Pasta Maker Market Size

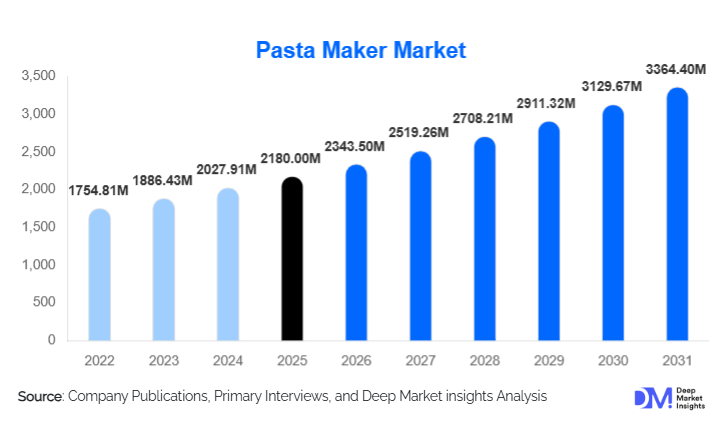

According to Deep Market Insights, the global pasta maker market size was valued at USD 2,180.00 million in 2025 and is projected to grow from USD 2,343.5 million in 2026 to reach USD 3,364.4 million by 2031, expanding at a CAGR of 7.5% during the forecast period (2026–2031). The pasta maker market growth is primarily driven by rising consumer preference for fresh and homemade food, increasing adoption of premium kitchen appliances, and expanding demand from commercial foodservice operators seeking in-house pasta production for quality control and cost optimization.

Key Market Insights

- Electric and fully automatic pasta makers dominate demand, driven by convenience, time efficiency, and consistent output quality.

- Residential households account for the largest market share, supported by growing interest in home cooking, artisanal food preparation, and diet customization.

- Europe remains the leading regional market, anchored by a strong pasta consumption culture in Italy, Germany, and France.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, westernized eating habits, and rising middle-class disposable income.

- Online distribution channels are rapidly expanding, supported by D2C strategies, influencer marketing, and broader product accessibility.

- Product innovation focusing on smart features and multi-grain compatibility is reshaping competitive differentiation.

What are the latest trends in the pasta maker market?

Automation and Smart Kitchen Integration

The pasta maker market is witnessing a strong shift toward automation, with electric and fully automatic machines incorporating intelligent controls, digital timers, and pre-programmed recipes. Manufacturers are increasingly integrating smart features such as app connectivity, automatic ingredient proportioning, and real-time monitoring to align with the growing adoption of smart kitchens. These advancements reduce manual intervention, improve consistency, and appeal strongly to tech-savvy consumers seeking convenience without compromising food quality.

Rising Demand for Multi-Grain and Specialty Pasta

Health-conscious consumers are driving demand for pasta makers capable of handling alternative flours such as whole wheat, rice, chickpea, lentil, and gluten-free blends. This trend is particularly strong in North America and Europe, where dietary preferences and food allergies are influencing purchasing decisions. Manufacturers are responding by offering enhanced extrusion systems, adjustable pressure controls, and interchangeable dies that support diverse pasta textures and formulations.

What are the key drivers in the pasta maker market?

Growing Preference for Fresh and Homemade Food

Consumers are increasingly prioritizing fresh, preservative-free, and customizable food options, driving the adoption of pasta makers in residential kitchens. The ability to control ingredients, portion sizes, and nutritional content has positioned pasta makers as essential appliances among health-conscious households. This driver has gained further momentum as consumers seek premium cooking experiences at home.

Expansion of Commercial Foodservice and Cloud Kitchens

Restaurants, cafés, and cloud kitchens are increasingly adopting pasta makers to enable on-demand production, reduce dependency on packaged pasta, and differentiate menus. Commercial operators value the consistency, cost savings, and operational efficiency offered by medium- and high-capacity machines, making foodservice expansion a key growth driver for the market.

What are the restraints for the global market?

High Initial Product Cost

Electric and fully automatic pasta makers involve higher upfront costs compared to manual alternatives, which can limit adoption in price-sensitive markets. This restraint is particularly evident in developing regions, where consumers may prioritize multifunctional appliances over specialized equipment.

Maintenance and Durability Concerns

Motor reliability, cleaning complexity, and replacement part availability remain concerns, especially in lower-priced models. Negative user experiences related to durability can impact brand trust and slow repeat purchases, posing a challenge for manufacturers operating in competitive price segments.

What are the key opportunities in the pasta maker industry?

Smart and Connected Appliance Ecosystems

The integration of pasta makers into connected kitchen ecosystems presents significant growth opportunities. Smart pasta makers that sync with mobile apps, recipe platforms, and other appliances can command premium pricing and improve customer retention. This opportunity is particularly strong in developed markets with high smart home penetration.

Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East offer substantial untapped potential due to rising disposable incomes and increasing exposure to global cuisines. Localized product designs, compact models, and pricing strategies tailored to regional preferences can help manufacturers capture new demand.

Product Type Insights

Electric pasta makers lead the market, accounting for approximately 44% of global revenue in 2024, due to their balance of automation and affordability. Fully automatic pasta makers represent the fastest-growing sub-segment, driven by premium residential and commercial adoption. Manual pasta makers continue to hold relevance among traditional users and entry-level consumers seeking affordability and mechanical simplicity.

End-Use Insights

The residential segment dominates the pasta maker market with nearly 58% share in 2024, supported by home cooking trends and premium kitchen investments. The commercial segment is growing at a faster pace, driven by restaurants, hotels, and cloud kitchens seeking operational efficiency and product differentiation. Industrial food processors represent a smaller but stable segment, primarily focused on artisanal and private-label pasta production.

Distribution Channel Insights

Online channels account for approximately 41% of global sales, supported by e-commerce platforms, brand-owned websites, and digital marketing strategies. Offline retail remains important for premium and commercial purchases, where hands-on demonstrations and after-sales support influence buying decisions. Hybrid omnichannel strategies are becoming increasingly common among leading brands.

| By Product Type | By End Use | By Material | By Capacity | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global pasta maker market with around 38% share in 2024. Italy remains the largest contributor, followed by Germany and France, supported by high per capita pasta consumption and strong culinary traditions. Demand spans both residential and commercial segments.

North America

North America accounts for approximately 27% of the global market, led by the United States. Strong demand for premium appliances, health-focused cooking, and commercial foodservice expansion supports steady growth.

Asia-Pacific

Asia-Pacific holds nearly 22% market share and is the fastest-growing region, with a CAGR exceeding 11%. China, Japan, South Korea, and India are key growth markets, driven by urban lifestyles and westernized diets.

Latin America

Latin America represents a smaller but growing market, with Brazil and Mexico leading regional demand. Growth is supported by expanding middle-class populations and rising interest in home cooking appliances.

Middle East & Africa

The Middle East & Africa region shows gradual growth, driven by hospitality expansion and premium residential demand, particularly in the UAE and Saudi Arabia.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|