Herbal Personal Care Products Market Size

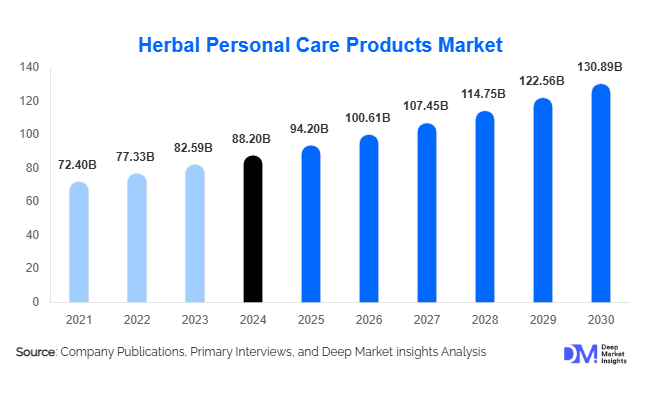

According to Deep Market Insights, the global herbal personal care products market was valued at USD 88.2 billion in 2024 and is projected to grow from USD 94.20 billion in 2025 to reach USD 130.89 billion by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). This growth is driven by rising consumer preference for clean-label, chemical-free products, expanding demand for natural skincare and haircare, and increasing adoption of eco-friendly and plant-based formulations across global personal care industries.

Key Market Insights

- Herbal and clean-beauty products are shifting from niche to mainstream categories, driven by rising awareness of chemical-free lifestyles and holistic wellness.

- Skin care remains the largest product category, with demand for herbal moisturizers, serums, face creams, and anti-aging products gaining momentum worldwide.

- Asia-Pacific is the fastest-growing regional market, supported by Ayurveda-driven demand in India and strong botanical skincare trends in China and Southeast Asia.

- North America and Europe collectively dominate revenue share, driven by high adoption of premium natural beauty products and strong sustainability regulations.

- E-commerce and D2C models are reshaping purchase behaviors, with rapid growth in online herbal skincare and haircare sales.

- Brands are investing in sustainable, biodegradable, and refillable packaging, as eco-conscious consumers increasingly demand low-impact personal care.

What are the latest trends in the herbal personal care products market?

Premium Clean-Label & Certified Organic Products Rising

Certified organic and botanical-rich formulations are rapidly gaining traction as consumers increasingly distrust synthetic chemicals in personal care. Major brands are launching products with transparent ingredient lists, sustainably sourced plant extracts, and dermatologist-tested claims. Certifications such as ECOCERT, USDA Organic, and COSMOS are becoming important differentiators in mature markets like the U.S., U.K., Germany, Japan, and Australia. The shift is reinforced by the growth of vegan beauty, cruelty-free claims, and zero-toxin formulations that combine high efficacy with environmental safety. This trend is transforming herbal personal care from basic remedies to science-driven, performance-enhanced products.

Technology-Enhanced Personalization & Smart Beauty Solutions

Consumers increasingly expect personalized skincare and haircare routines tailored to their unique needs. Companies are using AI-driven skin analysis tools, mobile apps, and digital diagnostics to recommend custom herbal formulations. Smart beauty devices, AR try-on applications, and data-driven ingredient selection are emerging, allowing users to evaluate product fit before purchase. Meanwhile, innovative delivery systems, nano-herbal extracts, plant-based actives, and bio-fermented ingredients are enhancing absorption and performance. These tech-integrated solutions are particularly appealing to younger consumers who want natural products without compromising on modern innovation.

What are the key drivers in the herbal personal care products market?

Growing Shift Toward Natural & Chemical-Free Lifestyles

Consumers worldwide are switching to natural products amid rising concerns over parabens, sulfates, and synthetic fragrances used in conventional personal care. Herbal formulations offer safer alternatives with plant-based actives, driving adoption across skincare, haircare, baby care, and grooming. This shift is amplified by increasing health consciousness, social media awareness, and dermatologists recommending mild, botanical-based routines for sensitive skin.

Rapid Expansion of E-Commerce & Direct-to-Consumer Brands

Online platforms have drastically increased the accessibility of herbal products. E-commerce giants and brand-owned D2C websites offer global reach, product variety, subscription models, and personalized recommendations. This shift benefits emerging brands that leverage social media influencers, clean-beauty communities, and online reviews to build trust without traditional retail investments.

Innovation in Herbal Ingredients, Sustainable Packaging & Clean Beauty

Herbal personal care companies are investing heavily in advanced formulations that enhance efficacy while maintaining natural purity. Plant stem cells, botanical extracts, essential oils, and mineral blends are being integrated into high-performance skincare and haircare systems. Simultaneously, innovations in biodegradable packaging, refill stations, and eco-friendly materials are strengthening brand loyalty among eco-conscious consumers.

Restraints: Regulatory Gaps & Efficacy Concerns

Regulatory Inconsistencies Across Countries

Despite growing demand, global regulations for herbal formulations remain fragmented. Variations in ingredient approvals, labeling norms, and organic certification requirements complicate product development and expansion into international markets. This increases compliance costs for manufacturers and slows cross-border distribution.

Consumer Perception of Lower Efficacy

While herbal products offer safety benefits, some consumers perceive them as less potent compared to chemical-based alternatives. Lack of clinical trials and inconsistent product quality can reduce trust, particularly in therapeutic applications like anti-aging, dandruff control, or acne treatments.

