Plywood Market Size

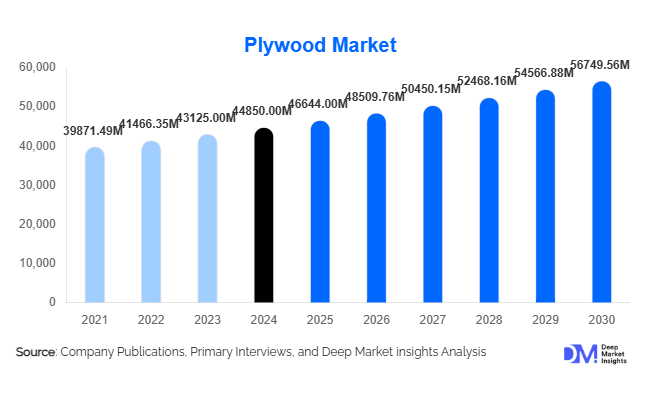

According to Deep Market Insights, the global plywood market size was valued at USD 44,850.00 million in 2024 and is projected to grow from USD 46,644.00 million in 2025 to reach USD 56,749.56 million by 2030, expanding at a CAGR of 4.0% during the forecast period (2025–2030). The plywood market growth is primarily driven by rising residential and commercial construction activity, increasing demand from the furniture manufacturing sector, and sustained public infrastructure investments across emerging and developed economies.

Key Market Insights

- Hardwood plywood dominates global demand, driven by its superior strength, surface finish, and widespread use in furniture and interior applications.

- Asia-Pacific leads the global plywood market, accounting for nearly half of total demand due to large-scale construction, furniture exports, and infrastructure development.

- Furniture and modular interior applications are the fastest-growing demand segment, supported by urbanization and rising disposable incomes.

- Low-emission and eco-certified plywood products are gaining traction as regulations tighten around formaldehyde emissions and sustainable forestry.

- Dealer and distributor networks remain the dominant sales channel, particularly in emerging markets with fragmented retail structures.

- Technological upgrades in pressing, resin formulation, and automation are improving yield efficiency and product consistency for manufacturers.

What are the latest trends in the plywood market?

Shift Toward Low-Emission and Sustainable Plywood

One of the most prominent trends in the plywood market is the accelerated shift toward low-formaldehyde and bio-based adhesive systems. Regulatory frameworks in North America and Europe are increasingly favoring E0 and E1 emission-grade plywood, compelling manufacturers to invest in cleaner resin technologies. Sustainable forestry certifications and traceable timber sourcing are also becoming critical purchase criteria, particularly for export-oriented plywood producers. As green building standards gain adoption globally, sustainable plywood products are transitioning from niche offerings to mainstream construction materials.

Value-Added and Specialty Plywood Products

Manufacturers are expanding their portfolios to include calibrated plywood, fire-retardant boards, termite-resistant panels, and marine-grade products. These value-added plywood variants command higher margins and cater to specialized end uses such as coastal infrastructure, public buildings, and premium interiors. The integration of precision manufacturing and digital quality control systems is further supporting the growth of specialty plywood segments.

What are the key drivers in the plywood market?

Growth in Construction and Infrastructure Activity

Global construction activity remains the single largest driver of plywood demand. Rapid urbanization, affordable housing initiatives, and infrastructure investments across Asia-Pacific, the Middle East, and Africa are significantly increasing the consumption of structural-grade plywood. In developed markets, renovation and remodeling activities are sustaining replacement demand, particularly for flooring, roofing, and wall sheathing applications.

Expansion of the Furniture and Interior Design Industry

The furniture manufacturing sector is emerging as a high-growth driver for the plywood market. Plywood’s strength, durability, and workability make it the preferred substrate for modular furniture, cabinetry, and interior paneling. Rising exports of ready-to-assemble and customized furniture from Asia-Pacific to North America and Europe are further amplifying plywood consumption globally.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in timber and resin prices pose a persistent challenge for plywood manufacturers. Supply disruptions caused by climate variability, logging restrictions, and geopolitical trade barriers can significantly impact production costs and margins. Smaller producers are particularly vulnerable to sudden cost escalations, limiting their pricing flexibility.

Environmental Regulations and Compliance Costs

Stringent environmental regulations related to deforestation, emissions, and waste management increase compliance costs for plywood manufacturers. Adhering to sustainability certifications and emission standards often requires capital-intensive investments, which can slow capacity expansion and restrict market entry for new players.

What are the key opportunities in the plywood industry?

Green Building and Eco-Certified Construction Materials

The global push toward green construction presents a major opportunity for plywood manufacturers offering low-emission and sustainably sourced products. Participation in government-backed housing and infrastructure projects increasingly depends on compliance with environmental standards, enabling certified producers to access premium and large-scale contracts.

Emerging Market Capacity Expansion

Rapid urban growth in India, Southeast Asia, Africa, and Latin America is creating strong opportunities for localized plywood manufacturing. Establishing production facilities near timber sources can reduce logistics costs and improve competitiveness, particularly in underpenetrated regional markets.

Product Type Insights

Hardwood plywood leads the global market, accounting for approximately 42% of total market value in 2024, driven by furniture and interior applications. Softwood plywood is widely used in structural construction and formwork. Tropical plywood holds a smaller but stable share, particularly in export markets, while specialty and aircraft-grade plywood cater to niche, high-performance applications.

Application Insights

Structural construction remains the largest application segment, representing nearly 46% of global plywood demand. Furniture and cabinetry account for around 28%, and this segment is also the fastest-growing due to modular furniture trends. Interior paneling, packaging, and transportation applications collectively contribute the remaining share, supported by industrial and logistics growth.

Distribution Channel Insights

Dealers and distributors dominate plywood sales with approximately 52% market share, particularly in emerging economies. Direct B2B sales are significant in large infrastructure and commercial projects, while organized retail and home improvement stores are gradually expanding in urban markets.

End-Use Insights

Residential construction is the largest end-use segment, accounting for about 40% of total demand, followed by commercial construction and furniture manufacturing. The furniture segment is growing at over 7.5% CAGR, making it the most dynamic end-use category. Industrial manufacturing and public infrastructure projects provide stable, long-term demand support.

| By Product Type | By Resin / Bonding Type | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global plywood market with approximately 46% market share in 2024. China leads regional demand, supported by construction and furniture exports, while India is the fastest-growing major market with growth exceeding 8% CAGR. Southeast Asian countries such as Indonesia and Vietnam play a critical role as manufacturing and export hubs.

North America

North America accounts for around 18% of global demand, led by the United States. Residential remodeling, commercial construction, and strong import demand support market growth. Canada contributes through both domestic consumption and exports.

Europe

Europe represents approximately 16% of the plywood market, with Germany, France, Italy, and the U.K. as key consumers. Demand is driven by renovation activity and sustainable construction practices.

Latin America

Latin America holds nearly 10% market share, led by Brazil and Mexico. Growth is supported by housing development and industrial expansion.

Middle East & Africa

The Middle East & Africa region accounts for roughly 10% of global demand, driven by infrastructure megaprojects in the GCC and housing development in Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plywood Market

- Weyerhaeuser

- Georgia-Pacific

- Boise Cascade

- UPM-Kymmene

- SVEZA

- Greenply Industries

- Century Plyboards

- West Fraser

- Metsä Group

- Egger Group

- Samling Group

- Austral Plywoods

- Canfor

- Kitply Industries

- Shandong Chenhong Group