Outdoor Living Structures Market Size

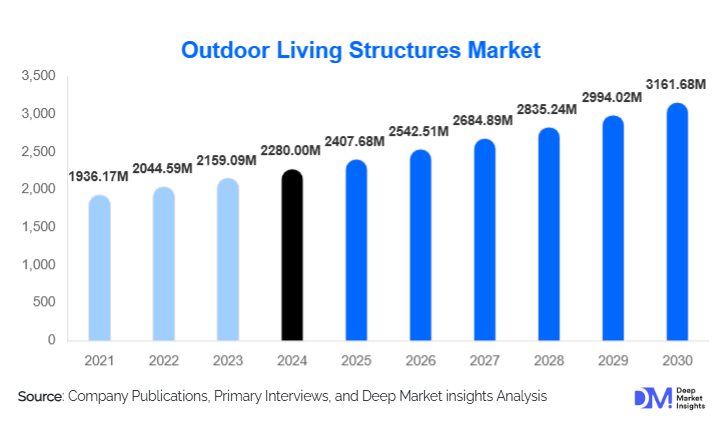

According to Deep Market Insights, the global outdoor living structures market size was valued at USD 2280 million in 2024 and is projected to grow from USD 2407.68 million in 2025 to reach USD 3161.68 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for aesthetically pleasing and functional outdoor spaces in residential, commercial, and public infrastructure, increasing adoption of sustainable and modular materials, and expansion of hospitality and recreational projects globally.

Key Market Insights

- Integration of smart and sustainable technologies in outdoor living structures, such as solar-powered lighting, IoT-enabled kitchens, and automated shading systems, is attracting environmentally conscious consumers.

- Residential applications dominate the market, with rising urbanization, higher disposable income, and demand for private leisure spaces driving growth in pergolas, decks, and gazebos.

- Commercial and hospitality sectors are fueling demand for premium outdoor solutions in hotels, resorts, restaurants, and recreational facilities, creating opportunities for high-margin products.

- North America leads the market share in 2024 due to mature construction and landscaping industries, while Asia-Pacific is the fastest-growing region, driven by urban development and rising middle-class affluence.

- Technological adoption in materials, design, and modular systems is reshaping the market, allowing faster installations, customization, and cost optimization.

- Government-backed urban infrastructure projects and public park development are contributing to the steady expansion of outdoor living structures globally.

What are the latest trends in the outdoor living structures market?

Sustainable and Eco-Friendly Materials

Manufacturers are increasingly adopting composite materials, recycled wood, and low-maintenance metals to address environmental concerns and meet growing consumer preference for sustainable outdoor living solutions. The demand for environmentally friendly products is particularly high in North America and Europe, where green construction standards and eco-conscious lifestyles drive adoption. Products with certifications for durability, recyclability, and low environmental impact are gaining traction, encouraging manufacturers to integrate sustainable practices into production and marketing strategies.

Modular and Prefabricated Structures

Prefabrication and modular design are becoming popular for pergolas, decks, and outdoor kitchens due to faster installation, lower labor costs, and customizable designs. Residential and commercial developers favor these solutions for urban housing projects, resorts, and community spaces, as they reduce construction time while offering aesthetic flexibility. The trend is particularly strong in Asia-Pacific, where rapid urbanization and housing development projects require efficient, scalable outdoor living solutions.

What are the key drivers in the outdoor living structures market?

Rising Residential and Commercial Construction

The surge in new residential complexes, villas, and commercial properties, including hotels and office spaces, is driving demand for outdoor living structures. Homeowners and businesses are investing in patios, decks, and pergolas to enhance property value, functionality, and lifestyle appeal. The trend toward outdoor leisure spaces is reinforced by urban lifestyle changes, increased remote working, and interest in private recreational areas.

