in emerging markets, driving higher sales volumes and enabling niche and premium brands to reach wider audiences.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

High competition from low-cost, unbranded vacuums in price-sensitive regions poses a challenge for established manufacturers, limiting margin growth and making product differentiation essential for sustained profitability.

Battery Performance and Durability Concerns

Lower-end cordless models often face battery degradation and reduced runtime issues, which can negatively impact consumer confidence and repeat purchases. Manufacturers must invest in battery management systems and quality assurance to maintain reliability.

What are the key opportunities in the portable car vacuum cleaner industry?

Emerging Demand in Commercial and Fleet Applications

Ride-hailing companies, car rental agencies, and fleet operators are increasingly investing in portable vacuum cleaners to maintain vehicle hygiene efficiently. Bulk procurement contracts and recurring replacement cycles offer steady revenue streams for manufacturers targeting commercial customers.

Expansion in Emerging Economies

Asia-Pacific, Latin America, and parts of the Middle East & Africa are witnessing rapid urbanization, rising vehicle ownership, and a growing middle class. Localized manufacturing supported by government initiatives can reduce costs, improve accessibility, and boost market penetration in these regions.

Integration of Advanced Features and Smart Technologies

Opportunities exist for high-end products with features such as app-based usage monitoring, multiple attachments for different surfaces, enhanced HEPA filtration, and noise reduction. These innovations cater to premium consumers willing to pay for convenience, safety, and performance.

Product Type Insights

Within the global portable car vacuum cleaner market, handheld compact vacuums dominate due to their superior portability, ease of storage, and convenience for everyday vehicle cleaning. These models are particularly favored by individual vehicle owners and urban consumers with limited storage space. Canister-style portable vacuums, although less common, are preferred in professional detailing, fleet maintenance, and commercial applications, as they deliver higher suction power and longer operational cycles. In terms of suction technology, wet & dry variants lead the market due to their versatility in handling both liquid spills and dry debris, making them highly suitable for households, ride-hailing fleets, and auto detailing centers. Mid-range products priced between USD 30 and 70 capture the largest revenue share, offering an optimal balance between affordability and performance. Meanwhile, premium products continue to gain traction in developed markets such as North America and Europe, driven by technological innovations, improved battery life, and enhanced filtration systems that appeal to quality-conscious consumers.

Application Insights

The individual vehicle owner segment accounts for the largest demand, primarily driven by growing consumer awareness regarding interior cleanliness, dust management, and allergen control. Consumers increasingly prefer compact, cordless solutions for convenient daily maintenance. On the other hand, commercial applications, including ride-hailing fleets, rental agencies, and professional auto detailing centers, are experiencing rapid growth. These segments generate high-volume, recurring demand due to the operational necessity of maintaining hygiene standards across multiple vehicles. Emerging applications, such as electric vehicle service centers and luxury fleet management, are also contributing to market expansion, as these environments require lightweight, cordless vacuums that minimize noise, support efficient cleaning, and protect sensitive interiors.

Distribution Channel Insights

Online retail platforms dominate sales in the portable car vacuum cleaner market, supported by the growing penetration of e-commerce, direct-to-consumer (D2C) channels, and digital marketing campaigns. Consumers increasingly rely on online platforms to compare product features, read reviews, and access global brands that may not be available locally. Offline retail, including automotive accessory stores, hypermarkets, and specialty electronics outlets, continues to play a crucial role for mid-range and low-cost products, especially in emerging markets where in-store purchase trust remains high. Subscription-based models, bulk procurement for commercial fleets, and fleet maintenance contracts are emerging as alternative distribution channels, creating new revenue streams and enhancing customer retention. Social media marketing, influencer endorsements, and targeted online campaigns further accelerate adoption and brand visibility.

End-User Insights

Individual vehicle owners remain the primary end users, representing the largest market share, driven by increased urbanization, rising disposable incomes, and growing emphasis on vehicle hygiene. Commercial fleets, including ride-hailing services, car rental companies, and auto detailing centers, are the fastest-growing segment, with a CAGR exceeding 10%. These users demand durable, high-performance vacuums to maintain a large number of vehicles efficiently. Export-driven demand is also expanding, with manufacturing hubs in China, South Korea, and Southeast Asia supplying portable vacuums to North American, European, and Middle Eastern markets. This cross-border trade is further fueled by competitive pricing, technological differentiation, and strong logistics networks.

| By Product Type | By Price Range | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 26% of the global market, led by the U.S., where high vehicle ownership, preference for premium and technologically advanced products, and well-established e-commerce infrastructure support growth. Key growth drivers include the widespread adoption of ride-hailing services, increasing commercial fleet sizes, and a strong focus on vehicle interior hygiene among consumers. The region also benefits from technological innovation adoption, with consumers favoring cordless, handheld, and wet & dry variants that deliver convenience and high performance.

Europe

Europe accounts for roughly 22% of global demand, with Germany, the U.K., and France as the leading markets. The market is driven by high awareness of vehicle maintenance, established automotive aftermarket networks, and consumer preference for energy-efficient, eco-friendly, and premium-grade products. Germany, in particular, shows strong demand for wet & dry and cordless handheld vacuums, reflecting a trend toward technologically advanced, versatile solutions. Urbanization, high disposable income, and increasing professional auto detailing services are additional drivers contributing to growth in the region.

Asia-Pacific

Asia-Pacific is the largest regional market, accounting for 38% share, led by China and India. Rapid urbanization, increasing middle-class incomes, and a surge in vehicle ownership are the primary growth drivers. Rising demand for convenience and portability has fueled the adoption of handheld compact and mid-range vacuums, while commercial adoption in ride-hailing and fleet services is increasing. Additionally, government incentives promoting local electronics manufacturing, the availability of affordable products, and strong e-commerce penetration are accelerating market expansion.

Latin America

Latin America is the fastest-growing region, with a CAGR of approximately 9.5%, driven by rising vehicle ownership, growing consumer awareness about vehicle hygiene, and expanding fleet services in Brazil and Mexico. Urbanization and increasing disposable income are fueling demand for mid-range handheld and wet & dry vacuum cleaners. The growing popularity of ride-hailing fleets and professional detailing services in key metropolitan areas further contributes to market growth.

Middle East & Africa

This region accounts for around 8% of the market, with demand concentrated in the UAE, Saudi Arabia, and South Africa. High-income populations, increasing luxury vehicle penetration, and adoption by commercial fleets are key growth drivers. Premium products with advanced features such as cordless operation, high suction power, and wet & dry functionality are particularly popular in urban centers. Expanding car rental markets, growing ride-hailing services, and a strong focus on vehicle hygiene are further stimulating demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|