Online Printing Services Market Size

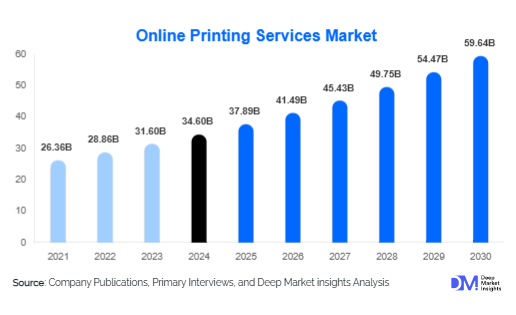

According to Deep Market Insights, the global Online Printing Services Market size was estimated at USD 34.6 billion in 2024 and is projected to grow from USD 37.89 billion in 2025 to reach USD 59.64 billion by 2030, expanding at a robust CAGR of 9.5% during the forecast period (2025–2030). The market growth is driven by rising demand for personalized printing, rapid e-commerce expansion, advanced digital printing technologies, and growing integration of cloud-based print-ordering platforms across both B2B and B2C segments.

Key Market Insights

- Digital printing technology dominates the market due to its flexibility, high-speed production, and capacity for mass customization and low-volume orders.

- Custom merchandise printing is the fastest-growing service category, fueled by e-commerce, influencer branding, gifting, and personalization trends.

- SMEs are the largest consumer segment, making up over 35% of demand due to branding, promotional, and packaging print requirements.

- Asia-Pacific is the fastest-growing regional market due to small business digitalization and rising e-commerce penetration.

- Eco-friendly and sustainable printing materials are gaining traction, particularly in Europe and North America.

- AI-driven design automation and 3D printing integration are reshaping the future of online printing services.

What are the latest trends in the Online Printing Services Market?

AI-Based Smart Design and Order Automation

Online printing platforms are increasingly using AI-driven tools for layout creation, template personalization, and real-time design adjustment across a wide range of products, from business cards and brochures to labels and packaging. These tools suggest fonts, colors, formats, and image placements automatically based on the user's niche, brand guidelines, and past design behavior, reducing reliance on professional designers. Additionally, automated pricing engines, print simulation tools, and order tracking systems enhance customer experience by providing instant quotations, visual proofs, and delivery updates. Recommendation engines also cross-sell complementary items such as matching envelopes, stickers, or inserts. AI-based product personalization, such as unique packaging designs, wedding invitations, branded apparel, and photo books, is making customization more cost-efficient and scalable, especially for SMEs and individuals who require frequent low-volume, quick-turnaround orders without complex design workflows.

Shift Toward Sustainable Printing Solutions

Growing environmental awareness and strict regulatory standards are reshaping the printing industry, particularly in packaging and commercial print applications. Manufacturers are adopting eco-friendly inks, recyclable or recycled papers, water-based coatings, and sustainable packaging materials to comply with corporate ESG commitments and regional regulations. Printed products now often include carbon neutrality certifications, FSC-compliant substrates, and explicit recyclability information, making sustainability a visible part of the value proposition. European and North American consumers show a 20–30% higher preference for eco-certified printing options, and many large enterprises now mandate green specifications in their print procurement. This trend has accelerated investments in green printing technologies, waste reduction mechanisms, closed-loop paper recovery, and energy-efficient digital printing operations, resulting in lower lifecycle emissions and more transparent sustainability reporting across the online printing supply chain.

What are the key drivers in the Online Printing Services Market?

Expansion of E-commerce and D2C Brands

The proliferation of D2C startups, subscription boxes, and digital-first brands has significantly boosted demand for printed packaging, labels, merchandise, inserts, and promotional materials tailored to smaller, more frequent batches. Online platforms offering integrated printing solutions compatible with Shopify, Etsy, Amazon, WooCommerce, and other commerce backends are capturing strong B2B demand by enabling automated order flows and print-on-demand capabilities directly from storefronts. Rapid order processing, custom packaging with brand-specific designs, and scalable print-on-demand services are now essential for online retailers seeking to differentiate unboxing experiences and manage inventory efficiently. As more brands move away from generic packaging toward custom-branded materials, online printing providers that offer API connectivity, dynamic pricing, and multi-location fulfillment gain a structural advantage, driving long-term market growth.