Increased Focus on Aesthetic and Lifestyle-Oriented Spaces

Consumers are increasingly prioritizing outdoor aesthetics as an extension of their living space. Modern designs, integration of landscaping, lighting, and outdoor kitchens are key considerations for high-income residential buyers. In commercial applications, hotels, resorts, and restaurants are investing in luxury outdoor structures to create unique guest experiences and drive higher customer satisfaction.

Technological Advancements and Material Innovation

Advancements in composite materials, weather-resistant metals, and modular designs are improving durability and ease of maintenance. Smart outdoor technologies such as solar lighting, automated shading, and IoT-enabled appliances enhance functionality, attracting premium buyers and driving market expansion.

What are the restraints for the global market?

High Initial Investment Costs

The upfront cost of high-quality outdoor living structures, including premium materials, installation, and design services, can be a barrier for mid- and low-income consumers. While long-term durability offsets costs, initial investment remains a limiting factor in price-sensitive regions.

Seasonal and Climate-Dependent Demand

Outdoor living structures are highly dependent on climate and weather conditions. Regions with extreme temperatures or long rainy seasons may see slower adoption, affecting growth projections. Seasonal fluctuations in construction activity and consumer demand can also impact revenue for manufacturers and installers.

What are the key opportunities in the outdoor living structures market?

Expansion in Emerging Economies

Countries such as India, China, Brazil, and Mexico present significant growth opportunities due to increasing disposable income, urbanization, and exposure to Western lifestyle trends. Affordable modular solutions and locally tailored designs can help manufacturers capture market share and create long-term growth pipelines in these regions.

Smart Outdoor Living Solutions

The integration of IoT, solar technologies, automated shading, and weather sensors is creating premium product segments. Smart outdoor kitchens, pergolas with remote-controlled lighting, and automated patio solutions cater to tech-savvy consumers, enhancing convenience and appeal for luxury residential and hospitality projects.

Government and Public Infrastructure Projects

Urban redevelopment, community park construction, and government-backed landscaping projects offer consistent demand for outdoor structures. Public-private partnerships in urban spaces and recreational developments create opportunities for large-scale installation contracts, particularly in North America, Europe, and select Asia-Pacific cities.

Product Type Insights

Pergolas dominate the global outdoor living structures market, accounting for nearly 28% of the 2024 market share, primarily due to their architectural versatility, aesthetic enhancement capabilities, and broad applicability across residential and commercial landscaping projects. Pergolas are increasingly viewed as functional lifestyle extensions rather than decorative add-ons, driving higher adoption rates globally. The segment’s leadership is further supported by rising demand for shaded outdoor areas that balance natural exposure with comfort, particularly in warm and temperate climates.

Wooden pergolas remain highly preferred in North America and Europe, especially in premium residential properties, resorts, and outdoor dining spaces, owing to their natural appearance and compatibility with traditional and modern architectural styles. In contrast, modular metal pergolas—typically aluminum or steel—are gaining traction across Asia-Pacific due to their superior durability, lower maintenance requirements, and cost-effectiveness, making them suitable for high-density urban developments. Decks and patios follow pergolas in market share, driven by strong residential housing activity, renovation trends, and the growing popularity of outdoor entertainment and leisure spaces in vacation homes and suburban properties.

Material Insights

Wood continues to be the leading material in the outdoor living structures market, representing approximately 35% of the total market in 2024. Its dominance is attributed to its natural aesthetic appeal, ease of customization, and strong consumer preference for organic, visually warm outdoor environments. Wood is widely used in pergolas, decks, gazebos, and arbors, particularly in regions with established landscaping cultures such as North America and Europe.

However, composite materials and vinyl are the fastest-growing material segments, especially in regions exposed to extreme weather conditions, high humidity, or temperature variations. These materials offer superior resistance to moisture, UV radiation, and pests, while significantly reducing long-term maintenance costs. Their eco-friendly attributes—such as the use of recycled content—also align with sustainability-driven construction trends. Metal structures, including aluminum and galvanized steel, are increasingly adopted in commercial and public infrastructure projects due to their structural strength, modularity, and suitability for large-scale installations, particularly in urban and hospitality-driven developments.

