Pedometer Market Size

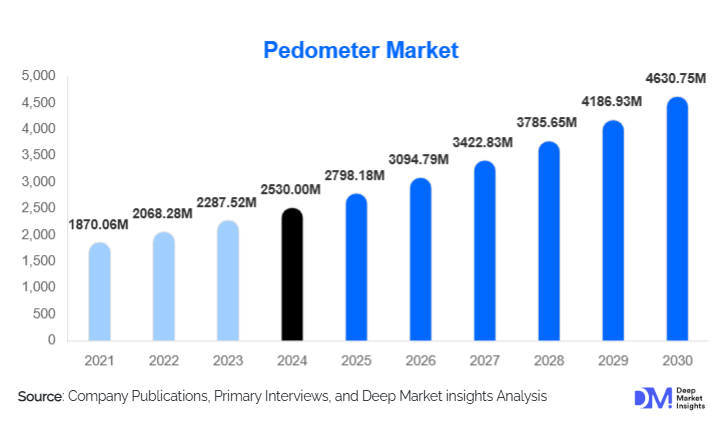

According to Deep Market, the global pedometer market size was valued at USD 2,530 million in 2024 and is projected to grow from USD 2,798.18 million in 2025 to reach USD 4,630.75 million by 2030, expanding at a CAGR of 10.6% during the forecast period (2025–2030). Market growth is driven by the accelerating adoption of fitness wearables, increasing health awareness, the rising prevalence of lifestyle diseases, and advancements in AI, Bluetooth, GPS, and cloud-integrated smart pedometers.

Key Market Insights

- Smart pedometers dominate the market with over 48% share due to high preference for Bluetooth, GPS, mobile app connectivity, and AI-enabled features.

- MEMS accelerometer technology accounts for 41% of total device deployment owing to its precision and low power consumption.

- North America leads with a 32% share, driven by strong consumer fitness culture, corporate wellness programs, and wearable tech adoption.

- Asia-Pacific is the fastest-growing region, with a forecast CAGR of over 12.7% due to rising fitness trends, smartphone penetration, and government health initiatives.

- Residential and personal fitness applications represent 55% of end-use demand, followed by healthcare rehabilitation and corporate use.

- The top five players control around 44% of the market with a focus on AI integration, mobile connectivity, and remote health monitoring.

What are the latest trends in the Pedometer Market?

AI-Integrated and Cloud-Connected Pedometers

AI-enabled pedometers are incorporating smart algorithms that analyze gait, exertion levels, and activity intensity to generate customized fitness plans and mobility improvement suggestions. These devices collect detailed biometric data, including heart rate variability, sleep cycle quality, and walking posture, enhancing their medical relevance. Cloud connectivity allows long-term data storage, trend analysis, and integration with digital health platforms used by hospitals and insurance providers. In healthcare, AI pedometers support remote diagnosis of mobility disorders and post-operative rehabilitation tracking. They also enable remote patient monitoring in telehealth programs, particularly for chronic disease management and geriatric care.

Expansion of Corporate Wellness and Insurance-Linked Health Programs

Corporations are increasingly deploying fitness wearables, including pedometers, to monitor employee health metrics such as daily activity levels, sedentary behavior, and caloric output. These programs are integrated with employee performance incentives and insurance-linked rewards. Companies in the banking, technology, healthcare, and manufacturing sectors are using pedometer data to reduce healthcare costs, improve productivity, and support employee engagement initiatives. Insurers now analyze step count data and physical activity records from pedometers to offer dynamic premium adjustments, incentivizing active lifestyles. This integration is fueling high-volume corporate procurement and recurring demand in enterprise health management.

