Pet Sitting Market Size

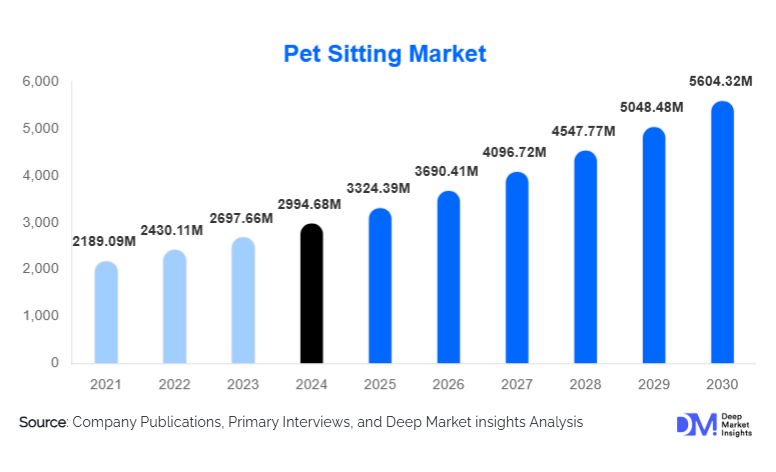

According to Deep Market Insights, the global pet sitting market size was valued at USD 2,994.68 million in 2024 and is projected to grow from USD 3,324.39 million in 2025 to reach USD 5,604.32 million by 2030, expanding at a CAGR of 11.01% during the forecast period (2025–2030). The pet sitting market growth is primarily driven by rising pet ownership, increasing pet humanization, growth in travel frequency among working professionals, and the rapid adoption of digital platforms that connect pet owners with verified care providers.

Key Market Insights

- In-home pet sitting dominates demand as pet owners increasingly prefer personalized care in familiar environments over traditional boarding facilities.

- Digital platforms and mobile apps are reshaping service delivery, accounting for nearly half of global bookings through real-time scheduling, sitter verification, and transparent pricing.

- North America leads the global market, supported by high pet adoption rates, premium pricing, and strong penetration of app-based pet care services.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising disposable income, and rapid expansion of the middle-class pet-owning population.

- Dogs remain the primary revenue-generating pet type, reflecting higher care intensity, walking needs, and frequent service utilization.

- Specialized and premium care services, including senior pet care and medical sitting, are emerging as high-margin growth segments.

What are the latest trends in the pet sitting market?

Digital Platform Expansion and Service Standardization

The pet sitting market is witnessing a strong shift toward app-based and web-enabled platforms that offer end-to-end service management. These platforms provide verified sitter profiles, insurance-backed services, GPS-enabled updates, and real-time communication between pet owners and sitters. Standardized pricing models, customer reviews, and background checks have significantly increased trust, encouraging first-time users to adopt professional pet sitting services. Subscription-based offerings and bundled services are also gaining popularity, particularly among frequent travelers and urban pet owners.

Rising Demand for Specialized and Premium Pet Care

Pet owners are increasingly seeking specialized care services tailored to senior pets, post-surgical recovery, behavioral support, and exotic animals. This trend reflects the growing humanization of pets and the willingness among owners to pay premium rates for certified and experienced caregivers. Specialized services command higher margins and are driving professionalization within the industry through training programs, certifications, and partnerships with veterinary clinics.

What are the key drivers in the pet sitting market?

Growth in Pet Ownership and Humanization

The global rise in pet adoption, particularly in urban households, has significantly expanded the addressable market for pet sitting services. Pets are increasingly treated as family members, leading owners to prioritize personalized, low-stress care solutions. This shift has driven sustained demand for in-home and customized pet sitting services, especially for dogs and cats.

Increasing Travel and Mobility Among Consumers

Rising domestic and international travel, coupled with hybrid work models, has increased the need for short- and medium-term pet care solutions. Pet sitting offers flexibility and continuity of care, making it a preferred alternative to kennels and boarding facilities. This driver has been particularly influential in developed markets with high travel frequency.

What are the restraints for the global market?

Regulatory Fragmentation and Lack of Standardization

The pet sitting industry faces fragmented regulations across countries and regions, with inconsistent licensing, insurance, and certification requirements. This lack of standardization increases compliance complexity for service providers and limits scalability across borders.

Service Quality and Liability Risks

Inconsistent service quality, sitter reliability issues, and liability concerns related to pet safety or property damage remain key challenges. Smaller or unorganized providers often lack adequate insurance coverage, which can slow adoption among risk-averse consumers.

What are the key opportunities in the pet sitting industry?

Technology-Driven Service Innovation

Advanced technologies such as AI-based sitter matching, smart home integration, pet monitoring devices, and digital health records present significant opportunities for market expansion. Companies investing in automation and data-driven personalization can enhance customer retention and operational efficiency.

Untapped Demand in Emerging Markets

Emerging economies in the Asia-Pacific and Latin America offer substantial growth potential due to rising pet ownership and limited organized pet care infrastructure. Localized pricing strategies, partnerships with veterinary clinics, and regional sitter networks can help new entrants capture early market share.

