Online Board Games Market Size

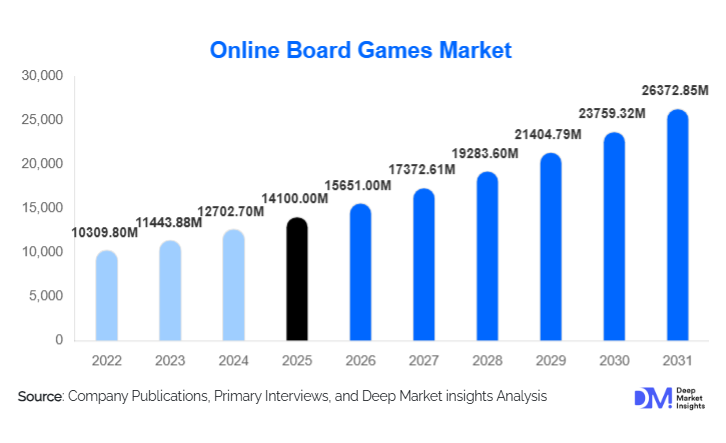

According to Deep Market Insights, the global online board games market size was valued at USD 14,100.00 million in 2024 and is projected to grow from USD 15,651.00 million in 2025 to reach USD 26,372.85 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The online board games market growth is primarily driven by rising mobile gaming penetration, increasing demand for social and multiplayer digital experiences, and the growing appeal of cognitively engaging games across all age groups.

Key Market Insights

- Mobile platforms dominate the online board games market, accounting for over 60% of global revenues due to smartphone accessibility and freemium monetization models.

- Strategy-based board games such as chess, go, and competitive card games lead demand, driven by esports-style tournaments and long engagement cycles.

- Asia-Pacific represents the largest regional market, supported by rapid digital adoption in China and India.

- North America remains the highest ARPU region, fueled by subscription-based gaming and premium features.

- Educational and corporate adoption is emerging as a high-growth segment, leveraging board games for learning, collaboration, and team-building.

- AI-driven matchmaking and cloud-based multiplayer platforms are reshaping user engagement and retention strategies.

What are the latest trends in the online board games market?

Rise of Competitive and Tournament-Based Play

Online board games are increasingly adopting competitive formats inspired by esports. Global leaderboards, ranked matchmaking, and cash or reward-based tournaments are becoming integral to user engagement strategies. Games such as online chess, poker, and rummy are witnessing high participation rates in daily and seasonal tournaments, increasing session duration and monetization opportunities. Streaming platforms and influencer-driven gameplay content are further amplifying interest in competitive board gaming, particularly among younger demographics.

AI-Powered and Personalized Gameplay Experiences

Artificial intelligence is being widely integrated into online board games to enhance player experience. AI-driven opponents with adaptive difficulty levels allow users to improve skills gradually, while intelligent matchmaking systems pair players based on skill, behavior, and play style. Personalization features such as customized boards, avatars, and rule variations are improving retention rates. These advancements are especially valuable in single-player and casual gaming segments, where user churn has traditionally been higher.

What are the key drivers in the online board games market?

Expanding Mobile Gaming Ecosystem

The proliferation of affordable smartphones and low-cost mobile data has significantly expanded the global gaming population. Online board games, which require minimal processing power and bandwidth, are ideally positioned to benefit from this trend. Mobile-first development strategies have enabled developers to scale rapidly across emerging economies, contributing substantially to global revenue growth.

Growing Demand for Social and Cognitive Gaming

Consumers are increasingly seeking games that combine entertainment with mental stimulation and social interaction. Online board games offer multiplayer engagement, strategic thinking, and nostalgia-driven appeal, making them popular across age groups. The ability to connect with friends and family remotely has further reinforced demand, particularly in post-pandemic digital lifestyles.

What are the restraints for the global market?

High Competition and User Acquisition Costs

The online board games market is highly competitive, with low entry barriers resulting in app store saturation. Developers face rising user acquisition costs due to intense competition for visibility, particularly in mature markets such as North America and Europe. Smaller studios often struggle to sustain marketing spend and long-term user retention.

Regulatory and Compliance Challenges

Regulations surrounding real-money gaming, data privacy, and child protection vary significantly across countries. Compliance with these frameworks increases operational complexity and limits monetization options in certain regions. Inconsistent regulations pose challenges for global expansion strategies, particularly for multiplayer and tournament-based games.

What are the key opportunities in the online board games industry?

Educational and Corporate Gamification

Educational institutions are increasingly adopting online board games to support learning outcomes related to logic, strategy, and collaboration. Similarly, corporations are leveraging board games for remote team-building and employee engagement. This institutional demand offers high-margin, subscription-based revenue opportunities and long-term contracts for developers.

Integration of Blockchain and Digital Ownership

Blockchain-enabled board games are emerging as a niche but promising opportunity. Features such as verifiable digital assets, NFT-based collectibles, and transparent reward systems are attracting competitive and high-spending users. This technology integration enhances trust, enables secondary markets, and supports innovative monetization models.

Game Type Insights

Strategy board games dominate the market, accounting for approximately 32% of global revenues in 2024. Their popularity is driven by competitive depth, global tournaments, and strong community engagement. Casual and family board games form the second-largest segment, benefiting from mass-market appeal and cross-generational usage. Card-based board games, particularly poker and rummy, generate substantial revenues due to real-money and competitive play elements, while trivia and word games are gaining traction among casual and older players.

Platform Insights

Mobile applications represent the largest platform segment with around 61% market share, supported by freemium monetization and high daily active users. PC and web-based platforms remain relevant for strategy-intensive games and professional players, while cloud-based platforms are emerging as scalable solutions for multiplayer experiences. Console-based board games occupy a niche segment, primarily in developed gaming markets.

Monetization Model Insights

Freemium models lead the market with nearly 48% of total revenues, driven by in-app purchases and cosmetic upgrades. Subscription-based models are the fastest growing, particularly among adult users seeking ad-free gameplay, exclusive features, and premium tournaments. Advertisement-supported models remain popular in emerging markets, offering free access to cost-sensitive users.

End-Use Insights

Individual consumers account for approximately 78% of total market demand, driven by entertainment and social interaction needs. Educational institutions are the fastest-growing end-use segment, expanding at an estimated CAGR of 15%, as online board games are integrated into digital learning platforms. Corporate usage is also increasing, particularly for remote collaboration and cognitive training applications.

| By Game Type | By Platform | By Monetization Model | By Player Mode | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for nearly 29% of the global online board games market in 2024. The United States leads regional demand due to high ARPU, widespread subscription adoption, and a strong competitive gaming culture. Canada follows with a notable demand for educational and family-oriented board games.

Europe

Europe represents approximately 22% of the global market, led by the U.K., Germany, and France. Strong demand for strategy and trivia-based games, coupled with high digital literacy, supports steady growth. Subscription-based and premium board games are particularly popular in Western Europe.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, accounting for around 34% of global revenues. China and India are key growth engines, driven by mobile-first gaming adoption and expanding digital payment ecosystems. India is the fastest-growing country, registering a CAGR exceeding 15%.

Latin America

Latin America holds a growing share of the market, led by Brazil and Mexico. Rising smartphone penetration and increasing acceptance of online gaming are supporting demand, particularly for casual and card-based board games.

Middle East & Africa

The Middle East & Africa region is an emerging market, driven by improving digital infrastructure and young demographics. The UAE and Saudi Arabia lead regional demand, while South Africa and Nigeria show increasing participation in multiplayer board gaming.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|