Online Movie Ticketing Services Market Size

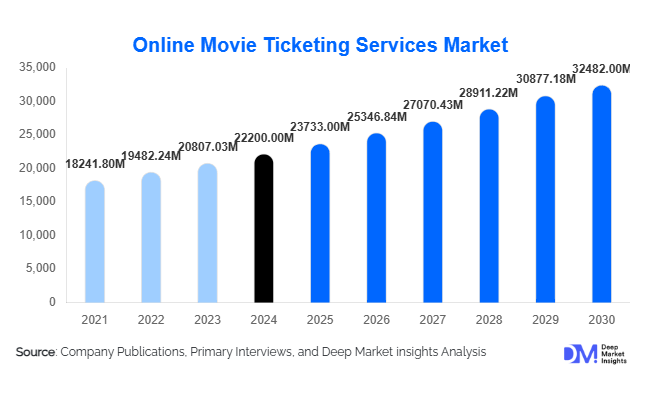

According to Deep Market Insights, the global online movie ticketing services market size was valued at USD 22,200 million in 2024 and is projected to grow from USD 23,733 million in 2025 to reach USD 32,482 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is driven by the increasing penetration of smartphones and internet connectivity, the expansion of multiplexes and premium cinema formats, and the rising consumer preference for convenience, contactless transactions, and digital entertainment experiences.

Key Market Insights

- Mobile applications dominate global online movie ticket bookings, contributing over 55% of total market revenue in 2024, supported by deep smartphone penetration and intuitive user interfaces.

- Asia-Pacific leads the market with around 35% share in 2024, owing to rapid urbanization, digital payment adoption, and expansion of multiplex chains in India, China, and Southeast Asia.

- Premium cinema formats such as IMAX, 4DX, and Dolby Cinema are expanding globally, driving higher-value ticket sales through online channels.

- Digital wallets and UPI payments are the fastest-growing payment modes, capturing nearly 20% share in 2024 and rising rapidly across emerging markets.

- Technological integration, including AI-based recommendations, AR/VR seat previews, and dynamic pricing engines, is reshaping user engagement and monetization strategies.

Latest Market Trends

Mobile-First and App-Driven Bookings

The proliferation of smartphones and low-cost internet has firmly established mobile apps as the preferred platform for movie ticket purchases. Enhanced UX/UI designs, integrated loyalty programs, and push notifications for new releases are making mobile the cornerstone of the industry. Cross-platform synchronization allows users to select seats, pre-order concessions, and manage group bookings, while data analytics deliver personalized recommendations that improve conversion rates.

Premium Format Expansion

Multiplex chains are investing heavily in premium screen formats, and online ticketing platforms are optimizing these listings with immersive seat maps and early access for loyal members. IMAX, 4DX, and Dolby Cinema formats drive higher ticket prices and attract advance online bookings, strengthening revenue per transaction. As urban middle-class consumers in Asia and Latin America demand better cinema experiences, online ticketing is becoming integral to premium theatre monetization.

Online Movie Ticketing Market Drivers

Growing Smartphone and Internet Penetration

Rising smartphone ownership and improving mobile internet speeds worldwide are the strongest catalysts for online ticketing adoption. Consumers increasingly prefer mobile booking for convenience, transparency, and secure digital payments. This trend is universalfrom mature markets like North America to rapidly digitalizing economies such as India and Brazil.

Multiplex Growth and Diversified Screen Experiences

The global expansion of multiplexes and cinema modernization initiatives directly fuels online ticketing growth. As theatres transition to digital operations, integration with online portals allows real-time seat management and revenue optimization. Premium and immersive formats encourage booking, reinforcing digital ticketing as the default channel.

Shift Toward Contactless and Digital Payments

Post-pandemic preferences for contactless booking and cash-free transactions have permanently altered consumer behavior. QR-based e-tickets, mobile wallets, and digital invoices enhance safety and convenience, leading to higher retention and repeat purchases through digital channels.

Market Restraints

Security and Fraud Risks

Online payment frauds, counterfeit QR codes, and data privacy concerns continue to challenge market confidence. Without strong cybersecurity frameworks and PCI-compliant payment gateways, platforms risk customer attrition and reputational loss.

Uneven Theatre Integration

Small and independent theatres, especially in developing regions, often lack the digital infrastructure required for seamless integration. This creates regional gaps in platform coverage and limits the full digitization of ticketing networks, slowing overall market penetration.

Online Movie Ticketing Market Opportunities

Emerging Market Penetration

Asia-Pacific, Latin America, and parts of Africa offer substantial untapped potential. Expanding middle-class populations, local language interfaces, and partnerships with domestic payment systems (like UPI and PIX) will drive rapid adoption. Regional customization, along with government incentives for digital transformation, further enhances this opportunity.

Technological Innovation and AI Personalization

Integrating AI and analytics to predict user preferences, automate pricing, and offer contextual promotions can boost conversion rates and retention. Emerging technologies such as VR seat previews and AI chatbots for booking assistance are differentiating leaders from generic aggregators.

Cross-Industry Partnerships

Collaborations with streaming platforms, fintech companies, and loyalty-program operators are opening new monetization pathways. Bundled ticket-plus-subscription models and “cinema + OTT” cross-promotions enable platforms to capture audiences across both in-theatre and online entertainment ecosystems.

