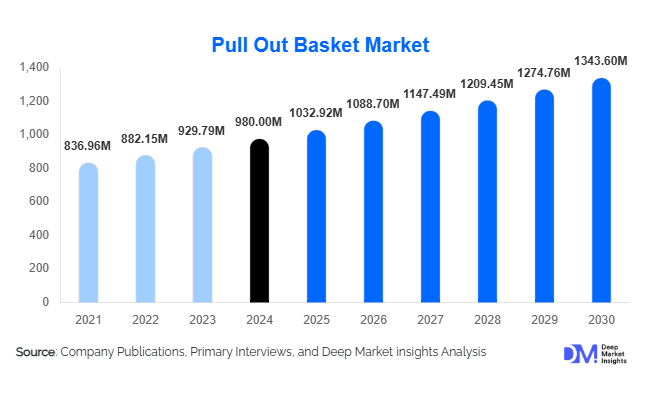

Pull Out Basket Market Size

According to Deep Market Insights, the global pull-out basket market size was valued at USD 980.00 million in 2024 and is projected to grow from USD 1,032.92 million in 2025 to reach USD 1,343.60 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The pull-out basket market growth is primarily driven by rising adoption of modular kitchens and space-optimized furniture, increasing urbanization, and growing consumer preference for ergonomic, premium, and organized storage solutions across residential and commercial spaces.

Key Market Insights

- Pull-out baskets are transitioning from basic storage hardware to value-added modular solutions, supported by soft-close mechanisms, higher load capacities, and premium finishes.

- Residential applications dominate global demand, driven by new housing construction, kitchen renovations, and lifestyle upgrades.

- Asia-Pacific leads global consumption, supported by rapid urban development, modular kitchen penetration, and cost-competitive manufacturing.

- Europe remains a technology and design leader, with strong adoption of premium, sustainable, and precision-engineered pull-out systems.

- OEM supply channels account for the largest sales share, reflecting long-term contracts with modular kitchen and furniture manufacturers.

- Soft-close and heavy-duty pull-out baskets are gaining traction as consumers prioritize durability, convenience, and noise-free operation.

What are the latest trends in the pull-out basket market?

Premiumization and Soft-Close Technology Adoption

The pull-out basket market is witnessing a strong shift toward premium products featuring soft-close rails, silent motion systems, and higher load-bearing capacities. Consumers increasingly associate pull-out baskets with kitchen aesthetics, durability, and long-term convenience rather than basic utility. Manufacturers are focusing on precision-engineered slides, corrosion-resistant coatings, and sleek finishes such as matte black and brushed steel. This trend is particularly pronounced in Europe and North America, where renovation-driven demand favors high-performance and visually appealing storage systems.

Integration with Smart and Modular Furniture Systems

Another emerging trend is the integration of pull-out baskets into smart and modular furniture ecosystems. While still a niche segment, automated and sensor-enabled pull-out systems are gaining attention in premium residential projects and luxury kitchens. These systems enhance accessibility and ergonomics, especially for elderly users and compact urban homes. Modular kitchen brands are increasingly offering pull-out baskets as standardized components, driving volume growth and reinforcing the shift toward factory-fitted storage solutions.

What are the key drivers in the pull-out basket market?

Growth of Modular Kitchens and Space-Optimized Living

The global expansion of modular kitchens is a primary driver of pull-out basket demand. Urban households increasingly require efficient storage solutions to maximize limited living space. Pull-out baskets offer organized access, improved visibility, and better utilization of cabinet depth, making them an essential component of modern kitchen layouts. This driver is especially strong in Asia-Pacific, where compact apartments and rapid urbanization are reshaping interior design preferences.

Rising Home Renovation and Remodeling Activity

In mature markets such as North America and Western Europe, renovation and remodeling projects significantly contribute to market growth. Homeowners are upgrading traditional cabinets with modern pull-out systems to enhance functionality and aesthetics. Rising disposable incomes and lifestyle-driven spending on interiors are further reinforcing replacement demand for pull-out baskets across kitchens, wardrobes, and utility spaces.

Increasing Demand from Commercial and Hospitality Segments

Commercial applications, including hotels, offices, retail spaces, and institutional kitchens, are increasingly adopting pull-out baskets to improve storage efficiency and operational ergonomics. Standardized furniture solutions in hospitality and corporate offices are supporting steady growth in this segment, complementing strong residential demand.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuating prices of key raw materials such as steel and aluminum pose a significant restraint for pull-out basket manufacturers. These materials directly influence production costs, pricing strategies, and profit margins. Frequent price volatility limits long-term pricing stability, particularly for manufacturers supplying OEMs under fixed-price contracts.

