Online Photo Printing Market Size

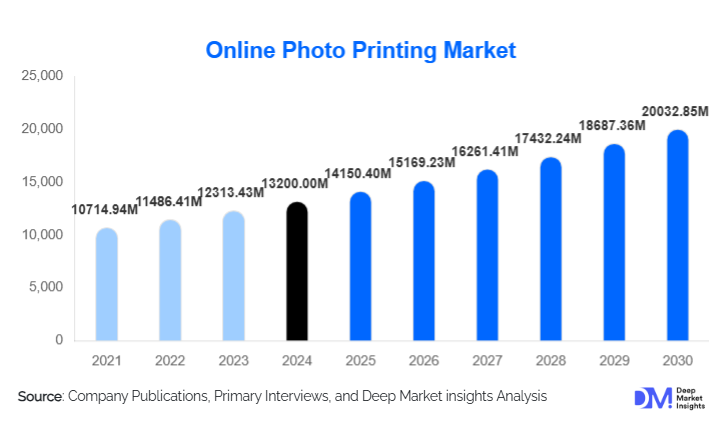

According to Deep Market Insights, the global online photo printing market size was valued at USD 13,200.00 million in 2024 and is projected to grow from USD 14,150.40 million in 2025 to reach USD 20,032.85 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is primarily driven by the rising penetration of smartphones and digital photography, increasing demand for personalized photo products, and rapid adoption of mobile-first e-commerce platforms. The shift from traditional in-store photo printing toward online and app-based ordering has significantly expanded market reach, while premiumization trends in photo books, wall décor, and customized gifting continue to boost average order values globally.

Key Market Insights

- Personalized photo products are replacing standard prints, with higher-margin photo books, wall art, and gifts gaining popularity.

- Mobile applications dominate ordering behavior, accounting for over 60% of global online photo print orders.

- North America leads global revenue share, supported by high disposable income anda mature e-commerce infrastructure.

- Asia-Pacific is the fastest-growing region, driven by expanding middle-class populations and smartphone adoption in China and India.

- Corporate and B2B demand is rising steadily, particularly for branded merchandise, employee gifting, and promotional printing.

- Technology adoption, including AI-based photo enhancement and automated design tools, is improving customer experience and conversion rates.

What are the latest trends in the online photo printing market?

Premiumization and Emotional Gifting

The market is witnessing a clear shift toward premium, emotionally driven products such as hardcover photo books, canvas prints, metal prints, and customized gifts. Consumers increasingly associate printed photos with memory preservation and gifting for life events such as weddings, travel, birthdays, and anniversaries. This trend has enabled companies to offset pricing pressure in standard photo prints by focusing on differentiated, design-led offerings with higher profit margins. Seasonal gifting occasions and subscription-based photo book models are further reinforcing demand.

AI-Driven Design and Automation

Artificial intelligence is transforming the online photo printing experience by simplifying product creation. AI-powered tools automatically select the best photos, optimize layouts, enhance image quality, and suggest personalized product designs. These capabilities reduce user effort, shorten order completion time, and improve conversion rates, particularly for mobile users. Automation in printing workflows and fulfillment is also reducing turnaround times and operational costs, enabling faster delivery and scalable growth.

What are the key drivers in the online photo printing market?

Growth of Smartphone Photography and Social Media

The exponential rise in smartphone usage and social media content creation has significantly increased the volume of digital images captured globally. Consumers are increasingly seeking tangible ways to preserve and showcase digital memories, driving demand for photo prints, books, and décor. The emotional value attached to physical photographs continues to support long-term market growth despite the availability of digital storage alternatives.

Expansion of E-Commerce and Mobile-First Platforms

Rapid growth in e-commerce infrastructure and mobile payment ecosystems has made online photo printing more accessible and convenient. Mobile applications now offer seamless photo uploads, real-time previews, and doorstep delivery, encouraging impulse purchases and repeat ordering. This driver is particularly strong in emerging markets, where mobile commerce adoption is accelerating faster than desktop-based retail.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

While demand for personalized photo products is growing globally, price sensitivity remains a key challenge in developing regions. High logistics costs, import duties on printing materials, and limited purchasing power restrict the adoption of premium photo products, potentially slowing revenue growth in these markets.

Digital Substitution Risk

The increasing reliance on cloud storage, social media galleries, and digital photo frames poses a long-term substitution risk to physical photo printing. Although emotional and gifting-driven demand mitigates this threat, companies must continuously innovate to maintain consumer relevance.

What are the key opportunities in the online photo printing industry?

Emerging Market Expansion and Localization

Asia-Pacific, Latin America, and parts of the Middle East present strong growth opportunities due to rising disposable incomes and expanding digital ecosystems. Establishing localized printing hubs, vernacular-language platforms, and region-specific product offerings can significantly enhance market penetration. Countries such as India, Indonesia, Brazil, and Mexico are expected to drive incremental demand over the next decade.

