Performing Art Companies Market Size

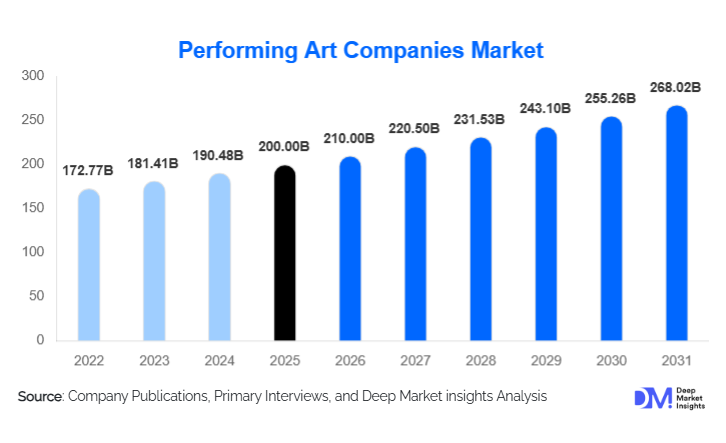

According to Deep Market Insights, the global performing art companies market size was valued at USD 200.00 billion in 2024 and is projected to grow from USD 210.00 billion in 2025 to reach USD 268.02 billion by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is primarily driven by the strong revival of live entertainment, rising cultural tourism, increased public funding for arts and culture, and the growing commercialization of performing arts through touring, sponsorships, and digital distribution models.

Key Market Insights

- Live performance demand has rebounded strongly post-pandemic, with audiences prioritizing experiential and in-person cultural entertainment.

- Theatre and music performance companies dominate global revenues, supported by long-running productions, touring franchises, and premium ticket pricing.

- North America remains the largest market, driven by Broadway, touring circuits, and high per-capita spending on cultural experiences.

- Asia-Pacific is the fastest-growing region, supported by government investments in cultural infrastructure and rising middle-class consumption.

- Digital and hybrid performance models are expanding audience reach and creating new monetization opportunities.

- Government subsidies and cultural policies continue to play a critical role in sustaining non-profit and heritage-focused performing art institutions.

What are the latest trends in the performing art companies market?

Hybrid Live-Digital Performance Models

Performing art companies are increasingly adopting hybrid models that combine live stage performances with digital streaming and on-demand content. This trend enables companies to extend audience reach beyond physical venues, monetize archived productions, and generate recurring revenue through subscriptions and virtual ticketing. Digital broadcasts of theatre, opera, and dance performances are gaining traction among international audiences and younger demographics, reducing geographical barriers and improving revenue stability. Many companies are also experimenting with virtual reality (VR) and immersive video formats to enhance audience engagement.

Experiential and Immersive Stage Productions

There is a growing shift toward immersive and experiential performances that integrate advanced stage technology, interactive storytelling, and audience participation. Projection mapping, augmented reality visuals, and AI-assisted choreography are being used to modernize traditional art forms and attract new audiences. These innovations are particularly effective in metropolitan markets, where competition for entertainment spending is intense, and audiences seek differentiated experiences.

What are the key drivers in the performing art companies market?

Revival of Cultural Tourism and Live Events

The resurgence of cultural tourism is a major driver for the performing arts companies market. Cities known for theatre, opera, ballet, and orchestral performances are experiencing increased visitor footfall, directly boosting ticket sales and performance frequency. Governments and tourism boards are actively promoting cultural festivals and landmark productions as destination attractions, providing sustained demand for resident and touring companies.

Public Funding and Institutional Support

Public subsidies and institutional funding remain critical growth enablers, particularly in Europe and the Asia-Pacific. Governments continue to invest in performing arts as tools for cultural preservation, creative employment, and international cultural diplomacy. These funding mechanisms help stabilize revenues, support talent development, and enable long-term artistic planning.

What are the restraints for the global market?

High Operating and Production Costs

Performing art companies face high fixed and variable costs related to talent compensation, stage production, venue rentals, logistics, and touring. Rising labor costs, energy prices, and insurance expenses exert pressure on profit margins, particularly for mid-sized and independent companies. These cost challenges can limit expansion and reduce financial resilience.

Shifting Audience Demographics

In mature markets, traditional audiences for classical theatre, opera, and ballet are aging, while younger consumers exhibit fragmented entertainment preferences. Companies that fail to modernize content, marketing, and delivery channels risk declining attendance and relevance.

What are the key opportunities in the performing art companies industry?

Government-Led Cultural Infrastructure Expansion

Significant investments in new theatres, opera houses, and cultural centers, particularly in Asia-Pacific and the Middle East, present long-term opportunities for performing art companies. These projects create sustained demand for professional productions, touring contracts, and international collaborations, enabling market expansion into high-growth regions.

Cross-Industry Collaborations and Experiential Integration

Collaborations with tourism operators, luxury hospitality brands, corporate event organizers, and educational institutions are creating new revenue streams. Embedding performances into destination experiences, branded events, and institutional programming allows companies to increase revenue per production and diversify income beyond ticket sales.

Art Form Insights

Theatre companies represent the largest share of the global performing arts companies market, accounting for approximately 32% of total revenue in 2024. This dominance is primarily driven by the strong commercial appeal of musicals and dramatic productions, particularly long-running shows and franchise-based productions in major cultural hubs such as New York, London, and select Asian metropolitan centers. Theatre companies benefit from higher ticket pricing, extended performance runs, repeat attendance, and strong integration with cultural tourism, making them the most commercially scalable art form globally.

