Outdoor Gym Equipment Market Size

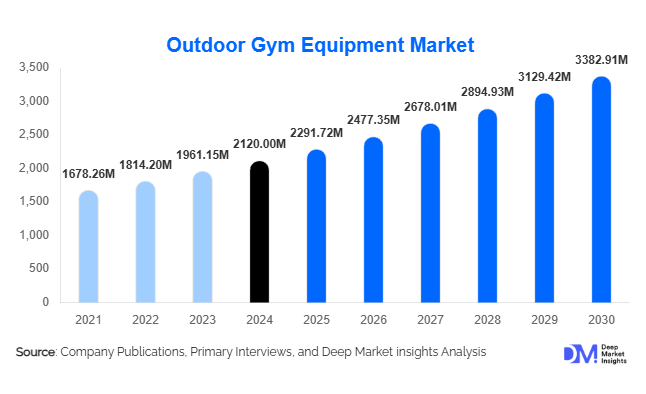

According to Deep Market Insights, the global outdoor gym equipment market size was valued at USD 2,120.00 million in 2024 and is projected to grow from USD 2,291.72 million in 2025 to reach USD 3,382.91 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). Growth in this market is primarily driven by increasing health awareness, urban planning initiatives promoting active lifestyles, and rising investments in public wellness infrastructure and residential amenity spaces.

Key Market Insights

- Strength training outdoor equipment dominates the market, accounting for nearly 48% of 2024 revenues, reflecting demand for multifunctional and durable outdoor rigs.

- Municipal and public park installations lead demand, supported by wellness-focused government initiatives and smart city projects.

- Permanent installations account for about 60% of total installations, indicating long-term investment in fixed outdoor fitness zones.

- Asia-Pacific is the fastest-growing region, driven by large-scale urban development and residential fitness integration in India and China.

- Technology integration and inclusive design are emerging as major differentiators among manufacturers, with smart-connected and senior-friendly equipment gaining popularity.

- Stainless and galvanized steel remain the preferred materials, representing over half of global installations due to durability and weather resistance.

Latest Market Trends

Smart-Connected Outdoor Gyms

Manufacturers are increasingly integrating IoT and sensor-based technologies into outdoor gym equipment. Smart-connected stations track user activity, display workout data, and sync with mobile apps, enabling users to monitor performance and maintenance. This trend aligns with growing urban digitization and fitness tracking culture, especially across developed cities in North America and Europe. These innovations enhance user engagement, allowing municipalities and property developers to collect data on equipment usage and maintenance requirements, reducing downtime and improving user experience.

Eco-Friendly and Inclusive Equipment Designs

The demand for sustainable outdoor gym equipment is rising as governments and communities prioritize environmentally responsible urban development. Manufacturers are adopting recycled materials, powder-coated finishes, and biodegradable composites to minimize environmental impact. Additionally, inclusive designssuch as equipment tailored for seniors, differently-abled individuals, and children gaining prominence. These innovations ensure accessibility for all users, promoting social inclusion and community health while aligning with evolving ESG (Environmental, Social, and Governance) objectives.

Outdoor Gym Equipment Market Drivers

Rising Health Awareness and Fitness Culture

Globally, increasing awareness of lifestyle-related diseases such as obesity and cardiovascular ailments has led to a surge in outdoor fitness participation. Outdoor gym zones offer accessible and cost-effective solutions for public exercise, encouraging governments, schools, and corporations to invest in open-air fitness infrastructure. The pandemic further accelerated outdoor fitness adoption as individuals sought safe, socially distanced exercise options.

Urbanization and Smart City Infrastructure Development

Rapid urbanization and smart city initiatives are driving the installation of outdoor gym equipment across parks, recreational trails, and community zones. Municipalities are embedding outdoor wellness infrastructure within urban layouts, encouraging active commuting and outdoor fitness. The trend toward greener cities and increased public wellness spending in countries like the U.S., Germany, China, and India continues to propel this demand.

Residential and Commercial Real Estate Amenity Upgrades

Developers and corporate campuses are incorporating outdoor gyms as part of wellness-focused amenity packages. Residential complexes in Asia-Pacific and Europe are adopting modular outdoor gyms to attract tenants and increase property value. Corporate entities are also investing in outdoor wellness zones to enhance employee engagement, positioning outdoor gyms as a long-term fixture of modern workplace design.

Market Restraints

High Installation and Maintenance Costs

Outdoor gym equipment must be weather-resistant, durable, and anchored for safety, resulting in higher upfront and ongoing maintenance costs. These financial barriers deter smaller municipalities and budget-conscious residential projects. Corrosion control, inspection schedules, and vandalism mitigation further add to lifecycle expenses, making cost efficiency a key challenge for market participants.

Safety and Vandalism Concerns

Unsupervised public installations face challenges related to safety, misuse, and vandalism. The need for robust materials and anti-theft features increases manufacturing complexity. In some regions, limited maintenance protocols or the absence of standardized safety guidelines have reduced consumer trust, hindering broader market adoption.

