Organic Personal Care Ingredients Market Size

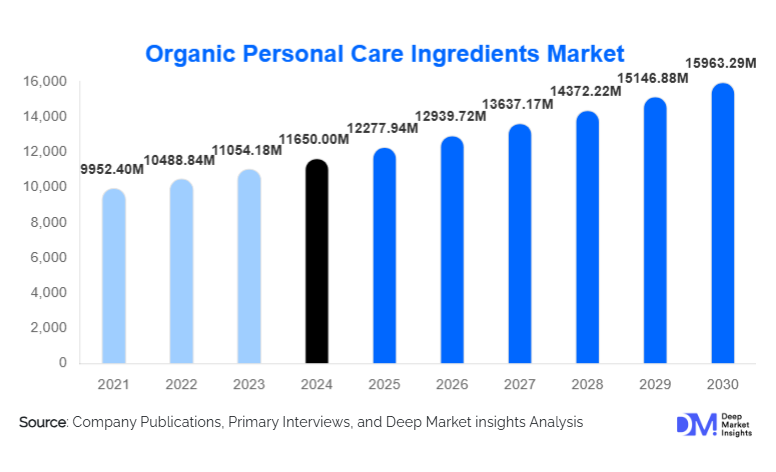

According to Deep Market Insights, the global organic personal care ingredients market size was valued at USD 11,650.00 million in 2024 and is projected to grow from USD 12,277.94 million in 2025 to reach USD 15,963.29 million by 2030, expanding at a CAGR of 5.39% during the forecast period (2025–2030). Growth is fueled by rising demand for clean-label formulations, increasing adoption of natural cosmetics, tightening global regulations around synthetic ingredients, and the rapid expansion of the premium skincare and haircare segments worldwide.

Key Market Insights

- Consumer preference for natural, safe, and transparent formulations is accelerating global demand for certified organic emollients, preservatives, botanical extracts, and fermentation-derived actives.

- Europe remains the largest market, driven by COSMOS and Ecocert certification, long-standing natural beauty culture, and strict regulatory frameworks guiding ingredient selection.

- Asia-Pacific is the fastest-growing region, benefiting from expanding manufacturing capacity, rising middle-class beauty spending, and a cultural shift toward herbal and plant-derived formulations.

- Biotechnology and fermentation-based ingredient production are transforming product innovation, enabling replacements for silicones, petrochemical surfactants, and synthetic preservatives.

- Direct supplier–manufacturer partnerships dominate procurement, as brands seek traceability, reduced contamination risks, and verified certification compliance.

- Global clean beauty trends, sustainability commitments, and carbon-neutral sourcing goals are reshaping product portfolios among major manufacturers.

What are the latest trends in the organic personal care ingredients market?

Biotechnology-Enabled Natural Ingredient Development

Biotechnology is becoming a cornerstone for innovation in organic personal care ingredients. Fermentation-derived hyaluronic acid, peptides, natural preservatives, and bio-based surfactants are increasingly used to replace conventional synthetic materials. These ingredients offer higher purity, consistent quality, and sustainability advantages, enabling brands to meet rising consumer expectations. Manufacturers are investing in microbial fermentation platforms, enzymatic extraction processes, and strain engineering to develop high-performance organic actives that deliver clinically proven results. This trend is reshaping premium skincare, anti-aging, and dermatology-focused formulations, establishing biotech-based organics as one of the fastest-growing subsegments.

Sustainable and Circular Ingredient Sourcing

Ingredient suppliers are moving toward circular production systems, utilizing upcycled botanicals, agricultural waste streams, and renewable energy-powered extraction. Upcycled AHAs from fruit waste, antioxidant-rich grape seed extracts from winery by-products, and essential oils derived from leftover plant biomass are gaining traction. Brands are increasingly promoting sustainability credentials in marketing, emphasizing carbon-neutral manufacturing, traceability platforms, and eco-friendly sourcing certifications. This shift aligns with broader ESG and corporate sustainability goals, reinforcing consumer trust and improving ingredient availability while reducing environmental impact.

What are the key drivers in the organic personal care ingredients market?

Rising Global Demand for Clean and Transparent Beauty

Consumers are actively seeking products formulated without synthetic chemicals, parabens, sulfates, silicones, or artificial preservatives. The growing awareness of skin sensitivities, endocrine disruptors, and environmental impacts is pushing brands toward certified organic ingredients. Organic emollients, botanical extracts, and essential oils have become foundational elements of premium and mass-market beauty portfolios. Major retailers have introduced clean beauty standards, accelerating compliance and expanding the market for organic-certified inputs.

Regulatory Pressure Supporting Organic Ingredient Adoption

Regulations in Europe, North America, and parts of Asia are tightening restrictions on synthetic cosmetics ingredients, promoting safer alternatives. COSMOS, NATRUE, and USDA Organic certifications have become influential in defining ingredient acceptance globally. This regulatory push encourages brand reformulation strategies, boosting the use of natural preservatives, biodegradable surfactants, and plant-derived actives. Governments are also incentivizing organic farming, green chemistry research, and sustainable production methods, further stimulating market growth.

What are the restraints for the global market?

High Costs of Organic Ingredient Production

Organic-certified ingredients typically cost 30–70% more than their synthetic equivalents due to complex certification processes, agricultural limitations, and lower crop yields. Manufacturers in price-sensitive markets face challenges in incorporating high-cost inputs into mainstream product lines. Premium pricing restricts adoption among mass-market brands and slows penetration in developing regions.

Raw Material Supply Vulnerabilities

Organic ingredient production heavily depends on agricultural output, making it vulnerable to climate change, seasonal variability, and supply chain disruptions. Shortages of lavender, shea butter, chamomile, and other popular botanicals frequently cause price volatility. Certification delays and inconsistent global availability also challenge manufacturers seeking stable procurement.