Growing Demand for Personalized Printing

Consumers increasingly prefer unique, personalized products, such as custom stationery, apparel, event kits, photo calendars, wall art, and business merchandise that reflect individual or brand identity. This consumer shift toward individualized brands has improved revenue prospects for online print providers, especially those offering low-volume, quick turnaround print orders with digital previews and high design flexibility across multiple SKUs. Variable data printing enables names, messages, and graphics to change from unit to unit without resetting the press, making personalization economically viable for small batches. The rise of social media, influencer marketing, and gifting culture further amplifies this trend, as customers expect visually distinctive, “shareable” physical products that reinforce online branding and campaigns.

What are the restraints for the global market?

High Competitive Pressure and Price Sensitivity

The online printing landscape is fragmented, with numerous global, regional, and niche service providers offering overlapping product portfolios, causing price wars and reducing average profit margins. Customers frequently use comparison sites and platform marketplaces to benchmark rates, templates, delivery speed, and discount offers, leading to commoditization in widely available products like business cards, flyers, and basic labels. This high price sensitivity forces many providers to compete primarily on discounts and promotions rather than differentiated value, making it challenging to recover technology and marketing investments. As a result, smaller firms without scale advantages struggle to sustain margins, while larger players are compelled to optimize operations aggressively to maintain profitability.

Logistics and Quality Control Challenges

Maintaining consistent print quality across regions and managing shipment delays, damage, and returns remain key challenges in online printing, particularly when servicing cross-border orders. Ensuring color accuracy, substrate quality, and print durability for custom orders requires standardized color management systems, calibrated equipment, and rigorous quality checks at each production site. At the same time, reliance on third-party couriers and complex last-mile logistics adds variability in delivery times, packaging integrity, and overall customer satisfaction. To mitigate these issues, providers must invest in distributed print networks, local production partnerships, and advanced order-routing algorithms, all of which increase operational complexity and capital requirements.

What are the key opportunities in the Online Printing Services Market?

AI-Integrated Printing and Smart Personalization

Artificial intelligence can reshape the printing process with intelligent design tools, automated color management, customized packaging renders, and AI-enabled customer preference tracking that learns from past orders and browsing behavior. Platforms can use AI to recommend optimal product configurations, bundle related items, and pre-populate templates with brand assets, reducing design time and increasing order conversion. Smart personalization increases conversion rates and customer retention by delivering highly relevant designs and offers, creating long-term growth opportunities for print service platforms that integrate AI into both front-end customer interfaces and back-end production planning. Over time, predictive analytics can also optimize capacity utilization and inventory planning for substrates and consumables.

Eco-Friendly Print Solutions and Green Certifications

Sustainability-focused printing, using biodegradable inks, recycled paper, low-VOC coatings, and energy-efficient processes, is emerging as a premium niche with strong corporate and institutional demand. Companies achieving global certifications such as FSC, PEFC, and carbon-neutral print labeling can target environmentally conscious corporate clients, retailers, and public-sector buyers who increasingly include sustainability criteria in tenders and vendor selection. This opens opportunities for long-term contracts, higher-value packaging projects, and preferred-supplier status. Online platforms that clearly communicate environmental attributes in product configurators and provide carbon footprint data per order can further differentiate themselves and capture growing ESG-driven budgets.

Product Type Insights

Custom merchandise printing holds the largest share (22%) due to rising demand for personalized gifts, branded apparel, corporate merchandise, and influencer products sold through online stores and social platforms. It offers higher margins and faster repeat orders compared to traditional print categories like brochures or flyers, as designs are frequently refreshed to support campaigns, seasons, or product launches. Packaging material printing is also rapidly growing due to the booming e-commerce sector, where custom boxes, mailers, stickers, and inserts are used to enhance brand visibility and customer experience. Photo printing remains popular among individuals for wedding albums, wall art, and travel photo books, supported by increased smartphone photography and seamless photo uploads from cloud galleries and social media.

Application Insights

Commercial printing dominates with 41% market share, driven by demand for corporate branding materials, marketing collateral, catalogs, event displays, signage, training manuals, and internal communication tools. Recurring orders from businesses ensure stable volume and long-term relationships for online providers. Packaging printing is expanding quickly, catering to e-commerce, cosmetics, food, and consumer electronics brands that increasingly use custom-printed packaging as a branding touchpoint. Personalized consumer printing, including photo books, invitations, event kits, and custom gifts, is seeing strong demand momentum, especially around seasonal peaks such as holidays, weddings, and festivals, contributing to a more diversified revenue mix for platforms.

