Organic Mascara Market Size

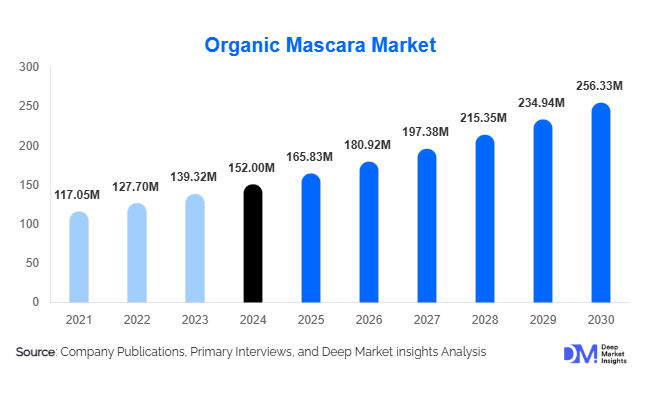

According to Deep Market Insights, the global organic mascara market size was valued at USD 152.00 million in 2024 and is projected to grow from USD 165.83 million in 2025 to reach USD 256.33 million by 2030, expanding at a CAGR of 9.1% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness about the harmful effects of synthetic chemicals, growing demand for clean and vegan beauty products, and the rapid expansion of e-commerce and direct-to-consumer channels, enabling global reach of organic cosmetics.

Key Market Insights

- Consumers are increasingly shifting toward chemical-free and natural formulations, boosting the adoption of organic mascaras that offer both cosmetic enhancement and skin-safe benefits.

- Premium and mid-range organic mascaras are expanding globally, with high-quality natural ingredients and certifications enhancing brand credibility and attracting health-conscious consumers.

- North America dominates the market, with the U.S. and Canada driving demand due to high disposable incomes, strong beauty consciousness, and preference for certified organic products.

- Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea, driven by rising urbanization, social media influence, and increasing willingness to adopt premium organic cosmetics.

- Technological integration, including e-commerce platforms, digital marketing, and influencer-led campaigns, is transforming consumer engagement and market penetration.

What are the latest trends in the organic mascara market?

Clean and Natural Beauty Trends

Consumers globally are moving away from conventional mascaras containing parabens, sulfates, and synthetic dyes. The preference for plant-based and mineral-derived ingredients is growing, with certifications such as Ecocert, USDA Organic, and Vegan Society driving trust. Brands are responding with multifunctional organic mascaras offering volumizing, lengthening, and lash-conditioning benefits. Vegan formulations, cruelty-free testing, and eco-friendly packaging are becoming key differentiators that shape consumer buying decisions.

Rise of Digital and E-commerce Channels

Online platforms have emerged as the primary distribution channel, accounting for approximately 45% of the global market share in 2024. Consumers rely on online reviews, influencer recommendations, and subscription-based models to explore new organic mascaras. Brands are leveraging AI-driven recommendations, targeted social media campaigns, and influencer collaborations to enhance engagement. This shift toward e-commerce has particularly accelerated adoption in emerging markets such as APAC and LATAM, where offline availability of organic mascaras is limited.

What are the key drivers in the organic mascara market?

Rising Consumer Awareness of Clean Beauty

Growing awareness of the adverse effects of chemical-laden cosmetics is fueling the demand for organic mascaras. Approximately 45% of mascara users in North America and Europe prefer organic options, creating strong growth opportunities for certified and 100% natural products. Consumers are increasingly seeking safe, hypoallergenic, and vegan options that support both beauty and skin health.

Innovative Product Formulations

Companies are introducing multifunctional mascaras that provide volumizing, lengthening, and lash-conditioning benefits while using plant-based ingredients. Fiber mascaras, tinted organic variants, and hybrid formulations combine cosmetic performance with natural care, allowing brands to command premium pricing and increase adoption.

Expansion of Online and Direct-to-Consumer Channels

Brands adopting D2C models and e-commerce platforms have increased accessibility, particularly in underserved markets. Subscription services, personalized packaging, and social media-driven marketing are enabling global reach, driving growth in emerging markets such as China, India, and Brazil.

What are the restraints for the global market?

