Pet Treadmill Market Size

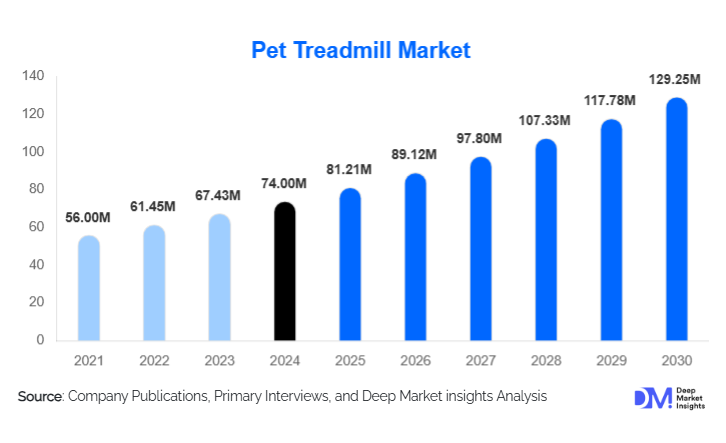

According to Deep Market Insights, the global pet treadmill market size was valued at USD 74.00 million in 2024 and is projected to grow from USD 81.21 million in 2025 to reach USD 129.25 million by 2030, expanding at a CAGR of 9.74% during the forecast period (2025–2030). The pet treadmill market growth is primarily driven by rising pet obesity, increasing adoption of smart and connected fitness devices for pets, and growing demand for veterinary rehabilitation and professional pet training solutions worldwide.

Key Market Insights

- Pet treadmills are increasingly integrating smart technology, including IoT sensors, AI-driven gait analysis, and app-based monitoring, allowing owners and veterinarians to track health metrics and customize exercise routines.

- Residential adoption dominates, as busy urban lifestyles and nuclear family setups limit outdoor exercise opportunities for pets, driving home-based treadmill solutions.

- North America holds the largest share of the global market, supported by high per-pet expenditure, advanced veterinary infrastructure, and growing awareness of preventive pet healthcare.

- Asia-Pacific is the fastest-growing region, led by China, India, and South Korea, due to rising middle-class pet ownership, urbanization, and expanding veterinary services.

- Veterinary rehabilitation and hydrotherapy applications are creating premium demand for advanced treadmills, including underwater systems, particularly in Europe and North America.

- Technological adoption, such as AI-enabled speed control, biometric monitoring, and cloud data integration, is transforming pet treadmills from niche fitness products into essential pet wellness solutions.

What are the latest trends in the pet treadmill market?

Smart & Connected Pet Fitness Solutions

Pet treadmill manufacturers are increasingly embedding IoT and AI capabilities into their products, enabling remote monitoring, real-time health tracking, and integration with veterinary telemedicine services. Features such as heart-rate monitoring, programmable exercise routines, and mobile app connectivity allow owners to track their pets’ fitness progress, detect mobility issues early, and ensure safe rehabilitation. These trends are particularly appealing to tech-savvy consumers and professional veterinary facilities, creating recurring revenue streams through software subscriptions and connected services.

Hydrotherapy & Rehabilitation Focus

Underwater pet treadmills, used for hydrotherapy, are gaining prominence in veterinary clinics and rehabilitation centers. These systems aid post-surgical recovery, improve mobility in aging pets, and support weight management in obese animals. The increased clinical adoption of treadmill-based therapy, along with growing awareness among pet owners, is driving demand for high-end, durable treadmills capable of therapeutic and fitness applications. Veterinary practitioners are recommending treadmill therapy as part of preventive care protocols, expanding its use beyond purely recreational exercise.

What are the key drivers in the pet treadmill market?

Rising Pet Obesity & Health Awareness

The increase in pet obesity, particularly in dogs, has created demand for controlled indoor exercise solutions. Pet owners are increasingly investing in treadmills to maintain their pets’ weight, improve cardiovascular health, and reduce the risk of lifestyle-related illnesses. Urbanization and limited outdoor space are accelerating the adoption of home-based pet fitness equipment.

