Outdoor Cooking Equipment Market Size

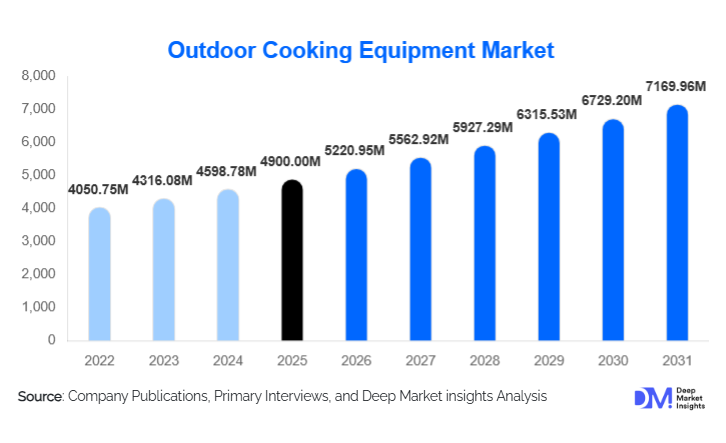

According to Deep Market Insights, the global outdoor cooking equipment market size was valued at USD 4,900.00 million in 2025 and is projected to grow from USD 5,220.95 million in 2026 to reach USD 7,169.96 million by 2031, expanding at a CAGR of 6.55% during the forecast period (2026–2031). The outdoor cooking equipment market growth is primarily driven by rising consumer spending on outdoor living and home improvement, the growing popularity of backyard grilling and outdoor social gatherings, and increasing adoption of premium and technology-enabled cooking solutions across residential and commercial end users.

Key Market Insights

- Grills dominate the outdoor cooking equipment market, accounting for more than half of global revenue, driven by strong demand for gas and pellet grills.

- Residential end users represent the largest demand segment, supported by backyard cooking culture, home renovation trends, and premium outdoor kitchen installations.

- North America leads global demand, backed by high per-capita spending on outdoor lifestyle products and established grilling traditions.

- Asia-Pacific is the fastest-growing regional market, driven by urbanization, expanding hospitality infrastructure, and rising disposable incomes.

- Premium and smart outdoor cooking equipment adoption is accelerating, with connected grills and automated temperature control systems gaining traction.

- Sustainability-focused fuel options, including pellet and electric grills, are reshaping product innovation and regulatory compliance strategies.

What are the latest trends in the outdoor cooking equipment market?

Premiumization and Smart Cooking Technologies

The outdoor cooking equipment market is witnessing a clear shift toward premium and technologically advanced products. Consumers are increasingly upgrading from basic charcoal grills to pellet grills, smart gas grills, and integrated outdoor kitchen systems. Features such as Wi-Fi connectivity, mobile app control, automated temperature regulation, and fuel optimization are enhancing user convenience and cooking precision. This trend is particularly strong in North America and Europe, where consumers are willing to pay higher prices for durability, performance, and connected experiences. Manufacturers are leveraging these technologies to build brand ecosystems and improve customer retention.

Growing Demand for Sustainable and Alternative Fuel Equipment

Sustainability is emerging as a key trend in the outdoor cooking equipment market. Pellet grills, electric grills, and hybrid fuel systems are gaining popularity due to lower emissions, improved fuel efficiency, and regulatory compliance. Environmentally conscious consumers are favoring products that reduce smoke output and utilize renewable or recyclable materials. Manufacturers are also investing in eco-friendly packaging, energy-efficient designs, and low-emission burners, positioning sustainability as a long-term competitive differentiator.

What are the key drivers in the outdoor cooking equipment market?

Rising Outdoor Living and Home Improvement Spending

Increased investment in outdoor living spaces is a major driver of market growth. Consumers are increasingly designing patios, decks, and backyards as functional cooking and entertainment areas, driving demand for grills, outdoor ovens, and built-in kitchen equipment. This trend is reinforced by higher disposable incomes and the perception of outdoor cooking equipment as a lifestyle investment rather than a seasonal purchase.

Expansion of Commercial Outdoor Dining and Catering

The growth of outdoor dining concepts across restaurants, hotels, resorts, and catering services is fueling commercial demand for outdoor cooking equipment. Live grilling stations, open-air kitchens, and experiential dining formats are becoming more common, particularly in tourism-driven regions. This is driving demand for durable, high-capacity grills, smokers, and portable cooking systems designed for continuous commercial use.

What are the restraints for the global market?

Seasonal Demand and Weather Dependency

Outdoor cooking equipment sales are highly seasonal, particularly in colder climates where demand declines during the winter months. This seasonality creates inventory management challenges and uneven revenue cycles for manufacturers and retailers, potentially limiting year-round growth.

Raw Material Price Volatility

Fluctuating prices of stainless steel, aluminum, and electronic components directly impact manufacturing costs and profit margins. Mid-range manufacturers are particularly vulnerable to cost pressures, as their ability to pass on price increases to consumers is limited compared to premium brands.

What are the key opportunities in the outdoor cooking equipment industry?

Smart and Connected Outdoor Cooking Ecosystems

The integration of IoT, AI-driven cooking controls, and digital monitoring platforms presents a significant opportunity for both established players and new entrants. Smart grills and smokers enable remote cooking management, recipe automation, and real-time diagnostics, creating opportunities for recurring revenue through software upgrades and accessories.

Emerging Market Expansion and Hospitality-Led Demand

Rapid urbanization and tourism development in Asia-Pacific, the Middle East, and Latin America are opening new growth avenues. Countries such as China, India, the UAE, and Thailand are witnessing rising demand for luxury villas, resorts, and outdoor dining venues. Localized manufacturing and affordable mid-range offerings can help companies capture these emerging opportunities.

