Outdoor Tables Market Size

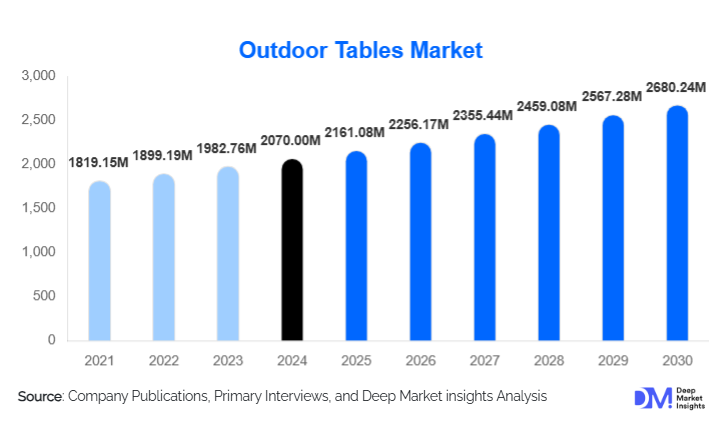

According to Deep Market Insights, the global outdoor tables market size was valued at USD 2,070.00 million in 2024 and is projected to grow from USD 2,161.08 million in 2025 to reach USD 2,680.24 million by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). The outdoor tables market growth is primarily driven by rising consumer spending on outdoor living spaces, rapid expansion of outdoor hospitality infrastructure, and increasing adoption of durable, weather-resistant furniture across residential, commercial, and public settings.

Key Market Insights

- Outdoor dining and leisure culture is reshaping furniture demand, with consumers increasingly treating patios, balconies, and decks as extensions of indoor living spaces.

- Residential applications dominate the market, supported by home improvement spending and growth in premium housing and second homes.

- Metal-based outdoor tables lead globally due to superior durability, corrosion resistance, and lightweight properties.

- North America holds the largest market share, driven by high per-capita furniture spending and a strong culture of outdoor living.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, hospitality expansion, and rising middle-class incomes.

- Sustainability and recycled materials are becoming key differentiators, influencing purchasing decisions in both residential and institutional segments.

What are the latest trends in the outdoor tables market?

Premiumization of Outdoor Living Spaces

Outdoor tables are increasingly positioned as lifestyle and design products rather than basic utility furniture. Consumers are investing in aesthetically refined dining, coffee, and multifunctional tables that complement landscaping and architectural themes. Features such as fire-pit integration, extendable surfaces, and modular configurations are gaining traction, particularly in premium residential and hospitality applications. This trend is driving higher average selling prices and stronger demand for mid-range and premium outdoor table categories.

Sustainable and Weather-Resilient Materials

Manufacturers are rapidly shifting toward recycled plastics, composite materials, FSC-certified wood, and powder-coated metals to meet sustainability expectations and regulatory requirements. Demand for UV-resistant, rust-proof, and low-maintenance outdoor tables is rising across all climates. Eco-certifications and circular design principles are increasingly influencing institutional buyers, particularly in Europe and North America.

What are the key drivers in the outdoor tables market?

Expansion of Outdoor Hospitality and Foodservice

The global expansion of cafés, restaurants, resorts, rooftop dining venues, and beachside hospitality is a major driver of outdoor table demand. Hospitality operators prioritize durable, stackable, and easy-to-maintain tables that can withstand heavy usage and varying weather conditions. This has resulted in consistent bulk procurement and replacement demand, particularly in tourism-driven economies.

Rising Home Improvement and Lifestyle Spending

Consumers are increasingly investing in outdoor home upgrades, including patios, gardens, and balconies. Outdoor dining tables and side tables are among the most purchased items as homeowners seek functional yet visually appealing furniture. This trend is especially strong in North America and Europe, where outdoor entertainment is culturally embedded.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of aluminum, steel, hardwood, and resin significantly impact manufacturing costs and profit margins. Smaller manufacturers are particularly vulnerable, as they face challenges in passing on cost increases to end consumers without losing competitiveness.

Seasonal Demand Cyclicality

Outdoor table demand is highly seasonal in temperate regions, with peak sales concentrated in warmer months. This seasonality creates inventory management and cash-flow challenges for manufacturers and retailers, especially those heavily reliant on offline sales channels.

What are the key opportunities in the outdoor tables industry?

Public Infrastructure and Urban Development Projects

Governments across Asia-Pacific, the Middle East, and Latin America are increasing investments in public parks, recreational zones, promenades, and smart city projects. These developments create long-term opportunities for manufacturers supplying vandal-resistant, weather-proof, and standardized outdoor tables through public procurement and infrastructure contracts.

Growth of Sustainable and Recycled Furniture Lines

Sustainability-driven product lines using recycled plastics, composites, and responsibly sourced wood are opening new revenue streams. Brands that align with circular economy principles and offer eco-certified outdoor tables are well-positioned to capture premium pricing and institutional demand.

Product Type Insights

Outdoor dining tables dominate the market, accounting for approximately 42% of global revenue in 2024, driven by their central role in residential patios and hospitality dining areas. Coffee and side tables represent a fast-growing segment, supported by casual outdoor seating trends. Folding and portable tables are gaining adoption in urban apartments and public event spaces, while picnic and park tables remain essential for municipal and recreational applications.

Material Type Insights

Metal outdoor tables, primarily aluminum and steel, lead the market with an estimated 34% share in 2024 due to durability, corrosion resistance, and ease of maintenance. Wood-based tables continue to attract premium buyers seeking natural aesthetics, while plastic and resin tables remain popular in economy segments. Composite and recycled materials are the fastest-growing category as sustainability gains prominence.

End-Use Insights

The residential segment accounts for nearly 48% of total market demand, driven by outdoor lifestyle upgrades and premium housing growth. The hospitality sector contributes around 31%, supported by global tourism recovery and café culture expansion. Commercial offices and public infrastructure collectively form a stable demand base, particularly in urban development projects.

Distribution Channel Insights

Offline retail channels dominate with approximately 46% market share, as consumers prefer physical inspection for furniture durability and comfort. However, online direct-to-consumer and e-commerce platforms are the fastest-growing channels, supported by digital visualization tools, customization options, and doorstep delivery.

| By Product Type | By Material Type | By End Use | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds around 32% of the global outdoor tables market, led by the United States. High disposable income, strong DIY culture, and widespread adoption of outdoor entertaining drive sustained demand. Canada contributes steady seasonal growth, particularly in premium residential segments.

Europe

Europe accounts for approximately 28% of global demand, with Germany, France, and the U.K. as key markets. Sustainability regulations, outdoor dining culture, and compact urban living spaces support consistent adoption of durable and eco-friendly outdoor tables.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 9% CAGR. China, India, Japan, and Australia drive demand through rapid urbanization, hospitality investments, and rising middle-class consumption. The region is also emerging as a major manufacturing hub.

Latin America

Brazil and Mexico lead regional demand, supported by resort developments and urban outdoor spaces. Growth is moderate but stable, with increasing imports of mid-range outdoor tables.

Middle East & Africa

The UAE and Saudi Arabia drive demand through luxury hospitality and public infrastructure projects, while South Africa remains a key regional manufacturing and consumption hub.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Tables Market

- IKEA

- Keter Group

- Brown Jordan

- Ashley Furniture Industries

- Agio International

- Fermob

- Nardi Group

- Dedon

- Polywood

- Lifetime Products