Humanization of Pets

Pets are increasingly regarded as family members, prompting higher spending on wellness and fitness solutions. This trend drives the adoption of advanced treadmill models with smart features, premium materials, and multi-functional capabilities. Veterinary endorsements of treadmill use for both fitness and rehabilitation have reinforced the perception of treadmills as essential pet wellness equipment.

Veterinary & Professional Adoption

Professional facilities such as veterinary hospitals, rehabilitation centers, and service dog training units are adopting treadmills for clinical therapy and structured training. Hydrotherapy treadmills, in particular, are becoming indispensable in post-surgery rehabilitation and mobility enhancement programs. Institutional adoption ensures consistent demand and higher average selling prices for advanced treadmill models.

What are the restraints for the global market?

High Initial Cost

Advanced and underwater pet treadmills are expensive, often ranging from USD 2,000 to USD 35,000. High upfront costs restrict adoption among price-sensitive consumers and small veterinary clinics, particularly in emerging markets. While long-term health benefits exist, affordability remains a key barrier.

Limited Awareness & Training

Many pet owners and smaller veterinary practices lack knowledge regarding treadmill usage, safety protocols, and benefits. Misconceptions about pet safety on treadmills can hinder adoption, and training programs for proper usage are still underdeveloped in several regions.

What are the key opportunities in the pet treadmill market?

Smart Technology Integration

There is significant growth potential in connected and AI-enabled treadmills that track fitness, rehabilitation progress, and health metrics. Integration with mobile apps and tele-veterinary platforms opens new revenue streams and improves adoption by tech-savvy consumers and veterinary professionals.

Emerging Veterinary & Rehabilitation Infrastructure

Expansion of specialty veterinary hospitals and physiotherapy centers in Asia-Pacific, Latin America, and the Middle East creates new market demand for hydrotherapy and advanced treadmill systems. Localized manufacturing and distribution networks can further capitalize on this opportunity.

New Institutional End-Users

Police, military canine units, service animal programs, and pet wellness chains are emerging as high-value buyers. Bulk procurement opportunities and long-term contracts provide stable demand, while partnerships with pet insurance companies and wellness platforms may subsidize treadmill adoption.

Product Type Insights

Electric and motorized pet treadmills dominate the global pet treadmill market, accounting for approximately 48% of total revenue in 2024. The leadership of this segment is primarily driven by its adjustable speed control, programmable exercise modes, enhanced safety features, and compatibility with smart technologies, making these systems suitable for both residential pet owners and professional veterinary environments. Increasing adoption of app-connected treadmills, real-time health monitoring, and automated safety shut-off mechanisms has further strengthened demand for electric models, particularly in developed markets.

Manual pet treadmills represent a smaller but stable share of the market, supported by cost-sensitive consumers and first-time buyers seeking basic indoor exercise solutions. These treadmills are particularly popular in emerging economies where affordability and simplicity are key purchasing factors. Meanwhile, underwater pet treadmills constitute the premium segment of the market and are widely used in veterinary rehabilitation, hydrotherapy, and post-surgical recovery. Although limited in volume, this segment generates high revenue per unit and is experiencing strong adoption in advanced veterinary hospitals and specialty rehabilitation centers.

Pet Type Insights

Dogs account for approximately 82% of the global pet treadmill market, making them the dominant pet type segment. This leadership is driven by dogs’ higher daily exercise requirements, greater susceptibility to obesity, and frequent use in rehabilitation and structured training programs. Veterinarians commonly recommend treadmill-based exercise for dogs recovering from orthopedic surgeries, suffering from arthritis, or managing weight-related health conditions, further reinforcing demand.

Cats represent a smaller but gradually expanding segment as awareness grows around indoor feline obesity and inactivity, particularly in urban households. Other pets, including small mammals and exotic animals, currently contribute marginal revenue; however, increasing pet ownership diversity and improved availability of size-specific treadmill designs are expected to support gradual adoption within this niche segment over the forecast period.

