Personal Care Electrical Appliances Market Size

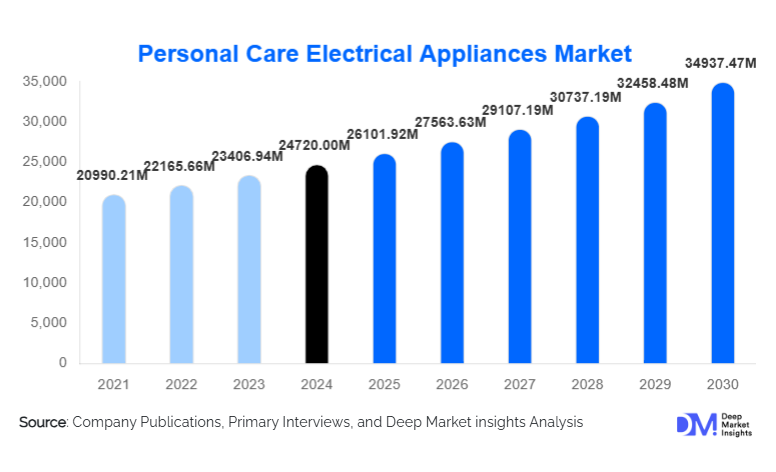

According to Deep Market Insights, the global personal care electrical appliances market size was valued at USD 24,720.00 Million in 2024 and is projected to grow from USD 26,101.92 Million in 2025 to reach USD 34,937.47 Million by 2030, expanding at a CAGR of 5.60% during the forecast period (2025–2030). This growth is driven by increasing consumer focus on personal grooming, rising urbanization, expanding e-commerce penetration, and accelerating adoption of smart, cordless, and battery-operated grooming devices across global markets.

Key Market Insights

- Hair care appliances remain the dominant product category, contributing nearly one-third of global revenue due to strong demand for hair dryers, straighteners, and styling tools.

- Cordless and battery-operated devices are rapidly gaining market share as consumers prioritize portability, convenience, and multifunctional usage.

- Online retail channels now account for over 40% of global sales, supported by rapid digital commerce growth and increasing consumer preference for online research and purchase.

- North America leads global market revenue, supported by high per-capita spending and strong adoption of premium grooming devices.

- Asia-Pacific is the fastest-growing regional market, driven by rising middle-class income, beauty awareness, and widespread digital access in markets such as China, India, and Southeast Asia.

- Male grooming is emerging as a high-growth subsegment, with rapid uptake of electric trimmers, shavers, and body grooming tools.

- Smart and connected grooming devices, including app-connected toothbrushes, facial devices, and personalized hair styling tools, are reshaping product innovation trends.

What are the latest trends in the personal care electrical appliances market?

Smart, Connected & Sensor-Integrated Personal Care Devices

Technology integration is redefining consumer grooming behavior. Smart electrical appliances, such as app-synced electric toothbrushes, facial cleansing devices with skin sensors, and hair stylers with temperature-control intelligence, are becoming mainstream. These devices provide real-time performance analytics, personalized settings, and usage tracking, enabling tailored grooming experiences. AI-driven personalization is emerging, where devices automatically adapt to skin type, hair density, or brushing habits. This trend strongly appeals to tech-savvy consumers and the premium segment, improving brand loyalty and enabling subscription-based replacement heads and attachments.

Rising Popularity of Cordless, Portable & Rechargeable Devices

Driven by lifestyle shifts, cordless appliances, such as rechargeable shavers, trimmers, hair stylers, and portable facial devices, are becoming the preferred choice among global consumers. Improvements in lithium-ion battery efficiency, fast charging, and compact ergonomic designs have accelerated this trend. For frequent travelers, busy professionals, and younger demographics, cordless solutions offer unmatched flexibility and portability. This transition is also pushing brands to invest in lightweight materials, compact engineering, and improved power optimization.

What are the key drivers in the personal care electrical appliances market?

Growing Consumer Focus on Self-Care, Grooming, and Personal Hygiene

Across global markets, personal grooming has become integral to daily routines. Rising social media influence, self-image awareness, and beauty consciousness continue to elevate demand for high-quality grooming appliances. Consumers are adopting salon-like treatments at home, boosting sales of hair stylers, facial cleansers, oral-care devices, and grooming kits. This structural shift toward at-home grooming significantly increases replacement cycles and category penetration.

Technological Innovations in Battery, Motor, and Smart Capabilities

Advancements in brushless motors, compact heating elements, long-life batteries, and microprocessor controls are redefining performance standards. Devices now offer faster results, greater precision, and enhanced safety features such as automatic shut-off and heat protection sensors. These innovations enable premium pricing while supporting user convenience and device longevity, driving market expansion across mid-range and high-end categories.

What are the restraints for the global market?

High Competitive Pressure & Low Differentiation in Mass-Market Categories

The mass-market segment faces strong competition from regional manufacturers offering low-cost alternatives. Categories such as basic hair dryers and entry-level shavers have become commoditized, pushing margins downward. As a result, global leaders must continually innovate to justify higher prices, while new entrants face significant challenges in building brand differentiation.

Regulatory Compliance & Product Safety Standards

Electrical grooming appliances must meet stringent safety certifications, including CE, UL, BIS, and energy compliance standards. Meeting these requirements increases manufacturing and R&D costs, particularly for companies operating across multiple regions. Noncompliance can result in recalls or import restrictions, creating operational and financial risks that constrain market expansion.

What are the key opportunities in the personal care electrical appliances industry?

