Outdoor Cushion Market Size

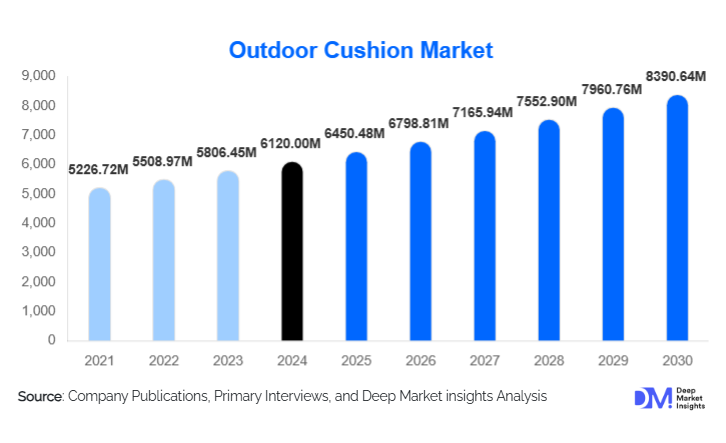

According to Deep Market Insights, the global outdoor cushion market size was valued at USD 6,120 million in 2024 and is projected to grow from USD 6,450.48 million in 2025 to reach USD 8,390.64 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The outdoor cushion market growth is primarily driven by the rising popularity of outdoor living spaces, increasing residential and commercial infrastructure development, and growing consumer preference for premium, durable, and weather-resistant outdoor furnishings.

Key Market Insights

- Residential adoption of outdoor living spaces is expanding, with homeowners investing in patios, balconies, and gardens, driving demand for comfortable and aesthetically appealing cushions.

- Material innovation and smart fabrics, including UV-resistant, water-repellent, and antimicrobial coatings, are enhancing durability and product appeal, particularly in premium segments.

- North America dominates the outdoor cushion market, led by the U.S. and Canada, due to high disposable income, outdoor lifestyle trends, and strong e-commerce penetration.

- APAC is the fastest-growing region, driven by urbanization, rising middle-class income, and growing hospitality and commercial infrastructure in China, India, and Southeast Asia.

- Europe remains a key market, with Germany, France, and the UK showing strong demand for premium and sustainable cushions.

- E-commerce and online retail are reshaping market dynamics by providing consumers with access to customized, premium, and international outdoor cushion products.

Latest Market Trends

Eco-Friendly and Sustainable Outdoor Cushions

Manufacturers are increasingly producing outdoor cushions using recycled materials, sustainable foams, and environmentally friendly fabrics to cater to growing consumer awareness of sustainability. Eco-conscious cushions, including recycled polyester and biodegradable foams, are becoming mainstream offerings. This trend appeals to environmentally aware consumers in Europe, North America, and APAC, driving market differentiation and premiumization opportunities. Additionally, sustainable manufacturing aligns with governmental initiatives promoting eco-friendly production practices.

Technology-Enhanced Cushion Materials

Innovation in fabrics and fillings is reshaping the market. Advanced waterproof, UV-resistant, stain-proof, and antimicrobial coatings improve durability and longevity, enhancing consumer confidence in outdoor products. Smart cushions integrating cooling gel layers or weather-adaptive foams are emerging in high-end segments. E-commerce platforms are increasingly offering customization tools, allowing buyers to select fabric types, cushion thickness, and patterns, further enhancing the adoption of technologically advanced products.

Outdoor Cushion Market Drivers

Growing Outdoor Lifestyle Trend

Increasing interest in outdoor living areas such as gardens, terraces, patios, and balconies is driving demand for comfortable and stylish cushions. Urban housing developments with limited indoor space have heightened the appeal of outdoor leisure furniture. Consumers prioritize both comfort and aesthetics, resulting in higher adoption of premium and mid-range cushion products that enhance outdoor experiences.