Integration with Smartphones, Apps, and Smart Bands

Modern pedometers are embedded into smartwatches, fitness bands, and mobile apps, allowing users to access advanced analytics, real-time performance feedback, and gamified wellness challenges. NFC-enabled pedometers allow seamless syncing with smartphones, while Wi-Fi-based devices facilitate real-time data transfer to cloud health dashboards. App-based integration allows users to participate in virtual fitness communities, share health milestones, and receive medical insights. In smart healthcare applications, pedometers integrate with electronic health records (EHRs), enabling doctors to monitor patient mobility and post-treatment recovery. Gamification, including step challenges and rewards, is increasing device stickiness and long-term user engagement.

What are the key drivers in the Pedometer Market?

Health Awareness and Preventive Healthcare Shift

Rising cases of obesity, hypertension, Type-2 diabetes, and heart-related ailments are encouraging individuals to adopt wearable fitness devices for early detection and preventive lifestyle management. Pedometers provide continuous mobility monitoring, helping users maintain healthy daily activity benchmarks such as 8,000–10,000 steps per day. Governments are promoting preventive care through public wellness campaigns and insurance-linked fitness incentives, further boosting pedometer adoption in both developed and emerging markets.

Technological Advancements and Smart Wearable Adoption

Pedometers now include GPS-based route tracking, AI coaching, biometrics, and digital health history tracking. The integration of pedometers into smartwatches, smartphones, and wireless health monitoring platforms is enabling real-time tracking and personalized insights, improving user convenience and appeal. The miniaturization of MEMS sensors and advancements in wearable electronics have increased device accuracy, durability, and battery efficiency, supporting widespread adoption across fitness, healthcare, military, and sports sectors.

Growth in Remote Patient Monitoring and Rehabilitation

Healthcare providers are incorporating pedometers into treatment plans for post-surgical recovery, mobility rehabilitation, and elderly care to monitor walking patterns, recovery progress, and physical therapy compliance. Gait analysis, fall detection, and step consistency measurements allow clinicians to assess recovery without in-person visits. In long-term care facilities, pedometers help assess risk for mobility-related complications in aging populations.

What are the restraints for the global market?

Data Privacy and Security Concerns

Pedometers collect sensitive biometric data such as step history, heart rate, and location information, raising concerns around health data protection and user privacy. Compliance with data protection regulations like GDPR in Europe, HIPAA in the U.S., and regional cybersecurity laws requires strict control on health data collection, storage, and sharing. Manufacturers face challenges in implementing secure encryption and user consent mechanisms, increasing complexity in cloud-enabled pedometer deployment.

Competition from Multi-Function Smartwatches

Basic pedometers are facing declining demand due to the availability of multifunctional wearables such as smartwatches and fitness bands that offer more comprehensive health and lifestyle features. Consumers increasingly prefer integrated wearable platforms that include heart monitoring, GPS navigation, sleep analytics, and stress detection, reducing the relevance of single-function pedometers in premium market segments.

What are the key opportunities in the Pedometer Market?

Healthcare and Rehabilitation-Based Applications

Pedometers are gaining acceptance in clinical applications for physical rehabilitation, fall-risk assessment, geriatric mobility tracking, orthopedic recovery, and post-surgery care. Hospitals are integrating pedometer data into digital monitoring platforms to assess recovery milestone adherence and therapy progress. Remote rehabilitation programs are increasingly using pedometers to evaluate walking patterns in stroke recovery and arthritis care. These use cases are expanding adoption beyond consumer fitness and creating new demand in medical-grade pedometer segments.

AI and Smartphone Ecosystem Integration

Advanced pedometers can integrate with smartphone health ecosystems such as Apple Health, Google Fit, and Samsung Health, allowing users to access AI-based analytics and personalized fitness recommendations. AI-driven predictive modeling enables early detection of abnormal gait or inconsistent movement, useful in diagnosing Parkinson’s and musculoskeletal disorders. Subscription-based health analytics platforms and cloud data services further enhance monetization for manufacturers.