Huge Growth Potential in Emerging Markets

Rapid urbanization, rising disposable incomes, and growing beauty awareness in markets such as India, Indonesia, Vietnam, and Brazil present strong growth opportunities. Consumers in these regions are shifting from manual grooming to electric devices, driven by increased exposure to beauty influencers and growing modern retail penetration. Brands offering mid-priced, durable, and multifunctional appliances can tap into this large, underpenetrated opportunity.

Expansion of E-Commerce & Direct-to-Consumer (D2C) Channels

The dominance of online retail provides brands with direct access to consumers without dependence on traditional distribution. D2C models allow companies to build customer relationships, generate recurring sales (replacement parts, accessories), and collect behavioral data. Social commerce, influencer partnerships, and targeted digital marketing further support rapid scale-up, making online-first growth strategies a key market opportunity.

Product Type Insights

Hair care appliances dominate the market, accounting for an estimated 30–35% of global revenue. Hair dryers, straighteners, and trimmers remain daily-use tools with frequent replacement cycles and high penetration. Hair removal appliances show high demand among both men and women, while skin-care devices, facial massagers, LED therapy tools, and cleansing brushes are emerging as a fast-growing premium niche. Oral care appliances, particularly electric toothbrushes and water flossers, continue to gain traction due to rising dental hygiene awareness.

Application Insights

Home-based grooming is the dominant application segment, driven by convenience, cost efficiency, and privacy. The rise of at-home beauty routines, including hair styling, facial cleansing, and skin therapy, is boosting demand for multi-functional grooming tools. Professional and semi-professional usage (salons, barbershops, freelancers) represents a growing segment, particularly for high-performance trimmers, clippers, and dryers. With rising interest in wellness and personalized care, applications such as LED facial therapy, microcurrent toning, and scalp massagers are gaining momentum across premium consumer groups.

Distribution Channel Insights

Online retail is the largest distribution channel, accounting for 40–45% of global sales. E-commerce platforms, brand D2C stores, and online marketplaces benefit from transparent pricing, product comparisons, and consumer reviews. Offline specialty stores, hypermarkets, and pharmacies continue to attract buyers seeking hands-on product evaluation. Subscription models, especially for oral-care accessories, razor heads, and brush attachments, are emerging as strong retention-driven channels. Influencer-led marketing and social media campaigns significantly influence purchasing decisions, particularly among younger demographics.

End-User Insights

Women account for the largest consumer segment, contributing 55–60% of global demand for personal care electrical appliances. Their usage spans hair styling, skin care devices, and premium grooming kits. The male grooming segment is one of the fastest-growing, driven by rising demand for beard trimmers, electric shavers, and body groomers. Unisex products, such as oral care devices, massage guns, and hair dryers, are also expanding across multi-person households. Family and household usage is increasing, supported by broader device acceptance and frequent gifting trends.

Age Group Insights

Consumers aged 25–45 represent the largest purchasing segment due to higher disposable incomes and greater emphasis on grooming and lifestyle improvement. Young adults (18–30) drive strong demand in cordless trimmers, portable styling tools, and budget grooming kits. Mature users (45–65) show increasing preference for premium oral-care products, massage devices, and skin rejuvenation gadgets. Senior consumers, while a smaller demographic, represent a growing demand for easy-to-use massagers, ergonomic oral-care appliances, and low-strain grooming solutions.

| By Product Type | By Application | By Distribution Channel | By Power Source | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (25–30%) owing to high adoption of premium grooming tools, strong e-commerce penetration, and advanced consumer awareness. The U.S. drives the majority of demand, with strong purchasing patterns in hair styling appliances, electric toothbrushes, and men’s grooming devices. Brand loyalty, technological adoption, and preference for cordless appliances support continued growth.

Europe

Europe remains a mature but stable market, contributing 20–25% of global demand. Consumers in Germany, the U.K., France, and Italy show high adoption rates for energy-efficient and salon-grade devices. Growth is particularly strong in premium oral-care tools, eco-friendly grooming appliances, and professional-style hair devices. Strict regulatory standards also favor high-quality branded products.

Asia-Pacific

Asia-Pacific is the fastest-growing regional segment, contributing 30–35% of global revenue. China, India, Japan, and South Korea are major growth centers. Rising urbanization, booming e-commerce ecosystems, and expanding middle-class affordability are key growth drivers. Demand is especially strong for hair styling tools, trimmers, and electric toothbrushes. India shows significant long-term potential due to low market penetration and a rapidly growing grooming culture.

Latin America

Latin America is an emerging market for grooming appliances, led by Brazil and Mexico. Growth is influenced by rising beauty consciousness, urban middle-class expansion, and increasing interest in affordable grooming tools. While price sensitivity remains high, demand for mid-range and unisex grooming tools is expanding steadily.

Middle East & Africa

MEA is witnessing growing adoption driven by rising disposable incomes in GCC nations and increasing grooming awareness across Africa. The UAE and Saudi Arabia lead premium grooming demand, while South Africa is emerging as a strong adopter of hair care and oral-care appliances. Market expansion is supported by modern retail growth and increasing youth-driven beauty trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Personal Care Electrical Appliances Industry

- Philips

- Panasonic Corporation

- Conair Corporation

- The Procter & Gamble Company

- Colgate-Palmolive

- Dyson

- Remington

- Wahl Clipper Corporation

- Helen of Troy Limited

- Groupe SEB

- Homedics

- Revlon

- Shiseido (electrical beauty devices category)

- Lion Corporation

- Flyco

Recent Developments

- In April 2025, Philips launched its next-generation AI-powered electric toothbrush line, integrating real-time pressure sensing and personalized brushing guidance.

- In March 2025, Panasonic expanded its cordless grooming device series with high-torque brushless motors designed for professional and home use.

- In January 2025, Dyson introduced a new hair styling system using low-heat, high-airflow technology aimed at reducing hair damage while delivering salon-grade results.