Material and Product Innovation

Advanced fabric technology, including waterproof, UV-resistant, and anti-fade materials, along with durable foam types, is fueling market growth. Manufacturers are introducing custom designs, ergonomic seating options, and weatherproof coatings, which extend product life and justify premium pricing. Such innovations also create opportunities in commercial spaces, including hotels, resorts, and outdoor dining areas.

Digital and E-commerce Growth

The surge in online retail has significantly influenced the outdoor cushion market. Consumers now have easier access to a wider range of products, customization options, and premium international brands. E-commerce platforms allow small and mid-sized manufacturers to expand globally, providing convenience, price transparency, and faster delivery, boosting overall market growth.

Market Restraints

High Raw Material Costs

Fluctuating prices of polyester, foam, and specialized fabrics can impact profitability, particularly for mid-range and budget segments. Manufacturers must balance cost with quality to remain competitive, which may affect pricing strategies and margins.

Seasonality and Weather Dependence

Demand for outdoor cushions is often seasonal, peaking in spring and summer in many regions. Harsh weather conditions, such as heavy rain or extreme heat, can negatively impact sales. Manufacturers and retailers need to plan for inventory and production cycles to mitigate seasonal demand fluctuations.

Outdoor Cushion Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in APAC and LATAM offer a significant growth opportunity. Countries like India, China, Brazil, and Mexico are witnessing growing adoption of residential outdoor spaces and hospitality infrastructure, creating demand for both premium and mid-range outdoor cushions. Tailored marketing strategies and localized designs can help manufacturers penetrate these markets effectively.

Smart and Innovative Materials

The adoption of advanced fabrics and smart cushion technologies presents opportunities for differentiation. Anti-fade, UV-resistant, and water-repellent fabrics, along with cooling gel or antimicrobial foams, are attracting premium buyers. Manufacturers that invest in material innovation can capture higher margins and establish brand recognition in competitive markets.

Eco-Friendly Product Lines

Consumer preference for sustainable and environmentally conscious products is creating new avenues for growth. Outdoor cushions made from recycled materials, biodegradable fabrics, and eco-friendly foams are gaining popularity. Such products also align with regulatory incentives in Europe and North America, providing manufacturers with marketing and compliance advantages.

Product Type Insights

Seat cushions continue to dominate the global outdoor cushion market, accounting for 45% of the total 2024 revenue. Their widespread adoption in both residential and commercial settings is driven by their versatility, ergonomic comfort, and ease of replacement. Seat cushions are suitable for chairs, sofas, and benches, making them the preferred choice across diverse end-use applications. Back cushions and floor cushions are experiencing steady growth, particularly in premium residential and hospitality sectors, although they remain secondary in market share. Cushion sets, which bundle seat and back cushions together, are gaining traction in high-end segments due to convenience, cohesive design aesthetics, and the growing trend of coordinated outdoor furniture ensembles. The key driver for this segment is rising urban residential adoption of outdoor living spaces, where consumers prioritize comfort and style for patios, decks, and terraces.

Material Insights

Polyester fabric cushions hold 38% of the market share in 2024 due to their combination of durability, cost-effectiveness, and resistance to UV exposure and moisture. These characteristics make polyester the fabric of choice for long-lasting outdoor applications. Polyurethane foam dominates the filling segment because of its comfort, resilience, and ability to retain shape over time, enhancing the overall user experience. Additionally, sustainable and recycled material-based cushions are emerging as a strong trend, particularly in Europe and North America, reflecting growing eco-conscious consumer preferences and regulatory support for environmentally friendly manufacturing. Durability, weather resistance, and sustainability are the primary drivers encouraging consumers to prefer these materials across residential and commercial segments.

Application Insights

Residential use represents the largest application, accounting for 52% of the global market, fueled by urban households investing in patios, balconies, gardens, and terraces to enhance outdoor living experiences. The hospitality segment, including hotels, resorts, and restaurants, is the fastest-growing application due to the increasing demand for premium, durable, and customizable outdoor cushions that can withstand heavy usage while maintaining aesthetics. Recreational and public spaces such as parks, urban plazas, and outdoor event venues also present emerging opportunities, especially in rapidly urbanizing regions of APAC and LATAM. The growth in residential and hospitality applications is primarily driven by urbanization, rising disposable incomes, and the expansion of lifestyle-focused outdoor infrastructure.