Service Type Insights

In-home pet sitting represents the largest service type segment in the global pet sitting market, accounting for approximately 38% of total revenue in 2024. The dominance of this segment is primarily driven by pet owners’ strong preference for personalized, one-on-one care provided within a familiar home environment. In-home services significantly reduce anxiety and behavioral stress for pets, particularly dogs, senior animals, and pets with medical conditions. Additionally, rising concerns around disease transmission in communal boarding facilities and the growing willingness of owners to pay premium rates for individualized care further reinforce the leadership of this segment.

Boarding-based pet sitting and pet daycare services collectively form the second-largest service category. These services are favored by owners seeking structured routines, socialization opportunities, and supervised group care, particularly for high-energy dogs. Daycare services benefit from repeat weekday usage among working professionals, especially in urban centers. Meanwhile, drop-in visits are widely adopted for short-term needs such as feeding, walking, or litter maintenance, making them popular for cost-conscious customers and short absences.

Pet Type Insights

Dogs dominate the pet sitting market, contributing nearly 52% of global revenue in 2024. This leadership is driven by dogs’ higher dependency on daily care routines, including walking, feeding, exercise, and behavioral engagement. Dog owners also tend to travel more frequently with greater reliance on professional care providers, resulting in higher service utilization rates and longer booking durations.

Cats represent the second-largest pet type segment, supported by growing urban cat ownership and increasing acceptance of professional care for litter management, feeding, and companionship. While cats typically require less intensive care than dogs, rising awareness around feline stress management and health monitoring is increasing demand for in-home cat sitting services.

Booking Channel Insights

Digital platforms and mobile applications account for approximately 46% of total pet sitting bookings globally, making them the leading booking channel. The rapid growth of this segment is driven by consumer demand for convenience, transparent pricing, verified sitter profiles, and real-time service updates. Features such as GPS tracking, live photo updates, insurance coverage, and customer reviews have significantly increased trust and accelerated adoption, particularly among younger and tech-savvy pet owners.

Independent local pet sitters continue to play a critical role, especially in suburban and semi-urban markets where community-based trust and price sensitivity remain strong. These providers often compete on cost and personal relationships but face challenges related to scalability and standardization. Veterinary-affiliated pet sitting services are gaining traction, particularly for medically sensitive pets and senior animals. This channel benefits from strong credibility, professional oversight, and integration with veterinary care, making it increasingly attractive for high-value and specialized service demand.

End-Use Insights

Individual residential households remain the dominant end-use segment, accounting for approximately 89% of total market demand. Growth in this segment is driven by rising pet ownership, increasing travel frequency, dual-income households, and heightened expectations for premium and personalized pet care services.

Commercial end users, including relocation agencies, hospitality providers, corporate housing firms, and real estate developers, represent a smaller but rapidly expanding segment. As pet-friendly housing and travel become key differentiators, these organizations are increasingly partnering with pet sitting providers to offer bundled services. This segment is experiencing faster growth than residential demand, supported by corporate mobility trends and the expansion of pet-inclusive policies across industries.

| By Service Type | By Pet Type | By Booking Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global pet sitting market, accounting for approximately 44% of total revenue in 2024. The United States is the largest contributor, driven by high pet ownership rates, strong pet humanization trends, and widespread adoption of app-based pet sitting platforms. Premium pricing, high disposable income, and frequent domestic and international travel among pet owners further support market leadership. Canada contributes steady growth, supported by increasing urbanization, rising demand for in-home pet care, and growing awareness of professional pet sitting services. Strong digital infrastructure and high trust in insured service providers act as key regional growth drivers.

Europe

Europe accounts for approximately 27% of global market revenue, with major demand originating from the U.K., Germany, France, and Italy. Growth in this region is driven by increasing pet humanization, rising outbound travel, and strong acceptance of professional service-based pet care. Regulatory support for animal welfare and higher standards for pet care services also encourage the adoption of certified and insured pet sitters. Additionally, Europe benefits from dense urban populations and a growing preference for in-home care over boarding facilities, particularly for cats and senior pets. Cross-border travel within the EU further increases short- and medium-term pet sitting demand.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, accounting for approximately 18% of global revenue in 2024. Rapid urbanization, rising disposable income, and expanding middle-class pet ownership in countries such as China, Japan, South Korea, and India are the primary growth drivers. Increased adoption of Western pet care practices, growing penetration of smartphones, and rapid expansion of digital pet sitting platforms are accelerating market growth. Younger demographics and first-time pet owners are particularly driving demand for app-based and on-demand pet sitting services.

Latin America

Latin America represents nearly 7% of the global pet sitting market, led by Brazil and Mexico. Market growth is supported by rising pet adoption, increasing awareness of professional pet care, and the gradual expansion of digital booking platforms. Urban middle-income households are increasingly adopting paid pet sitting services, particularly for dogs. Although pricing sensitivity remains a challenge, improving digital access and localized service models are expected to support steady regional growth.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% of the global market, with growth concentrated in the UAE, Saudi Arabia, and South Africa. High expatriate populations, premium pet ownership trends, and frequent international travel are key demand drivers in the Middle East. In Africa, South Africa leads regional demand due to established pet care infrastructure and urban pet ownership. Growth across the region is supported by rising disposable income in select markets and increasing demand for premium and specialized pet care services.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Sitting Market

- Rover

- Wag

- Care.com

- Fetch! Pet Care

- PetBacker

- TrustedHousesitters

- Pawshake

- Mad Paws

- Gudog

- PetCloud

- Holidog

- PetSitter.com

- HouseMyDog

- PawPals

- Pawshake Asia