Product Type Insights

Mobile app-based ticketing continues to lead the global online movie ticketing services market with over 55% share in 2024, driven by convenience, one-tap payments, and real-time personalization features. Push notifications for last-minute deals, personalized movie recommendations, and integration with digital wallets enhance user engagement and retention, making mobile the dominant channel across most mature and emerging markets. Web/desktop portals remain relevant for corporate, group, or pre-planned bookings, as larger screens facilitate seat selection, bulk transactions, and comparative pricing. Kiosk terminals cater to theatres adopting hybrid models, providing a last-mile solution in regions with lower smartphone penetration or for customers preferring in-person assistance. Mobile wallets and UPI-based payments have emerged as the fastest-growing payment medium, especially in Asia-Pacific and Latin America, accelerating the adoption of app-based ticketing.

Application Insights

Standard screening tickets dominate booking volume globally, reflecting the core demand for mainstream movie-going. Premium format tickets (IMAX, 4DX, Dolby Cinema) are driving higher margins and accounted for roughly 15% of 2024 revenue. Growth in premium formats is primarily driven by multiplex chains offering immersive experiences, coupled with loyalty programs and bundled concessions that encourage early online purchases. Subscription and loyalty-based booking models are steadily growing, supported by repeat customers in urban centers and student populations who benefit from discounts and exclusive early access to new releases.

End-Use Insights

Individual consumer bookings account for approximately 70% of total transactions, underscoring the dominance of retail demand. Corporate and institutional bookings are niche but growing steadily, fueled by employee engagement events, marketing tie-ins, and bulk ticket arrangements. The fastest-growing end-use segments include tier-2/3 city consumers in emerging markets and urban premium-format patrons. Cross-border or export-driven demand is also increasing, as international travelers increasingly leverage mobile apps and global ticketing platforms to pre-book cinema experiences abroad.

| By Product Type | By Application | By Distribution Channel | By Payment Method |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents approximately 27% of the global market in 2024. The U.S. leads due to high multiplex penetration, early adoption of premium formats (IMAX, 4DX, Dolby), and mature digital payment systems. The primary driver is the combination of premium experiences and scale, where loyalty programs and in-app upsells encourage repeat purchases and higher per-ticket revenue. The robust mobile and app ecosystem allows operators to implement dynamic pricing and targeted marketing campaigns effectively. Canada mirrors these trends with strong urban multiplex networks and a growing demand for personalized viewing experiences.

Europe

Europe accounts for roughly 18–20% of the global market, led by the U.K., Germany, and France. Growth is steady due to high broadband penetration, established cinema culture, and mature digital payments. The key driver is stringent consumer data and safety regulations, which support privacy-compliant booking experiences and integrated cinema-loyalty programs. These features enhance user trust and retention, enabling operators to offer personalized discounts, early-access tickets, and loyalty card redemption. Sustainability and eco-friendly initiatives in theatres further reinforce long-term adoption and brand loyalty among environmentally conscious consumers.

Asia-Pacific

Asia-Pacific leads the global market with approximately 35% share in 2024 and is the fastest-growing region (projected CAGR ~9.2%). Drivers include rapid smartphone adoption, a large under-penetrated urban population, and the proliferation of super-apps integrating payments, travel, and entertainment. Mobile payments, including local instant-pay rails, facilitate frictionless transactions, while partnerships between multiplex chains and fintech providers accelerate ticketing adoption. Urbanization, rising disposable income, and a growing middle class are boosting demand for premium formats and bundled experiences, particularly in India, China, Japan, and Southeast Asia.

Latin America

Latin America contributes approximately 6–8% of global market revenue, led by Brazil and Mexico. Regional growth is driven by urbanization, improving internet access, and the rapid rollout of multiplex screens. The combination of these factors supports increasing adoption of mobile and app-based ticketing platforms in urban centers. Localized payment options, mobile wallet promotions, and incentives for first-time online users further accelerate digital ticket adoption. Latin American consumers are increasingly embracing premium-format experiences and group bookings, providing a platform for long-term expansion.

Middle East & Africa

This region accounts for roughly 6% of global market share, with the UAE, Saudi Arabia, and South Africa being key contributors. Growth is driven by infrastructure upgrades and regional multiplex expansions, including new screens and cinema chains. Mobile payments are leapfrogging traditional card penetration in many markets, enabling faster adoption of online ticketing. High-income populations in the Gulf, combined with the Saudi Vision 2030 cinema liberalization, are creating new demand pockets for premium ticketing, loyalty programs, and app-based engagement. Regional investments in entertainment infrastructure are expected to sustain growth over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online Movie Ticketing Services Market

- Fandango Media LLC

- Atom Tickets LLC

- BookMyShow Entertainment Pvt Ltd

- Cineplex Inc.

- Cinemark Holdings Inc.

- AMC Entertainment Holdings Inc.

- VOX Cinemas

- PVR Cinemas Ltd.

- INOX Leisure Ltd.

- Mtime Commercial Information Service Co., Ltd.

- Dalian Wanda Group Co., Ltd.

- Carnival Films Pvt Ltd.

- BigTree Entertainment Pvt Ltd.

- MovieTickets.com Inc.

- Zoonga Worldwide Private Limited

Recent Developments

- In May 2025, BookMyShow announced a strategic AI-based personalization engine to enhance customer targeting and upselling across India and Southeast Asia.

- In April 2025, Fandango expanded its premium IMAX and Dolby Cinema ticketing integration, offering early-access mobile sales for high-demand Hollywood releases.

- In February 2025, Atom Tickets partnered with PayPal and Venmo to launch instant-split payment features, simplifying group bookings for U.S. consumers.