Higher Product Costs

Organic mascaras are typically priced 30–50% higher than conventional variants, limiting adoption among price-sensitive consumers, particularly in emerging markets. Higher raw material costs and certification expenses contribute to this price premium.

Limited Offline Availability

Although e-commerce penetration is strong, the limited presence of organic mascaras in smaller cities and rural areas restricts growth potential. Consumers still prefer testing products before purchase, making retail visibility crucial.

What are the key opportunities in the organic mascara industry?

Innovative Natural Ingredient Formulations

Brands can differentiate themselves by adopting new natural ingredients like jojoba oil, aloe vera, and shea butter while incorporating sustainable sourcing and bio-fermentation technologies. High-performance, multifunctional mascaras appeal to health-conscious and eco-conscious consumers globally.

Regional Market Expansion

Emerging markets such as China, India, Brazil, and the Middle East are seeing growing disposable incomes, urbanization, and beauty awareness. Expanding into these regions, coupled with supportive government incentives for local manufacturing, provides significant growth opportunities for both existing players and new entrants.

Direct-to-Consumer and Digital Strategies

D2C models, subscription boxes, and influencer-led campaigns allow brands to access niche consumer segments globally. Leveraging AI for personalization and targeted marketing can enhance conversion rates and loyalty, particularly among millennials and Gen Z consumers.

Product Type Insights

Volumizing organic mascaras lead the market, accounting for 35% of the 2024 share, driven by consumer demand for fuller lashes combined with chemical-free formulations. Lengthening mascaras and fiber-based variants are also growing, offering multifunctional benefits. Premium and mid-range mascaras dominate due to high-quality ingredients, certifications, and superior performance.

Application Insights

The individual consumer segment represents the largest end-use, contributing 65% of the 2024 market. Professional salons and spas are increasingly adopting organic mascaras for premium client services, while gift packs and seasonal promotional bundles are gaining traction in North America and Europe. Export-driven demand is growing, particularly from North America and Europe to emerging APAC markets.

Distribution Channel Insights

E-commerce channels dominate with 45% of the market share, driven by online marketplaces, brand websites, and subscription models. Offline retail in department stores, beauty stores, and pharmacies remains important, especially in mature markets. D2C strategies and influencer campaigns are reshaping consumer engagement and purchase behavior globally.

| By Product Type | By Formulation Type | By Price Tier | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 30% share in 2024. The U.S. and Canada drive growth due to high disposable income, mature beauty markets, and strong awareness of organic certifications. Consumers favor premium, cruelty-free, and vegan mascaras, making this region a stable growth hub.

Europe

Europe also accounts for 30% of the market, led by Germany, France, and the U.K. High regulatory standards, eco-conscious consumers, and established retail channels support organic mascara adoption. Emerging interest in multifunctional and certified organic products is further fueling growth.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and South Korea. Rising urbanization, social media influence, and expanding middle-class disposable incomes are encouraging premium and mid-range organic mascara adoption. CAGR in this region is expected to exceed 10% during 2025–2030.

Latin America

Brazil and Mexico are key markets, with moderate growth due to increasing beauty awareness and disposable income. Outbound demand for premium organic mascaras is rising among affluent consumers.

Middle East & Africa

The UAE and Saudi Arabia lead demand for luxury and premium organic mascaras. Intra-regional trade within Africa is also growing, with increasing adoption of eco-friendly and certified organic products among urban consumers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Organic Mascara Market

- L’Oréal

- Estée Lauder

- Maybelline

- Physicians Formula

- ILIA Beauty

- RMS Beauty

- Kjaer Weis

- Burt’s Bees

- Pacifica Beauty

- Honest Beauty

- 100% Pure

- Kosas

- Saie Beauty

- Alima Pure

- Ere Perez

Recent Developments

- In January 2025, ILIA Beauty launched a new fiber-based organic mascara with lash-conditioning benefits and 100% plant-derived pigments.

- In March 2025, L’Oréal expanded its organic mascara portfolio in Asia-Pacific, focusing on D2C and e-commerce channels in China and India.

- In May 2025, RMS Beauty introduced a multifunctional organic mascara combining volumizing, lengthening, and lash-strengthening properties with certified natural ingredients.