Music performance companies, including orchestras and opera houses, form the second-largest segment, supported by robust institutional funding, premium pricing models, and strong demand for classical and contemporary music experiences. Opera houses and symphony orchestras benefit from long-established audience bases, philanthropic support, and government subsidies, particularly in Europe and parts of the Asia-Pacific, enabling stable revenue generation despite higher operating costs. Dance companies, circus arts, and multidisciplinary performing arts are gaining increasing traction through international festivals, touring circuits, and experimental formats. These segments are driven by rising demand for culturally diverse, visually immersive, and contemporary performance styles, particularly among younger audiences. Multidisciplinary and experimental performers are also benefiting from collaborations with digital artists and immersive stage technologies, enabling differentiation and global reach despite smaller absolute market shares.

Revenue Model Insights

Ticket-based commercial performing art companies dominate the market, accounting for approximately 41% of global revenue in 2024. This leadership is driven by strong pricing power, premium seating structures, dynamic pricing models, and ancillary revenue streams such as merchandise, food and beverage sales, and exclusive audience experiences. High-profile productions, particularly in theatre and live music, are able to command premium pricing due to brand recognition, critical acclaim, and tourism-driven demand.

Publicly funded and non-profit performing art companies continue to play a critical role in sustaining cultural heritage and artistic diversity. These organizations benefit from government grants, municipal funding, and philanthropic contributions, which help stabilize revenues and mitigate market volatility. This model is especially prominent in Europe and parts of Asia, where cultural policy strongly supports institutional arts. Digital and hybrid revenue models are emerging as the fastest-growing segment, driven by global streaming demand, digital ticketing, and intellectual property monetization. Performing art companies are increasingly leveraging live-streamed performances, subscription-based platforms, and on-demand archives to reach international audiences. This model reduces dependency on physical venue capacity and enhances long-term monetization of creative assets.

End-Use Insights

Cultural tourism remains the largest end-use segment in the performing art companies market, accounting for nearly 38% of total demand. Major cities with established performing arts ecosystems attract domestic and international tourists seeking immersive cultural experiences, directly driving ticket sales and performance frequency. Performing arts are increasingly integrated into destination marketing strategies, reinforcing their role as economic and tourism drivers.

Educational institutions represent a rapidly growing end-use segment, supported by curriculum integration, youth engagement initiatives, and institutional partnerships. Schools, universities, and cultural academies increasingly collaborate with performing art companies to deliver workshops, residencies, and educational performances, contributing to stable, recurring demand. Corporate entertainment and branded live experiences are also expanding, as companies leverage performing arts for product launches, corporate events, and brand storytelling. Additionally, digital platforms are emerging as a distinct end-use category, enabling global distribution of performances, long-tail revenue generation, and access to audiences in markets without physical performing arts infrastructure.

| By Art Form | By Revenue Model | By End Use | By Venue Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global performing art companies market, making it the largest regional contributor. The United States leads regional demand due to the global prominence of Broadway, extensive touring circuits, and strong private-sector investment in live entertainment. High disposable income, a mature ticketing ecosystem, and a strong corporate sponsorship culture support sustained market growth. Canada benefits from stable government funding, public arts grants, and a well-developed cultural infrastructure, which together ensure consistent demand across theatre, music, and dance segments.

Europe

Europe represents around 29% of the global market share, driven by the U.K., Germany, France, and Italy. Growth in this region is underpinned by strong public subsidies, long-standing heritage institutions, and deep-rooted cultural consumption habits. Government-backed funding models, combined with high levels of cultural tourism, ensure stable revenues for theatres, opera houses, and orchestras. Europe also benefits from dense cross-border touring networks, enabling performing art companies to scale performances across multiple countries efficiently.

Asia-Pacific

Asia-Pacific holds nearly 24% of the global market and is the fastest-growing region, expanding at over 7% CAGR. Growth is driven by significant investments in cultural infrastructure, rising disposable incomes, and increasing government focus on developing creative economies. China, Japan, South Korea, and India are leading demand, supported by new national theatres, performing arts centres, and international festival platforms. Expanding urban middle-class populations and growing interest in global and contemporary performing arts are accelerating audience growth across the region.

Latin America

Latin America accounts for approximately 6% of global revenue, with Brazil and Mexico serving as key demand centres. Market growth is supported by increasing urban cultural participation, expansion of regional festivals, and rising public-private collaboration in cultural programming. While funding constraints remain a challenge, growing middle-class consumption and increasing international cultural exchange are gradually strengthening the regional performing arts ecosystem.

Middle East & Africa

The Middle East & Africa region contributes around 7% of the global market. Growth is driven by cultural diversification strategies in countries such as the UAE and Saudi Arabia, where governments are investing heavily in arts infrastructure as part of broader economic diversification agendas. Large-scale cultural festivals, new opera houses, and international touring partnerships are boosting demand. In Africa, strong heritage institutions and growing intra-regional tourism are supporting steady expansion, particularly in urban cultural hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Performing Art Companies Market

- Cirque du Soleil

- Disney Theatrical Group

- Royal Shakespeare Company

- Nederlander Organization

- Shiki Theatre Company

- Toho Stage

- National Theatre (UK)

- Sydney Theatre Company

- Comédie-Française

- Teatro alla Scala

- Berliner Philharmoniker

- New York City Ballet

- Paris Opera Ballet

- Bolshoi Theatre

- Royal Opera House