Pet Odor Eliminator Spray Market Size

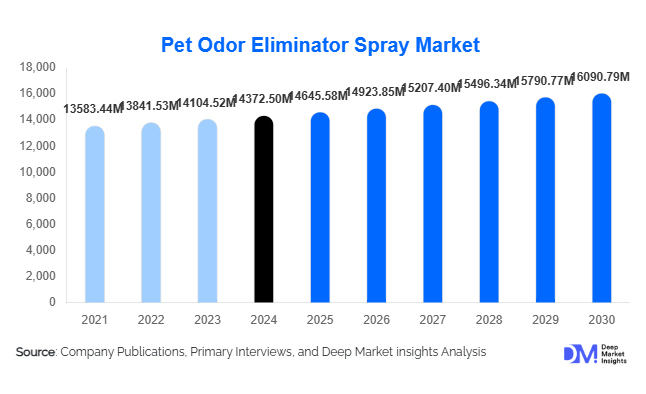

According to Deep Market Insights, the global pet odor eliminator spray market size was valued at USD 14,372.50 million in 2024 and is projected to grow from USD 14,645.58 million in 2025 to reach USD 16,090.79 million by 2030, expanding at a CAGR of 1.9% during the forecast period (2025–2030). The pet odor eliminator spray market growth is primarily driven by rising pet ownership, increasing pet humanization trends, growing urban apartment living, and heightened consumer focus on indoor hygiene and odor-neutralization solutions that are safe for pets and humans.

Key Market Insights

- Enzyme-based and bio-derived sprays are gaining strong consumer preference due to their ability to neutralize odors at the molecular level rather than masking them.

- Residential pet owners dominate demand, accounting for over 70% of total consumption, driven by multi-pet households and repeat usage.

- North America leads the global market due to high per-pet spending and strong penetration of premium pet care products.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class income, urbanization, and rapid growth in dog and cat adoption.

- Online and direct-to-consumer channels are transforming sales, enabling subscription models and premium brand positioning.

- Sustainability and non-toxic formulations are emerging as key differentiation factors among leading brands.

What are the latest trends in the pet odor eliminator spray market?

Shift Toward Enzyme-Based and Natural Formulations

One of the most prominent trends in the pet odor eliminator spray market is the rapid shift toward enzyme-based, probiotic, and plant-derived formulations. Consumers are increasingly avoiding chemical-heavy sprays due to concerns around pet health, allergies, and long-term exposure to volatile organic compounds. Enzyme-based sprays dominate the formulation landscape by effectively breaking down odor-causing organic matter from urine, feces, and dander. Natural ingredient labeling, cruelty-free testing, and biodegradable packaging are becoming strong purchase drivers, particularly among millennial and Gen Z pet owners. Premium brands are leveraging these trends to command higher margins and build long-term customer loyalty.

Digital-First and Subscription-Based Sales Models

E-commerce and direct-to-consumer platforms are reshaping how pet odor eliminator sprays are marketed and sold. Brands are increasingly offering subscription-based delivery models that ensure repeat purchases and stable revenue streams. Digital platforms also allow companies to educate consumers on product usage, safety, and efficacy through videos and reviews. Influencer marketing, pet-focused social media communities, and targeted digital advertising are significantly influencing buying decisions, particularly in urban markets.

What are the key drivers in the pet odor eliminator spray market?

Rising Pet Humanization and Indoor Living

The growing trend of treating pets as family members has led to increased spending on hygiene, cleanliness, and comfort-enhancing products. As more pets live indoors, especially in apartments and condominiums, odor control has become a necessity rather than a discretionary purchase. This shift has significantly boosted demand for safe, surface-compatible, and fabric-friendly odor eliminator sprays.

Growth of Multi-Pet Households

Multi-pet ownership is increasing globally, intensifying odor challenges within homes. This directly drives higher consumption frequency and repeat purchases of odor-eliminator sprays. Households with both dogs and cats increasingly prefer multi-pet universal sprays, supporting volume growth across mass-market and mid-premium price tiers.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

While premium and natural sprays are gaining popularity, price sensitivity remains a key restraint in emerging markets. Consumers in developing regions often opt for low-cost alternatives or traditional cleaning agents, limiting penetration of specialized pet odor eliminator sprays.

