Outdoor Living Products Market Size

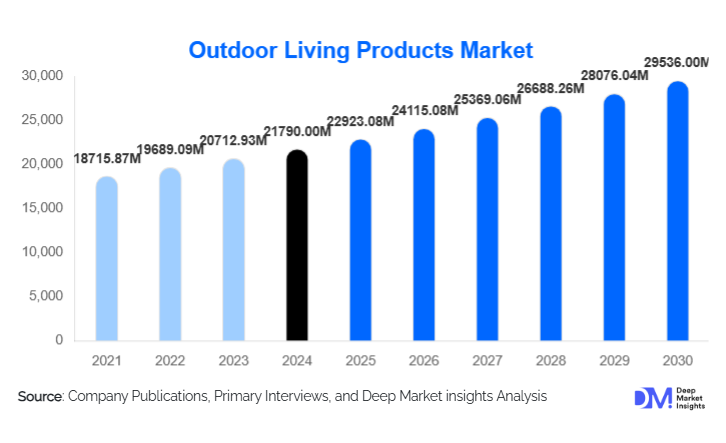

According to Deep Market Insights, the global outdoor living products market size was valued at USD 21790 million in 2024 and is projected to grow from USD 22923.08 million in 2025 to reach USD 29536 million by 2030, expanding at a CAGR of 5.2% during the forecast period (2025–2030). The outdoor living products market growth is primarily driven by the rising preference for “outdoor rooms”, sustained home-improvement and renovation activity, and increasing investment by residential and hospitality sectors in high-quality furniture, shade structures, kitchens, and décor that extend usable living and entertaining space beyond traditional interiors.

Key Market Insights

- Outdoor furniture remains the anchor category, accounting for around 39% of global revenues in 2024, making it the single largest product segment in the outdoor living ecosystem.

- Residential single-family homes dominate demand, contributing close to 50% of total market value as homeowners upgrade patios, decks, and gardens into fully equipped outdoor living spaces.

- North America leads global market share (around 35–37% of 2024 value), while Asia-Pacific is the fastest-growing region, supported by urbanization, rising incomes, and expanding middle-class homeownership.

- Mid-range / mass-premium products account for about 45% of revenues, as consumers prioritize design, durability, and brand value while remaining price-conscious.

- Home improvement and DIY chains are the largest channel, with roughly 32% share, but e-commerce and D2C brands are rapidly scaling, reshaping how consumers discover and purchase outdoor solutions.

- The market is highly fragmented, with the top five manufacturers together holding only about 18–20% of global revenue, leaving significant space for regional specialists and design-led brands.

- Sustainable materials, composites, and smart features (e.g., motorized pergolas, smart lighting, connected grills) are moving from niche to mainstream, setting the tone for next-generation outdoor living concepts.

What are the latest trends in the outdoor living products market?

Indoor–Outdoor Continuity and Premium “Outdoor Rooms”

One of the most prominent trends is the blurring of boundaries between indoor and outdoor spaces. Homeowners increasingly design patios, decks, balconies, and rooftops as integrated “outdoor rooms” that mirror indoor aesthetics and comfort. Coordinated seating, modular sectionals, dining sets, outdoor rugs, cushions, and décor are combined with pergolas, shade sails, and weather-protected kitchens to create cohesive environments. This has led to a shift from single-item purchases to multi-product sets and curated collections, significantly increasing average spend per project. In higher-income markets, demand is moving toward premium and designer outdoor furniture with performance fabrics, contemporary silhouettes, and customizable configurations. Hospitality operators are mirroring this trend by creating lounge-style pool decks, rooftop terraces, and garden bars that deliver a residential feel while supporting high guest throughput.

Smart, Sustainable, and Low-Maintenance Outdoor Ecosystems

Technology and sustainability are reshaping consumer expectations in outdoor living. Smart lighting systems, app-controlled grills, motorized pergolas, adjustable louver roofs, and connected heaters are being integrated into premium projects, often linked to broader home-automation platforms. At the same time, low-maintenance and eco-conscious materials such as composite decking, recycled plastics, certified wood, and high-performance coatings are in high demand. Consumers increasingly expect long product lifespans, minimal upkeep, and transparent sourcing. Solar-powered lighting, off-grid power options for outdoor kitchens and entertainment, and modular designs that can be repaired or reconfigured are gaining traction. Together, these trends are shifting the category from basic seasonal products to durable, technology-enhanced ecosystems aligned with ESG and wellness priorities.