Corporate and B2B Photo Printing Solutions

Corporate demand for customized photo merchandise is growing across industries such as real estate, education, hospitality, and events. Platforms offering bulk ordering, brand customization, and enterprise integrations can unlock recurring revenue streams and higher margins compared to consumer-only models.

Product Type Insights

Photo prints remain the largest product category in the online photo printing market, accounting for approximately 38% of global revenue in 2024. Their dominance is driven by high-order frequency, affordability, and continued demand for everyday prints such as 4x6 and 5x7 formats. Photo prints benefit from repeat consumer behavior, particularly for family photos, travel memories, and casual gifting, making them a volume-driven revenue anchor for most platforms.

Photo books represent the fastest-growing product segment, holding nearly 27% market share, supported by rising demand for premium, personalized gifting and memory preservation. The growth of this segment is driven by higher disposable incomes, emotional consumption patterns, and increasing use of photo books for weddings, anniversaries, and milestone events. Advanced design tools, lay-flat binding, and premium cover materials have positioned photo books as a high-margin category globally.

Order Platform Insights

Mobile application-based platforms dominate the market, accounting for an estimated 62% share of total online photo printing orders in 2024. This leadership is driven by smartphone-centric consumer behavior, ease of photo access from mobile galleries, and intuitive app-based design interfaces. Features such as AI-powered auto-layouts, instant previews, and integrated digital payments have significantly improved conversion rates and repeat usage on mobile platforms.

Web-based platforms continue to play a critical role, particularly among professional photographers and corporate clients who require advanced customization, color calibration, and bulk ordering capabilities. Desktop platforms are also preferred for complex products such as multi-page photo books and large-format wall décor, where detailed design control and screen accuracy are essential.

End-Use Insights

Individual consumers remain the largest end-use segment, accounting for nearly 68% of global demand. This segment is primarily driven by personal memory preservation, life-event photography, and gifting behavior. Increasing emotional attachment to physical photo products, despite the growth of digital storage, continues to support sustained consumer demand. Professional photographers contribute consistent and stable demand for high-quality prints, albums, and portfolios. This segment prioritizes color accuracy, print durability, and premium materials, making it less price-sensitive and more quality-driven.

Corporate and commercial users represent the fastest-growing end-use segment, expanding at over 10% CAGR. Growth is driven by rising demand for branded photo merchandise, employee gifting programs, promotional materials, and real estate and hospitality applications. Enterprises increasingly favor online photo printing platforms for scalable customization and efficient bulk fulfillment.

| By Product Type | By Order Platform | By End Use | By Printing Technology | By Fulfillment Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global online photo printing market in 2024, led by the United States. Regional growth is driven by high disposable incomes, a mature e-commerce ecosystem, and a strong culture of personalized gifting. Consumers in this region exhibit high adoption of premium photo books and wall décor products, supported by widespread use of smartphones and advanced logistics infrastructure that enables fast delivery and subscription-based photo printing models.

Europe

Europe accounts for around 28% of global revenue, with Germany, the U.K., and France leading demand. Growth in this region is driven by strong consumer preference for high-quality printing, design aesthetics, and environmentally sustainable materials. European consumers show a higher willingness to pay for premium photo books and eco-certified products, supported by robust cross-border e-commerce and established photo printing traditions.

Asia-Pacific

Asia-Pacific represents approximately 24% of the global market and is the fastest-growing region, expanding at over 11% CAGR. Growth is fueled by rapid smartphone adoption, expanding middle-class populations, and increasing penetration of mobile commerce platforms. China and India drive volume growth through high smartphone usage and gifting culture, while Japan contributes premium demand for high-quality prints and photo books. Investments in localized fulfillment centers and vernacular mobile apps are further accelerating regional adoption.

Latin America

Latin America contributes nearly 8% of global revenue, with Brazil and Mexico as key markets. Regional growth is supported by rising internet penetration, improving e-commerce logistics, and increasing urban consumer spending on personalized gifts. Seasonal gifting occasions and social media-driven photo sharing are strengthening demand for photo gifts and standard prints across major cities.

Middle East & Africa

The Middle East & Africa region holds approximately 6% of the global market, led by the UAE, Saudi Arabia, and South Africa. Growth in this region is driven by high per-capita income in Gulf countries, strong demand for premium gifting, and expanding corporate printing applications. Increasing digital adoption and investment in e-commerce infrastructure are gradually improving market accessibility across both the Middle East and parts of Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online Photo Printing Market

- Shutterfly

- CEWE Group

- Snapfish

- Mixbook

- Fujifilm Imaging Solutions

- VistaPrint

- WhiteWall

- Walmart Photo

- CVS Photo

- Walgreens Photo

- Mpix

- Bay Photo Lab

- Printique

- Nations Photo Lab

- AdoramaPix