Oleoresins Market Size

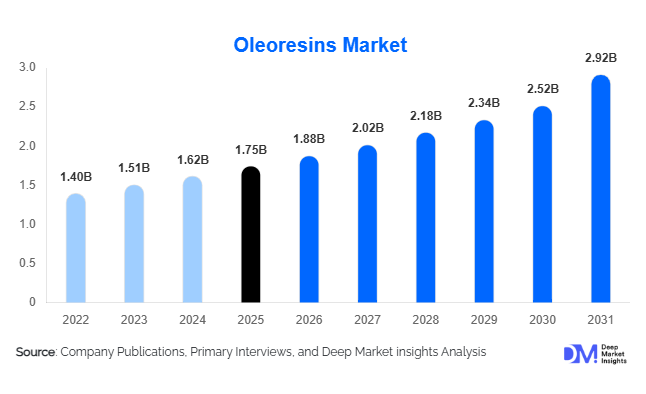

According to Deep Market Insights, the global oleoresins market size was valued at USD 1.75 billion in 2025 and is projected to grow from USD 1.88 billion in 2026 to reach USD 2.92 billion by 2031, expanding at a CAGR of 7.6% during the forecast period (2026–2031). The oleoresins market growth is primarily driven by rising demand for clean-label ingredients, increasing application of natural flavors and colors in food & beverages, and growing adoption of botanical extracts across pharmaceuticals, nutraceuticals, and personal care industries.

Key Market Insights

- Food & beverages remain the largest application segment, accounting for over half of global oleoresin demand due to clean label reformulations.

- Paprika and capsicum oleoresins dominate product demand, driven by their dual functionality as natural colorants and flavor enhancers.

- Asia Pacific leads global supply and exports, supported by abundant spice cultivation and cost efficient processing.

- North America and Europe drive premium demand, particularly for organic, high-purity, and sustainably sourced oleoresins.

- Advanced extraction technologies, such as supercritical CO₂ extraction, are reshaping quality standards and pricing structures.

- Nutraceutical and pharmaceutical applications are the fastest growing end uses, fueled by preventive healthcare and functional nutrition trends.

What are the latest trends in the oleoresins market?

Shift Toward Clean-Label and Natural Ingredients

One of the most significant trends shaping the oleoresins market is the global shift toward clean label and natural ingredient formulations. Food manufacturers are actively replacing synthetic flavors, colors, and preservatives with plant derived oleoresins to meet evolving regulatory standards and consumer expectations. This trend is particularly strong in Europe and North America, where transparency, traceability, and natural sourcing influence purchasing decisions. Oleoresins offer consistency, longer shelf life, and stronger sensory profiles compared to raw spices, making them increasingly preferred in industrial food processing.

Technology-Driven Extraction and Product Innovation

Technological advancements are transforming oleoresin production, with increasing adoption of supercritical CO₂ extraction, encapsulation, and water-soluble formulations. These technologies improve yield efficiency, eliminate solvent residues, and enable customized functionality for beverages, pharmaceuticals, and cosmetics. Nano-emulsified oleoresins and encapsulated powders are gaining traction, especially in functional foods and dietary supplements, where stability and bioavailability are critical. Automation, digital quality monitoring, and traceability platforms are also becoming standard among leading manufacturers.

What are the key drivers in the oleoresins market?

Rising Demand from Food & Beverage Industry

The global food and beverage industry remains the primary growth engine for the oleoresins market. Increasing consumption of processed foods, ready-to-eat meals, sauces, snacks, and beverages has driven demand for standardized, natural flavoring and coloring solutions. Oleoresins provide consistent taste intensity and color stability, making them ideal for large scale food manufacturing. Clean label regulations and consumer preference for natural ingredients further strengthen this driver.

Growth of Nutraceuticals and Preventive Healthcare

The rapid expansion of the nutraceutical and dietary supplement industry is a major driver for oleoresins such as turmeric, black pepper, ginger, and cinnamon. These extracts are valued for their antioxidant, anti-inflammatory, and digestive health properties. Rising health awareness, aging populations, and increasing disposable income are accelerating the use of oleoresins in capsules, functional beverages, and herbal formulations, especially in North America and Asia-Pacific.

What are the restraints for the global market?

Raw Material Price Volatility

Oleoresins are highly dependent on agricultural raw materials, including spices and herbs that are subject to seasonal variations, climate change, and geopolitical factors. Fluctuations in crop yield and spice prices directly impact production costs and pricing stability. This volatility poses challenges for long-term contracts and margin predictability, particularly for smaller manufacturers.

Quality Standardization and Regulatory Complexity

Maintaining consistent quality across different batches and complying with varying regional regulations remain key challenges. Differences in food safety standards, botanical classifications, and permissible solvent limits across regions increase compliance costs. Smaller producers often face difficulties in meeting stringent certification and traceability requirements demanded by multinational buyers.

What are the key opportunities in the oleoresins industry?

Expansion into High-Value Pharmaceutical and Cosmetic Applications

Oleoresins are increasingly being adopted in pharmaceuticals, cosmeceuticals, and natural personal care products due to their bioactive and aromatic properties. Growth in clean beauty, herbal medicine, and plant-based cosmetics presents opportunities for manufacturers to develop premium-grade oleoresins with higher margins. Customized extracts and certified organic variants are expected to see strong demand.

