Pet Diabetes Care Market Size

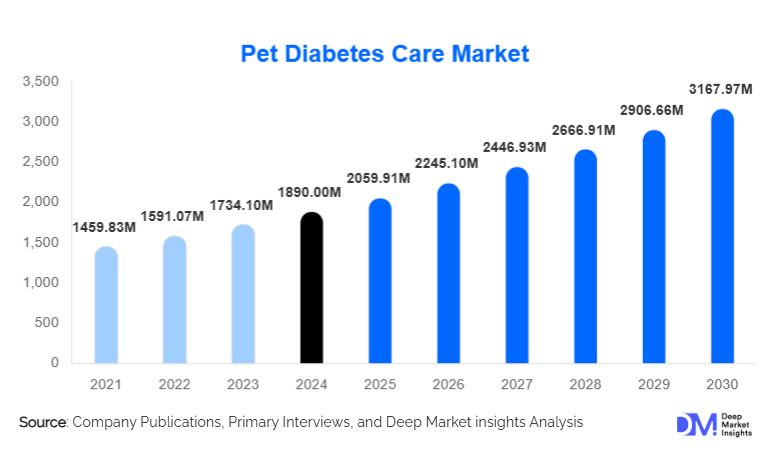

According to Deep Market Insights, the global pet diabetes care market size was valued at USD 1,890.00 million in 2024 and is projected to grow from USD 2,059.91 million in 2025 to reach USD 3,167.97 million by 2030, expanding at a CAGR of 8.99% during the forecast period (2025–2030). The market growth is primarily driven by the rising prevalence of diabetes in companion animals, increasing adoption of advanced glucose monitoring solutions, and the growing shift toward human-grade healthcare standards for pets.

Key Market Insights

- Pet diabetes prevalence is rising globally due to obesity, aging pets, and genetic factors, driving demand for insulin, diagnostics, and monitoring devices.

- Continuous glucose monitors (CGMs) and AI-enabled monitoring tools are transforming diabetes management, making advanced care accessible for home users.

- North America dominates the market, supported by high pet healthcare spending and strong veterinary infrastructure.

- Asia-Pacific is the fastest-growing region due to rising pet ownership, expanding veterinary services, and increasing awareness of chronic pet diseases.

- Therapeutic diabetic diets and prescription nutrition are witnessing rapid adoption, offering recurring revenue opportunities for pet food manufacturers.

- Veterinary telehealth and digital diabetes tracking apps are becoming key decision-making and monitoring tools for pet owners.

What are the latest trends in the pet diabetes care market?

AI-Driven & Wearable Glucose Monitoring Solutions

The adoption of continuous glucose monitoring technologies for pets is accelerating as manufacturers adapt human CGM technologies for veterinary use. AI-driven algorithms are improving insulin dosing precision, while Bluetooth-enabled sensors allow real-time tracking of glucose levels through mobile apps. These solutions reduce stress for pets, eliminate frequent clinic visits, and provide veterinarians with rich datasets for personalized treatment planning. This trend aligns with the broader pet humanization movement, where owners increasingly demand medical-grade healthcare for their animals.

Growth of Therapeutic Diabetic Diets & Personalized Nutrition

As dietary management becomes integral to diabetes control, veterinary nutrition companies are developing low-glycemic, high-fiber, and metabolically balanced formulations tailored to diabetic pets. Subscription-based delivery of diabetic pet foods is growing, providing recurring revenue for brands and convenience for owners. Innovations in microbiome-focused diets, species-specific formulations, and prescription-only food lines reflect a broader shift toward personalized nutrition supported by diagnostic testing and veterinary guidance.

Veterinary Telehealth & Remote Diabetes Management

Digital health platforms now enable remote glucose tracking, real-time veterinary consultations, and automated alerts for hypo/hyperglycemic episodes. These technologies enhance pet owner compliance and reduce the strain on veterinary clinics. Teleconsultations also expand diabetes management access in underserved regions, enabling earlier diagnosis and more consistent treatment outcomes.

What are the key drivers in the pet diabetes care market?

Increasing Prevalence of Pet Obesity & Chronic Diseases

With nearly 30–40% of dogs and cats classified as overweight or obese, the incidence of diabetes mellitus is rising globally. This condition often requires lifelong management, creating sustained demand for insulin, monitoring devices, and veterinary care. Greater awareness of chronic pet illnesses has also contributed to more routine screening and earlier detection, supporting market growth.

Growth in Pet Healthcare Spending & Insurance Coverage

Veterinary healthcare expenditures continue to rise, driven by premiumization, humanization of pets, and improved access to veterinary insurance. In markets such as the U.S., U.K., and Australia, growing insurance penetration allows owners to pursue advanced diabetes care, including CGMs, long-acting insulin, and frequent diagnostic tests. This trend significantly reduces cost barriers and boosts adoption rates of premium diabetes treatments.

Innovation in Insulin Therapies & Glucose Monitoring Devices

The market is experiencing robust innovation, including species-specific insulin, auto-injector pens, AI-assisted monitoring, and more accurate glucometers. These solutions improve treatment adherence, reduce user error, and enhance long-term disease control. Manufacturers investing heavily in digital integration and telehealth-enabled devices are shaping the next stage of growth.

What are the restraints for the global market?

High Cost of Diabetes Treatment

Managing diabetes in pets involves recurring costs for insulin, glucose strips, prescription diets, and veterinary visits. These costs can be prohibitive in emerging markets, limiting adoption among middle- and low-income households. High device costs, especially for CGMs and smart monitoring tools, continue to restrict widespread use in price-sensitive regions.