Regulatory Scrutiny on Chemical Ingredients

Stricter regulations related to chemical compositions, VOC emissions, and biocides in regions such as Europe and North America increase compliance costs for manufacturers. Reformulation requirements and labeling standards can slow product launches and increase operational expenses.

What are the key opportunities in the pet odor eliminator spray industry?

Commercial and Institutional Pet Care Facilities

The rapid expansion of pet boarding facilities, grooming salons, veterinary clinics, and pet daycare centers presents a significant B2B opportunity. These facilities require high-performance, long-lasting odor control solutions and often purchase in bulk. Customized industrial-grade sprays and refill formats offer strong revenue potential for manufacturers.

Asia-Pacific Market Expansion

Asia-Pacific represents a high-growth opportunity driven by rising pet adoption in China, India, South Korea, and Southeast Asia. Urban housing constraints and increasing awareness of pet hygiene are accelerating demand for odor control products. Localized pricing strategies and region-specific formulations can help brands rapidly scale in these markets.

Product Type Insights

Enzyme-based odor eliminator sprays dominate the product landscape, accounting for approximately 38% of the global market in 2024, due to their superior efficacy and pet-safe positioning. Chemical neutralizer sprays continue to hold a notable share in cost-sensitive markets, while plant-based and probiotic sprays are the fastest-growing sub-segments, supported by sustainability and clean-label trends. Premium formulations increasingly emphasize non-toxic ingredients, allergen-free claims, and eco-friendly packaging.

Application Insights

Fabric and upholstery applications lead the market, representing around 34% of total demand, as carpets, sofas, bedding, and pet furniture are primary odor-retention surfaces. Floor and surface sprays follow closely, driven by frequent cleaning needs in multi-pet homes. Litter box and cage sprays are witnessing rising demand, particularly in cat-dominant households and small animal ownership segments.

Distribution Channel Insights

Online retail and direct-to-consumer platforms account for approximately 41% of global sales, driven by convenience, subscription models, and product education. Pet specialty stores remain critical for premium and new product launches, while supermarkets and hypermarkets dominate volume sales in the mass-market segment. Veterinary clinics are emerging as trusted distribution points for medically safe and professional-grade sprays.

End-User Insights

Residential pet owners represent the largest end-user segment, accounting for nearly 72% of total market demand in 2024. Commercial pet facilities are the fastest-growing end-user segment, expanding at a CAGR exceeding 10%, driven by professional hygiene standards and higher pet throughput. Veterinary and animal healthcare facilities increasingly demand odor control solutions compatible with clinical environments.

| By Product Formulation | By Pet Type | By Application Area | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 38% share in 2024, driven by the U.S., which alone accounts for nearly 30%. High pet expenditure, strong brand presence, and widespread adoption of premium pet care products support market dominance.

Europe

Europe holds around 27% market share, with Germany, the U.K., and France driving demand. The region shows a strong preference for eco-friendly, low-chemical formulations, supported by strict regulatory frameworks.

Asia-Pacific

Asia-Pacific accounts for nearly 24% of the market and is the fastest-growing region, registering a CAGR of about 10.8%. China and India are key growth engines due to rising urban pet ownership and expanding middle-class populations.

Latin America

Latin America represents approximately 7% of global demand, led by Brazil and Mexico. Growth is supported by increasing pet adoption and the gradual premiumization of pet care products.

Middle East & Africa

The Middle East & Africa region holds around 4% market share, with demand concentrated in the UAE and South Africa. Rising disposable income and the growth of organized pet care retail are supporting market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Odor Eliminator Spray Market

- The Clorox Company

- Church & Dwight Co., Inc.

- Spectrum Brands Holdings

- Nestlé Purina PetCare

- SC Johnson

- Central Garden & Pet

- Reckitt Benckiser

- Zep Inc.

- Earth Friendly Products

- PetIQ, Inc.

- Wahl Clipper Corporation

- Arm & Hammer Pet Care

- Bio-Green Clean

- Simple Solution

- Nature’s Miracle