Portable Blender Market Size

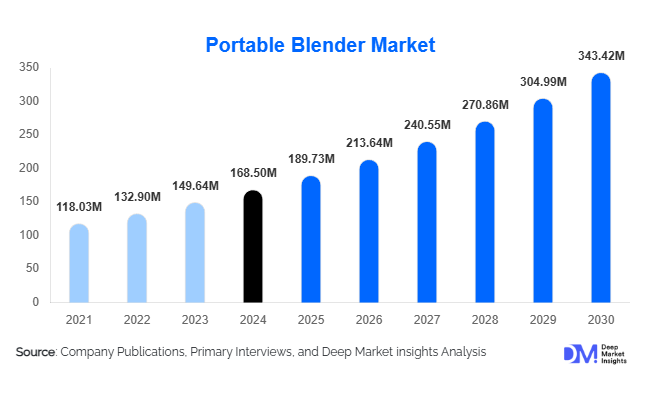

According to Deep Market Insights, the global portable blender market size was valued at USD 168.50 million in 2024 and is projected to grow from USD 189.73 million in 2025 to reach USD 343.42 million by 2030, expanding at a CAGR of 12.6% during the forecast period (2025–2030). The market growth is primarily driven by rising health-conscious lifestyles, increasing demand for on-the-go nutrition, and the adoption of compact, rechargeable, and smart appliance technologies.

Key Market Insights

- Portable blenders are increasingly becoming lifestyle-oriented appliances, integrating portability, aesthetics, and smart features to meet the needs of busy consumers.

- Rechargeable battery-powered models dominate the market, catering to mobile, fitness-focused, and travel-oriented users seeking convenience and compact designs.

- North America leads the market in terms of revenue, with the USA being the largest importer and a hub for health-focused appliance adoption.

- Asia-Pacific is the fastest-growing region, led by rising urbanization, disposable income, and e-commerce penetration in China, India, and Southeast Asia.

- Online and e-commerce channels are expanding rapidly, providing global reach and direct-to-consumer sales opportunities for innovative portable blender brands.

- Material innovations, such as BPA-free plastics, stainless-steel components, and eco-friendly builds, are influencing consumer preference and market differentiation.

What are the latest trends in the portable blender market?

Health and On-the-Go Nutrition Trends

Consumers are increasingly prioritizing personal wellness, leading to higher demand for smoothies, protein shakes, and fresh juice preparation outside traditional kitchens. Portable blenders provide convenience for fitness enthusiasts, office-goers, and travelers who require single-serve or travel-sized solutions. Meal-prep culture and wellness-oriented diets are supporting the growth of compact, portable appliances that enable fast and efficient preparation of nutritious drinks.

Smart and Rechargeable Portable Blenders

Technology adoption is a growing trend, with manufacturers introducing USB-C rechargeable models, faster motors, safety sensors, and app-connected features that track blending performance. Smart portability is increasingly appealing to younger demographics who value efficiency, battery longevity, and multifunctional appliances. These innovations also allow premium positioning, offering higher profit margins and differentiating products in a crowded market.

What are the key drivers in the portable blender market?

Growing Health-Conscious Consumer Base

Global health trends emphasizing fitness, nutrition, and lifestyle wellness are driving the adoption of portable blenders. Millennials and Gen Z are particularly influential, seeking appliances that enable fresh, on-the-go smoothies, shakes, and juice blends. The convenience factor is especially crucial in urban centers with busy lifestyles and limited kitchen space.

Urbanization and Busy Lifestyles

Increasing urbanization, smaller living spaces, and high mobility are creating demand for compact and lightweight appliances. Portable blenders cater to commuters, travelers, and gym enthusiasts who prefer personal, single-serve devices. This trend is accelerating growth in both developed and emerging markets, where convenience is a priority.

E-Commerce and Online Distribution

Online sales channels are rapidly expanding, allowing brands to reach global consumers directly. E-commerce platforms enable price transparency, consumer reviews, and influencer-driven marketing, which significantly impact product visibility and adoption. The online channel also supports new entrants, reducing dependency on traditional retail networks.

What are the restraints for the global market?

Technical Limitations and Performance Expectations

Portable blenders often trade off power and capacity for size and portability. Consumer dissatisfaction regarding blending efficiency, battery life, and durability can limit adoption. High expectations for multi-functionality in small devices remain a challenge for manufacturers.

Competition and Substitution Risks

Portable blenders face competition from countertop personal blenders and other kitchen appliances. Low-cost imports and generic models also reduce pricing power, constraining profit margins and slowing growth in mature markets.

What are the key opportunities in the portable blender industry?

Expansion in Emerging Markets

Rapid urbanization, rising disposable income, and growing health awareness in Asia-Pacific, Latin America, and the Middle East provide significant opportunities for market expansion. Localized marketing, product customization, and e-commerce penetration can accelerate adoption.

Smart and Sustainable Product Innovation

Innovations such as rechargeable USB-C batteries, smart blending apps, and sustainable materials are opening premium and differentiated market segments. Brands that integrate technology and eco-friendly design can capture higher-value consumers.

Strategic Partnerships and Lifestyle Branding

Collaborations with gyms, wellness studios, and nutrition brands offer opportunities for co-branded products, subscription services, and corporate gifting. Lifestyle positioning can create loyalty, increase visibility, and enhance market penetration.

