Pet Remote Control Collar Market Size

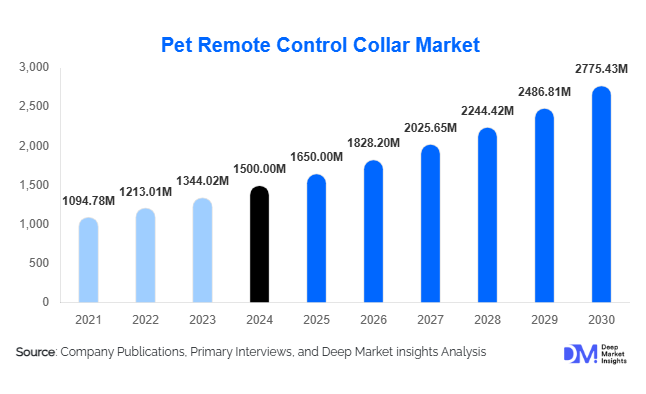

According to Deep Market Insights, the global pet remote control collar market size was valued at USD 1,500 million in 2024 and is projected to grow from USD 1,650 million in 2025 to reach USD 2,775.43 million by 2030, expanding at a CAGR of 10.8% during the forecast period (2025–2030). The market growth is primarily driven by rising pet ownership, increasing humanization of pets, and the rapid adoption of smart wearable technology that enhances pet safety, training, and health monitoring.

Key Market Insights

- Smart collars with GPS tracking and health-monitoring sensors dominate the market, appealing to tech-savvy pet owners seeking comprehensive care solutions.

- Remote training collars continue to gain traction for behavioral training of dogs, particularly in regions with high pet adoption rates.

- North America holds the largest market share, led by the U.S., due to high disposable income and widespread pet ownership.

- Asia-Pacific is the fastest-growing region, driven by emerging markets like China and India, with increasing pet adoption and disposable income.

- Online retail channels are expanding rapidly, providing convenience, extensive product selection, and digital support, driving higher adoption globally.

- Technological integration, including AI-enabled behavior monitoring, smartphone connectivity, and wearable sensors, is enhancing product appeal and engagement.

Latest Market Trends

Integration of Smart Technology

Manufacturers are increasingly embedding advanced technology into pet collars. GPS-enabled tracking, real-time health monitoring, and smartphone app connectivity are becoming standard. AI-based behavior analysis and activity tracking allow owners to monitor pets remotely, providing safety and training efficiency. Battery life and waterproof designs are also improving, meeting the demands of active pet owners and outdoor applications.

Shift Toward Humane and Ethical Training

There is a noticeable shift from shock-based collars toward vibration, sound, and gentle stimulation devices due to growing ethical concerns. Brands focusing on humane, safe, and scientifically backed training methods are capturing higher market preference, especially in regions with stricter animal welfare regulations.

Pet Remote Control Collar Market Drivers

Rising Pet Ownership

Globally, more households are adopting pets, particularly dogs and cats. As pets are increasingly regarded as family members, owners invest in advanced products for safety, monitoring, and training. This growing adoption is a major driver, especially in North America and Europe, where pet care expenditure per household is highest.

Technological Advancements

Wearable technology integration, such as GPS, health sensors, and smartphone connectivity, has made pet collars multifunctional. These features provide convenience, security, and behavior management solutions, encouraging adoption among tech-savvy pet owners and veterinary professionals.

Humanization of Pets

As pets are increasingly viewed as companions rather than animals, premium products with enhanced comfort, safety, and smart features are gaining traction. Pet owners are willing to pay more for collars that offer multi-functional benefits, driving market growth.

Market Restraints

Ethical and Regulatory Concerns

The use of shock-based collars faces regulatory restrictions and ethical opposition, particularly in Europe. These concerns can limit adoption and push manufacturers to innovate more humane alternatives.

High Cost of Advanced Collars

Collars with GPS, AI sensors, and health monitoring features are expensive, which may reduce penetration in price-sensitive markets and limit market expansion.

Pet Remote Control Collar Market Opportunities

Emerging Market Expansion

Asia-Pacific and Latin America represent untapped opportunities. Rising disposable incomes, urbanization, and increasing pet adoption in China, India, and Brazil provide significant growth potential. Companies can capture market share by localizing products and pricing strategies suitable for these regions.

Technological Innovation

Integration of AI-driven behavior tracking, real-time health monitoring, and IoT-based smart features can differentiate products. Companies investing in R&D to improve battery life, durability, and connectivity are likely to gain a competitive edge and increase customer loyalty.

E-commerce and Direct-to-Consumer Channels

Online retail growth provides a platform to reach global audiences efficiently. Offering personalized services, subscription models, and digital customer support can enhance engagement, expand brand visibility, and boost sales.

Product Type Insights

Smart collars lead the market, accounting for over 60% of the 2024 market share. These collars are preferred for their multifunctionality, including GPS tracking, health monitoring, and smartphone integration. Remote training collars hold substantial adoption among dog owners for behavioral correction, while surgical collars are essential in veterinary care, supporting post-operative recovery.

Application Insights

Dogs account for approximately 59.7% of the market, driving the majority of product demand. Demand is particularly high for training and monitoring applications, followed by post-surgery recovery. Cats and other pets are growing segments, mainly for activity monitoring and safety applications.

Distribution Channel Insights

Online retail dominates with 55% of the market share in 2023, fueled by convenience, product information, and competitive pricing. Pet specialty stores and veterinary clinics remain relevant for premium, expert-recommended products. Direct-to-consumer and subscription-based models are emerging as innovative distribution channels.

| By Product Type | By Animal Type | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 38% of the market in 2024, led by the U.S. High pet adoption rates, disposable income, and technology integration drive market dominance. Canada follows a similar trend with the increasing adoption of smart collars and remote training devices.

Europe

Europe accounts for approximately 30% of the market, with Germany and the U.K. leading demand due to high disposable income and ethical pet care adoption. Ethical regulations are shaping product preferences, encouraging humane training collars.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, and Japan. Rising disposable income, urbanization, and growing pet adoption are key factors. The market in India is expected to grow at 18.9% CAGR during 2024–2030.

Latin America

Brazil and Mexico are emerging markets with increasing pet adoption. Outbound imports of high-quality collars are rising, with growing demand in urban centers for premium and smart collars.

Middle East & Africa

The market is growing steadily, with Saudi Arabia showing a projected CAGR of 14.1%. Urbanization and increased pet ownership in the UAE and South Africa are contributing to growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Remote Control Collar Market

- Garmin

- PetSafe

- SportDOG

- Dogtra

- Petsafe Innovations

- Wahl

- Beaphar

- PetTech Solutions

- Tractive

- FitBark

- Pawbo

- DogCare Tech

- Petfon

- Innotek

- Pawscout

Recent Developments

- In March 2025, Garmin launched a new GPS-enabled dog collar with enhanced battery life and smartphone integration, targeting professional trainers and pet owners.

- In February 2025, PetSafe introduced a vibration-only training collar in Europe, responding to ethical concerns over shock-based devices.

- In January 2025, SportDOG expanded its smart collar portfolio in North America, integrating health-monitoring sensors and AI-based behavior tracking.