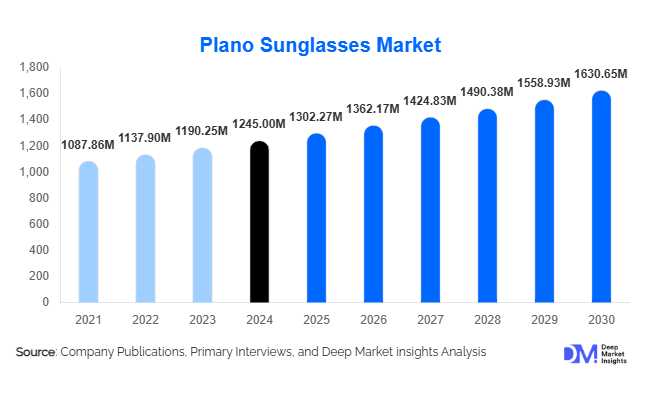

Plano Sunglasses Market Size

According to Deep Market Insights, the global plano sunglasses market size was valued at USD 1,245.00 million in 2024 and is projected to grow from USD 1,302.27 million in 2025 to reach USD 1,630.65 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). The plano sunglasses market growth is primarily driven by rising fashion consciousness, increasing awareness of UV eye protection, and expanding adoption of sunglasses as everyday lifestyle accessories across both developed and emerging economies.

Key Market Insights

- Fashion-driven demand remains the backbone of the plano sunglasses market, with consumers purchasing multiple pairs annually to match changing styles and seasons.

- Mid-range and premium sunglasses dominate value share, as consumers increasingly seek branded products that balance aesthetics, comfort, and durability.

- North America remains the largest regional market, supported by high discretionary spending and strong penetration of global eyewear brands.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, expanding urban populations, and increasing fashion awareness.

- Online and direct-to-consumer (D2C) channels are reshaping distribution, improving accessibility, and enabling competitive pricing.

- Sustainability is emerging as a key differentiator, with growing use of bio-based frames and recycled materials.

What are the latest trends in the plano sunglasses market?

Premiumization and Lifestyle Branding

The plano sunglasses market is witnessing a strong shift toward premium and lifestyle-oriented branding. Consumers increasingly view sunglasses as fashion statements rather than purely functional accessories. This has led to rising demand for designer frames, limited-edition collections, and celebrity or influencer-endorsed products. Brands are investing heavily in design innovation, seasonal refreshes, and collaborations with fashion houses to maintain relevance. Premium lenses such as polarised, gradient, and mirror-coated variants are gaining traction, allowing manufacturers to command higher price points and improve margins.

Digital-First and D2C Expansion

Technology-enabled retail is transforming the plano sunglasses market. Online platforms now offer virtual try-on tools, AI-powered recommendations, and customisation features that enhance the purchasing experience. Direct-to-consumer models are gaining popularity, enabling brands to reduce reliance on intermediaries while building stronger customer relationships. This trend is particularly strong among younger consumers who value convenience, transparent pricing, and fast delivery.

What are the key drivers in the plano sunglasses market?

Growing Awareness of UV Eye Protection

Rising awareness regarding the harmful effects of ultraviolet radiation on eye health is a major growth driver. Consumers increasingly recognise plano sunglasses as essential protective gear for daily outdoor exposure, commuting, and recreational activities. Public health messaging and optometric recommendations are reinforcing this perception, supporting sustained demand growth across age groups.

Expansion of Outdoor and Leisure Activities

The global rise in outdoor recreation, sports participation, and travel has significantly boosted demand for plano sunglasses. Activities such as cycling, hiking, beach tourism, and water sports require eye protection from glare and sunlight. Performance-oriented plano sunglasses with polarised lenses and lightweight frames are particularly benefiting from this trend.

What are the restraints for the global market?

Price Sensitivity and Counterfeit Products

In emerging markets, price sensitivity remains a key challenge. Unorganised players and counterfeit products capture significant volume share, limiting revenue growth for established brands. Counterfeiting also dilutes brand equity and exerts downward pressure on pricing in the economy and mid-range segments.