Product Type Insights

Plastic-built portable blenders dominate the market due to their lightweight, affordable, and customizable designs, accounting for approximately 54% of the market in 2024. Within product categories, single-serve/personal blenders lead with 50% market revenue, propelled by increasing preference for convenient, portion-controlled nutrition. This segment’s growth is driven by fitness-conscious consumers seeking quick and easy smoothie or protein shake solutions for home and travel use. Multi-function blenders are emerging rapidly, supported by consumer demand for space-saving appliances that integrate blending, grinding, and juicing in one device.

Power Source Insights

Rechargeable (Li-ion, USB-C) blenders dominate with 40% of market value due to the universal availability of USB-C charging and convenience for mobile users. The trend is further boosted by longer battery life, eco-friendlier designs, and compatibility with portable power banks. Replaceable battery models maintain relevance in regions with limited access to reliable electricity, while manual variants appeal to sustainability-focused consumers and emergency-use niches.

Application Insights

Home use remains the largest application segment, accounting for nearly 67% of market share in 2024. This dominance is attributed to consumers’ preference for compact appliances that fit modern small kitchens. However, the on-the-go and travel segment is the fastest-growing, propelled by gym-goers, commuters, and outdoor enthusiasts demanding mobility and energy efficiency. Office, corporate wellness, and hospitality applications are expanding through co-branding initiatives and gifting programs.

Distribution Channel Insights

Online platforms capture 35% of market share, underpinned by strong e-commerce infrastructure and global digital penetration. Online channels enable startups to enter the market with minimal barriers and leverage influencer marketing. Offline retail remains vital for premium and impulse purchases through hypermarkets and specialty stores. Meanwhile, subscription models and partnerships with wellness or fitness brands are emerging as new growth avenues.

Price Tier Insights

Mid-range portable blenders dominate, offering a balance of affordability and performance. This segment appeals to mainstream consumers seeking reliable, rechargeable, and easy-to-clean devices. The premium tier is expanding in developed regions due to rising interest in high-quality materials, longer warranties, and enhanced aesthetics. Economy models remain popular in emerging markets, especially within Asia-Pacific and Latin America, due to high price sensitivity.

End-User Insights

Home consumers represent the bulk of global demand, driven by urban professionals and small households. Fitness and wellness users form a fast-growing secondary demographic, particularly among gym-goers and health-conscious millennials. The travel and outdoor segment is accelerating due to compact, rugged designs tailored for portable nutrition. Office and hospitality applications, including corporate gifting, are emerging as niche opportunities. Export-oriented manufacturing in Asia, especially China and India, ensures cost-effective production and global distribution scalability.

| By Product Type | By Power / Energy Source | By Capacity | By Application / End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global portable blender market, accounting for approximately 30% of global revenue (USD 51 million in 2024). The U.S. dominates regional sales, driven by high consumer spending on health, convenience, and premium appliances. Strong e-commerce ecosystems, robust influencer marketing, and the adoption of tech-enabled, rechargeable products underpin market leadership. Regional drivers include high fitness participation rates, integration of smart features like USB-C fast charging, and brand collaborations with fitness influencers. Continued innovation in premium designs and BPA-free materials is expected to sustain market growth in the U.S. and Canada.

Europe

Europe accounts for around 25% of the global market (USD 43 million in 2024). The region’s growth is fueled by eco-conscious consumers seeking sustainable, BPA-free, and energy-efficient products. Countries such as Germany, the U.K., and France are major markets, emphasizing premium design and compliance with environmental regulations. Urban lifestyles and rising preference for eco-friendly, rechargeable appliances support continued expansion. The EU’s regulatory framework promoting energy-efficient and recyclable materials is fostering product innovation and higher adoption among young professionals.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with an estimated CAGR of 12–13% during 2025–2030. Regional market share stands at approximately 22% (USD 38 million in 2024), led by China, India, Japan, and Southeast Asia. Drivers include rapid urbanization, a growing young workforce, and mass adoption of e-commerce platforms. The region benefits from large-scale local manufacturing, cost advantages, and increasing adoption of portable nutrition trends. Price-sensitive consumers are fueling volume sales, while local brands capitalize on low-cost production and influencer-led digital campaigns. The rise of “smart kitchen” devices across APAC further supports category growth.

Latin America

Latin America presents emerging opportunities, driven by a growing urban middle class and demand for affordable, durable appliances. Brazil, Mexico, and Argentina are key contributors, collectively representing roughly 10% of global demand. Regional growth is supported by hybrid retail channels combining online and neighborhood stores, alongside expanding access to e-commerce. Influencer marketing, fitness culture adoption, and increasing disposable incomes are enhancing market potential across the region.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8–10% of the global share, with demand concentrated in GCC countries such as the UAE, Saudi Arabia, and Qatar. Premium, travel-grade appliances are gaining popularity among expatriate and tourist populations. Key regional drivers include rising tourism, growing expatriate communities, and demand for compact appliances suitable for travel and luxury lifestyles. Africa remains an emerging market, with localized manufacturing and gradual adoption in urban centers contributing to incremental demand growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Blender Market

- NutriBullet

- BlendJet

- Hamilton Beach

- Oster

- Beast Health

- PopBabies

- KitchenAid

- BELLA

- BILACA

- Cuisinart

- Ninja (SharkNinja)

- Philips

- Xiaomi

- KEYTON

- Little Bees

Recent Developments

- In May 2025, BlendJet launched a new USB-C rechargeable portable blender with improved battery life and safety sensors for global markets.

- In April 2025, NutriBullet introduced a premium line with stainless-steel housing and app-connected blending performance tracking, targeting health-conscious consumers.

- In February 2025, Hamilton Beach expanded its online direct-to-consumer offerings in North America and Asia-Pacific, focusing on single-serve and travel-friendly models.