Personal Care Ingredients Market Size

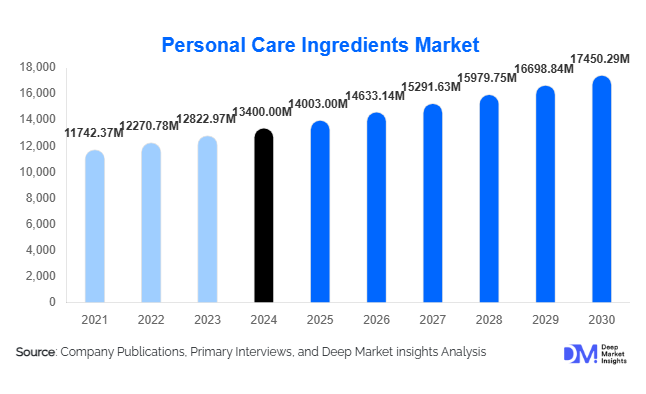

According to Deep Market Insights, the global personal care ingredients market size was valued at USD 13,400.00 million in 2024 and is projected to grow from USD 14,003.00 million in 2025 to reach USD 17,450.29 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). Market growth is supported by rising global demand for skincare, haircare, cosmetics, and hygiene products, alongside increasing adoption of natural, bio-based, and multifunctional ingredients in premium and mass-market formulations.

Key Market Insights

- Skin care remains the largest application segment, driving demand for emollients, active ingredients, conditioning polymers, and natural extracts.

- Emollients dominate the ingredient type category, accounting for nearly 40% of global personal care ingredient consumption in 2024.

- Asia-Pacific leads global demand with 30–35% market share, supported by booming cosmetics consumption in China, India, South Korea, and Japan.

- Clean-label and bio-based ingredients are the fastest-growing segments, driven by consumer preference for sustainable, natural, and plant-derived formulations.

- Active ingredients, including peptides, antioxidants, and botanical extracts, are witnessing high growth due to rising demand for premium, multifunctional, and anti-aging products.

- Technological innovations in ingredient delivery systems (nano-encapsulation, controlled-release actives) are reshaping formulation capabilities for cosmetic brands.

What are the latest trends in the personal care ingredients market?

Growing Adoption of Natural, Bio-Based & Clean-Label Ingredients

One of the most transformative trends in the personal care ingredients industry is the shift toward natural, sustainable, and clean-label formulations. Consumers increasingly scrutinize ingredient lists, avoiding synthetic preservatives, sulfates, parabens, and petrochemical derivatives. This has accelerated demand for plant extracts, botanical actives, natural emollients, and bio-based surfactants. Brands are reformulating existing products using green chemistry principles, while suppliers develop eco-certified ingredients with transparent sourcing. This trend aligns strongly with regulatory pressures in Europe and North America, promoting safer, renewable, and biodegradable ingredients.

Premiumization and High-Performance Active Ingredients

Premium skincare and haircare categories continue to expand, driving strong demand for high-performance active ingredients such as peptides, ceramides, antioxidants, retinoids, niacinamide, and encapsulated vitamins. Consumers expect products that address multiple concerns, hydration, anti-aging, brightening, barrier repair, and sun protection, fueling the growth of multifunctional ingredients. Cosmeceuticals and dermatology-backed formulations are rapidly blurring the line between beauty and clinical skincare. This trend has created strong opportunities for suppliers offering advanced delivery systems that enhance efficacy, stability, and bioavailability of active ingredients.

What are the key drivers in the personal care ingredients market?

Rising Global Consumption of Skincare & Haircare Products

Increasing beauty consciousness, self-care culture, and hygiene awareness, especially among millennials and Gen Z, are driving the consumption of skin and hair products worldwide. From moisturizers and serums to anti-frizz hair treatments and scalp health solutions, ingredient demand has surged across categories. Urban lifestyles, digital influence, and social media have raised expectations for performance-driven products, directly boosting ingredient demand.

Shift Towards Multifunctional & Premium Formulations

Consumers increasingly prefer products that deliver multiple benefits, anti-aging + SPF, hydration + brightening, or cleansing + microbiome support. This shift requires high-value ingredients such as multifunctional polymers, sophisticated emollients, and targeted actives. Brands are investing heavily in innovative ingredients that offer superior sensorial properties, longer-lasting effects, and enhanced skin compatibility.

Expansion of Personal Care Markets in APAC & Emerging Economies

APAC, LATAM, and the Middle East are witnessing rapid growth in personal care consumption driven by rising incomes, youthful populations, and strong local manufacturing ecosystems. China, India, Brazil, Indonesia, and the UAE are emerging as hotspots for ingredient demand. Expanding domestic cosmetics brands and increasing imports of high-quality formulations are further supporting growth.

What are the restraints for the global market?

Regulatory Complexity and Compliance Pressure

The personal care industry faces increasingly stringent regulations related to ingredient safety, toxicity, environmental impact, and labeling. The EU's REACH regulations, microplastics bans, and U.S. FDA scrutiny can slow down product development and increase compliance costs. Many synthetic and controversial ingredients face restrictions, making it challenging for suppliers to navigate global regulatory landscapes.

Raw Material Price Volatility & Supply Chain Disruptions

Petrochemical-based ingredients are vulnerable to crude oil fluctuations, while botanical ingredients depend on seasonal crop yields. Global supply chain disruptions, weather events, geopolitical tensions, or logistical constraints pose challenges for manufacturers. Cost inflation in natural oils, plant-derived actives, and specialty surfactants continues to pressure margins in the ingredient supply chain.

What are the key opportunities in the personal care ingredients industry?