Price Sensitivity in Emerging Markets

Despite strong demand growth, price sensitivity in emerging economies remains a challenge. Low-cost local manufacturers and unorganized players offer basic pull-out baskets at significantly lower prices, limiting the penetration of premium products. This intensifies competition and pressures margins for established global brands operating in cost-conscious markets.

What are the key opportunities in the pull-out basket industry?

Smart and Automated Storage Solutions

The growing adoption of smart homes presents opportunities for automated and sensor-enabled pull-out baskets. While currently limited to premium segments, smart pull-out systems offer differentiation through enhanced convenience, accessibility, and integration with connected kitchen ecosystems. Early investment in this segment can help manufacturers capture high-margin demand as adoption scales.

Expansion in Emerging Residential Markets

Rapid residential construction in emerging economies such as India, Vietnam, Indonesia, Brazil, and Mexico offers significant growth potential. Government-led housing initiatives and rising middle-class incomes are accelerating the adoption of modular kitchens, directly benefiting pull-out basket demand. Localized manufacturing and cost-optimized product portfolios provide strong entry opportunities for both existing players and new entrants.

Product Type Insights

Wire pull-out baskets dominate the global market, accounting for approximately 38% of total revenue in 2024 due to their affordability, durability, and widespread application. Stainless steel and aluminum pull-out baskets are gaining share in premium segments, driven by corrosion resistance and aesthetic appeal. Wooden and hybrid material baskets cater to high-end interior designs, particularly in Europe and luxury residential projects, while smart and automated systems represent a small but fast-growing niche.

Application Insights

Kitchen cabinets represent the largest application segment, contributing nearly 61% of global market revenue in 2024. This dominance reflects the essential role of pull-out baskets in modern kitchen storage. Wardrobes and closets form the second-largest segment, driven by demand for organized clothing and accessory storage. Bathroom vanities, utility rooms, and commercial furniture applications are steadily expanding as storage optimization gains importance across diverse interior spaces.

Distribution Channel Insights

OEM supply channels lead the pull-out basket market, accounting for approximately 46% of total sales, supported by long-term contracts with modular kitchen and furniture manufacturers. Specialty hardware stores remain important for replacement and retrofit demand, while online direct-to-consumer channels are growing rapidly due to increased digital purchasing and customization options. Project-based sales linked to real estate developments are also gaining traction, particularly in large residential and hospitality projects.

End-Use Insights

The residential segment dominates global demand with nearly 68% market share in 2024, driven by housing construction and renovation activity. Commercial end use, including hospitality and offices, is growing steadily as standardized furniture solutions gain adoption. Industrial and institutional applications remain niche but offer stable demand for heavy-duty pull-out systems in kitchens, laboratories, and storage-intensive facilities.

| By Product Type | By Installation Type | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global pull-out basket market with approximately 41% market share in 2024. China and India are the largest contributors, supported by massive residential construction, modular kitchen adoption, and strong domestic manufacturing. India is the fastest-growing country in the region, driven by urban housing demand and rising middle-class spending on home interiors.

Europe

Europe accounts for around 27% of global demand, led by Germany, Italy, and the U.K. The region is characterized by a strong preference for premium, sustainable, and precision-engineered pull-out systems. European manufacturers also play a key role in technological innovation and exports.

North America

North America represents approximately 22% of the global market, with the U.S. as the primary contributor. Demand is largely renovation-driven, with homeowners upgrading kitchens and storage systems to modern, high-performance pull-out solutions.

Latin America

Latin America holds a smaller but growing share, driven by residential construction in Brazil and Mexico. Rising urbanization and the gradual adoption of modular kitchens are supporting steady growth.

Middle East & Africa

The Middle East and Africa region is experiencing moderate growth, supported by real estate development in the UAE and Saudi Arabia. Hospitality and luxury residential projects are key demand drivers, while Africa remains an emerging market with long-term potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pull-Out Basket Market

- Blum Group

- Hettich

- Häfele

- Grass GmbH

- Salice

- Kesseböhmer

- FGV

- Vauth-Sagel

- Sugatsune

- King Slide

- SISO Denmark

- Taiming

- Oulin

- ITW Proline

- Samet