Product Type Insights

Grills dominate the global outdoor cooking equipment market, accounting for approximately 52% of the market in 2024. This dominance is driven primarily by the popularity of gas grills and pellet grills, which offer convenience, consistent performance, and ease of use for both residential and commercial consumers. The premiumization of outdoor cooking experiences has further strengthened grills’ position, with high-end pellet grills incorporating smart connectivity, precise temperature control, and fuel efficiency. Smokers represent a growing niche segment, fueled by the rising global interest in slow-cooked barbecue and gourmet outdoor cuisine. Outdoor ovens, particularly pizza ovens, are increasingly adopted by premium residential users and hospitality operators looking to offer unique culinary experiences. Portable cooking equipment remains critical for camping, adventure tourism, and recreational activities, reflecting the market’s expanding lifestyle orientation. Meanwhile, built-in outdoor kitchen equipment is experiencing rapid growth within the luxury residential segment, driven by home improvement investments and the desire for fully integrated outdoor entertaining spaces.

Fuel Type Insights

Gas-powered outdoor cooking equipment continues to dominate, accounting for nearly 48% of global market share. Gas offers widespread fuel availability, operational convenience, and faster heating, making it the preferred choice among residential and commercial users. Pellet grills are the fastest-growing fuel segment, as they provide precision cooking, enhanced flavor profiles, and a sustainable alternative to traditional fuels. Charcoal remains popular among traditional users and barbecue enthusiasts seeking authentic flavors, while electric grills are gaining traction in urban and environmentally regulated markets due to their low emissions and suitability for apartment living or indoor-outdoor hybrid settings.

End-Use Insights

The residential segment accounts for approximately 63% of total market demand, driven by lifestyle trends, increasing disposable incomes, and the growing popularity of backyard cooking as part of home improvement and entertainment culture. The commercial segment, including hotels, restaurants, resorts, and catering services, is growing at a faster pace, over 6.5% CAGR, propelled by the expansion of outdoor dining concepts, experiential hospitality offerings, and tourism-driven demand for high-capacity, durable outdoor cooking solutions. This segment benefits from investments in open-air kitchens, live cooking stations, and premium outdoor dining experiences that enhance consumer engagement and brand differentiation.

Distribution Channel Insights

Offline retail channels, including specialty stores, home improvement outlets, and dedicated kitchen showrooms, account for approximately 58% of global sales. Their success is supported by in-store demonstrations, hands-on experience, and customer support services. However, online channels are rapidly gaining prominence as consumers increasingly prefer direct-to-consumer platforms, e-commerce marketplaces, and brand-owned websites offering customization, bundled accessories, and delivery convenience. Digital adoption is also accelerating due to the ability to compare products, access real-time reviews, and engage with technology-driven features such as smart grill management apps.

| By Product Type | By Fuel Type | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 38% of the global outdoor cooking equipment market, with the United States accounting for nearly 80% of regional demand. Growth in this region is driven by a deeply entrenched grilling culture, rising disposable incomes, and strong adoption of premium, technology-enabled outdoor cooking equipment. Seasonal backyard gatherings, barbecues, and holiday cooking traditions further support demand. Additionally, commercial adoption is growing due to the proliferation of outdoor dining restaurants and event catering, making North America a mature but steadily expanding market.

Europe

Europe represents about 26% of global demand, with Germany, the UK, and France leading consumption. Growth in the region is supported by increasing interest in outdoor lifestyle and home-based entertainment, as well as a strong preference for sustainable and low-emission fuel options, such as pellet and electric grills. The adoption of energy-efficient and environmentally friendly outdoor cooking equipment is further driven by stringent EU regulations and growing consumer awareness. Premiumization trends and a focus on outdoor social experiences are also significant contributors to regional growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 7% CAGR. Key markets include China, Japan, Australia, and India. Urbanization, rising disposable incomes, and expanding hospitality and tourism infrastructure are primary growth drivers. Rising interest in Western-style leisure activities, including backyard grilling and luxury outdoor dining experiences, is fueling residential demand. Commercial adoption in resorts, hotels, and restaurants is increasing, particularly in urban tourism hubs. Additionally, government support for urban lifestyle development, outdoor hospitality, and smart home technologies is contributing to market expansion.

Latin America

Latin America is experiencing steady growth, led by Brazil and Mexico. The region’s barbecue culture, increasing disposable income among the middle class, and growing interest in residential outdoor cooking are primary drivers. Outdoor cooking is becoming an integral part of social and family gatherings, particularly in urban areas. Expansion of hospitality and resort infrastructure is also driving commercial adoption, while manufacturers are increasingly offering mid-range and portable equipment suited to local consumer preferences.

Middle East & Africa

The Middle East & Africa region is witnessing rising demand, particularly in the UAE, Saudi Arabia, and South Africa. Growth drivers include the expansion of luxury residential properties, premium resorts, and high-end hospitality projects emphasizing outdoor kitchens and culinary experiences. High disposable incomes, combined with strong tourism and outdoor leisure trends, are fueling residential and commercial demand. In Africa, intra-regional travel and tourism are gradually increasing in demand, with hotels and resorts investing in durable, high-capacity outdoor cooking equipment to cater to both local and international visitors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Cooking Equipment Market

- Weber LLC

- Traeger, Inc.

- Napoleon Grills

- Char-Broil LLC

- Broil King

- Coleman Company

- Big Green Egg

- Blackstone Products

- Masterbuilt Manufacturing

- Camp Chef

- Landmann USA

- Rinnai Corporation

- Bull Outdoor Products

- Dyna-Glo

- Kenmore