Application Insights

Fitness and weight management applications lead the pet treadmill market with an estimated 44% share in 2024. The dominance of this segment is driven by rising pet obesity rates, increasing preventive healthcare awareness, and growing demand for structured indoor exercise solutions that are independent of weather and outdoor space availability. Pet owners are increasingly using treadmills as part of routine fitness programs to improve cardiovascular health and reduce long-term veterinary costs.

Rehabilitation and hydrotherapy applications represent the fastest-growing segment, supported by rising post-surgical recovery needs, aging pet populations, and growing adoption of physiotherapy in veterinary medicine. Behavioral training and veterinary diagnostics remain niche segments but are gaining traction, particularly among professional trainers and advanced veterinary clinics that use treadmills for gait analysis, endurance conditioning, and anxiety reduction programs.

End-Use Insights

Residential pet owners account for approximately 52% of total market demand, driven by urban lifestyles, time constraints, and increasing willingness to invest in home-based pet wellness equipment. The rising trend of pet humanization and premium pet care spending continues to support this segment globally.

Veterinary clinics and pet rehabilitation centers represent the fastest-growing end-use segment, expanding at a CAGR of nearly 13%. Growth is supported by increasing veterinary specialization, higher surgical intervention rates, and the integration of treadmill-based rehabilitation protocols. Professional training centers, including service animal programs and working dog facilities, as well as pet wellness chains, are emerging as high-value institutional buyers. Additionally, export-driven demand from the Asia-Pacific is accelerating as veterinary infrastructure expands across developing economies.

| By Product Type | By Pet Type | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global pet treadmill market with approximately 38% market share in 2024, with the United States alone contributing nearly 31%. Regional growth is driven by high disposable income, strong pet insurance penetration, advanced veterinary infrastructure, and widespread awareness of preventive pet healthcare. The region also leads in the adoption of technologically advanced and premium treadmill models, supported by strong R&D activity and early adoption of smart pet fitness solutions. High obesity rates among companion animals further reinforce sustained demand.

Europe

Europe holds around 27% of the global market, led by Germany, the United Kingdom, and France. Growth in this region is primarily driven by well-established veterinary rehabilitation networks, strict animal welfare standards, and high awareness of pet fitness and mobility care. The increasing prevalence of aging pets and rising demand for hydrotherapy solutions have accelerated the adoption of underwater and clinical-grade treadmills. Europe also shows strong demand for eco-friendly and energy-efficient equipment, influencing product design and purchasing decisions.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at an estimated CAGR of 14%. China, India, South Korea, and Japan are key growth markets, supported by rapid urbanization, rising middle-class income, increasing pet adoption rates, and expanding access to veterinary services. The region is witnessing strong demand for imported premium treadmills, while localized manufacturing and assembly initiatives are helping reduce costs and improve market penetration. Growing awareness of preventive pet healthcare and the emergence of organized pet wellness chains are further accelerating growth.

Latin America

Latin America accounts for approximately 8% of the global market, with Brazil and Mexico leading regional demand. Growth is driven by rising disposable income among urban pet owners, increasing availability of modern veterinary clinics, and growing influence of North American pet wellness trends. Adoption remains concentrated in metropolitan areas, with premium treadmills gaining traction among affluent consumers and specialized veterinary centers.

Middle East & Africa

The Middle East & Africa region collectively represents around 5% of the global market. Growth is led by the UAE and Saudi Arabia, where premium pet wellness spending, expatriate populations, and advanced veterinary facilities support demand for high-end treadmill solutions. In Africa, emerging veterinary infrastructure and growing awareness of animal rehabilitation in countries such as South Africa and Kenya are creating niche growth opportunities, particularly within professional and institutional end-use segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Treadmill Market

- DogPacer

- FitFurLife

- PetRun

- K9 Treadmill

- iFetch Wellness

- Hydro Physio

- Canine Aqua Treadmill

- Shandong Jingpeng

- LifeSpan Pet

- Bertec Animal Systems

- Shenzhen HYPET

- PetZen

- Lansen Animal Health

- RunBuddy

- PawHut