High Competitive Intensity

The plano sunglasses market is highly competitive, with frequent product launches and low switching costs for consumers. Maintaining differentiation requires continuous investment in marketing, design, and innovation, which can strain profitability for smaller players.

What are the key opportunities in the plano sunglasses industry?

Sustainable and Eco-Friendly Sunglasses

The growing emphasis on sustainability presents a major opportunity. Consumers, particularly in Europe and North America, are increasingly favouring products made from bio-acetate, recycled plastics, and environmentally responsible packaging. Brands that integrate circular economy practices, such as recycling programs and carbon-neutral manufacturing, are likely to gain a competitive advantage.

Emerging Market Expansion

Rapid urbanisation and rising disposable income in Asia-Pacific, Latin America, and the Middle East are creating new growth avenues. Localised designs, affordable pricing strategies, and region-specific marketing campaigns can help brands tap into these high-growth markets.

Product Type Insights

Fashion plano sunglasses dominate the global market, accounting for approximately 42% of total revenue in 2024. Their leadership is driven by high replacement frequency and strong influence from fashion trends. Sports and performance sunglasses are the fastest-growing product type, supported by increasing participation in outdoor activities. Luxury and designer sunglasses command a disproportionate share of market value due to premium pricing and strong brand equity, while lifestyle and casual sunglasses cater to everyday usage across broad consumer segments.

Frame Material Insights

Plastic frames lead the market with around 48% share, owing to their affordability, lightweight nature, and design flexibility. Metal frames, particularly stainless steel and titanium, are popular in premium segments for their durability and sleek aesthetics. Hybrid frames combine functionality and style, while bio-based materials represent a fast-growing niche aligned with sustainability trends.

Distribution Channel Insights

Optical retail stores remain the dominant distribution channel, contributing approximately 36% of global sales in 2024. However, online and D2C platforms are the fastest-growing channels, driven by convenience, competitive pricing, and digital engagement tools. Brand-owned exclusive stores continue to play a critical role in premium positioning and customer experience, while travel retail benefits from tourism recovery.

End-Use Insights

Daily wear and fashion use represent the largest end-use segment, accounting for nearly 55% of global demand. Sports and outdoor use is the fastest-growing segment, expanding at over 7% CAGR. Travel and tourism-related demand has rebounded strongly, while corporate and promotional gifting represents a niche but growing application.

| By Product Type | By Frame Material | By Lens Type | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 31% of the global plano sunglasses market, led by the United States. High consumer spending power, strong brand awareness, and widespread outdoor lifestyles support sustained demand. Premium and polarised sunglasses are particularly popular in this region.

Europe

Europe holds around 27% of the global market share, with Italy, France, and Germany as key contributors. The region benefits from strong fashion influence and a well-established luxury eyewear manufacturing base. Sustainability-driven purchasing is increasingly shaping consumer preferences.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for roughly 29% of global demand in 2024. China, India, and Japan lead regional consumption, supported by rising disposable income, expanding middle-class populations, and growing fashion awareness. The region is expected to record the highest CAGR through 2030.

Latin America

Latin America represents a developing market for plano sunglasses, with Brazil and Mexico driving regional demand. Growth is supported by urbanisation, tourism, and the increasing penetration of international brands.

Middle East & Africa

The Middle East and Africa together account for a smaller but steadily growing share of the global market. Demand is driven by high sunlight exposure, tourism, and luxury consumption in countries such as the UAE and Saudi Arabia, alongside growing urban markets in Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plano Sunglasses Market

- EssilorLuxottica

- Safilo Group

- Kering Eyewear

- Marchon Eyewear

- De Rigo Vision

- Marcolin Group

- Maui Jim

- Costa Del Mar

- Oakley

- Polaroid Eyewear

- Bollé Brands

- Serengeti Eyewear

- Fielmann Group

- Warby Parker