Planter Market Size

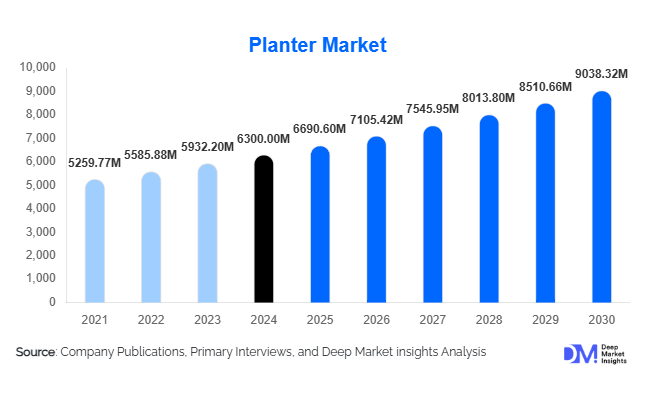

According to Deep Market Insights, the global planter market size was valued at USD 6,300 million in 2024 and is projected to grow from USD 6,690.60 million in 2025 to reach USD 9,038.32 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The planter market growth is primarily driven by rising urban gardening trends, increasing adoption of indoor and outdoor decorative planters, and the growth of smart and self-watering planter solutions catering to convenience-focused consumers.

Key Market Insights

- Plastic planters dominate the market globally, accounting for a significant share due to their cost-effectiveness, durability, and wide variety of designs suitable for both indoor and outdoor applications.

- Smart and self-watering planters are gaining traction, especially in urban areas, as consumers seek low-maintenance solutions that integrate technology with plant care.

- The residential segment drives the largest demand, with urban dwellers in apartments and homes increasingly investing in balcony and indoor gardening solutions.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, expanding middle-class populations, and urban housing growth in countries like China and India.

- Europe leads the premium planter segment, with high adoption of ceramic, metal, and eco-friendly planters due to design preferences and sustainability awareness.

- Online retail channels are reshaping distribution, allowing consumers to purchase customizable planters directly and boosting global market accessibility.

Latest Market Trends

Smart and Self-Watering Planters

The adoption of smart planters with integrated moisture sensors and self-watering systems is rapidly increasing. These planters allow real-time monitoring via mobile apps, providing alerts and automated watering to reduce maintenance efforts. This trend is particularly strong in urban centers where space is limited and consumers prefer convenience. Smart planters are also attracting environmentally conscious consumers, as they help conserve water and optimize plant growth, aligning with broader sustainability initiatives.

Eco-Friendly and Sustainable Materials

Consumer preference is shifting toward eco-friendly planters made of recycled plastics, biodegradable composites, and sustainably sourced wood. European and North American markets are leading this transition, driven by regulations and growing environmental awareness. Companies offering certified green products are experiencing higher brand loyalty, and eco-friendly innovations are emerging as a key differentiator for global planter manufacturers. This trend is expected to continue, influencing product design and marketing strategies across the industry.

Planter Market Drivers

Urbanization and Indoor Gardening

Rapid urbanization is driving demand for space-saving planters suitable for apartments, balconies, and small gardens. With rising awareness of indoor air quality and home aesthetics, consumers are increasingly investing in decorative and functional planters. Urban gardening initiatives and smart home integration are further boosting market growth by combining convenience, aesthetics, and health benefits.

Rising Disposable Income and Lifestyle Trends

Increasing disposable income, especially in emerging economies such as India, China, and Brazil, is fueling spending on home décor, gardening, and lifestyle products. Consumers are willing to pay premiums for designer planters, smart solutions, and eco-friendly options, driving growth in both residential and commercial segments. Lifestyle trends focusing on wellness and green living are also supporting higher adoption rates of planters.

Growth in Commercial and Public Landscaping

Commercial spaces such as offices, hotels, restaurants, and malls are increasingly using planters for aesthetic and functional purposes. Public infrastructure projects, including urban streetscapes, parks, and green spaces, are contributing to consistent B2B demand. Large-scale contracts for decorative and durable outdoor planters are a significant growth driver in developed and developing regions alike.

Market Restraints

High Material and Manufacturing Costs

Premium materials such as ceramic, metal, and stone planters involve higher production costs, which can limit market penetration, especially in price-sensitive regions. Rising raw material prices and logistical expenses can impact profit margins for manufacturers and restrict adoption in certain segments.