Product Type Insights

Smart pedometers accounted for 48% of market revenue in 2024 due to their advanced features such as Bluetooth connectivity, GPS-based tracking, multi-parameter health monitoring, and AI-based coaching. These devices are widely adopted in both fitness and healthcare, making them preferred for long-term monitoring and real-time analytics. Electronic pedometers serve traditional fitness users requiring basic distance and step counting, while mechanical pedometers remain in demand for low-cost, battery-free operation in rehabilitation and eldercare settings.

Application Insights

Residential and individual fitness usage accounts for 55% of total global demand in 2024, driven by lifestyle modifications, fitness awareness campaigns, and integration with mobile wellness apps. Healthcare and rehabilitation applications are gaining traction due to rising adoption in hospitals, physiotherapy clinics, and elderly care facilities. Corporate wellness programs are also emerging as a major application area, especially in North America, Europe, and Asia-Pacific, where companies use pedometers to monitor employee physical activity as part of occupational health initiatives.

Distribution Channel Insights

Online channels dominate market distribution due to extensive product availability, consumer reviews, competitive pricing, and ease of comparison across brands and features. E-commerce platforms and brand-owned digital stores are leading due to growing reliance on home-based purchasing and digital marketing. Physical stores continue to be important for professional, healthcare-grade, and corporate bulk purchases where device demonstrations, warranties, and after-sales support are required.

End-User Insights

Individual consumers represent the largest end-user segment, driven by fitness monitoring, lifestyle management, and preventive health tracking. Healthcare institutions are increasingly using clinical-grade pedometers for patient rehabilitation, orthopedic recovery, and gait analysis. Corporate entities are deploying pedometers to support employee wellness tracking and insurance rewards programs. Professional athletes and training academies are adopting advanced pedometers for performance optimization and activity pattern analysis.

| By Product Type | By Technology | By End-Use / Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 32% of the global market share due to strong consumer demand for wearable fitness technology, advanced healthcare infrastructure, and widespread adoption of corporate wellness programs. The U.S. leads the region due to its dominant presence of major wearable brands and integration of pedometers in digital health platforms. Canada shows growing demand, particularly in remote patient monitoring and rehabilitation applications.

Europe

Europe contributes 27% of total revenue in 2024, supported by government-led preventive healthcare measures, insurance-linked fitness incentives, and aging population requirements. Markets such as Germany, France, the U.K., and Italy are adopting pedometers in public healthcare systems for remote monitoring and elderly care, boosting medical-grade pedometer demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with strong manufacturing capabilities in China, increasing adoption of smart wearables in India, and strong healthcare applications in Japan. China leads in production and export of pedometers. India’s Fit India Movement is driving consumer adoption, while Japan’s aging population is driving medical pedometer usage.

Latin America

Latin America shows gradual adoption in Brazil, Mexico, and Argentina, where increasing internet penetration and growing urban fitness culture are contributing to higher pedometer usage. Healthcare digitization initiatives are also introducing pedometers into remote monitoring systems.

Middle East & Africa

The Middle East and Africa market is emerging with rising adoption of premium health wearables in the UAE, Saudi Arabia, and South Africa. Government initiatives supporting smart healthcare and rising lifestyle health issues are driving demand for medical and fitness pedometers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pedometer Market

- Fitbit (Google LLC)

- Garmin Ltd.

- Omron Corporation

- Xiaomi Corporation

- Huawei Technologies

- Samsung Electronics

- Apple Inc.

- Polar Electro Oy

- Withings

- Fossil Group

- Suunto Oy

- Letsfit

- MorePro

- Yamax Corporation

- Tanita Corporation

Recent Developments

- In March 2025, Fitbit introduced an AI-powered pedometer platform integrated with Google Health Cloud, offering predictive analytics for heart health and mobility tracking.

- In January 2025, Garmin collaborated with MedTech firms to integrate rehabilitation-focused pedometer sensors for eldercare and post-surgical patients.

- In October 2024, Xiaomi launched a budget-friendly smart pedometer series featuring GPS and NFC capabilities, targeting Asian and European markets.