Pan-Tilt-Zoom Camera Market Size

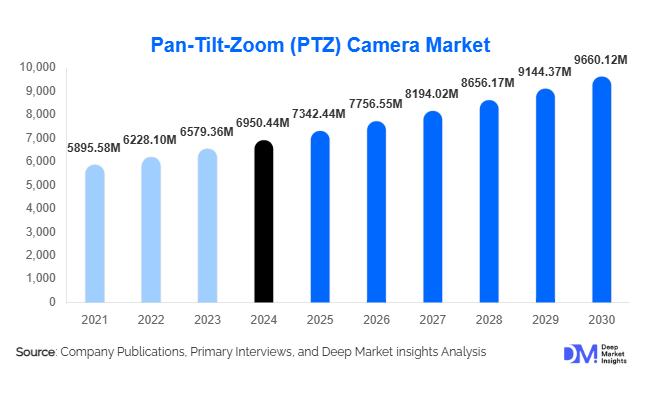

According to Deep Market Insights, the global pan-tilt-zoom camera market size was valued at USD 6,950.44 million in 2024 and is projected to grow from USD 7,342.44 million in 2025 to reach USD 9,660.12 million by 2030, expanding at a CAGR of 5.64% during the forecast period (2025–2030). The PTZ camera market growth is primarily driven by increasing demand for intelligent surveillance systems, adoption of AI and IoT-enabled cameras, and rising investments in smart city initiatives and critical infrastructure security worldwide.

Key Market Insights

- AI-enabled PTZ cameras are transforming security surveillance, enabling automated tracking, facial recognition, and real-time analytics, which reduces human intervention and improves monitoring efficiency.

- Outdoor and high-resolution PTZ cameras dominate adoption in public safety, transportation, and industrial sectors due to their ability to monitor large areas with precision and robustness against environmental conditions.

- North America holds the largest market share, driven by government investments in public safety, smart city programs, and high adoption of IP-based PTZ cameras across commercial and industrial facilities.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, infrastructure projects, and government initiatives like India’s “Smart Cities Mission” and China’s focus on public security modernization.

- Integration of PTZ cameras with IoT and cloud-based monitoring is creating opportunities for remote surveillance and analytics, making these systems highly attractive for transportation, industrial, and commercial applications.

What are the latest trends in the Pan-Tilt-Zoom camera market?

AI and Intelligent Surveillance Integration

PTZ cameras are increasingly integrated with AI capabilities, allowing features such as motion detection, object recognition, license plate reading, and predictive analytics. This enables faster response times in security incidents and reduces the need for constant human monitoring. Cloud-based platforms and IoT integration further enhance remote management, analytics, and scalability for large-scale surveillance projects.

High-Resolution and Thermal Imaging Adoption

Demand for Ultra HD (4K+) PTZ cameras and thermal imaging models is rising, especially in critical infrastructure, industrial, and transportation sectors. These cameras offer enhanced clarity, long-distance zoom, and night-time monitoring, which are essential for public safety and asset protection. Thermal PTZ cameras are being adopted in low-light environments and areas prone to vandalism or unauthorized access.

What are the key drivers in the PTZ camera market?

Rising Urbanization and Smart City Initiatives

Government initiatives toward smart cities are significantly driving PTZ camera deployment. Intelligent surveillance systems with PTZ capabilities are integral for traffic monitoring, public safety, and urban infrastructure management. Investments in IoT-based traffic systems, public security projects, and city-wide surveillance are providing long-term growth opportunities.

Increased Industrial and Commercial Security Requirements

Rising concerns over industrial theft, vandalism, and workplace safety are fueling the adoption of PTZ cameras in commercial and industrial setups. High-resolution cameras with automated tracking and remote monitoring capabilities help organizations safeguard assets and comply with regulatory security standards, thereby boosting market growth.

Technological Advancements and AI Integration

Advancements in AI, cloud computing, and video analytics are enabling PTZ cameras to become smarter and more efficient. Features such as automatic object tracking, facial recognition, and real-time alerts enhance operational efficiency. Integration with video management software (VMS) and networked security systems is also supporting broader market adoption.

What are the restraints for the global market?

High Initial Investment Costs

PTZ cameras, particularly AI-enabled and thermal models, involve higher acquisition and installation costs compared to fixed surveillance cameras. This can deter small and medium-sized enterprises or cost-sensitive applications from adoption, limiting market penetration in certain regions.