What are the key opportunities in the organic personal care ingredients industry?

Biotech-Driven Active Ingredient Expansion

Fermentation-based actives, natural peptides, and microbiome-friendly ingredients provide a major opportunity for differentiation in premium skincare. These high-efficacy organic actives appeal strongly to dermatology-focused brands and clinical beauty formulations. Companies investing in precision fermentation and enzymatic processing stand to gain substantial market share.

Scaling in Fast-Growth APAC Beauty Manufacturing Hubs

APAC markets such as China, India, and South Korea are rapidly expanding organic personal care production capacity. Local ingredient cultivation, cost-effective extraction capabilities, and supportive government incentives encourage new entrants. Partnerships with organic farming cooperatives and herbal medicine ecosystems present strong opportunities to secure raw materials while reducing production costs and lead times.

Product Type Insights

Organic emollients dominate the market, accounting for approximately 26% of total ingredient demand. Their multifunctional benefits—including moisturization, skin barrier repair, and compatibility with both skincare and haircare formulations—make them indispensable for clean beauty products. Plant oils such as argan, jojoba, coconut, and almond remain top sellers due to their strong consumer recognition and natural efficacy. Organic active ingredients form the second-largest category, driven by surging demand for botanical extracts, antioxidants, fruit-derived AHAs, and anti-aging compounds. Organic preservatives are one of the fastest-growing segments, supported by greater scrutiny of synthetic preservatives and rising consumer preference for essential-oil-based alternatives and fermentation-derived protection systems.

Application Insights

Skin care applications hold the largest share at 41% of the total market. Growing demand for natural anti-aging, brightening, hydrating, and sensitive-skin formulations is fueling the adoption of organic actives and plant-based emollients. The hair care segment is expanding quickly as sulfate-free, silicone-free, and botanical-based products become mainstream worldwide, increasing the consumption of natural surfactants and conditioning agents. Cosmetics, including foundations, lip products, and eye formulations, are integrating more plant-based pigments, waxes, and oils to meet clean beauty standards. Baby care products are also adopting organic ingredients due to heightened consumer concerns about safety and minimal skin irritation.

Distribution Channel Insights

Direct ingredient supplier-to-manufacturer sales dominate the organic personal care ingredients market, accounting for over 62% of distribution. This channel ensures full traceability, certification validation, and quality control, which are critical for clean beauty brands. Specialty chemical distributors focusing exclusively on natural-certified ingredients are growing, especially in APAC and Europe, providing regional accessibility. Online ingredient marketplaces are emerging for small and mid-sized formulators, though still representing a small share due to certification complexity and authenticity concerns.

End-Use Industry Insights

Personal care manufacturers represent the largest end-use segment, comprising around 48% of total demand. The rise of natural skincare, organic haircare, and wellness-driven product development drives heavy consumption of plant-based oils, botanical extracts, organic surfactants, and natural preservatives. The cosmetics industry is accelerating its shift toward organic colorants and waxes, particularly for lip and eye products. Pharmaceutical dermatology and cosmeceutical brands increasingly rely on natural actives with clinically validated benefits. Contract manufacturing organizations (CMOs) in India, South Korea, and Europe are experiencing rapid growth, becoming major purchasers of certified organic ingredients for global clean beauty brands.

| By Ingredient Type | By Application | By Certification Type | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global market. The U.S. drives demand through its large clean beauty ecosystem and strong adoption of premium organic skincare. Canada shows growing preference for COSMOS-certified and vegan formulations, aided by strict ingredient transparency regulations. The region emphasizes high-performance natural actives and biotech-enhanced organic ingredients.

Europe

Europe leads the global market with a 32% share in 2024. Germany, France, and the U.K. are major consumers, driven by stringent regulations, strong certification cultures, and long-standing natural product awareness. France is the largest consumer of botanical extracts, while Germany dominates sustainable haircare and dermo-cosmetics. Growing retail demand for Ecocert and NATRUE-certified formulations continues to propel ingredient imports from APAC and Latin America.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at 11–12% annually. China and India anchor large-scale manufacturing, supported by cost-efficient sourcing of plant materials. South Korea and Japan drive premium organic cosmetics innovation, focusing on fermentation technologies and microbiome-friendly ingredients. Expanding middle-class spending and social media-driven beauty adoption significantly boost regional consumption.

Latin America

Latin America’s demand is increasing steadily, with Brazil leading due to its biodiversity-rich ecosystem and vibrant natural cosmetics sector. Export-driven ingredient supply chains for organic oils and botanical extracts support regional growth. Mexico and Argentina are emerging markets adopting clean-label beauty trends.

Middle East & Africa

MEA shows rising interest in premium organic beauty, led by the UAE, Saudi Arabia, and South Africa. Demand is concentrated in luxury retail segments, focusing on organic fragrances, essential oils, and natural skincare. Africa also acts as a raw material hub for shea butter, essential oils, and plant extracts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Organic Personal Care Ingredients Market

- BASF SE (Care Creations)

- Croda International

- Ashland Global

- Clariant AG

- Evonik Industries

- Symrise AG

- Givaudan Active Beauty

- Lubrizol Life Science

- DSM-Firmenich

- Lonza Specialty Ingredients

- Kemin Industries

- Seppic

- Beraca

- AAK

- AkzoNobel (Natural Ingredient Portfolio)

Recent Developments

- In March 2025, Croda International expanded its plant-based emollient production line in Europe, integrating renewable energy and carbon-neutral processing technologies.

- In January 2025, Givaudan launched a new range of fermentation-derived natural actives aimed at premium anti-aging skincare formulations.

- In April 2025, BASF Care Creations partnered with regenerative farming cooperatives in Brazil to scale up sustainable sourcing of botanical extracts.