What are the key drivers in the outdoor living products market?

Hybrid Work and At-Home Leisure Lifting Outdoor Utilization

The rise of hybrid work and increased time spent at home have structurally boosted utilization of outdoor spaces. Patios, balconies, and gardens now serve multiple functions: relaxation zones, social hubs, remote-work areas, and fitness/wellness corners. This multi-functional use encourages higher investment in comfortable seating, work-friendly layouts, shelter from sun and rain, and year-round climate solutions such as heaters and fire pits. As consumers discover the health and mental-wellness benefits of spending time outdoors, they are more willing to allocate budgets to durable, aesthetically appealing outdoor products, supporting sustained market growth.

Home-Improvement and Renovation Cycles

Outdoor projects have become central to home-improvement and renovation planning. Decks, patios, pergolas, and landscaped gardens are perceived as high-ROI upgrades, enhancing both lifestyle and property value. This is particularly evident in markets with strong homeownership and DIY cultures, where large-format home centers dedicate substantial seasonal floor space to outdoor furniture, structures, and décor. Financing options, bundled project solutions (e.g., deck + railing + furniture), and homebuilder partnerships are further encouraging consumers to invest in complete outdoor living packages rather than minimal setups, driving volume and value across multiple product categories.

Tourism, Hospitality, and Experiential Retail Expansion

Growing investment in hotels, resorts, beach clubs, restaurants, cafés, and rooftop bars is another major demand driver. These venues rely on outdoor furniture, cabanas, shade structures, and decorative elements to create memorable guest experiences and maximize revenue per square meter. As hospitality brands compete on design, comfort, and Instagrammable spaces, they are upgrading to premium-grade, weather-resistant furniture and bespoke installations. Experiential retail concepts, such as open-air malls, garden centers with lifestyle zones, and mixed-use developments with public plazas, also require durable, design-led outdoor seating and structures. This commercial demand layer tends to be less seasonal and involves multi-year replacement cycles, providing a stable base for manufacturers and contract-focused brands.

What are the restraints for the global market?

Raw-Material Cost Volatility and Supply-Chain Disruptions

Outdoor living products are acutely sensitive to fluctuations in the prices of wood, metals, plastics, and textiles, as well as to freight and container costs. Sudden spikes in lumber or steel prices can compress manufacturer margins or force retail price increases that dampen demand. Many brands source components and finished goods from a limited number of manufacturing hubs, making them vulnerable to geopolitical tensions, logistics bottlenecks, and regulatory changes. Extended lead times, port congestion, and currency volatility can disrupt seasonal product launches, inventory planning, and promotional cycles, especially in markets where consumers expect time-bound spring and summer assortments.

Seasonality, Discretionary Spend, and Macro Sensitivity

The market’s strong seasonality and discretionary nature pose ongoing challenges. In temperate climates, sales are concentrated in warmer months, leading to pronounced peaks and troughs in demand. Retailers and manufacturers must carefully balance inventory and capacity to avoid overstocking or stockouts. Additionally, outdoor living products compete with other discretionary categories such as travel, electronics, and indoor renovations for consumer budgets. Economic slowdowns, interest-rate hikes, or declines in housing transactions can cause households and small businesses to delay or downsize outdoor projects. This cyclicality creates revenue volatility and complicates long-term investment decisions for players across the value chain.

What are the key opportunities in the outdoor living products industry?

Premium “Outdoor Room” Packages and Design-Led Solutions

There is a substantial opportunity to move beyond standalone products toward integrated “outdoor room” concepts that bundle furniture, shade, lighting, kitchens, and décor into coherent packages. Brands that offer modular collections, configurable layouts, and design services, either in-store or via digital visualization tools, can capture higher ticket sizes and deepen customer loyalty. Partnerships with builders, landscapers, and outdoor kitchen installers can create turnkey solutions for homeowners and hospitality buyers. The ability to deliver curated, on-trend aesthetics with reliable lead times is becoming a key differentiator in mid-range, premium, and luxury segments.

Urban and Small-Space Outdoor Innovations

Rapid urbanization and growth in multi-family housing are driving demand for compact, lightweight, and multi-functional outdoor products that work in small spaces such as balconies, pocket terraces, micro-courtyards, and rooftops. Foldable tables and chairs, stackable seating, built-in storage benches, slimline planters, railing-mounted elements, and modular micro-kitchens are all areas ripe for innovation. Manufacturers that optimize for footprint, weight restrictions, and flexible reconfiguration will be well positioned to serve urban consumers and developers looking to add attractive amenities to apartment blocks and mixed-use projects without large structural changes.