Application Insights

Residential applications dominate the global outdoor living structures market, accounting for approximately 55% of the total market share in 2024. Growth in this segment is driven by rising homeownership, increasing disposable income, and the growing trend of enhancing outdoor spaces as functional living extensions. Homeowners are investing in patios, decks, pergolas, and outdoor kitchens to improve lifestyle quality, support social gatherings, and increase property valuation, particularly in suburban and luxury housing developments.

Commercial applications represent nearly 30% of the market and are expanding rapidly due to the hospitality and food service sectors’ emphasis on outdoor dining, recreational spaces, and experiential environments. Hotels, resorts, cafés, and restaurants are incorporating high-end outdoor structures to attract customers and optimize usable space. Public infrastructure projects account for the remaining 15%, driven by investments in urban parks, community recreation areas, and landscaped public spaces, particularly under government-led smart city and urban revitalization initiatives.

| By Product Type | By Material | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, holding approximately 38% of the global market share in 2024. The United States dominates regional demand due to high disposable income levels, a mature residential construction and remodeling industry, and a strong cultural preference for outdoor leisure and entertainment spaces. Rising home renovation spending, widespread adoption of outdoor kitchens and decks, and strong demand for premium wooden pergolas support market growth. Canada is witnessing steady expansion, driven by urban housing development, hospitality sector investments, and increased focus on backyard and patio upgrades, particularly in suburban residential areas.

Europe

Europe accounts for approximately 26% of the global market share, with Germany, the United Kingdom, and France leading demand. Regional growth is driven by sustainability-focused construction practices, a strong preference for eco-friendly materials, and high adoption of outdoor living concepts in urban and semi-urban settings. Stringent environmental regulations and green building standards are accelerating the shift toward composite materials and modular outdoor structures. Additionally, increasing investments in premium landscaping, hospitality renovations, and outdoor dining infrastructure are supporting steady market expansion across Western and Southern Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, supported by rapid urbanization, rising middle-class income levels, and significant expansion in residential, hospitality, and mixed-use developments. China and India lead regional growth, driven by large-scale housing projects, smart city initiatives, and increased adoption of cost-effective modular pergolas, decks, and patios. Japan and Australia represent mature but stable markets, characterized by demand for high-quality, weather-resistant outdoor structures in luxury residential and tourism-related applications. Expanding hotel and resort construction across Southeast Asia further accelerates regional demand.

Latin America

Latin America is experiencing gradual growth, with Brazil, Mexico, and Argentina emerging as key markets. Rising urbanization, growing middle-income populations, and increased investment in residential and commercial construction are supporting adoption. Demand is particularly strong for modular and cost-efficient outdoor living structures that cater to both residential upgrades and hospitality developments. Tourism-driven infrastructure projects and increasing interest in outdoor recreational spaces are further contributing to regional market expansion.

Middle East & Africa

The Middle East and Africa region is witnessing growing demand for outdoor living structures, led by the UAE and Saudi Arabia. Market growth is driven by luxury residential villa developments, large-scale hospitality projects, and tourism-focused infrastructure investments. High temperatures and year-round outdoor living culture in the Middle East are increasing demand for shaded pergolas, gazebos, and premium outdoor kitchens. In Africa, countries such as South Africa are emerging markets, with demand driven by resort developments, eco-tourism lodges, and urban landscaping projects aimed at enhancing public and private outdoor spaces.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Living Structures Market

- Trex Company, Inc.

- AZEK Company Inc.

- Fiberon LLC

- Backyard X-Scapes, Inc.

- Patio Productions, LLC

- Trex Outdoor Furniture

- Weatherly Decks

- Veranda Outdoor Living

- Decks Direct

- EcoDecking Solutions

- Archadeck LLC

- Forever Redwood

- ThermoWood Ltd.

- Caliber Decks

- Deckorators, Inc.