What are the key opportunities in the herbal personal care products industry?

High-Potential Growth in Emerging Markets

Asia-Pacific, Latin America, and the Middle East are witnessing the rapid adoption of herbal personal care as incomes rise and wellness awareness grows. India and China, in particular, offer huge potential due to deep cultural roots in Ayurvedic and botanical remedies. Local manufacturing, low-cost raw materials, and growing retail penetration make these regions attractive for new entrants.

Tech-Led Customization & D2C Scaling

AI-powered personalization, virtual skincare consultations, and subscription-based models are opening new revenue streams. Startups leveraging digital channels can quickly scale, while established brands can enhance loyalty through ecosystem-building, app-based analysis, ingredient tracking, and refill services. This opportunity is strengthened by rising consumer preference for customized, clean beauty routines that align with personal health and sustainability goals.

Product Type Insights

Skin care is the dominant product category, accounting for nearly 25% of the global herbal personal care market in 2024. The segment includes herbal moisturizers, face cleansers, toners, anti-aging serums, and sun-care solutions. Rising demand for plant-based antioxidants, anti-inflammatory actives, and gentle formulations contributes to leadership in this segment. Haircare follows closely, driven by herbal oils, shampoos, and scalp treatments targeting concerns like hair fall, dandruff, and dryness. Body care, including herbal soaps, body washes, and lotions, is gaining traction as clean-label products become household staples.

Application Insights

Daily skincare routines remain the largest application area, as consumers increasingly adopt herbal products for cleansing, moisturizing, and anti-aging needs. Herbal haircare applications are also growing quickly due to rising concerns about pollution-induced hair damage and increased preference for sulfate-free shampoos. Baby care and sensitive-skin applications are witnessing rapid adoption because parents prefer safer, chemical-free products. Emerging niches include aromatherapy-infused cosmetics, scalp-care therapies, and herbal oral care, all driven by the wellness movement.

Distribution Channel Insights

Offline retail, including supermarkets, pharmacies, hypermarkets, and specialty stores, continues to hold over 55% of the market share in 2024. However, online platforms are the fastest-growing channel, supported by rising smartphone penetration, influencer-driven marketing, and subscription-based D2C models. E-commerce provides consumers with easy access to global herbal brands, transparent ingredient details, and personalized recommendations.

Consumer Type Insights

Women remain the primary consumer segment, driving demand for skincare, haircare, and cosmetics. However, the men’s grooming segment is one of the fastest-growing, fueled by rising awareness of beard care, natural shaving products, and male skincare routines. Baby and kids’ categories are gaining importance as parents increasingly avoid chemical-based products. Unisex and family-oriented herbal personal care lines are also expanding due to their broad appeal and convenience.

Age Group Insights

Consumers aged 25–45 account for the largest share of herbal personal care spending, driven by income stability, wellness orientation, and adoption of multi-step skincare routines. Younger adults (18–25) fuel growth in acne treatment, scalp care, and influencer-led cosmetic trends. Consumers above 45 increasingly prefer herbal anti-aging, pigmentation control, and sensitive-skin products, contributing significantly to premium segment growth.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 28–30% of global revenue in 2024. The U.S. is a leading market for premium herbal skincare, baby care, and haircare, driven by clean-beauty trends and high purchasing power. Canada shows growing demand for eco-friendly, certified-organic products, particularly through online channels.

Europe

Europe accounts for about 20–22% of the market. Strong regulations around sustainability, cruelty-free claims, and organic certification make herbal products highly attractive. Germany, France, and the U.K. lead demand for premium botanical skincare and haircare.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding roughly 22–25% of the global market share. India and China are major growth engines due to cultural affinity for herbal ingredients, availability of low-cost raw materials, and expanding middle-income groups. Japan, South Korea, and Australia exhibit high demand for premium, science-backed natural beauty products.

Latin America

Latin America contributes 8–10% to global revenue, with Brazil and Mexico showing rising preference for natural personal care. Herbal haircare and body care are especially popular due to climate-driven needs and increasing environmental awareness.

Middle East & Africa

The MEA region accounts for 6–8% of the market. The Gulf countries, UAE, Saudi Arabia, Qatar, are experiencing rapid growth in premium herbal cosmetics and grooming products due to high disposable incomes. African markets show increasing interest in herbal haircare and skincare, particularly among urban consumers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Herbal Personal Care Products Market

- The Himalaya Drug Company

- Amway Corporation

- Aveda Corporation

- Biotique (Bio Veda Action Research)

- Burt’s Bees

- Dabur India Ltd.

- Forest Essentials

- Kama Ayurveda

- Khadi Natural

- Lotus Herbals

- Lush Fresh Handmade Cosmetics

- Oriflame Cosmetics

- Patanjali Ayurved Ltd.

- The Body Shop International Ltd.

- Weleda AG

Recent Developments

- In March 2025, Aveda launched a new line of botanical serums featuring plant stem cell technology to boost skin regeneration.

- In February 2025, Himalaya expanded its global herbal baby-care portfolio across Europe and East Asia, focusing on dermatologically tested formulations.

- In January 2025, Lush introduced a biodegradable packaging line for its herbal shampoo bars and body-care products, strengthening its sustainability commitments.