Limited Awareness in Emerging Markets

In some developing regions, low awareness of decorative and functional planters restricts market growth. Traditional gardening practices and a preference for low-cost solutions hinder the adoption of premium and smart planters, presenting a challenge for manufacturers looking to expand market share.

Planter Market Opportunities

Urban Gardening and Smart Homes Integration

The increasing popularity of urban gardening and smart homes presents significant growth opportunities. Smart and self-watering planters, integrated with mobile apps and IoT-based monitoring, are capturing demand from urban dwellers seeking convenience and minimal maintenance. Companies that innovate in automation, connectivity, and plant care technology can leverage this expanding segment.

Emerging Regional Demand

Emerging markets in Asia-Pacific and Latin America are poised for rapid growth. Rising middle-class populations, urban housing expansion, and higher disposable incomes are driving demand for decorative and functional planters. Tailoring product designs and pricing strategies to regional preferences can unlock significant untapped market potential.

Sustainability and Eco-Friendly Product Launches

There is growing potential in eco-friendly planters made of recycled, biodegradable, and sustainable materials. Regulatory support in Europe and North America for green products, along with increasing consumer preference for sustainable solutions, offers manufacturers opportunities to differentiate their products, enhance brand reputation, and capture premium pricing.

Product Type Insights

Plastic planters dominate globally, accounting for approximately 42% of the 2024 market share due to affordability, durability, and versatility. Ceramic and metal planters are preferred in premium residential and commercial applications, while wooden and concrete planters are gaining traction for outdoor and decorative landscaping. Smart planters are emerging rapidly, particularly in urbanized regions, supported by technology integration and water-saving benefits.

Application Insights

Residential applications account for the largest segment, driven by growing home gardening trends and indoor décor preferences. Commercial applications, including offices, hotels, and malls, are expanding steadily, while public landscaping and agricultural/horticultural use provide consistent demand. Urban gardening, balcony gardening, and vertical planters are emerging sub-segments within residential applications, fueled by space constraints in cities.

Distribution Channel Insights

Online retail channels dominate planter distribution due to accessibility, customization options, and e-commerce convenience. Offline retail, including garden centers and specialty stores, remains relevant for bulk and high-end purchases. Wholesale and B2B channels drive commercial and public-sector demand, particularly for large-scale landscaping projects and institutional contracts.

End-Use Insights

Residential end-use dominates, representing over 55% of the global market share in 2024, fueled by urban gardening and home décor trends. Commercial and public landscaping segments are growing steadily, supported by hotels, offices, malls, and urban greening projects. Emerging applications in indoor vertical farming, urban agriculture, and tech-enabled smart planters indicate future growth potential.

| By Material Type | By Type of Planter | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global market in 2024. U.S. and Canadian demand is driven by disposable income, urban gardening trends, and smart home adoption. Commercial and residential segments are expanding, supported by technological integration and eco-friendly product preferences.

Europe

Europe represents nearly 25% of the 2024 market. Germany, the U.K., France, and Italy are leading consumers of premium planters, with strong adoption of sustainable and decorative products. Eco-conscious and design-oriented consumers are driving growth in ceramic, metal, and wooden planters.

Asia-Pacific

APAC is the fastest-growing region, led by China, India, Japan, and South Korea. Rapid urbanization, rising middle-class populations, and increasing home décor awareness are driving demand. Online retail and innovative designs for urban gardening accelerate growth, making APAC a critical market by 2030.

Latin America

Brazil and Argentina are key contributors to demand in Latin America. Affluent urban populations are adopting decorative and functional planters for residential and commercial use, with gradual growth in outdoor and public landscaping applications.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is expanding due to high-income urban households investing in home gardening and commercial landscaping. Africa, primarily South Africa, is growing steadily, driven by urban landscaping and horticultural applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Planter Market

- Lechuza

- Bloem

- Prosperplast

- Algreen

- Jiffy Group

- Fertil

- Garland

- Roman Company

- Landmark

- Stewart Garden

- Solex

- Veradek

- Plastia

- MyGarden

- BACSAC

Recent Developments

- In March 2025, Lechuza launched a series of smart self-watering planters with IoT integration for global markets, targeting urban residential consumers.

- In January 2025, Prosperplast expanded its production facility in Poland to meet rising demand in Europe and APAC, with an emphasis on recycled plastic planters.

- In February 2025, Bloem introduced eco-friendly ceramic planters in North America, promoting sustainable materials and design-focused home décor applications.