Distribution Channel Insights

Online platforms account for 35% of total market revenue, with consumers increasingly leveraging e-commerce to access a variety of styles, customization options, and real-time reviews. The convenience of doorstep delivery and competitive pricing has bolstered online adoption, particularly in APAC and LATAM. Offline channels, including specialty stores, home improvement outlets, and department stores, remain crucial, especially for tactile inspection and premium product sales. North America and Europe maintain a balanced distribution between online and offline channels, driven by mature retail infrastructure and consumer trust in physical stores. The primary drivers for channel growth include the proliferation of digital platforms, increasing comfort with online shopping, and the desire for product customization and premium choices.

| By Product Type | By Material | By Application | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest outdoor cushion market, accounting for 34% of global revenue in 2024. The United States and Canada are key contributors, supported by high disposable incomes, strong adoption of outdoor lifestyles, and widespread access to e-commerce platforms. Premium cushion adoption is significant, driven by homeowners investing in backyard leisure spaces, patios, and balconies. Additionally, the commercial segment, particularly hotels and resorts, contributes to strong demand. Key growth drivers include urban residential expansion, rising interest in outdoor leisure, and advanced online retail penetration, which allows consumers to access a wide variety of customizable and premium products.

Europe

Europe accounts for 28% of the market share, with Germany, France, and the U.K. leading in demand. Consumers in these regions prefer high-quality, durable, and sustainable outdoor cushions. Government incentives for eco-friendly manufacturing and environmental regulations further reinforce this trend. Premiumization in residential and hospitality applications is also a significant driver, as consumers seek aesthetically appealing, weather-resistant, and long-lasting products. Additional drivers include growing urban outdoor living adoption, environmental consciousness, and strong disposable income levels across Western Europe.

Asia-Pacific

APAC is the fastest-growing region, projected to expand at a CAGR of 11.2% from 2025–2030. China, India, and Southeast Asian countries are major contributors due to rapid urbanization, rising middle-class income, and the expansion of hospitality infrastructure. Increasing awareness of outdoor lifestyle trends and growing e-commerce adoption are also fueling market growth. Key drivers include rapid urban residential development, expanding hotel and resort segments, and rising digital penetration that allows consumers to explore premium and mid-range cushion offerings easily.

Latin America

Brazil and Mexico are the leading markets in LATAM, driven by urban residential adoption and growing hospitality infrastructure. Niche operators targeting premium and customizable offerings are gaining traction, as consumers seek products that combine durability with design appeal. The drivers for growth in this region include increasing disposable income, expansion of urban outdoor living spaces, and rising awareness of home decor and lifestyle products.

Middle East & Africa

MEA exhibits emerging demand, particularly in the UAE, Saudi Arabia, and South Africa. The region benefits from luxury hospitality growth, urban infrastructure development, and increasing adoption of outdoor leisure spaces in both residential and commercial sectors. Africa also functions as a manufacturing hub for premium outdoor fabrics and cushions. Key drivers include luxury hospitality expansion, high disposable incomes in GCC countries, investment in public infrastructure, and growing awareness of lifestyle-focused outdoor spaces.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Cushion Market

- IKEA

- Home Depot

- Wayfair

- Amazon Basics

- Frontgate

- Target

- Bed Bath & Beyond

- Pier 1 Imports

- Restoration Hardware

- Walmart

- Ashley Furniture

- La-Z-Boy

- RH Outdoor

- Crate & Barrel

- Sunbrella

Recent Developments

- In March 2025, IKEA launched a new weatherproof outdoor cushion line with recycled polyester fabrics targeting European and North American markets.

- In January 2025, Wayfair introduced customizable outdoor cushion collections for residential patios in APAC, boosting online sales penetration.

- In June 2025, Sunbrella expanded its eco-friendly, UV-resistant fabric range for outdoor cushions, focusing on the hospitality and premium residential segments.