Export-Oriented Growth and Emerging Market Demand

Emerging economies in Asia, Latin America, and Africa are witnessing rising consumption of processed foods and herbal products, creating new demand centers for oleoresins. At the same time, export opportunities remain strong as developed markets rely on spice-producing countries for supply. Investments in backward integration, contract farming, and regional processing hubs offer long-term growth potential.

Product Type Insights

Paprika oleoresins dominate the global oleoresins market, accounting for nearly 28% of total demand in 2025. Their leadership is primarily driven by their extensive use as natural food colorants, offering stable pigmentation, enhanced shelf life, and clean-label appeal across processed foods, snacks, sauces, and meat products. Increasing regulatory restrictions on synthetic additives further strengthen demand for paprika oleoresins.

Capsicum and turmeric oleoresins follow as key product categories, supported by their dual role in flavor enhancement and functional health benefits. Turmeric oleoresins, in particular, benefit from rising awareness of curcumin’s anti-inflammatory and antioxidant properties, driving adoption across food, nutraceutical, and pharmaceutical formulations.

Application Insights

The food and beverages segment remains the dominant application area, contributing approximately 52% of global oleoresins demand in 2025. Growth is driven by rising consumption of processed and convenience foods, increasing preference for natural flavors and colors, and strong adoption in savory foods, beverages, sauces, and seasonings. Oleoresins offer superior consistency, potency, and shelf stability compared to raw spices, making them a preferred choice for manufacturers.

Pharmaceuticals and nutraceuticals represent the fastest-growing application segment, fueled by rising preventive healthcare spending, increasing use of botanical extracts in formulations, and growing demand for immune-boosting and digestive health products. Oleoresins are widely used in capsules, tablets, syrups, and functional supplements due to their high bioactive concentration.

Form Insights

Oil-soluble oleoresins account for over 50% of the global market share, driven by their high compatibility with most food systems, flavor blends, and fat-based formulations. Their ease of blending and superior flavor release make them the preferred form across food processing and flavor manufacturing.

Encapsulated and powdered oleoresins are gaining popularity due to their improved stability, controlled release properties, and suitability for dry mixes, instant foods, dietary supplements, and beverage powders. Advances in spray drying and microencapsulation technologies are further accelerating adoption.Water-soluble oleoresins are an emerging high-growth segment, particularly for functional beverages, pharmaceutical syrups, and liquid supplements. Their ability to disperse evenly in aqueous systems without compromising flavor strength supports increasing use in health-focused drink formulations.

| By Product Type | By Form | By Extraction Technology | By Application |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest share of the global oleoresins market, accounting for approximately 37% of total demand in 2025. The region’s dominance is driven by abundant availability of raw spices, cost-effective production, and strong export-oriented processing infrastructure.

India remains the leading producer and exporter, supported by extensive spice cultivation, government support for spice processing, and the presence of major oleoresin manufacturers. China, Indonesia, and Vietnam are key contributors, benefiting from expanding food processing industries, rising herbal product consumption, and growing demand for natural ingredients across domestic and export markets.

Europe

Europe represents around 28% of global oleoresins demand, driven by stringent clean-label regulations, strong consumer preference for natural and organic ingredients, and high adoption of botanical extracts in food and personal care products.

Germany, the U.K., France, and Italy are major markets, particularly for premium and organic oleoresins. Growth is further supported by advanced food processing technologies, strong nutraceutical demand, and increasing use of plant-based ingredients in cosmetics and pharmaceutical applications.

North America

North America accounts for approximately 22% of the global oleoresins market, with the United States leading regional demand. Growth is fueled by advanced food manufacturing capabilities, high consumption of functional foods, and strong adoption of dietary supplements.

Clean-label trends, sustainability initiatives, and demand for high-purity, traceable, and organically sourced oleoresins are key drivers. The region also benefits from continuous innovation in flavor systems and nutraceutical formulations.

Latin America

Latin America holds a smaller but steadily growing share of the oleoresins market, led by Brazil and Argentina. Growth is supported by rising processed food consumption, expanding spice cultivation, and increasing regional food exports.

Improving food processing infrastructure and growing interest in natural ingredients for both domestic consumption and export markets are expected to support long-term expansion.

Middle East & Africa

The Middle East & Africa region contributes approximately 4% of global demand. Market growth is driven by increasing food imports, expanding cosmetics and personal care manufacturing, and rising use of spice extracts in regional cuisines.

GCC countries and South Africa are key markets, supported by growing urbanization, premium food consumption, and rising awareness of natural and functional ingredients.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Oleoresins Market

- Synthite Industries Ltd

- Plant Lipids Pvt. Ltd.

- Kancor Ingredients

- Kalsec Inc.

- Oterra A/S

- Akay Natural Ingredients

- AVT Naturals

- Gazignaire SA

- Universal Oleoresins

- PT Indesso Aroma

- Naturite Agro Products Ltd.

- Ungerer & Company

- Manohar Botanical Extracts

- Ozone Naturals

- Qingdao Ruibang Biotechnology