Data Privacy and Regulatory Concerns

Surveillance solutions, including PTZ cameras, are subject to strict data privacy and compliance regulations in various countries. Concerns over personal privacy, data storage, and cybersecurity risks can restrict deployment, particularly in residential and public spaces.

What are the key opportunities in the PTZ camera market?

Smart City and Urban Surveillance Expansion

Governments worldwide are investing in intelligent urban infrastructure, creating high demand for PTZ cameras. Integration with traffic management, public safety, and emergency response systems presents a significant opportunity for both new entrants and established players to provide end-to-end surveillance solutions.

AI and IoT-Enabled Camera Solutions

AI-driven PTZ cameras and IoT-enabled platforms offer predictive monitoring, automated alerts, and analytics-based insights. Companies that innovate in AI features, cloud integration, and smart monitoring solutions can gain a competitive advantage in growing industrial, commercial, and public safety applications.

Emerging Regional Markets

Regions such as Latin America, the Middle East, and Africa are witnessing rising infrastructure investments, urbanization, and security awareness. These markets offer untapped potential for PTZ camera adoption, particularly in public safety, smart city, and industrial surveillance applications.

Product Type Insights

Outdoor PTZ cameras dominate the market, accounting for approximately 40% of the 2024 market due to their durability and suitability for large-area monitoring in public, industrial, and transportation sectors. Indoor PTZ cameras also see substantial adoption in commercial spaces like malls, offices, and airports. AI-enabled and thermal PTZ cameras are emerging as high-value products, growing rapidly due to enhanced security and operational efficiency features.

Application Insights

Public safety and transportation monitoring remain the leading applications for PTZ cameras, capturing nearly 45% of total market usage in 2024. Industrial surveillance and commercial security are growing fast, fueled by increasing automation, asset protection needs, and regulatory compliance. Residential adoption, particularly in smart homes and gated communities, is emerging as a niche but rapidly expanding application.

End-Use Insights

Government and defense sectors lead PTZ camera adoption due to large-scale public surveillance requirements, accounting for 35% of the 2024 market share. Commercial enterprises follow closely, adopting PTZ solutions for office, retail, and logistics security. Transportation and industrial sectors are witnessing the fastest growth, particularly with integration into AI-enabled monitoring and traffic management systems. Emerging uses include healthcare facilities, educational institutions, and smart residential complexes, which are increasingly leveraging remote and automated PTZ surveillance.

| By Product Type | By Application | By End-User Industry | By Technology | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at 32% in 2024, driven by U.S. and Canadian government initiatives for smart cities, high adoption of IP-based PTZ cameras, and public safety investments. Extensive industrial and commercial infrastructure also supports demand.

Europe

Europe accounts for 28% of the global market, led by Germany, the U.K., and France. Strong regulatory frameworks, smart city projects, and industrial surveillance requirements drive growth. The region emphasizes energy-efficient, AI-enabled, and high-resolution PTZ cameras for both urban and industrial applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly China, India, Japan, and South Korea. Urbanization, government-backed smart city initiatives, and rising security awareness in commercial and industrial sectors are major drivers.

Middle East & Africa

The region is growing due to investments in smart infrastructure, transportation hubs, and critical security projects in the UAE, Saudi Arabia, and South Africa. Increasing public and private security spending supports PTZ adoption.

Latin America

Latin America, particularly Brazil and Mexico, is an emerging market. Rising urbanization, industrial surveillance needs, and government projects are driving the gradual adoption of PTZ solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pan-Tilt-Zoom (PTZ) Camera Market

- Axis Communications

- Hikvision

- Dahua Technology

- Hanwha Techwin

- Bosch Security Systems

- Pelco

- Canon

- Sony

- Panasonic

- Avigilon

- Flir Systems

- Vivotek

- Mobotix

- CP Plus

- Vicon Industries

Recent Developments

- In March 2025, Hikvision launched a new AI-powered PTZ camera series with integrated facial recognition and vehicle tracking for smart city deployments.

- In January 2025, Axis Communications introduced outdoor 4K PTZ cameras with advanced low-light performance for industrial and transportation surveillance.

- In February 2025, Hanwha Techwin expanded its PTZ camera portfolio with cloud-integrated solutions for commercial and residential applications.