Pore Strips Market Size

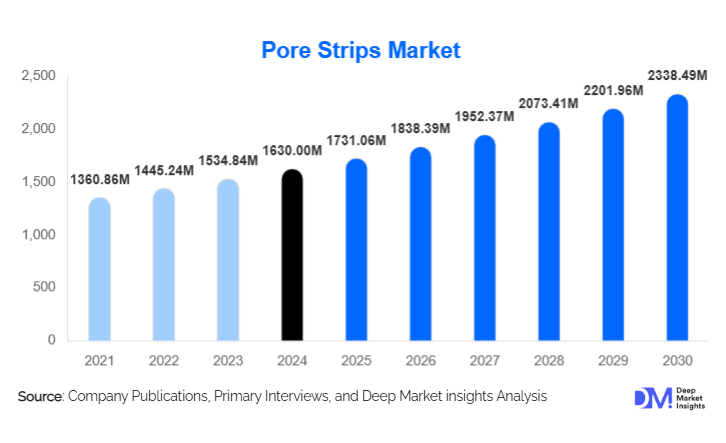

According to Deep Market Insights, the global pore strips market size was valued at USD 1,630 million in 2024 and is projected to grow from USD 1,731.06 million in 2025 to reach USD 2,338.49 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is primarily driven by rising skincare and grooming awareness, increasing adoption of at-home quick-action skincare solutions, and ongoing product innovations such as plant-based formulations, multi-functional strips, and eco-friendly packaging.

Key Market Insights

- Non-charcoal formulations dominate the market due to consumer preference for gentler, plant-based ingredients like aloe vera, tea tree, and witch hazel, representing 73% of the 2024 market.

- Home-use application leads, accounting for 72% of the market in 2024, are driven by convenience, affordability, and the growing trend of at-home self-care routines.

- Asia-Pacific holds the largest regional share at 42.9% in 2024, led by rising skincare awareness, e-commerce penetration, and growing male grooming adoption in countries like China and India.

- Online retail is the fastest-growing distribution channel, accounting for 35–40% of global sales due to D2C strategies, subscription models, and influencer marketing.

- Male grooming and body-zone applications are emerging, expanding market reach, and offering opportunities for product premiumization and customization.

- Technological adoption, including hydrocolloid adhesive technology, biodegradable strips, and multi-functional formulations, is reshaping product offerings and enhancing consumer engagement.

What are the latest trends in the pore strips market?

Natural and Plant-Based Ingredients

Consumers are increasingly demanding skincare products with natural ingredients. Pore strips using aloe vera, tea tree oil, witch hazel, and other plant extracts are gaining popularity, providing gentler alternatives to traditional charcoal-based strips. Brands are emphasizing “clean beauty” claims, hypoallergenic formulations, and environmentally friendly packaging to meet consumer expectations. This trend also enables premium pricing, enhancing revenue potential for manufacturers.

Expansion of Male Grooming and Specialized Applications

Male grooming is a fast-growing segment within skincare. Companies are introducing unisex or men-specific pore strips with larger sizes, higher adhesion, and formulations targeted to oilier skin. Body-zone strips for areas like the chest or back, and travel-friendly formats, are also emerging, creating additional avenues for market growth. Digital marketing and influencer campaigns targeting male consumers are accelerating adoption in Asia-Pacific and North America.

What are the key drivers in the pore strips market?

Rising Skincare Awareness and Self-Care Trends

Globally, consumers are increasingly prioritizing skincare and personal grooming. Quick, visible results from at-home treatments such as pore strips cater to busy lifestyles, particularly among younger demographics. Urbanization, social media influence, and growing disposable incomes are further accelerating adoption.

Growth of E-Commerce and Direct-to-Consumer Platforms

Online retail channels, including brand websites, marketplaces, and subscription services, are providing broader access to pore strips. Personalized promotions, targeted marketing, and seamless digital experiences enhance purchase frequency, while lower barriers for new entrants allow brands to scale quickly across regions.

Product Innovation and Premiumization

Innovations in hydrocolloid adhesives, biodegradable materials, multi-functional strips, and eco-friendly packaging are driving growth. Premium product lines that combine pore-cleansing with skincare benefits or specialty ingredients allow companies to differentiate from commoditized options and improve profitability.

What are the restraints for the global market?

Skin Sensitivity and Usage Limitations

Pore strips may not be suitable for all skin types, particularly sensitive or thin skin. Overuse can cause irritation or temporary skin damage, restricting the potential consumer base. Educating consumers on safe use remains critical for sustained market growth.