Distribution Channel Insights

Web-based platforms account for nearly 66% of the market, offering real-time previews, drag-and-drop design tools, template libraries, and doorstep delivery through integrated logistics partners. These platforms enable easy reordering and multi-user access for corporate accounts. Mobile application-based printing is gaining traction for on-the-go photo printing, business card orders, and quick reprints, particularly among freelancers and small business owners who manage their branding assets from smartphones. Corporate licensing models with cloud-based print portals are increasingly used by large enterprises and franchises for consistent branding, controlled artwork libraries, approval workflows, and centralized bulk procurement across multiple locations.

End User Insights

SMEs represent 35% of demand due to their need for affordable branding, packaging, point-of-sale materials, and promotional printing that can be ordered in small batches as business grows. Individual consumers are a rapidly growing segment, driven by gifting trends, event-based customization, and social media-driven personalization of lifestyle products. Large enterprises rely on standardized procurement, subscription-based printing, and specialized packaging solutions for marketing campaigns, product launches, and corporate communications, often requiring strict brand compliance and just-in-time deliveries. Educational institutions, government agencies, and non-profits also contribute to the recurring demand for certificates, educational materials, reports, and awareness campaign collateral.

| By Service Type | By Printing Technology | By End User | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 32% of the market share, led by the U.S., with strong adoption of digital printing, promotional printing for businesses, and advanced packaging customization for D2C brands and subscription services. A high concentration of e-commerce operators, marketing agencies, and technology-savvy SMEs supports sustained demand for online print ordering. Canada follows with growing demand for eco-friendly print solutions, bilingual marketing materials, and government-led digital infrastructure projects that require large volumes of printed communication and signage. The region also sees early adoption of AI, web-to-print automation, and omnichannel marketing integration.

Europe

Europe captures 27% of the market, driven by Germany, the UK, France, and Italy, which collectively host a strong manufacturing, retail, and packaging base. The region emphasizes sustainable print solutions, recycled packaging, and carbon-neutral print operations due to strict environmental regulations and mature ESG frameworks. Luxury packaging and premium print products are trending strongly in Western Europe, particularly in cosmetics, fashion, and gourmet food sectors. Online printing providers in Europe frequently differentiate through design quality, sustainability credentials, and localized language support across multiple markets.

Asia-Pacific

Asia-Pacific is the fastest-growing region (CAGR 11.2%) with booming SME activity, affordable digital printing, and e-commerce-led packaging demand across China, India, Southeast Asia, and Australia. China and India are emerging as manufacturing and export hubs for printed merchandise and packaging, supplying both domestic and international markets. Japan and South Korea lead in technology-driven print solutions, integrating automation, robotics, and advanced inkjet technologies into production. Rapid urbanization, rising disposable incomes, and the growth of regional marketplaces such as Lazada, Shopee, and Flipkart further accelerate the need for branded packaging and promotional printing.

Latin America

Brazil and Mexico are experiencing gradual growth, with rising demand from local retail, FMCG, and e-commerce industries looking to professionalize branding and packaging. Government policies supporting SME digitalization and entrepreneurship are encouraging the adoption of online printing services as businesses shift away from informal, non-branded materials. While price sensitivity remains high, there is increasing interest in customized labels, promotional print, and localized packaging prints for domestic consumption.

Middle East & Africa

The UAE and Saudi Arabia lead regional demand, driven by government modernization programs, trade events, tourism, and luxury retail that require high-quality promotional and packaging printing. Large infrastructure and smart city projects increase the need for signage, wayfinding systems, and corporate communication materials. South Africa and Kenya are showing growing demand for corporate printing, educational sector materials, and NGO-led communication campaigns. As digital adoption rises and logistics networks strengthen, more businesses in the region are expected to shift from traditional offline printers to integrated online printing platforms.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online Printing Services Market

- Vistaprint (Cimpress plc)

- Shutterfly LLC

- Printful

- Avery Dennison

- Snapfish

- GotPrint

- Zazzle Inc.

- Moo Print Ltd.

- Printify

- FedEx Office

- 4over Inc.

- Staples Print Solutions

- Laser Printing Inc.

- Photobox Group

- Overnight Prints

Recent Developments

- In October 2024, Printful announced AI-enabled design customization and AR-based product previews for apparel and merchandise orders.

- In July 2024, Vistaprint launched carbon-neutral printing options for European clients using FSC-certified paper and recyclable packaging.

- In March 2024, Avery Dennison invested in digital labeling technology to support sustainable packaging across the food and pharmaceutical industries.