Pet Carriers Market Size

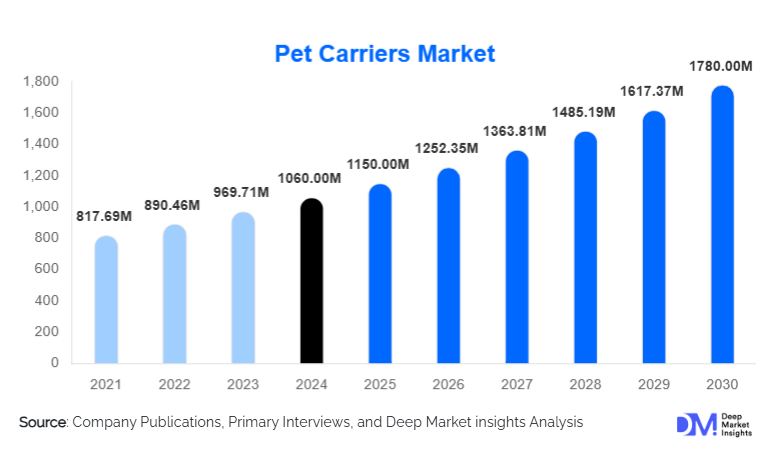

According to Deep Market Insights, the global pet carriers market was valued at USD 1,060 million in 2024 and is projected to grow from USD 1,150 million in 2025 to approximately USD 1,780 million by 2030, expanding at a CAGR of 8.9% during the forecast period (2025–2030). The pet carriers market growth is primarily driven by rising pet ownership worldwide, increasing humanization of pets, growth in pet travel and mobility, and expanding demand for airline-approved, ergonomic, and premium pet transportation solutions.

Key Market Insights

- Pet humanization trends are accelerating demand for comfortable, safe, and aesthetically designed carriers across urban households.

- Airline-compliant and travel-certified pet carriers are witnessing strong demand due to rising pet-inclusive travel globally.

- North America dominates the global market, supported by high pet ownership, premium spending, and strong e-commerce penetration.

- Asia-Pacific is the fastest-growing region, driven by rising disposable income, urbanization, and expanding organized pet retail.

- Online retail channels account for the largest share, benefiting from direct-to-consumer models and wider product visibility.

- Product innovation in lightweight materials and smart designs is reshaping competitive differentiation.

What are the latest trends in the pet carriers market?

Premium and Airline-Approved Carrier Designs

One of the most prominent trends in the pet carriers market is the increasing focus on premium, airline-approved designs. Consumers are prioritizing carriers that comply with cabin and cargo regulations while ensuring maximum comfort for pets. Manufacturers are introducing standardized dimensions, reinforced ventilation panels, padded interiors, and secure locking mechanisms to meet airline requirements. This trend is particularly strong in North America and Europe, where frequent air travel with pets is common. Premium airline-certified carriers also command higher price points, supporting value growth in the overall market.

Lightweight, Ergonomic, and Stylish Carriers

Pet carriers are increasingly positioned as lifestyle accessories rather than purely functional products. Lightweight fabrics, breathable mesh, collapsible structures, and ergonomic backpack-style carriers are gaining traction among urban pet owners. Design aesthetics, color customization, and fashion-oriented collections are becoming important purchase drivers, especially among younger consumers. This trend has led to rapid growth in backpack, sling, and wearable carrier formats, which offer convenience and hands-free mobility.

What are the key drivers in the pet carriers market?

Rising Global Pet Ownership

The steady increase in pet adoption across both developed and emerging economies is a fundamental growth driver for the pet carriers market. Changing lifestyles, delayed parenthood, and emotional well-being considerations have contributed to higher pet ownership rates. As pets increasingly become integral family members, owners are investing more in safe and comfortable transportation solutions for routine veterinary visits, travel, and daily mobility.