Competition from Alternative Skincare Treatments

Other at-home skincare solutions, such as exfoliating masks, chemical peels, and professional treatments, pose a substitution risk. Without continued innovation, commoditization, and consumer perception of limited efficacy may slow market expansion.

What are the key opportunities in the pore strips market?

Emerging Markets and Growing Male Grooming Segment

Rising skincare awareness in emerging economies, coupled with urbanization and increasing disposable incomes, offers growth opportunities. Male grooming adoption in markets like India and China is accelerating, presenting an under-penetrated segment for targeted products and marketing.

Product Innovation and Premiumization

Introducing plant-based, biodegradable, and multi-functional pore strips provides differentiation from traditional offerings. Premium formulations allow brands to charge higher prices while attracting environmentally and ingredient-conscious consumers.

Digital and Omnichannel Expansion

E-commerce, subscription services, and social media-driven marketing enable brands to reach consumers efficiently. Data-driven personalization, direct-to-consumer engagement, and influencer collaborations enhance brand loyalty and repeat purchase rates.

Product Type Insights

Non-charcoal formulations dominate the market, catering to consumers preferring gentler, natural ingredients, and accounting for 73% of the global market in 2024. Charcoal-based strips remain popular for deep cleansing but are being gradually complemented or replaced by plant-based alternatives. Premium and specialty strips targeting multi-functional benefits are gaining traction, offering higher profit margins and supporting category expansion.

Application Insights

Home-use application remains the largest segment (72% of the 2024 market) due to convenience and affordability. Salon/professional use is a niche but growing, especially in premium segments and spa treatments. Emerging applications include male grooming, body-zone strips, and travel kits, enabling expansion beyond traditional nose strips and supporting export-driven demand from Asia-Pacific manufacturers.

Distribution Channel Insights

Online retail dominates, accounting for 35–40% of global sales, leveraging D2C websites, e-commerce marketplaces, and social media campaigns. Offline channels such as hypermarkets, pharmacies, and specialty beauty stores continue to contribute, particularly in mature markets. Subscription services, personalized bundles, and targeted digital campaigns are shaping the future of distribution.

End-User Insights

Home users dominate the market, driven by convenience and frequency of use. Salon and professional segments are growing, particularly for premium multi-functional products. Male grooming and travel-size applications are creating new demand streams, further broadening the market.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 25–30% of the global market. The U.S. and Canada lead demand due to high disposable income, established skincare culture, and strong e-commerce penetration. Male grooming and premium at-home solutions are key drivers in this region.

Europe

Europe’s skincare market emphasizes natural ingredients and sustainability. Countries like the U.K., Germany, and France are the primary consumers. Growth is moderate but steady, focusing on premium and eco-conscious product lines.

Asia-Pacific

Asia-Pacific holds the largest market share (42.9% in 2024). China and India are the fastest-growing markets due to rising urbanization, disposable income, e-commerce penetration, and increasing male grooming adoption. South Korea and Japan are mature markets with steady demand, particularly for premium and multi-functional products.

Latin America

Latin America is emerging, led by Brazil, Argentina, and Mexico. Growth is driven by younger demographics and increasing awareness of skincare routines. Affluent consumers are beginning to adopt at-home skincare solutions.

Middle East & Africa

MEA remains an emerging market, with urbanized populations in GCC countries showing growing interest in skincare. Africa itself is the production hub for certain natural ingredients, contributing indirectly to global demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pore Strips Market

- The Procter & Gamble Company

- L’Oréal S.A.

- Unilever PLC

- Kao Corporation

- Walgreens Co.

- Ulta Beauty, Inc.

- Boscia, LLC

- Tonymoly Co., Ltd.

- Earth Therapeutics

- COSRX Inc.

- Pacifica Beauty LLC

- Formula 10.0.6

- Peace Out LLC

- LG Household & Healthcare

- The Boots Company PLC

Recent Developments

- In January 2025, L’Oréal launched a new line of plant-based pore strips targeting sensitive skin in Asia-Pacific, focusing on eco-friendly packaging and multi-functional benefits.

- In March 2025, Procter & Gamble introduced hydrocolloid adhesive strips in North America, aimed at premium home-use consumers.

- In June 2025, Unilever expanded distribution through online subscription models in Europe and Latin America, integrating influencer-led marketing campaigns for male grooming segments.