Smart, ESG-Aligned and Circular Outdoor Portfolios

Governments, institutional buyers, and increasingly consumers are prioritizing ESG performance and lifecycle impact when choosing outdoor products. This opens the door for companies that invest in recycled and low-carbon materials, transparent supply chains, and circular design principles such as modularity, repairability, and take-back programs. Integrating smart controls, such as energy-efficient lighting, automated shading, and connected climate systems, can further enhance value propositions, especially for hospitality and high-end residential projects. Credible certification and measurable sustainability credentials can be decisive in large tenders and retail sourcing programs, creating a long-term competitive edge for early adopters.

Product Type Insights

Outdoor furniture is the foundational product type, accounting for roughly 39% of global market value in 2024. Seating, dining sets, and modular lounge collections are core, with modular sectionals and conversation sets gaining share due to their flexibility and ability to fit varied spaces. Outdoor structures and shade solutions, pergolas, gazebos, awnings, and shade sails, form the next significant category, benefitting from consumers’ desire for weather protection and extended seasonal use. Outdoor kitchens and cooking systems (grills, built-in islands, storage, sinks) are expanding rapidly, particularly in North America and Australia, where they are increasingly seen as standard features in high-value homes. Décor, lighting, and climate comfort products (rugs, cushions, lighting, heaters, fire pits, water features) drive repeat purchases and seasonal refreshes, boosting overall basket size and supporting retail margins.

Application Insights

Residential applications dominate the market, with single-family homes and townhouses leading adoption of comprehensive outdoor living solutions. These households often invest in phased upgrades, starting with furniture then layering in structures, kitchens, and décor, creating ongoing replacement and upsell opportunities. Multi-family residential developments are emerging as a strong application area for compact and community-focused outdoor solutions, such as shared rooftop lounges, courtyards, and play areas. On the commercial side, hospitality and leisure applications, hotels, resorts, serviced apartments, beach clubs, and theme parks, are high-value segments that prioritize durability, aesthetics, and brand consistency. Restaurants, cafés, and bars rely heavily on outdoor seating, umbrellas, heaters, and ambiance lighting to expand capacity and differentiate guest experiences. Public and recreational spaces, including parks, waterfront promenades, and community hubs, specify highly durable furniture, shelters, and lighting that support long asset lifespans and low maintenance.

Distribution Channel Insights

Home improvement and DIY chains represent the largest distribution channel, capturing about 32% of global sales in 2024. These retailers leverage extensive store networks, seasonal merchandising, and private-label collections to reach mass and mid-market consumers. Specialty outdoor and furniture retailers cater to premium and design-focused buyers, often featuring curated international brands and offering consultative sales and project design support. Mass merchandisers and hypermarkets primarily serve the value and entry-level segments with high-volume, price-competitive assortments. Online pure-play retailers and marketplaces, along with brand-owned D2C websites, are gaining share as consumers increasingly research and purchase outdoor products digitally. Enhanced imagery, AR-based visualization, customer reviews, and flexible delivery/assembly services are accelerating this shift, particularly among younger and urban customers. Direct-to-consumer brands use storytelling, sustainability narratives, and limited collections to stand out in a crowded online landscape.

End-Use Insights

By end use, residential single-family homes account for about 50% of global outdoor living product revenues, driven by larger private outdoor areas and a strong culture of home personalization. Multi-family residential complexes are a fast-growing end-use segment, as developers differentiate projects with well-designed communal terraces, gardens, and rooftop amenities. Hospitality and leisure end uses (hotels, resorts, beach clubs, spas) contribute a substantial and resilient share of demand, often favoring premium-grade, contract-ready furniture and structures. Commercial and institutional spaces, restaurants, cafés, offices, educational campuses, and healthcare facilities, use outdoor installations to enhance user experience and brand identity. Public and recreational spaces add a specification-driven layer of demand, focusing on robust, vandal-resistant, and low-maintenance solutions that can withstand heavy use and varied climates.

