Online Apparel Market Size

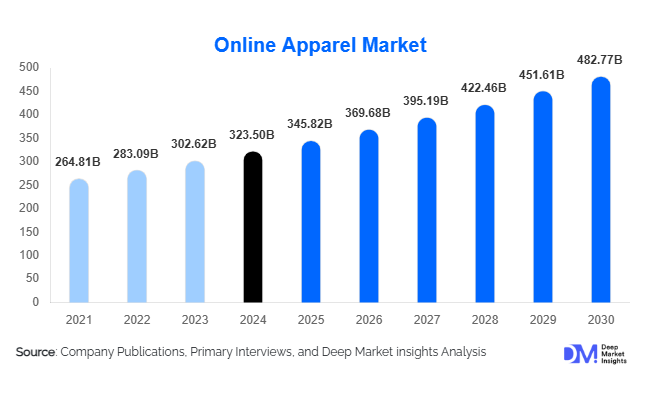

According to Deep Market Insights, the global online apparel market size was valued at USD 323.50 billion in 2024 and is projected to grow from USD 345.82 billion in 2025 to reach USD 482.77 billion by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). The online apparel market growth is primarily driven by accelerating e-commerce penetration, widespread smartphone adoption, rising demand for fast fashion, and increasing use of artificial intelligence and data analytics to personalize shopping experiences and optimize supply chains.

Key Market Insights

- Casual and everyday wear dominate online apparel demand, supported by work-from-home trends and high-frequency purchasing behavior.

- Women’s apparel represents the largest end-user segment, accounting for over half of total online apparel sales globally.

- Marketplace-led platforms continue to command a significant share due to logistics scale, pricing transparency, and wide product assortments.

- Asia-Pacific is the largest and fastest-growing regional market, driven by mobile-first consumers in China, India, and Southeast Asia.

- AI-driven personalization and virtual try-on technologies are reducing return rates and improving conversion ratios.

- Sustainability and ethical sourcing are increasingly influencing purchase decisions, particularly among Gen Z and millennial shoppers.

What are the latest trends in the online apparel market?

AI-Powered Personalization and Virtual Try-On

Online apparel retailers are rapidly integrating artificial intelligence to enhance customer engagement and operational efficiency. Personalized product recommendations, dynamic pricing engines, and predictive size-matching tools are becoming standard features across leading platforms. Virtual try-on technologies using augmented reality allow customers to visualize fit and style before purchase, significantly reducing return rates, which often exceed 25% in online fashion. These technologies are particularly influential among younger consumers who expect immersive, frictionless digital experiences. Retailers adopting AI-based personalization report higher average order values, improved customer retention, and stronger lifetime value metrics.

Rise of Direct-to-Consumer and Social Commerce

Direct-to-consumer (D2C) online apparel brands are gaining traction by bypassing intermediaries and building stronger brand relationships through owned digital channels. Social commerce, enabled by platforms such as Instagram, TikTok, and live-stream shopping, is reshaping product discovery and impulse purchasing. Influencer-led campaigns and user-generated content are accelerating trend cycles and reducing time-to-market for new collections. This trend is particularly prominent in Asia-Pacific, where live commerce has become a core sales channel for online apparel.

What are the key drivers in the online apparel market?

Growing Global E-Commerce Penetration

The continued expansion of e-commerce infrastructure and digital payment ecosystems is a primary driver of online apparel market growth. Increasing internet access, affordable smartphones, and improved last-mile logistics are enabling online apparel adoption across both developed and emerging economies. Convenience, flexible return policies, and competitive pricing are encouraging consumers to shift apparel purchases from offline to online channels.

Demand for Fast Fashion and Trend Responsiveness

Consumers increasingly expect rapid availability of new styles at affordable prices. Online-first fashion brands leverage data analytics and agile supply chains to respond quickly to changing trends, often launching new collections weekly. This responsiveness is driving higher purchase frequency and strengthening the dominance of online channels in apparel retail.

What are the restraints for the global market?

High Return Rates and Reverse Logistics Costs

Apparel remains one of the most return-prone e-commerce categories due to sizing inconsistencies and fit issues. Managing reverse logistics significantly impacts profitability, particularly for mass-market and fast-fashion players. High return volumes increase operational costs and complicate inventory management.

Supply Chain Volatility and Raw Material Price Fluctuations

Fluctuating prices of cotton, synthetic fibers, and energy inputs create cost pressures for online apparel manufacturers and retailers. Geopolitical tensions and disruptions in global shipping networks further contribute to supply chain uncertainty, impacting delivery timelines and margins.

What are the key opportunities in the online apparel industry?

Sustainable and Circular Fashion Models

The growing emphasis on sustainability presents significant opportunities for online apparel brands to differentiate through eco-friendly materials, recycled fabrics, resale platforms, and transparent supply chains. Circular fashion models, including rental and second-hand apparel, are expanding rapidly and command strong consumer interest, particularly in Europe and North America.

Expansion in Emerging Digital Economies

Rapid digital adoption in India, Southeast Asia, Latin America, and parts of Africa is creating a new base of online apparel consumers. Localized product offerings, vernacular content, and flexible payment options such as buy-now-pay-later schemes are enabling brands to capture first-time online shoppers in these regions.

Product Type Insights

Casual wear accounts for the largest share of the online apparel market, representing approximately 38% of total revenue in 2024, driven by everyday usage and comfort-oriented fashion trends. Sportswear and activewear are among the fastest-growing categories, supported by health-conscious lifestyles and the popularity of athleisure. Formal wear maintains steady demand through online channels, while ethnic and traditional wear is gaining traction through cross-border e-commerce and festive-driven sales. Innerwear and sleepwear benefit from repeat purchases and subscription-based models, while outerwear demand remains seasonal but high-value.

End-User Insights

Women’s apparel dominates the market with an estimated 52% share in 2024, driven by higher purchase frequency and wider product variety. Men’s apparel follows, supported by the growing acceptance of online shopping for fashion and grooming products. Children’s apparel represents a smaller but fast-growing segment, fueled by rising urbanization, higher disposable incomes among young families, and frequent replacement cycles due to rapid growth.

Distribution Channel Insights

Online marketplaces account for the largest share of online apparel sales, benefiting from extensive logistics networks, competitive pricing, and consumer trust. Brand-owned D2C platforms are gaining share as companies seek better margins and deeper customer insights. Omnichannel retailers continue to integrate online and offline experiences, offering services such as click-and-collect, seamless returns, and unified loyalty programs.

| By Product Type | By End User | By Price Point | By Business Model | By Technology Integration |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific represents approximately 42% of the global online apparel market in 2024, led by China and India. High mobile commerce penetration, social commerce adoption, and a large young population drive regional demand. Southeast Asian markets are emerging as high-growth hubs due to rising disposable incomes and improving logistics infrastructure.

North America

North America accounts for around 26% of the global market share, with the United States dominating regional demand. High average order values, strong D2C brand presence, and early adoption of AI-driven retail technologies support market maturity and steady growth.

Europe

Europe holds approximately 21% share of the online apparel market, driven by demand from the U.K., Germany, and France. Sustainability-focused purchasing behavior and strong regulatory frameworks are shaping product strategies across the region.

Latin America

Latin America represents about 7% of the market and is one of the fastest-growing regions, led by Brazil and Mexico. Improved digital payments and logistics are accelerating online apparel adoption.

Middle East & Africa

The Middle East & Africa accounts for roughly 4% of global demand, with growth led by the UAE and Saudi Arabia. Rising luxury apparel demand and expanding e-commerce ecosystems are key growth drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|