Pellet Heating Stove Market Size

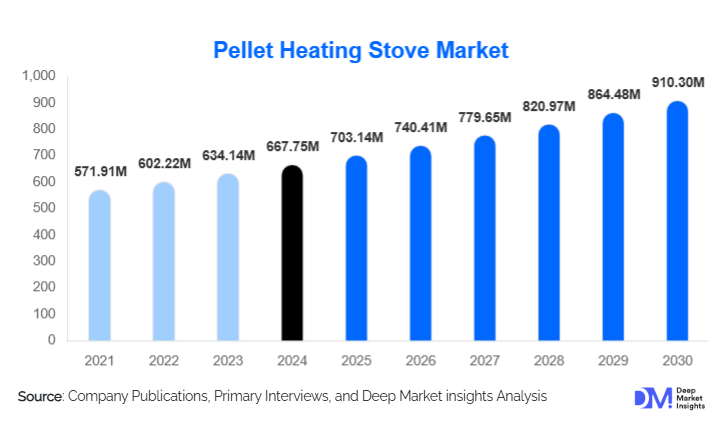

According to Deep Market Insights, the global pellet heating stove market size was valued at USD 667.75 million in 2024 and is projected to grow from USD 703.14 million in 2025 to reach USD 910.30 million by 2030, expanding at a CAGR of 5.30% during the forecast period (2025–2030). Market growth is driven by the increasing adoption of renewable and energy-efficient home heating systems, supportive government incentives for low-emission appliances, and the growing consumer preference for eco-friendly alternatives to traditional wood and gas stoves.

Key Market Insights

- Growing demand for sustainable residential heating solutions is driving the adoption of pellet-based stoves across Europe and North America.

- Technological advancements such as automated feeding systems, IoT-enabled temperature control, and higher fuel efficiency are enhancing consumer convenience and performance reliability.

- Europe dominates the global market due to strong environmental regulations, carbon emission targets, and widespread government subsidy programs promoting bioenergy use.

- Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, increasing awareness of green energy, and rising disposable incomes.

- Commercial applications of pellet heating stoves are increasing, especially in hospitality and small business settings seeking cost-effective, renewable heating options.

- Supply chain resilience and pellet fuel availability remain critical for ensuring stable market expansion in colder regions.

What are the latest trends in the pellet heating stove market?

Smart and Automated Pellet Stoves

Manufacturers are integrating smart technologies, including Wi-Fi connectivity and app-based remote control, enabling users to monitor temperature, fuel usage, and maintenance schedules in real time. Automated pellet feeding, self-cleaning mechanisms, and programmable thermostats are enhancing convenience and operational efficiency. This trend aligns with the broader adoption of smart home ecosystems, making pellet stoves an increasingly attractive option for tech-savvy consumers.

Eco-Labeling and Carbon-Neutral Design

Governments and industry bodies are introducing certification systems such as EcoDesign and EPA-compliance standards to encourage low-emission pellet stove manufacturing. New product lines are emphasizing carbon-neutral operation by sourcing pellets from sustainably managed forests and recycled biomass. Consumers are increasingly selecting stoves with transparent environmental credentials, reinforcing the shift toward climate-conscious home heating solutions.

What are the key drivers in the pellet heating stove market?

Government Incentives and Policy Support

Subsidies, tax rebates, and renewable energy credits offered by governments in Europe and North America are key growth catalysts. Programs such as the EU’s Renewable Energy Directive and the U.S. Federal Biomass Stove Tax Credit encourage residential consumers to transition to cleaner-burning pellet stoves. These incentives are expected to remain crucial in stimulating demand throughout the forecast period.

Rising Demand for Cost-Efficient Renewable Heating

Pellet stoves offer a cost-effective alternative to electric or fossil-fuel-based heating systems. The stability of pellet fuel prices, compared with volatile oil and gas costs, makes these systems appealing for long-term residential use. Growing awareness of the economic and ecological benefits of biomass-based heating is further expanding the consumer base in both developed and emerging markets.

What are the restraints for the global market?

High Initial Installation and Maintenance Costs

The upfront cost of purchasing and installing pellet stoves, along with the expense of periodic maintenance, can deter low-income households from adoption. While long-term savings are achievable, a high initial investment remains a significant market barrier, particularly in developing economies with limited financial support mechanisms.