Outdoor Gym Equipment Market Opportunities

Public Wellness and Government Infrastructure Programs

Governments worldwide are prioritizing community health through investments in outdoor fitness infrastructure. Smart city programs and green-space activation projects offer significant opportunities for manufacturers and service providers. Companies partnering with municipalities to provide turnkey outdoor gym solutionsincluding installation, digital tracking, and maintenance, capture consistent long-term contracts and strengthen public-private partnerships.

Residential and Mixed-Use Development Demand

The rise of wellness-driven real estate is fostering rapid adoption of outdoor gym installations in gated communities and apartment complexes. As developers seek differentiation, modular and aesthetically integrated outdoor gyms are becoming key amenities. This segment presents strong recurring demand, particularly in Asia-Pacific’s booming residential markets. Offering customizable and portable solutions for these developers is a critical opportunity for growth.

Technological Innovation and Inclusive Fitness Design

The integration of technology and inclusivity is redefining outdoor gym spaces. Smart equipment capable of tracking user performance, integrating with mobile applications, and providing adaptive resistance systems is expected to drive premium segment growth. Inclusive fitness equipment designed for seniors and differently-abled individuals also presents a major growth niche, backed by social inclusion mandates and aging population demographics in developed economies.

Product Type Insights

Strength training outdoor equipment leads the market with a 48% share in 2024, favored for multifunctional use and a higher average selling price per unit. Cardio equipment holds around 25% share, driven by demand for outdoor cross-training experiences. Flexibility and balance training units are growing rapidly in community fitness parks. The adoption of multifunctional modular gyms is expected to rise sharply as cities invest in compact, all-in-one outdoor stations to optimize space utilization.

Installation Type Insights

Permanent installations dominate the segment with nearly 60% share of total installations in 2024. These setups are primarily seen in municipal parks and large residential developments. Semi-permanent and portable installations are gaining momentum in developing economies, where flexibility and cost efficiency are prioritized for temporary community events and seasonal deployments.

End-User Insights

Public parks and recreational zones account for about 42% of total installations, making them the largest end-use segment. Residential complexes and corporate campuses represent the fastest-growing categories, propelled by lifestyle upgrades and corporate wellness initiatives. Educational institutions and health clubs with outdoor extensions are also expanding adoption, supported by policies encouraging youth physical fitness and outdoor learning environments.

| By Product Type | By Installation Type | By End User | By Distribution Channel | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the market with approximately 34% share in 2024. The United States drives regional growth through municipal investments in wellness zones and public parks. Increasing demand for smart-connected outdoor fitness systems and inclusive equipment contributes to steady expansion, while Canada’s emphasis on community health infrastructure further supports market development.

Europe

Europe accounts for 31% of the global share, led by the U.K., Germany, France, and Italy. The region benefits from strong public investment in wellness and aging population initiatives. European countries are adopting sustainable outdoor fitness equipment built from recycled materials, aligning with EU green infrastructure mandates. Southern Europe, particularly Spain and Italy, shows rapid growth due to urban redevelopment and tourism-based outdoor amenities.

Asia-Pacific

Asia-Pacific represents 21% of the 2024 market and is the fastest-growing region through 2030. China and India dominate demand, supported by rapid urbanization, government-led fitness missions, and the rise of wellness real estate. Modular outdoor gym zones in housing societies and municipal parks are expanding, with local manufacturing hubs emerging to meet cost-competitive supply needs.

Latin America

Latin America contributes around 7% of the global market value, led by Brazil and Mexico. The region’s municipalities are investing in outdoor fitness infrastructure to promote public health. Rising tourism-based outdoor amenities and urban recreation programs are stimulating new opportunities for local equipment suppliers.

Middle East & Africa

MEA holds about 5% of the global market, with the GCC regionespecially the UAE and Saudi Arabiadriving premium installations in residential and resort projects. South Africa and Egypt show rising adoption across community and school installations. Hot climates necessitate corrosion-resistant and shaded gym structures, prompting demand for advanced materials and innovative designs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players Outdoor Gym Equipment Market

- KOMPAN A/S

- Greenfields Outdoor Fitness

- PlayCore Inc.

- Landscape Structures Inc.

- MOVE Strong

- Norwell Corporation

- Street Workout Worldwide

- Eibe Group

- Exerfly Fitness

- AllPlay Systems

- Funn Fitness

- Huck Playgrounds

- Active Leisure Group

- PTI Sport

- Outdoor Gym Experts Ltd.

Recent Developments

- In June 2025, KOMPAN introduced a new line of smart outdoor gym stations integrating Bluetooth-enabled activity tracking for municipal fitness zones.

- In April 2025, PlayCore Inc. partnered with U.S. city councils to deploy modular outdoor gyms using sustainable materials as part of urban revitalization initiatives.

- In February 2025, Greenfields Outdoor Fitness launched inclusive outdoor gym modules for seniors and differently-abled users in European public parks, enhancing accessibility and community engagement.