Shortage of Veterinary Endocrinologists & Limited Access in Developing Regions

Although general veterinary practitioners can diagnose diabetes, specialized care is often needed for complex cases. A shortage of trained veterinary endocrinologists globally creates treatment inconsistencies and limits access to advanced diabetic care. In many developing countries, outdated diagnostic equipment and limited clinical training further hinder market expansion.

What are the key opportunities in the pet diabetes care industry?

Wearable CGMs & AI-Powered Diabetes Management Platforms

Wearable sensors adapted from human diabetes care offer one of the most promising growth opportunities. Companies that integrate data analytics, predictive algorithms, and remote vet dashboards can capture strong demand from tech-savvy pet owners. Low current penetration (<15%) indicates substantial runway for growth worldwide.

Emerging Markets in Asia-Pacific & Latin America

Rising disposable incomes, urbanization, and expanding veterinary networks are unlocking new opportunities in APAC and LATAM. Pet healthcare spending is increasing rapidly, while governments invest in modernizing veterinary infrastructures. Companies that localize manufacturing, partner with regional veterinary chains, or offer subscription-based diabetes management programs can capitalize on these fast-growing regions.

Advanced Prescription Diets & Personalized Nutrition

Therapeutic diets are becoming essential to diabetic treatment plans. Brands that develop species-specific, clinically validated, and glycemic-optimized formulas can differentiate strongly. Personalized nutrition, driven by metabolic testing and microbiome analysis, represents a new frontier, providing high-margin recurring revenue streams for manufacturers.

Product Type Insights

Insulin and injectable therapies dominate the market, accounting for approximately 38% of total revenue in 2024. As insulin remains the cornerstone treatment for diabetic pets, demand continues to rise with improved diagnosis rates and longer pet lifespans. Glucose monitoring devices, especially wearable CGMs, are the fastest-growing subsegment, driven by technological adoption and owner preference for minimally invasive monitoring. Prescription diabetic diets form another major share, benefiting from high treatment compliance and recurring purchasing behavior.

Application Insights

Household pet owners account for the majority of application demand, as they directly purchase insulin, monitoring devices, and diabetic diets. Veterinary hospitals represent the second-largest application, driven by diagnostic testing, endocrinology consultations, and CGM setup services. Veterinary diagnostic labs are emerging quickly due to the rising need for fructosamine testing and metabolic screening. Animal shelters and rescue facilities also contribute to demand as they increasingly manage chronic diseases among aging intake populations.

Distribution Channel Insights

Veterinary hospitals and clinics lead distribution, representing nearly 54% of the 2024 market. Pet owners rely on veterinarians for diagnosis, insulin prescriptions, and treatment planning, making clinics the central hub of diabetes management. Online pharmacies are growing rapidly as e-commerce adoption increases and subscription-based diabetic diet programs expand. Retail pharmacies and pet specialty stores continue to serve as important distribution channels for consumables such as syringes, lancets, and test strips.

Animal Type Insights

Dogs represent the largest animal type segment, accounting for 62% of total diabetic cases, due to higher obesity prevalence and greater susceptibility to Type 1 diabetes. Cats form a substantial share as well, particularly in cases of Type 2 diabetes linked to indoor lifestyles and diet habits. Other companion animals contribute a smaller portion but represent a niche segment for specialty care.

Age Group Insights

Aging pets, particularly those above 8 years of age, represent the highest incidence of diabetes, with demand concentrated in senior care products, long-term insulin therapies, and specialized diets. Middle-aged pets (4–8 years) show rising diagnosis rates due to earlier screening and preventive wellness programs. Younger animals contribute minimally to market volume but remain important for early detection initiatives.

| By Product Type | By Application | By Distribution Channel | By Animal Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, holding approximately 41% of the global share in 2024. The U.S. leads demand due to high pet healthcare expenditure, strong insurance penetration, and rapid adoption of advanced glucose monitoring devices. Canada contributes significantly, supported by an aging pet population and increasing chronic disease diagnosis rates.

Europe

Europe contributes around 29% of global demand, with Germany, the U.K., and France being major markets. Strong veterinary infrastructure, government-backed animal health standards, and a high preference for premium pet care drive market growth. Eastern Europe is emerging, supported by improved clinical training and increased pet adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to maintain a 12–13% CAGR through 2030. China, Japan, South Korea, and India lead demand growth. Rising disposable incomes, increased urban pet ownership, and expanding vet hospital chains support this momentum. China is the fastest-growing country in the world for pet diabetes care, driven by rising chronic disease diagnostics in pets.

Latin America

Latin America shows steady growth, led by Brazil and Mexico. Increasing middle-class spending, expanding retail pet care chains, and improved veterinary access support diabetes care adoption. However, affordability challenges limit advanced device penetration.

Middle East & Africa

The region is small but expanding, driven by high-income pet owners in the UAE, Saudi Arabia, and Qatar. Africa’s growth is concentrated in South Africa and Kenya, where veterinary healthcare modernization is accelerating. Limited endocrinology specialists remain a key restraint.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Pet Diabetes Care Market

- Zoetis Inc.

- Boehringer Ingelheim Vetmedica

- Elanco Animal Health

- MSD Animal Health (Merck)

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- Royal Canin

- Dechra Pharmaceuticals

- Arkray

- IDEXX Laboratories

- Bayer Animal Health

- PetTest

- Dexcom (Veterinary CGM Solutions)

- Abbott Animal Health

- Vetoquinol

Recent Developments

- In October 2024, Zoetis introduced a next-generation veterinary CGM platform integrating AI-driven alerts for hypoglycemia events in dogs and cats.

- In August 2024, Hill’s Pet Nutrition launched a microbiome-focused diabetic pet diet designed to improve glycemic stability and digestive health.

- In June 2024, IDEXX expanded its endocrinology diagnostics suite, offering advanced fructosamine and thyroid-pancreatic panels for early detection.