Dependence on Pellet Fuel Supply Chain

Market expansion is constrained by pellet fuel production and distribution capacity. Seasonal fluctuations and regional disparities in pellet availability can lead to price instability, particularly during peak winter months. Limited local manufacturing in certain regions also increases transportation costs and carbon footprints, challenging overall sustainability goals.

What are the key opportunities in the pellet heating stove industry?

Hybrid and Multi-Fuel Stove Innovations

Manufacturers are developing hybrid models capable of burning both pellets and other biomass fuels such as wood chips or agricultural residues. These innovations enhance flexibility and resilience against pellet supply shortages, broadening consumer choice and supporting market penetration in regions with diverse biomass resources.

Expansion into Emerging Markets

Rising demand for decentralized, renewable heating in the Asia-Pacific and Latin America offers lucrative opportunities. Governments in countries such as China, India, and Brazil are promoting bioenergy utilization through clean energy programs, creating an expanding market for pellet stove manufacturers. Local partnerships and cost-optimized product designs are expected to accelerate adoption in these regions.

Product Type Insights

Freestanding pellet stoves dominate global sales, favored for their ease of installation, mobility, and affordability. Insert pellet stoves are gaining popularity in urban homes as retrofitting options compatible with existing fireplaces. Advanced models featuring automatic ignition, programmable heating cycles, and smart control interfaces are capturing growing consumer interest across all categories.

Application Insights

Residential use accounts for the largest market share, as consumers increasingly adopt pellet stoves for primary or supplemental home heating. The commercial segment, including hotels, restaurants, and office spaces, is projected to grow significantly due to cost-efficient and environmentally friendly heating requirements. Industrial applications remain limited but are expected to rise gradually as manufacturing facilities explore renewable heat generation solutions.

Distribution Channel Insights

Online retail and e-commerce platforms are expanding rapidly, providing consumers with access to a wide variety of pellet stove brands and models. Offline distribution through specialty heating equipment retailers and hardware stores continues to dominate high-value purchases, especially where installation services are bundled. Increasing use of digital marketing and virtual product demonstrations is reshaping purchasing behavior in the post-pandemic era.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe leads the global market, accounting for more than 45% of total revenue in 2024. Countries such as Germany, Italy, France, and Austria have established mature markets supported by stringent emission standards and strong consumer incentives. EU-driven climate targets and biomass energy programs are expected to maintain Europe’s leadership through 2030.

North America

The U.S. and Canada are witnessing steady adoption, supported by rising energy costs and renewable heating incentives. The North American Pellet Stove Tax Credit and regional rebate programs are boosting sales, particularly in colder states and provinces. Increased consumer awareness of carbon reduction and home energy efficiency is fueling further demand.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, with expanding residential infrastructure and supportive renewable energy policies driving adoption. Rising middle-class income levels in China and India, along with government-led clean energy initiatives, are accelerating market growth. Japan and South Korea are also investing in biomass heating to reduce dependence on imported fossil fuels.

Latin America

Emerging interest in sustainable heating solutions is seen in Brazil, Chile, and Argentina. Local production of biomass pellets is creating opportunities for domestic stove manufacturers. However, high equipment costs and limited awareness still restrain broader market penetration.

Middle East & Africa

Adoption remains modest but gradually growing, particularly in South Africa and Turkey, where off-grid renewable heating systems are gaining traction. Regional governments promoting energy diversification and rural heating access may create future market opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pellet Heating Stove Market

- MCZ Group S.p.A.

- Harman (Hearth & Home Technologies)

- Rika Innovative Ofentechnik GmbH

- MCZ Group

- Edilkamin S.p.A.

- Ravelli S.p.A.

- Enviro (Sherwood Industries Ltd.)

- St. Croix Heating

- Nordic Fire

- Kingdom Bioenergy

Recent Developments

- In August 2025, Rika announced the launch of a new AI-controlled pellet stove series featuring predictive heat regulation and smart fuel optimization.

- In May 2025, Harman introduced an IoT-enabled pellet stove range in North America with app-based remote monitoring and voice assistant compatibility.

- In February 2025, MCZ Group partnered with Italian energy providers to promote pellet stove installations through zero-interest financing schemes.