Rapid Expansion of Clean Beauty & Sustainable Formulations

The rising preference for chemical-free, eco-friendly, and ethically sourced ingredients presents a significant growth opportunity. Suppliers that invest in green chemistry, biodegradable polymers, plant-derived surfactants, and microbiome-friendly ingredients are positioned to lead future demand. Certifications such as ECOCERT, COSMOS, and USDA Organic add further appeal for premium product lines.

High-Growth Potential in APAC, LATAM, and MEA

Emerging markets with rising beauty consumption present strong opportunities for organic growth and new manufacturing capacity. Ingredient suppliers establishing regional production hubs, particularly in India, China, Brazil, Indonesia, and the GCC, can benefit from lower costs, reduced import dependency, and rapidly expanding cosmetics sectors. Local botanical resources in these regions also offer opportunities to develop region-specific natural ingredients.

Product Type Insights

Emollients dominate the personal care ingredients market, accounting for nearly 40% of the global value. They serve as essential components in moisturizers, serums, lotions, foundations, and conditioning products. Their ability to enhance texture, hydration, and spreadability makes them indispensable in both premium and mass-market formulations. Active ingredients such as peptides, antioxidants, and botanical extracts are the fastest-growing sub-category, supported by growing demand for anti-aging, brightening, and skin-repair products. Surfactants remain critical for cleansing and foaming products, particularly in shampoos, body washes, and facial cleansers.

Application Insights

Skin care is the largest application segment, representing 35–45% of overall ingredient demand in 2024. Growing consumption of moisturizers, serums, sunscreens, and anti-aging products fuels strong demand for emollients, antioxidants, UV filters, and actives. Hair care is rapidly expanding, powered by innovations in scalp treatments, hair serums, color-protection formulas, and sulfate-free shampoos. Toiletries, make-up, and oral care collectively contribute a significant share, with oral care seeing rising demand for natural abrasives, herbal extracts, and antimicrobial agents.

Distribution Channel Insights

The personal care ingredients market is primarily served through B2B channels, including direct sales to cosmetic manufacturers, specialty chemical distributors, and formulation houses. Direct supply agreements dominate among top-tier FMCG and beauty brands, ensuring consistent quality and regulatory compliance. Online ingredient marketplaces and digital procurement platforms are increasingly popular among small and mid-sized cosmetic manufacturers, enabling transparent pricing, rapid comparison, and access to niche natural ingredients. Technical support and R&D collaborations are crucial aspects of distribution, helping brands optimize formulations and accelerate product launches.

End-Use Insights

Major end-use segments include skin care, hair care, color cosmetics, toiletries, and oral care. Skin care and hair care are the fastest-growing end-use industries, driven by rising demand for premium formulations and active-ingredient-rich products. Men’s grooming, cosmeceuticals, sun care, and baby care are emerging categories creating new demand for high-performance ingredients. Increasing export production in India, China, and Southeast Asia has enhanced demand for specialty ingredients across these end-use sectors. Growth in personal care manufacturing in emerging economies is fueling substantial ingredient consumption across all categories.

| By Ingredient Type | By Source Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 20–25% of global demand, driven by high per-capita spending on beauty and personal care. The U.S. leads consumption of anti-aging skincare, premium haircare, and clean-label products. Strong R&D ecosystems and regulatory oversight push suppliers to innovate in active ingredients and sustainable formulations. Demand is buoyed by wellness trends, dermatology-driven formulations, and rapid adoption of cosmeceuticals.

Europe

Europe holds 20–25% market share and leads in regulatory-driven innovation. Germany, France, Italy, and the U.K. exhibit high demand for safe, natural, and eco-certified ingredients. The region’s stringent cosmetic regulations foster the adoption of green chemistry and biodegradable alternatives. European consumers are early adopters of vegan, cruelty-free, and organic personal care products.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, accounting for 30–35% of global market share in 2024. China and India represent the highest-growth markets due to expanding middle-class populations, increasing beauty consciousness, and strong domestic manufacturing. South Korea and Japan drive demand for premium actives and innovative textures, fueling advanced ingredient needs. APAC’s rapid industrialization and export-based cosmetic production amplify ingredient consumption.

Latin America

Brazilians and Mexicans are strong consumers of personal care products, especially in hair care and fragrances. LATAM’s market is growing steadily, driven by urbanization and rising grooming habits. Local cosmetic manufacturing is expanding, resulting in demand for surfactants, conditioners, and natural oils.

Middle East & Africa

The region shows moderate but rising demand, supported by the GCC’s premium beauty market and Africa’s growing middle class. Countries like the UAE and Saudi Arabia prefer premium skincare and fragrance-rich formulations, increasing demand for specialty ingredients. Africa’s domestic manufacturing is expanding, particularly in South Africa, Kenya, and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Personal Care Ingredients Market

- BASF SE

- Dow Chemical Company

- Croda International Plc

- Evonik Industries AG

- Ashland Inc.

- Nouryon

- Clariant AG

- The Lubrizol Corporation

- Solvay S.A.

- Eastman Chemical Company

- Givaudan SA

- Lonza Group

- Innospec Inc.

- ADEKA Corporation

- Kao Corporation

Recent Developments

- In March 2025, BASF announced the expansion of its bio-based emollient production facility in Germany to meet rising demand for sustainable skincare ingredients.

- In January 2025, Croda International launched a new line of plant-derived surfactants designed for sensitive skin formulations and eco-friendly cleansing products.

- In February 2025, Ashland unveiled an encapsulated antioxidant technology aimed at enhancing the stability and performance of premium skincare formulations.