Price Range & Customer Segment Insights

The mid-range / mass-premium segment is the largest price tier, representing about 45% of market value. It targets consumers seeking a balance between durability, design, and affordability, often through big-box retail, marketplaces, and well-known omnichannel brands. Economy/value products serve budget-conscious buyers, seasonal renters, and small commercial operators, emphasizing functional, lightweight, and easy-to-assemble designs. Premium and luxury tiers are growing as affluent homeowners and high-end hospitality clients invest in designer collections, bespoke installations, and high-performance materials. These tiers deliver higher margins and often involve more complex projects, including custom outdoor kitchens, fully furnished terraces, and architect-specified structures. Across all price segments, consumers are increasingly willing to pay more for longer warranties, sustainability credentials, and service elements such as delivery, installation, and after-sales support.

| Product Type | Application | Distribution Channel | End Use | Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for approximately 35–37% of global outdoor living products demand in 2024. The United States alone contributes about 25–27% of worldwide revenues, supported by high homeownership, large yard sizes, and a strong home-improvement culture. Consumers prioritize comfort, durability, and aesthetics, with composite decking, metal frames, and performance fabrics widely adopted. Outdoor kitchens, fire features, and integrated lighting systems are standard in many mid-to-high-end homes. Canada mirrors many U.S. trends but requires products adapted to longer winters and significant temperature swings. E-commerce penetration is high, and omnichannel retailers dominate spring and summer promotional cycles.

Europe

Europe holds around 25–27% of global market value, with Germany, the U.K., France, Italy, Spain, and the Nordic countries leading demand. Design preferences and climate vary widely: Mediterranean markets emphasize al fresco dining and shade solutions, while Northern Europe favors minimalist, weather-resilient furniture and modular concepts that can be stored or reconfigured easily. Europe is also a major exporter of premium and luxury outdoor furniture, with Italy, Spain, Belgium, and Scandinavian countries housing many design-driven brands. Environmental regulations, strict timber sourcing rules, and high consumer awareness place sustainability at the center of product development and purchasing decisions.

Asia-Pacific

Asia-Pacific accounts for about 27–30% of global demand in 2024 and is the fastest-growing region, with an expected growth rate above the global average. China, India, Japan, South Korea, Australia, and Southeast Asian countries are key contributors. Rapid urbanization and rising disposable incomes are creating new demand in both suburban single-family homes and urban apartments with balconies and rooftops. Australia and New Zealand show strong uptake of decks, pergolas, and outdoor kitchens, influenced by a well-established outdoor lifestyle. Many APAC countries also serve as manufacturing hubs, exporting large volumes of furniture, shade systems, and structures to North America and Europe, reinforcing the region’s strategic importance.

Latin America

Latin America represents roughly 5–7% of global market value, with Brazil, Mexico, Chile, Colombia, and Argentina making up the bulk of demand. Warm climates and an outdoor social culture support steady consumption of outdoor furniture, hammocks, shade structures, and décor. However, macroeconomic volatility and currency fluctuations can constrain big-ticket purchases and create uneven demand patterns. Tourism-focused developments, particularly beach resorts and boutique hotels, are increasingly investing in higher-quality outdoor environments, creating opportunities for international and regional brands in mid-range and premium tiers.

Middle East & Africa

The Middle East & Africa region contributes around 5–6% of global market revenues but is expanding at an above-average rate. GCC countries, especially the UAE and Saudi Arabia, are key growth engines due to large-scale tourism, entertainment, and residential megaprojects. Demand is concentrated in shade structures, cabanas, daybeds, and climate control systems that can withstand extreme heat and UV exposure. Across Africa, emerging middle classes and growing domestic tourism are gradually boosting residential and hospitality investments in outdoor spaces. High-end safari lodges, coastal resorts, and city hotels are adopting premium outdoor furniture and structures to attract international visitors and differentiate guest experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The outdoor living products market share is moderately to highly fragmented. The top five global players are estimated to account for roughly 18–20% of total market revenues, with the remaining share distributed across a long tail of regional manufacturers, specialist design brands, and private-label suppliers. In outdoor furniture specifically, no single player dominates worldwide, although some brands hold strong regional leadership positions and extensive retail footprints. This fragmentation creates space for innovation-driven entrants, niche luxury labels, and contract-focused specialists to capture share through design, quality, sustainability, and service differentiation.

Top Manufacturers in the Outdoor Living Products Market

- Ashley Furniture Industries, LLC

- Brown Jordan International, Inc.

- Century Furniture LLC

- DEDON GmbH

- EMU Group S.p.A.

- Gloster Furniture GmbH

- Higold Group

- Homecrest Outdoor Living, LLC

- Hooker Furnishings Corporation

- IKEA Group

- Polywood, LLC

- RODA Srl

- Sun Garden GmbH

- Talenti Srl

- Trex Company, Inc.