Growth in Pet Travel and Mobility

The resurgence of global travel and the growing acceptance of pets in public spaces and transport systems are driving demand for pet carriers. Airlines, railways, and road travel segments are witnessing higher volumes of pets traveling with their owners. This has increased demand for wheeled carriers, backpack carriers, and airline-approved soft-sided carriers, particularly in developed markets.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

While demand for pet carriers is rising globally, price sensitivity remains a challenge in emerging economies. A significant portion of consumers continues to opt for low-cost or unbranded products, limiting the penetration of premium carriers. This intensifies price competition and can constrain margin expansion for branded manufacturers.

Regulatory and Standardization Challenges

Airline and country-specific regulations governing pet transportation vary widely, creating compliance challenges for manufacturers. Frequent changes in airline policies increase development costs and complicate product standardization across regions, acting as a restraint on faster global expansion.

What are the key opportunities in the pet carriers industry?

Smart and Technology-Integrated Pet Carriers

The integration of smart features such as temperature-regulating fabrics, anti-anxiety interiors, GPS tracking compatibility, and modular ventilation systems represents a major opportunity. Tech-enabled carriers appeal strongly to urban and premium consumers, offering higher margins and differentiation in competitive markets.

Expansion in Emerging Markets

Rapid growth in pet ownership across Asia-Pacific, Latin America, and parts of the Middle East presents significant expansion opportunities. Localized product designs, cost-efficient manufacturing, and partnerships with regional e-commerce platforms can help brands tap into these high-growth markets.

Product Type Insights

Soft-sided pet carriers dominate the global market, accounting for approximately 38% of total market value in 2024. Their lightweight construction, affordability, and airline compatibility make them the preferred choice among urban pet owners. Hard-sided carriers remain popular for larger pets and long-distance travel, while backpack and wearable carriers are the fastest-growing sub-segment due to convenience and ergonomic benefits. Wheeled carriers are gaining traction among older consumers and frequent travelers, offering enhanced mobility and reduced physical strain.

Material Insights

Fabric-based pet carriers hold the largest share, representing nearly 44% of the market in 2024. Polyester and nylon fabrics dominate due to their durability, breathability, and lightweight nature. Plastic-based carriers, typically made from ABS or polypropylene, are widely used for rigid and airline cargo applications. Hybrid material carriers that combine fabric exteriors with reinforced frames are increasingly popular for premium use cases.

Distribution Channel Insights

Online retail channels lead the pet carriers market, contributing around 41% of global sales in 2024. Brand websites and e-commerce platforms enable direct consumer engagement, product customization, and competitive pricing. Specialty pet stores continue to play a critical role in premium and first-time purchases, while supermarkets and veterinary clinics support impulse and replacement demand.

End-Use Insights

Personal household use accounts for approximately 63% of total market demand, driven by routine transportation needs such as vet visits and short-distance travel. The travel and airline transport segment is the fastest-growing end-use category, expanding at over 10% CAGR. Veterinary and medical transport remains a stable segment, supported by increasing preventive healthcare visits, while commercial pet services represent a growing niche in urban areas.

| By Product Type | By Material Type | By Pet Type | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global pet carriers market at approximately 34% in 2024. The United States dominates regional demand due to high pet ownership rates, premium spending behavior, and strong adoption of airline-approved carriers. E-commerce penetration and product innovation further support market leadership.

Europe

Europe accounts for nearly 26% of the global market, with Germany, the United Kingdom, and France leading demand. Strong animal welfare regulations and frequent intra-regional travel drive adoption of certified and high-quality pet carriers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 11% CAGR. China and Japan lead in market value, while India represents the fastest-growing country due to rising middle-class income, urbanization, and increasing pet adoption.

Latin America

Latin America contributes around 8% of global demand, led by Brazil and Mexico. Growth is supported by rising urban pet ownership and expanding organized retail channels.

Middle East & Africa

The Middle East & Africa region remains nascent but is growing steadily, driven by premium pet care adoption in the UAE and Saudi Arabia, along with urbanization trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Carriers Market

- Mars Incorporated

- Ferplast

- Petmate

- KONG Company

- MidWest Homes for Pets

- Outward Hound

- Sleepypod

- Hunter International

- Sherpa Pet Group

- Pet Gear

- Ancol Pet Products

- Richell

- Gen7Pets

- Bergan Pet Products

- Petsfit